Can You Claim Child Care Expenses For A Babysitter Verkko 9 helmik 2019 nbsp 0183 32 Can I Deduct Child Care Expenses if I Pay the Babysitter Cash Yes you can claim your childcare expenses whether you pay your babysitter using

Verkko 1 jouluk 2023 nbsp 0183 32 The IRS allows you to deduct certain childcare expenses on your tax return If you paid for a babysitter a summer camp or any care provider for a disabled child of any age or a child Verkko For 2022 the credit for child and dependent care expenses is nonrefundable and you may claim the credit on qualifying employment related expenses of up to 3 000 if you had one qualifying person or

Can You Claim Child Care Expenses For A Babysitter

Can You Claim Child Care Expenses For A Babysitter

https://www.moneycrashers.com/wp-content/uploads/2019/03/find-good-babysitter.jpg

Who Can Claim Child Care Expenses Family Lawyer Of Saskatoon

https://cdn.statically.io/img/familylawyerofsaskatoon.com/f=auto/wp-content/uploads/2022/07/Who-Can-Claim-Child-Care-Expenses-Featured-Image.jpg

![]()

Babysitter Expense Log Babysitter Tracker Babysitter Expense Nanny

https://static.vecteezy.com/system/resources/previews/022/348/054/non_2x/babysitter-expense-log-babysitter-tracker-babysitter-expense-nanny-expense-log-nanny-expense-baby-payment-log-spending-list-child-care-form-child-care-expenses-free-vector.jpg

Verkko It s possible you can claim the child and dependent care credit if all of these are true You pay someone to watch your children while you work The person you paid Verkko 11 kes 228 k 2021 nbsp 0183 32 To claim the credit you will need to complete Form 2441 Child and Dependent Care Expenses and include the form when you file your Federal income

Verkko 20 jouluk 2023 nbsp 0183 32 If you re a nanny or other worker who cares for others children in their employer s home and you have specific job duties assigned to you the IRS likely Verkko 16 marrask 2023 nbsp 0183 32 Child care expenses including babysitters and daycare are tax deductible but there are limitations on who can claim the expenses For example in

Download Can You Claim Child Care Expenses For A Babysitter

More picture related to Can You Claim Child Care Expenses For A Babysitter

Blog CloudTax Pro How Can I Claim Child Care Expenses

https://uploads-ssl.webflow.com/63f3057cb222cb5f4d2ef33e/63f3098c222b9b6292ec365b_childcare.jpeg

Browse Our Printable Receipt For Child Care Services Template Child

https://i.pinimg.com/736x/eb/11/9c/eb119c538119decb583fd8ce3b521978.jpg

Can You Claim A Child On Your Taxes In Miami If The Child Does Not Live

https://www.familylawprotection.com/wp-content/uploads/2023/03/can-you-claim-child-on-taxes-in-miami-if-child-does-not-live-with-you.jpg

Verkko 6 marrask 2018 nbsp 0183 32 You can still deduct child care expenses even if you pay the babysitter in cash The most important thing is that you maintain meticulous records Verkko 26 lokak 2023 nbsp 0183 32 These payments may be qualified childcare expenses if the family member babysitting isn t your spouse the parent of the child your dependent or your

Verkko 9 helmik 2019 nbsp 0183 32 Can you write off babysitting expenses as a babysitter If you re operating as an independent contractor you can deduct expenses you incur while Verkko 2 marrask 2023 nbsp 0183 32 Child care expenses are amounts you or another person paid to have someone else look after an eligible child so you could earn income go to

5 Things To Know About Claiming Child Care Expenses This Tax Season

https://i0.wp.com/hoyuenandco.com/wp-content/uploads/2019/01/Child-Care-Expenses-Deductions-CRA-Personal-Tax-Ho-Yuen-Co-Inc-CPA-Chartered-Professional-Accountants-Blog-Tax.jpg?w=3060&ssl=1

How The Child Care Flexible Spending Account Can Help Working Parents

https://imggarden.gardnerquadsquad.com/can_i_claim_child_care_expenses_paid_to_my_mother.jpg

https://kidsit.com/babysitting-expenses-parent-tax-guide

Verkko 9 helmik 2019 nbsp 0183 32 Can I Deduct Child Care Expenses if I Pay the Babysitter Cash Yes you can claim your childcare expenses whether you pay your babysitter using

https://nationaltaxreports.com/can-you-deduc…

Verkko 1 jouluk 2023 nbsp 0183 32 The IRS allows you to deduct certain childcare expenses on your tax return If you paid for a babysitter a summer camp or any care provider for a disabled child of any age or a child

How Long Can You Claim A Child As A Dependent Picnic

5 Things To Know About Claiming Child Care Expenses This Tax Season

Claiming Child Care Expenses In Canada

Three Ways A Class Can Prepare Babysitters For The Job

Daycare Business Income And Expense Sheet To File childcare

Free Child Support Demand Letter Template Sample Word PDF EForms

Free Child Support Demand Letter Template Sample Word PDF EForms

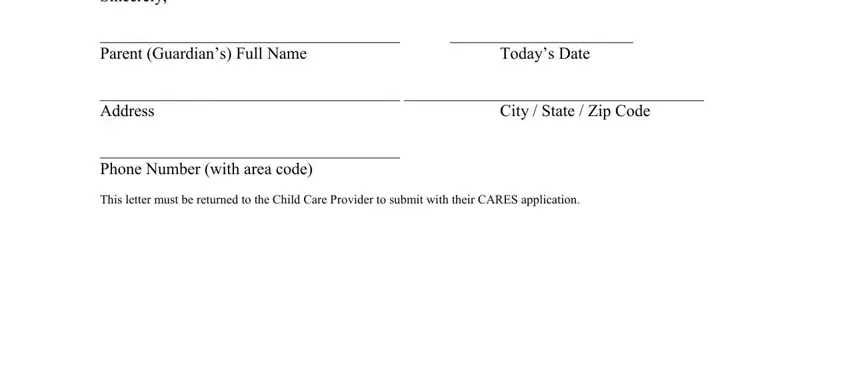

Child Care Payment Letter Fill Out Printable PDF Forms Online

Who Can Claim Child Care Expenses Family Lawyer Winnipeg

How To Claim Child Care Expenses YouTube

Can You Claim Child Care Expenses For A Babysitter - Verkko 11 kes 228 k 2021 nbsp 0183 32 To claim the credit you will need to complete Form 2441 Child and Dependent Care Expenses and include the form when you file your Federal income