Tax Return Depreciation Rental Property Verkko You own a residential rental house that you have been renting since 1999 and depreciating under ACRS You built an addition onto the house and placed it in service in 2022 You must use MACRS for the addition Under GDS the addition is depreciated as residential rental property over 27 5 years

Verkko 19 lokak 2023 nbsp 0183 32 To take a deduction for depreciation on a rental property the property must meet specific criteria According to the IRS You must own the property not be renting or borrowing it from someone else You must use the property to produce income in this case by renting it You must be able to determine a quot useful life quot for Verkko 25 elok 2023 nbsp 0183 32 Tax depreciation on rental property enables the property owner to recoup some of the cost of income producing property through yearly tax deductions This is done by depreciating the property or in other words deducting some of the cost each year on a taxpayer s tax return

Tax Return Depreciation Rental Property

Tax Return Depreciation Rental Property

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/07/20042010/OFFSET.jpg

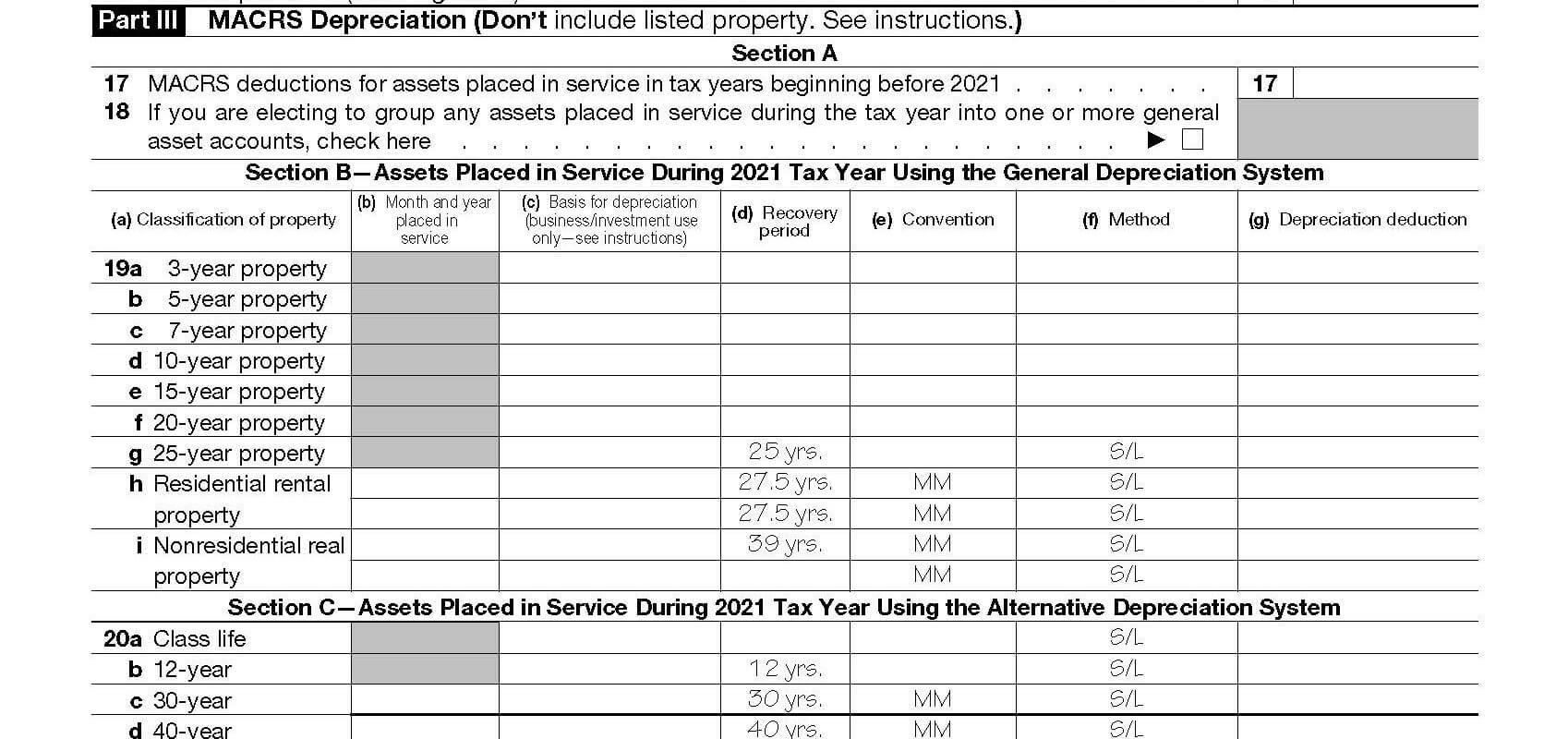

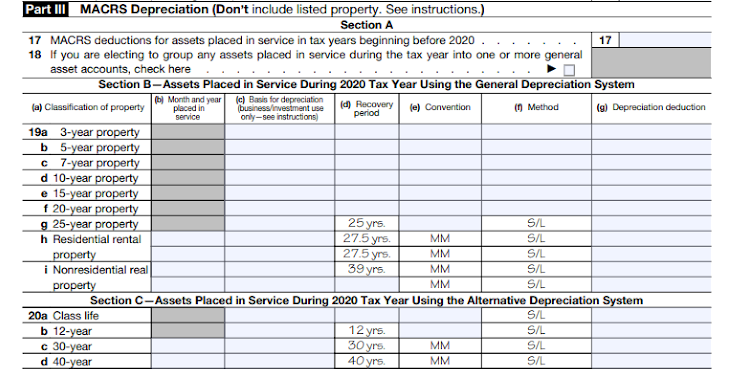

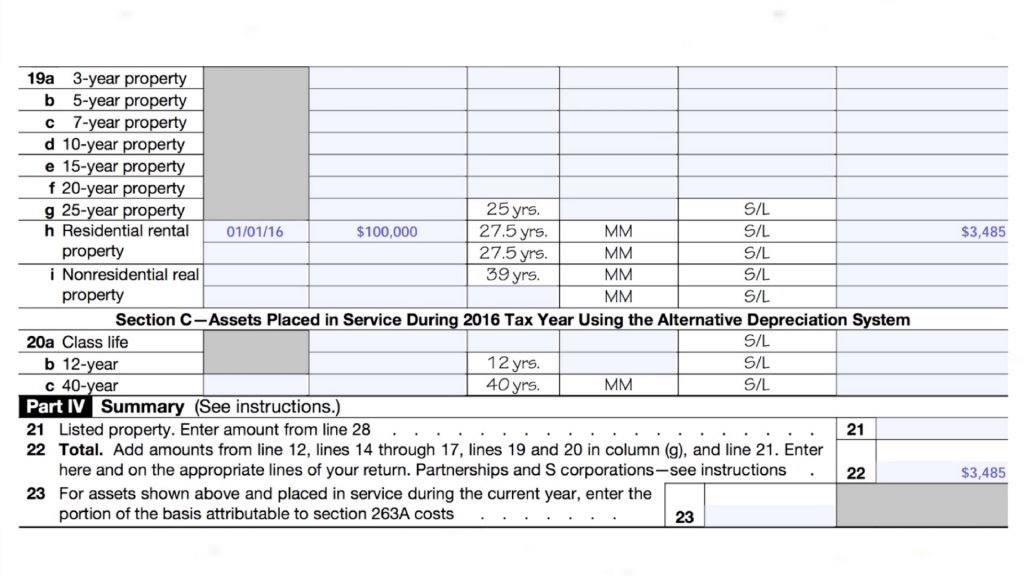

Irs Macrs Depreciation Table Excel Review Home Decor

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f4562_part3.jpg

3 Ways To Avoid Depreciation Recapture Tax On Rental Property The

https://thedarwiniandoctor.com/wp-content/uploads/2022/01/2022-Jan-3-Ways-to-Avoid-Depreciation-Recapture-Tax-on-Rental-Property.jpeg

Verkko 11 lokak 2023 nbsp 0183 32 What Deductions Can I Take as an Owner of Rental Property If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may include mortgage interest property tax operating expenses depreciation and repairs Verkko Depreciation is a non cash expense rental property owners take to reduce the amount of taxable net income Residential rental property is depreciated over a period of 27 5 years Real estate investors can depreciate the value of the building and certain improvements but not the value of the land

Verkko 1 hein 228 k 2020 nbsp 0183 32 The process of rental property depreciation involves writing off or subtracting rental property expenses on your annual tax returns Property depreciation can help the property owner reclaim the Verkko Claiming depreciation on your tax return can be done for rental property owned in the U S over anywhere from 3 40 years How is depreciation calculated on rental property The depreciation on a rental property can be calculated by taking the property s cost basis and dividing it by its projected useful life

Download Tax Return Depreciation Rental Property

More picture related to Tax Return Depreciation Rental Property

Why An Investment Property Depreciation Schedule Is Crucial For Every

https://duotax.com.au/wp-content/uploads/sample-report-for-tax-depreciation-schedule.jpg

Figuring Out Depreciation On Rental Property EamonMunira

https://turbotax.intuit.ca/tips/images/rental-income-tax.jpg

IRS Form 4562 Explained A Step by Step Guide

https://m.foolcdn.com/media/affiliates/images/Form_4562-05-Part_III_0RRc8Mi.width-750.png

Verkko 14 tammik 2022 nbsp 0183 32 This will let you get your rental property depreciation cost each year So if your property is worth 1 000 000 multiply that by 3 636 to get your rental property depreciation cost of 36 360 which you can then claim as a deduction on your annual tax return Verkko 1 marrask 2023 nbsp 0183 32 Several factors can impact the depreciation calculation for your rental property affecting the amount you can claim on your tax returns Understanding these factors is crucial for accurately calculating your rental property depreciation

Verkko 16 jouluk 2021 nbsp 0183 32 Depreciation recapture occurs when a rental property is sold Recapturing depreciation is the process the IRS uses to collect taxes on the gain you ve made from your income property and to recover the benefits you received by using the depreciation expense to reduce your taxable income Understanding rental property Verkko 7 toukok 2023 nbsp 0183 32 Master the art of calculating depreciation on your rental property with our comprehensive guide Uncover how depreciation can significantly impact your tax deductions and rental property returns Discover various methods special considerations and how it influences your property s resale

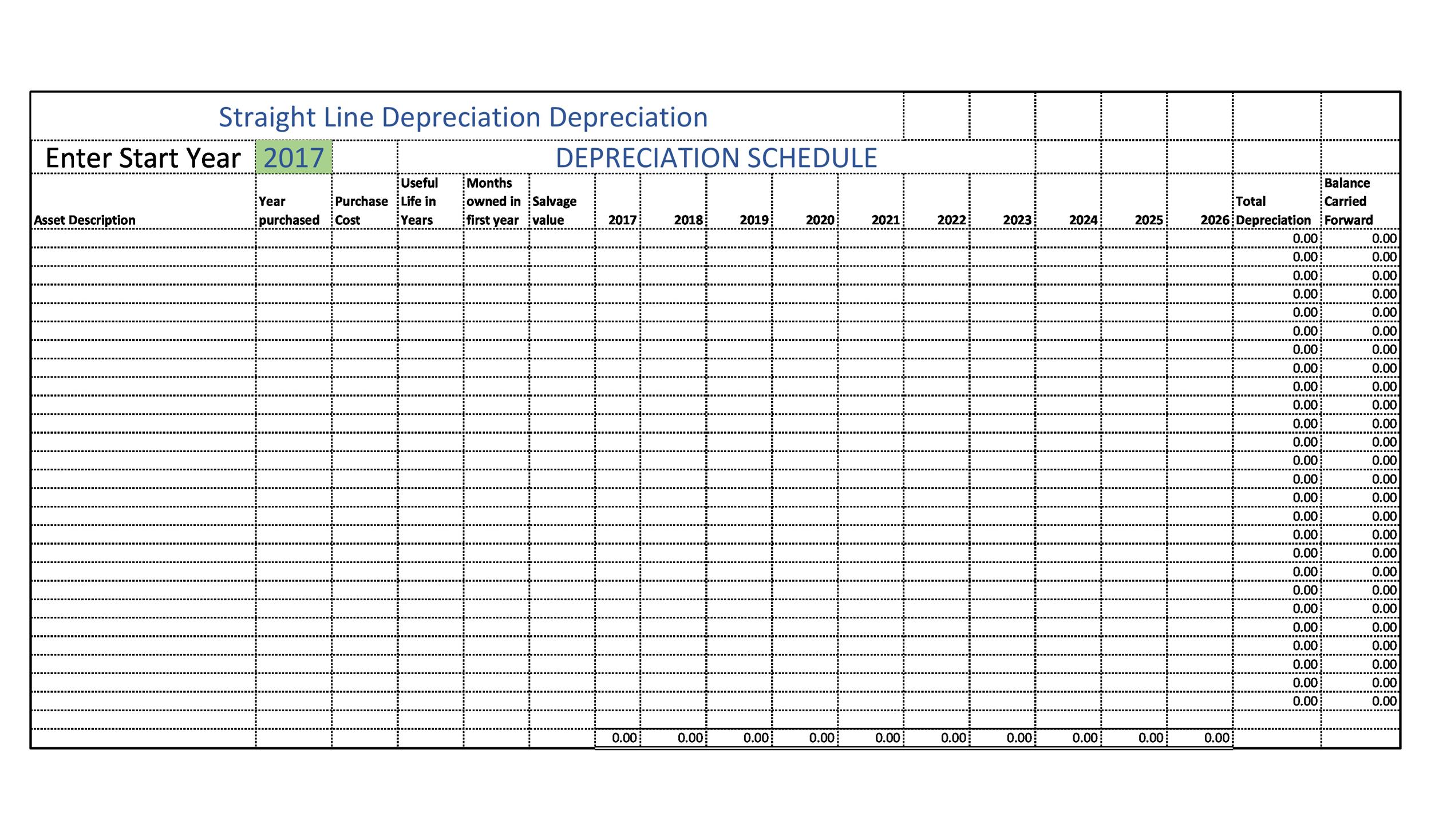

Depreciation Schedule Samples Find Word Templates

https://i0.wp.com/www.findwordtemplates.com/wp-content/uploads/2016/09/Depreciation-Schedule-4..gif?fit=652%2C505&ssl=1

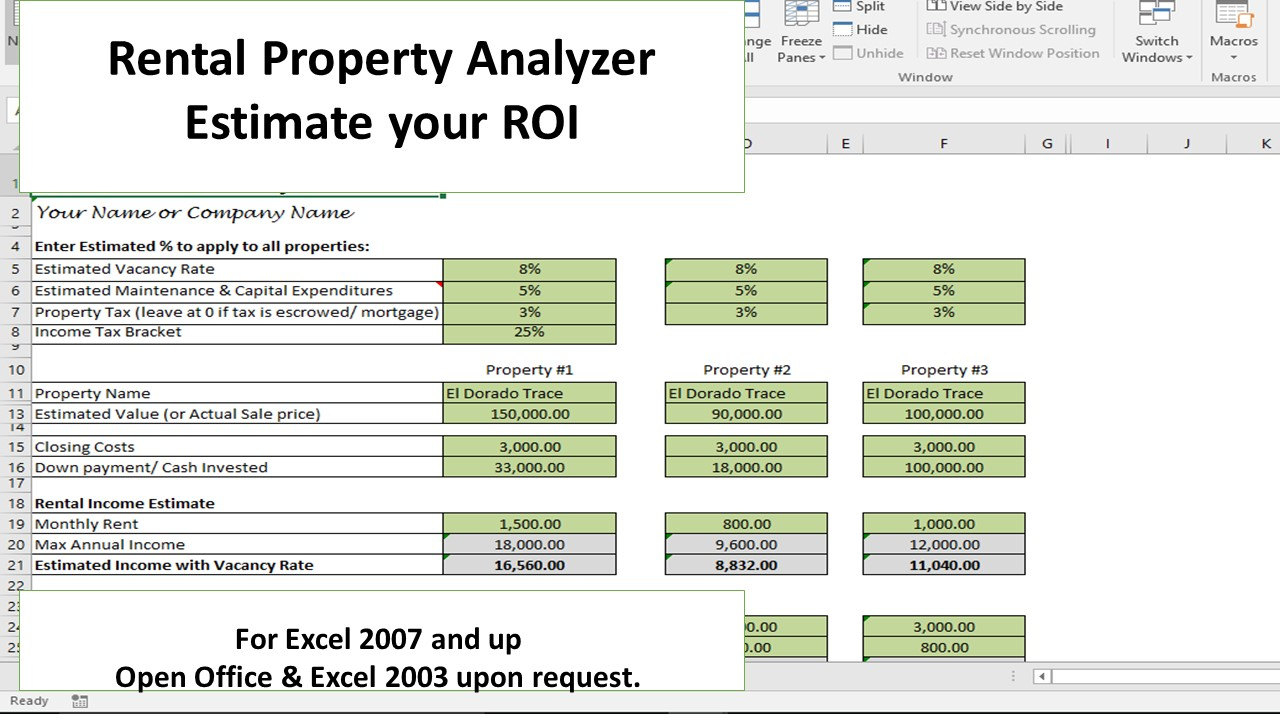

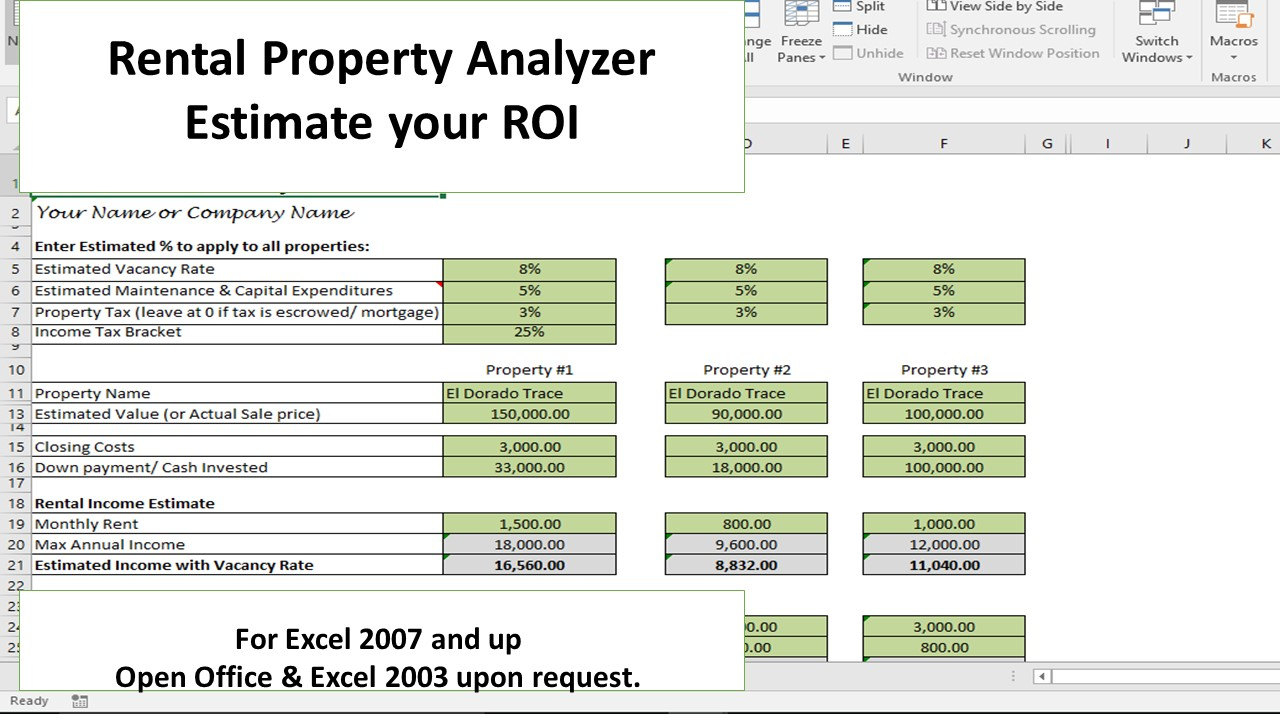

A Free Rental Property Depreciation Spreadsheet Template

https://wp-assets.stessa.com/wp-content/uploads/2022/09/17155135/rental-property-depreciation-spreadsheet.jpeg

https://www.irs.gov/publications/p527

Verkko You own a residential rental house that you have been renting since 1999 and depreciating under ACRS You built an addition onto the house and placed it in service in 2022 You must use MACRS for the addition Under GDS the addition is depreciated as residential rental property over 27 5 years

https://turbotax.intuit.com/tax-tips/rental-property/tax-deductions...

Verkko 19 lokak 2023 nbsp 0183 32 To take a deduction for depreciation on a rental property the property must meet specific criteria According to the IRS You must own the property not be renting or borrowing it from someone else You must use the property to produce income in this case by renting it You must be able to determine a quot useful life quot for

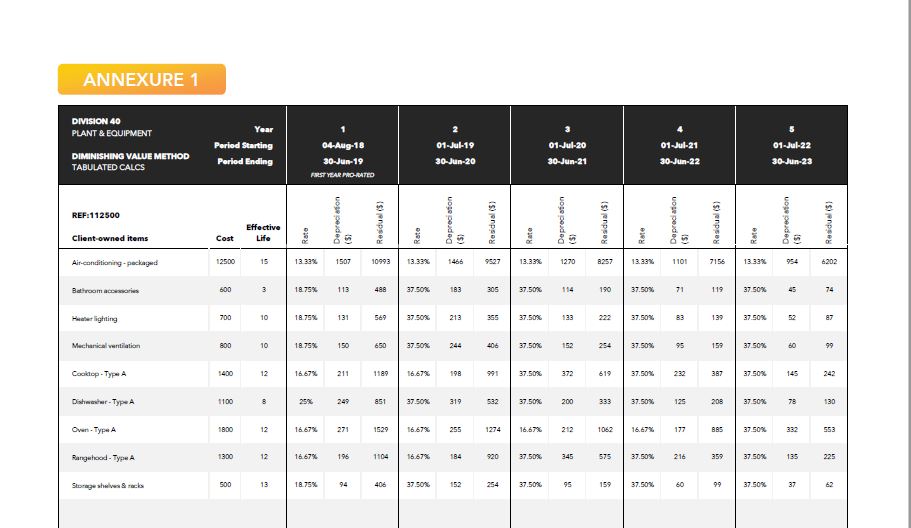

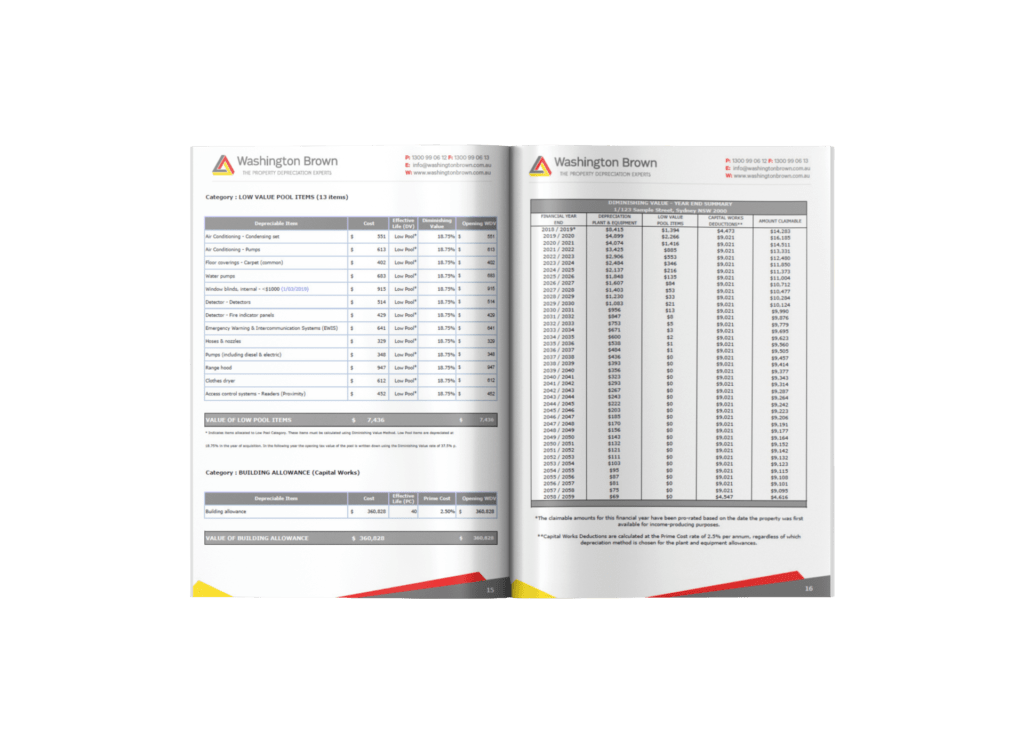

Tax Depreciation Schedules For Property Investors Washington Brown

Depreciation Schedule Samples Find Word Templates

Schedule Of Real Estate Owned Excel Template

Part 2 How To Prepare A 1040 NR Tax Return For U S Rental Properties

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Rental Property Spreadsheet Template Free In Download Free Rental

Rental Property Spreadsheet Template Free In Download Free Rental

What Is Bonus Depreciation A Small Business Guide

3 Smart Ways To Avoid Depreciation Tax On Rental Property

Irs Home Depreciation Calculator Atikkmasroaniati

Tax Return Depreciation Rental Property - Verkko 24 toukok 2022 nbsp 0183 32 How depreciation can lower your taxes When you buy a rental property you can deduct most of the expenses you incur keeping it up thus lowering your taxable income