Tax Return Depreciation Verkko With your company s depreciation expensing according to a plan together with the added tax deductible expense consisting of the depreciation difference your company can have the tax benefit relating to its assets maximum depreciation as the act on the taxation of business income allows

Verkko Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income generating activities Similar to accounting depreciation tax depreciation allocates depreciation expenses over multiple periods Verkko 25 maalisk 2020 nbsp 0183 32 The deduction is capped at 1 020 000 as of the 2019 tax year the return you ll file in 2020 You must deduct from this amount a percentage of the cost of Section 179 property that exceeds 2 550 000 if it was placed in service in that year This is referred to as the quot phase out threshold quot

Tax Return Depreciation

Tax Return Depreciation

http://templatelab.com/wp-content/uploads/2017/08/depreciation-schedule-template-07.jpg

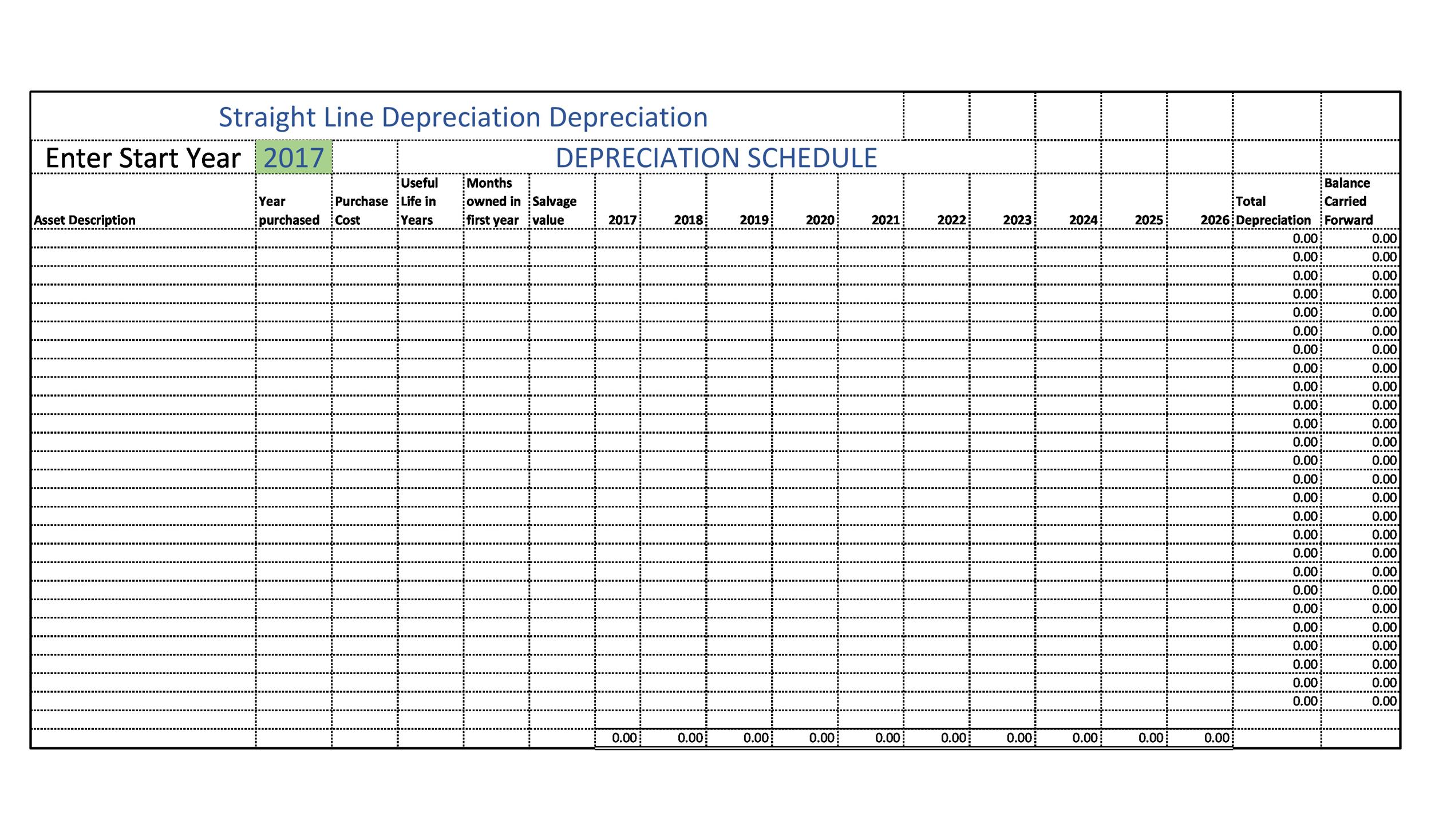

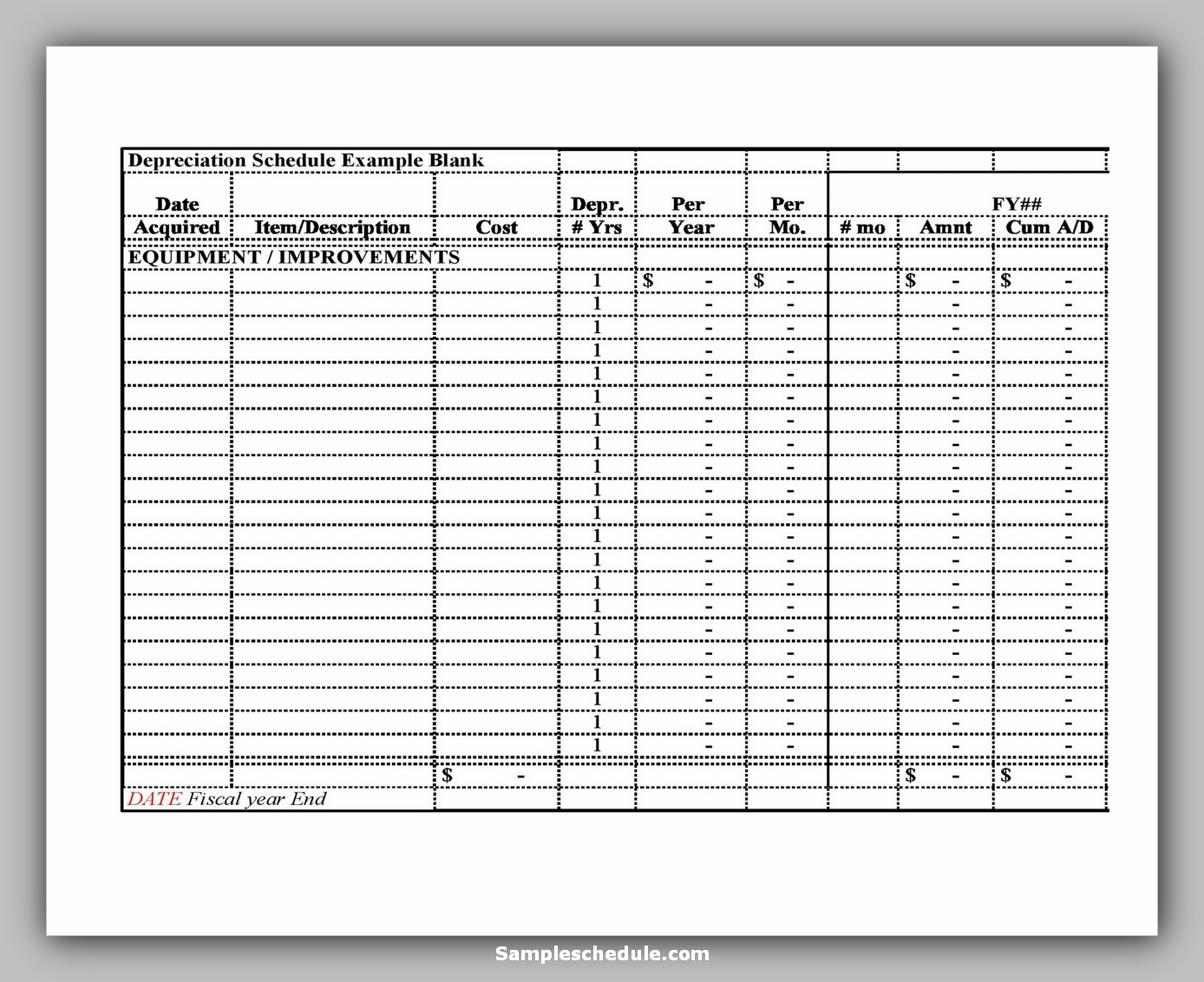

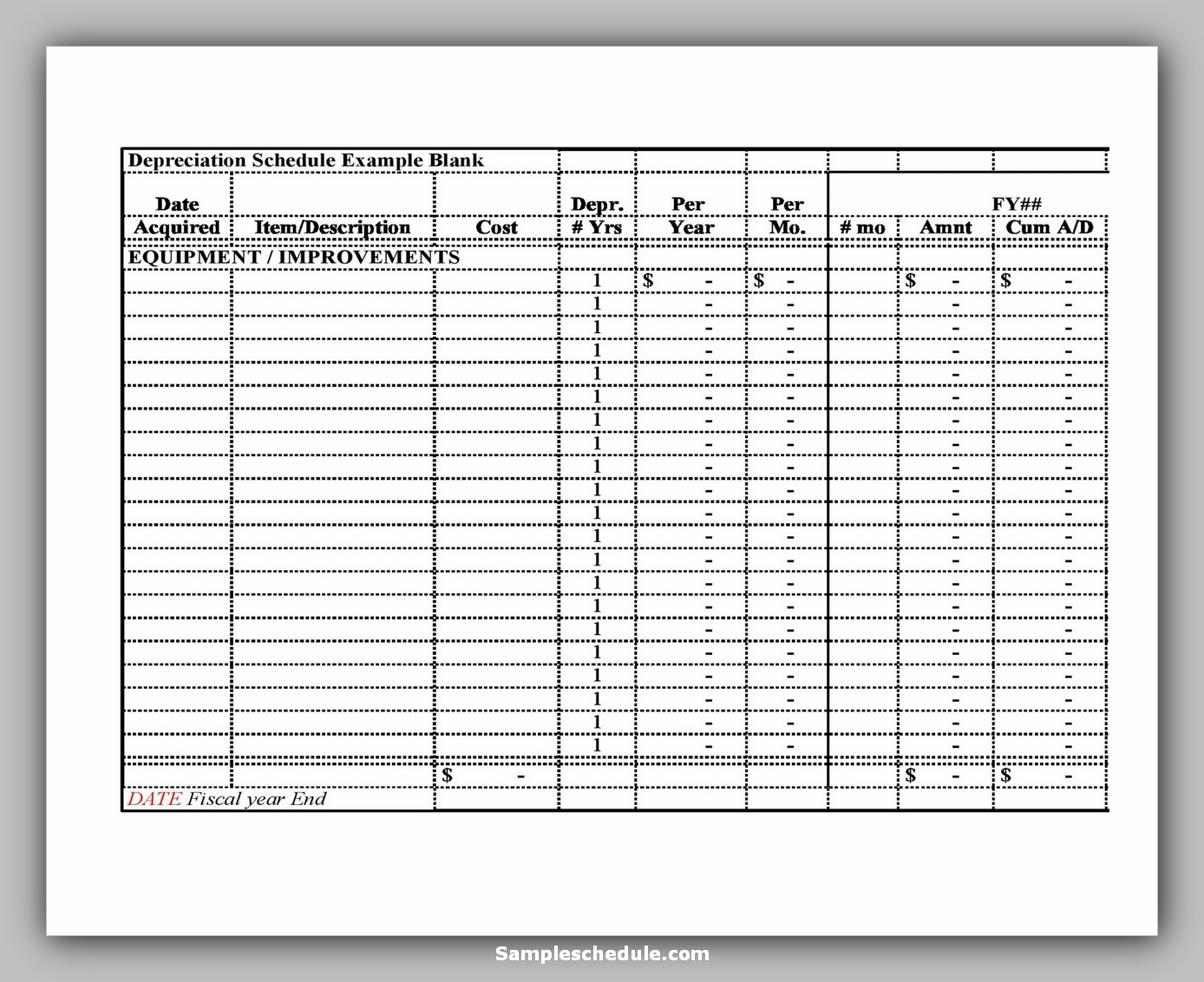

9 Free Depreciation Schedule Templates In MS Word And MS Excel

http://www.scheduletemplate.org/wp-content/uploads/2013/02/BlankDepreciationWorksheet.jpg?is-pending-load=1

Part 2 How To Prepare A 1040 NR Tax Return For U S Rental Properties

http://madanca.com/wp-content/uploads/2017/04/Depreciation-2-1024x576.png

Verkko 1 jouluk 2023 nbsp 0183 32 Depreciation is a tax deductible business expense It offers businesses a way to recover the cost of an eligible asset by writing off the expense over the course of its useful life A business Verkko 1 jouluk 2023 nbsp 0183 32 Depreciation is an accounting method used to calculate decreases in the value of a company s tangible assets or fixed assets By charting the decrease in the value of an asset or assets over

Verkko tax returns gt Allowed combinations of forms for electronic income tax returns xlsx 6 CHANGES TO THE PREVIOUS VERSION Versio n Identifi er Data element Description 1 0 000 Identifier The year is changed 581 584 Investments in machinery and equipment during the tax year Depreciation of investments in machinery and equipment Added Verkko Depreciation is the recovery of the cost of the property over a number of years You deduct a part of the cost every year until you fully recover its cost You may be able to elect under Section 179 to recover all or part of the cost of qualifying property up to a certain determinable dollar limit in the taxable year you place the qualifying

Download Tax Return Depreciation

More picture related to Tax Return Depreciation

Income Tax Depreciation Rates Regulations IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2020/04/shutterstock_1013222008-1-1.jpg

Amortization Expense Formula ShauniKonnie

https://i.pinimg.com/originals/18/df/f4/18dff475f74ffdaddbc1d757863cf374.png

Tax Depreciation Of Shield

https://media.wallstreetprep.com/uploads/2022/06/01112319/Depreciation-Tax-Shield-Calculator.jpg

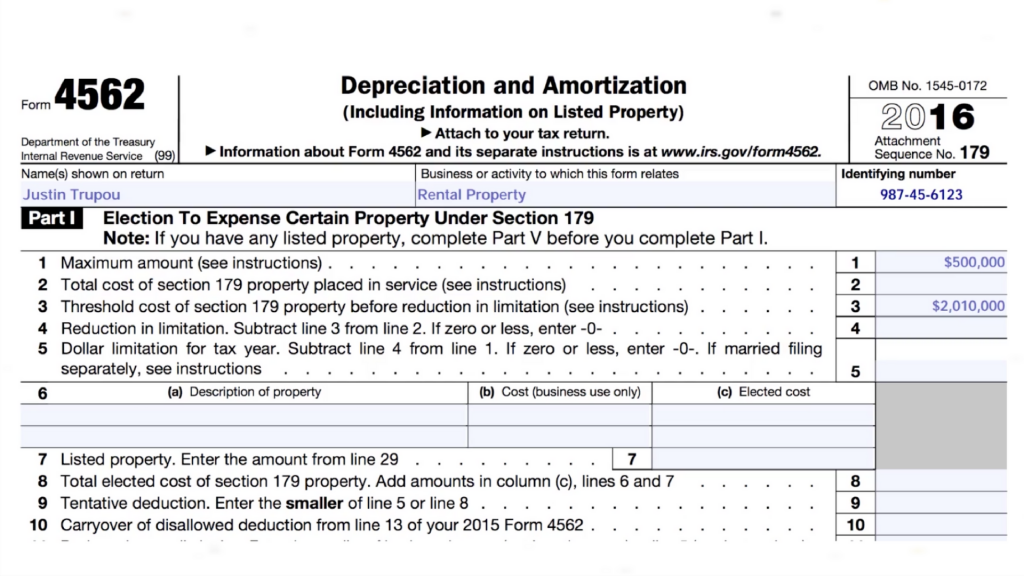

Verkko 21 jouluk 2023 nbsp 0183 32 Depreciation recapture is a process that allows the IRS to collect taxes on the financial gain a taxpayer earns from the sale of an asset Capital assets might include equipment or even furniture Once an asset s term has ended the IRS requires taxpayers to report any gain from the disposal or sale of that asset as Verkko 18 tammik 2023 nbsp 0183 32 Home About Form 4562 Depreciation and Amortization Including Information on Listed Property Use Form 4562 to Claim your deduction for depreciation and amortization Make the election under section 179 to expense certain property Provide information on the business investment use of automobiles and other listed

Verkko 30 kes 228 k 2022 nbsp 0183 32 Tax depreciation allows business owners to deduct the declining value of assets used in income generating activities from their federal taxes It is considered by the IRS to be an allowance for wear and tear and it can also be applied to obsolete items that are no longer usable Verkko Generally you adopt a method of accounting for depreciation by using a permissible method of determining depreciation when you file your first tax return or by using the same impermissible method of determining depreciation in two or more consecutively filed tax returns

Calculation Of Depreciation On Rental Property InnesLockie

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/07/20042010/OFFSET.jpg

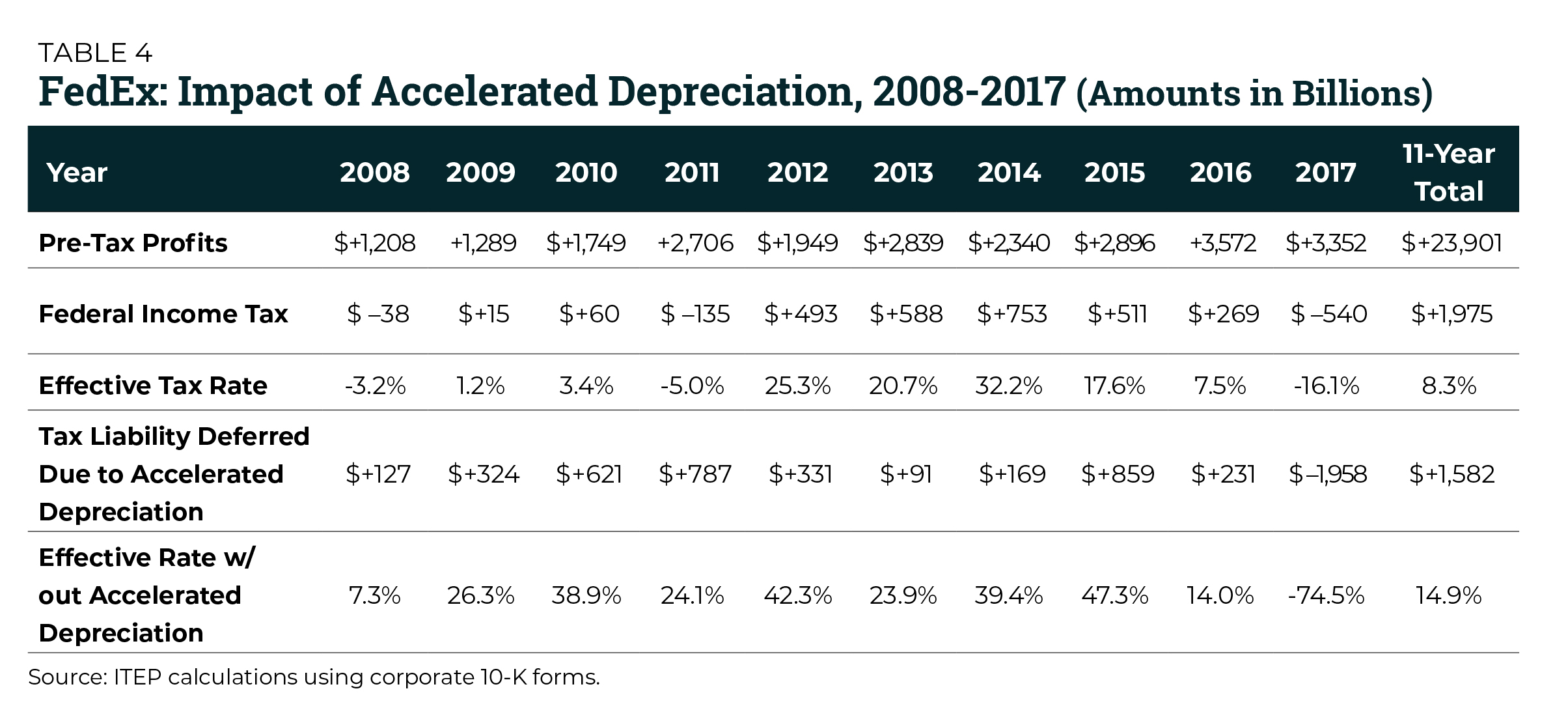

Tax Depreciation Tables Brokeasshome

http://itep.org/wp-content/uploads/111918-Depreciation_Table4.jpg

https://www.vero.fi/en/businesses-and-corporations/taxes-and-charges/...

Verkko With your company s depreciation expensing according to a plan together with the added tax deductible expense consisting of the depreciation difference your company can have the tax benefit relating to its assets maximum depreciation as the act on the taxation of business income allows

https://corporatefinanceinstitute.com/resources/accounting/tax-depreciation

Verkko Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income generating activities Similar to accounting depreciation tax depreciation allocates depreciation expenses over multiple periods

How To Calculate Depreciation Expense Using Straight Line Method Haiper

Calculation Of Depreciation On Rental Property InnesLockie

Line 14 Depreciation And Section 179 Expense Center For

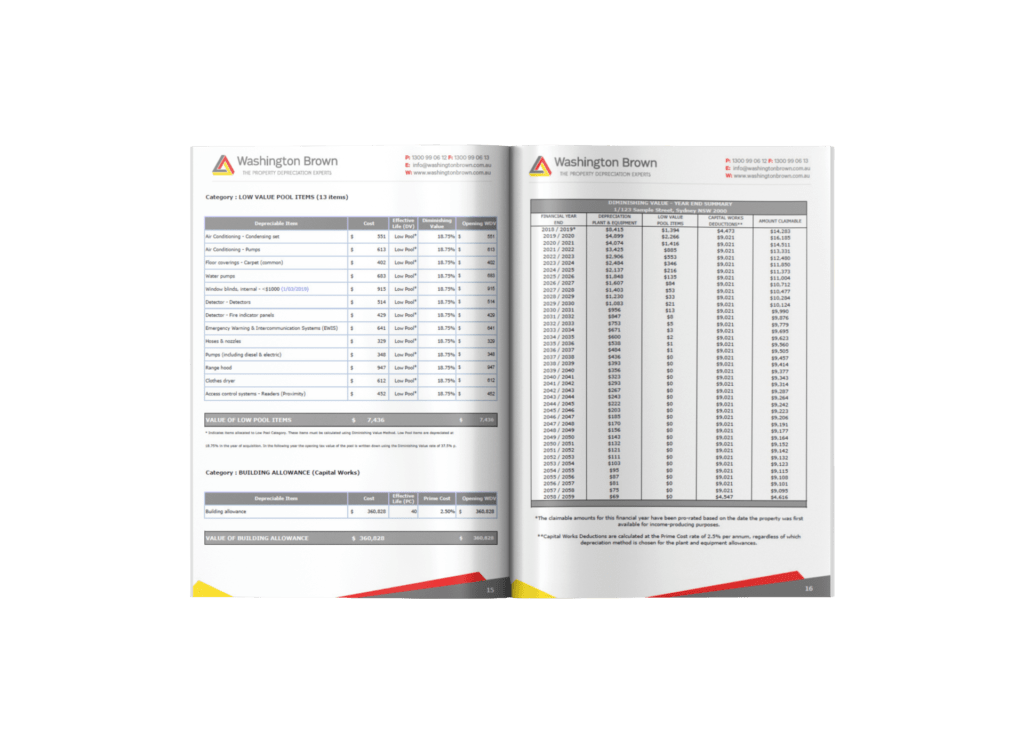

Tax Depreciation Schedules For Property Investors Washington Brown

Tax Return Types Of Investments Tax Depreciation Schedules

27 Sample Depreciation Schedule Sample Schedule

27 Sample Depreciation Schedule Sample Schedule

Depreciation Schedule Template

Fixtures Fittings Depreciation Rate BMT Insider

Negative Gearing And Depreciation

Tax Return Depreciation - Verkko Taxes December 20 2022 Tax depreciation refers to the depreciation expenses of a business that is an allowable deduction by the IRS This means that by listing depreciation as an expense on their income tax return in the reporting period a business can reduce its taxable income