Can You Claim Heat Pumps On Taxes Under the Energy Efficient Home Improvement Credit a taxpayer can claim the credit only for qualifying expenditures incurred for an existing home or for an addition to or

The 25c tax credit allows taxpayers to claim certain home energy upgrades like heat pumps to reduce their tax burden In 2023 the maximum federal tax credit for installing a heat pump increased to 30 of your project costs up to Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax

Can You Claim Heat Pumps On Taxes

Can You Claim Heat Pumps On Taxes

https://www.hvac.com/wp-content/uploads/2019/09/outdoor-heat-pumps-2.jpg

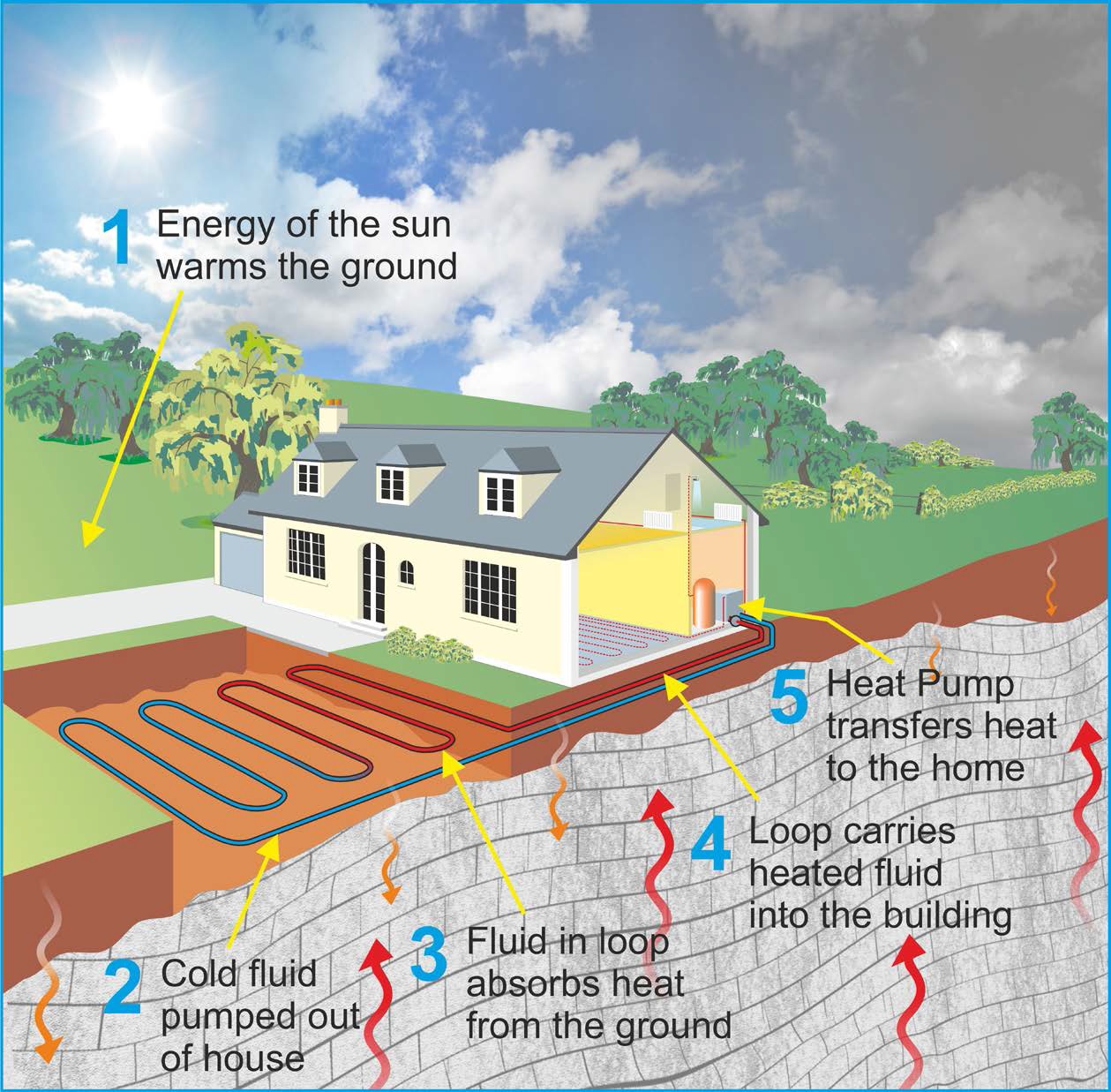

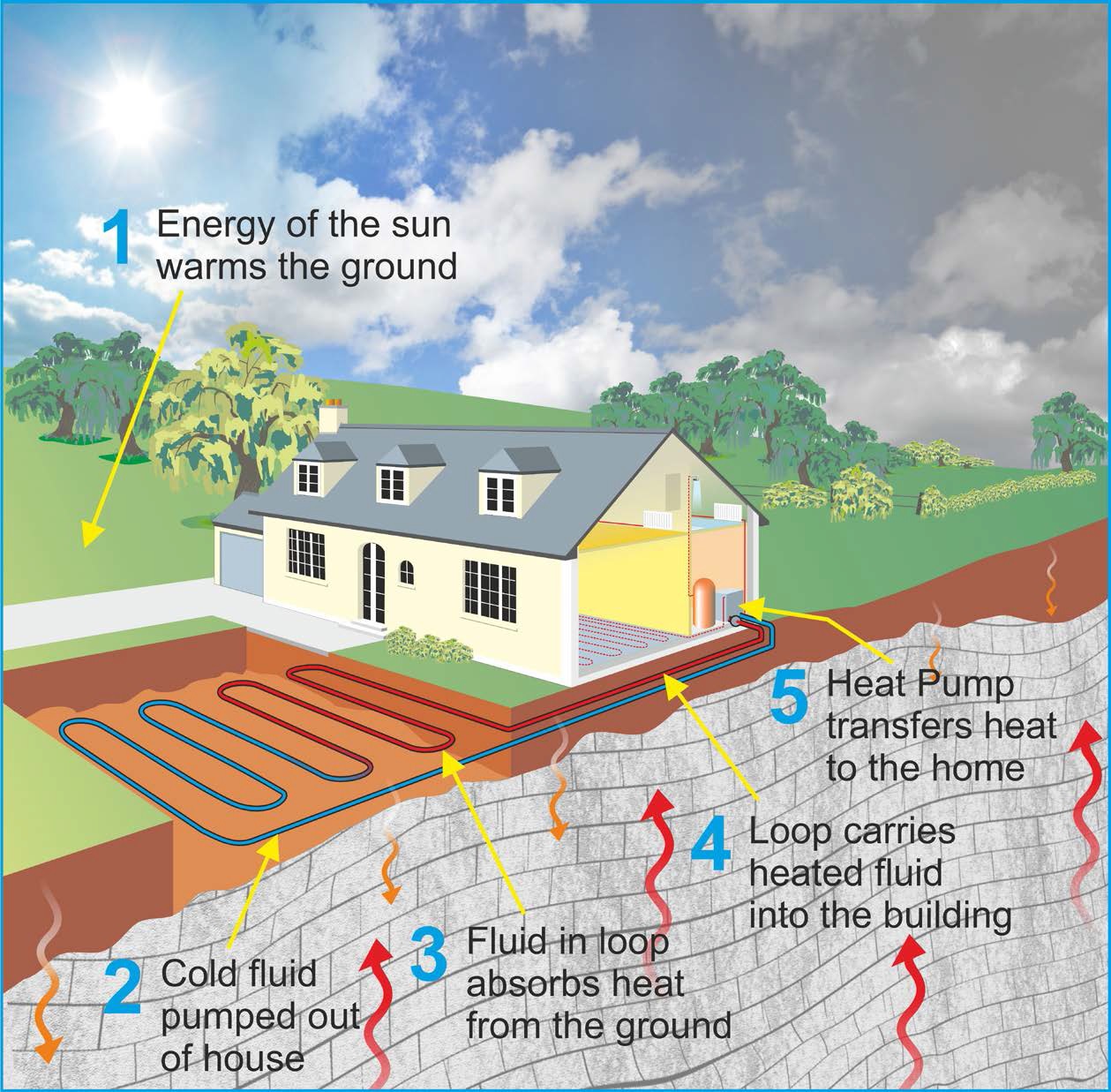

Heat Pump Archives Isabel Barros Architects Blog

https://isabelbarrosarchitects.ie/blog/wp-content/uploads/2015/05/How-ground-source-heat-pumps-work.jpg

Heat Pump Sahaj Cooling

https://sahajcooling.com/wp-content/uploads/2020/12/Sahaj-Heat-pump.png

If your project is 10 000 you can claim a 2 000 tax credit Tax credits are applied to the tax year you install the heat pump Any homeowners who install a new heat pump on or after this date may be eligible for a tax credit of up to 30 of the total cost they paid to purchase and install the new unit This credit is capped at a maximum of

Installing alternative energy equipment in your home such as solar panels heat pumps windows doors and roofing can qualify you for a credit up to 30 of your total cost For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made

Download Can You Claim Heat Pumps On Taxes

More picture related to Can You Claim Heat Pumps On Taxes

Upgrade To An Energy Efficient Heat Pump Hot Water System Save Up To

https://ultimateenergy.com.au/wp-content/uploads/2023/08/Heatpumpnsw.png

Heat Pumps On Vimeo

https://i.vimeocdn.com/video/686690085-8e1edf9c344fbc8c12daefd19c067d0151f878fb985d38db2b283aee2bccdb1a-d?f=webp

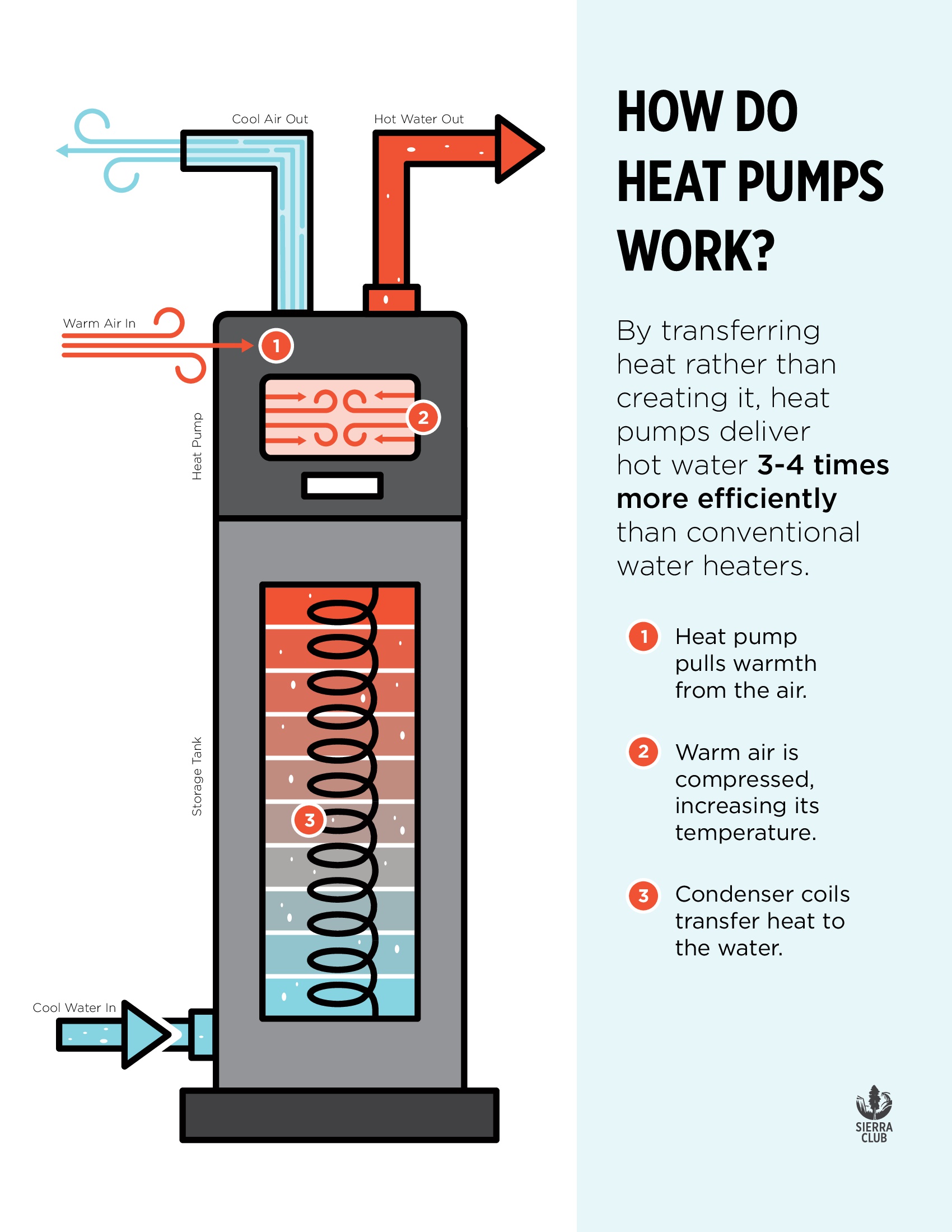

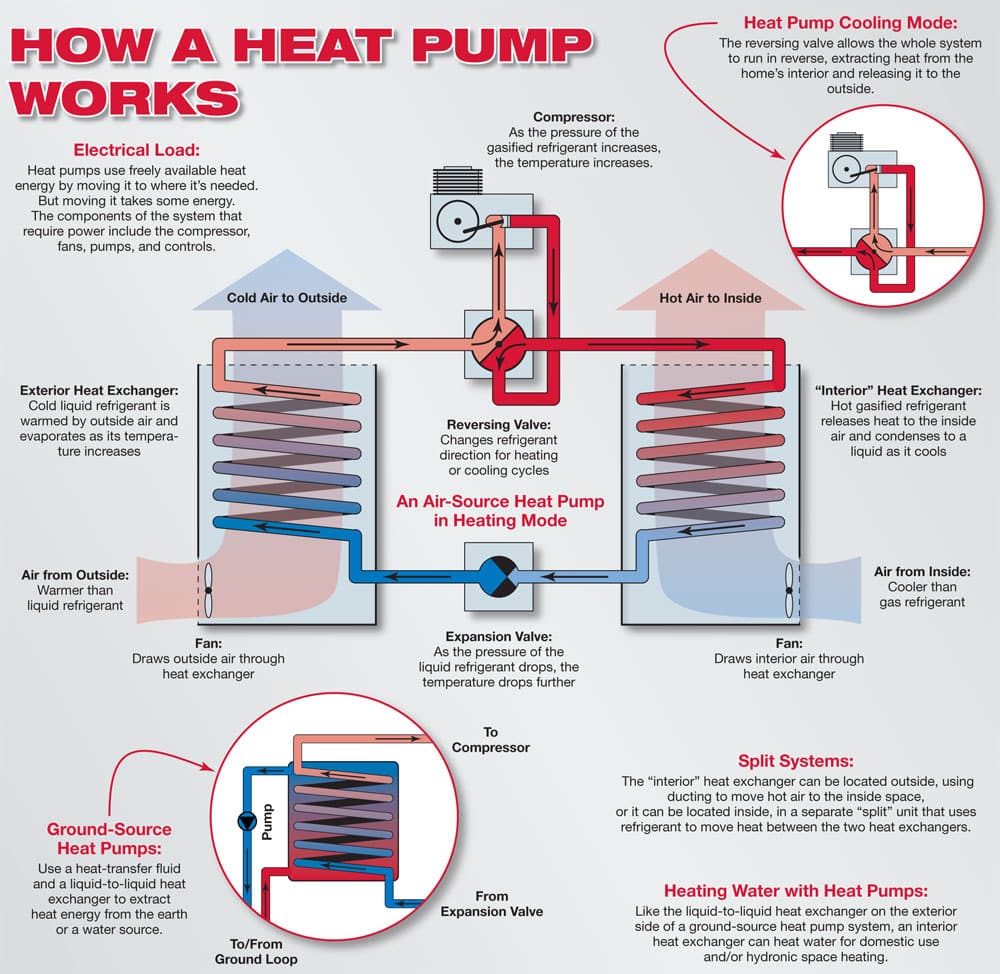

What The Heck Are Heat Pumps Sierra Club

https://www.sierraclub.org/sites/www.sierraclub.org/files/heat-pump.jpg

The heat pump meets the applicable energy efficiency and other requirements for qualifying for the Energy Efficient Home Improvement Credit Assume further that the taxpayer By further improving your home s envelope with new ENERGY STAR certified exterior doors and a heat pump water heater you can claim up to 600 or 30 of the product cost for upgrading your windows in one taxable year

If you opt to install a heat pump you ll be eligible for a federal tax credit for models that achieve the Consortium for Energy Efficiency s CEE highest tier for efficiency The following are questions and answers regarding the Home Energy Rebates administered by the U S Department of Energy DOE and funded by the Inflation Reduction Act IRA For

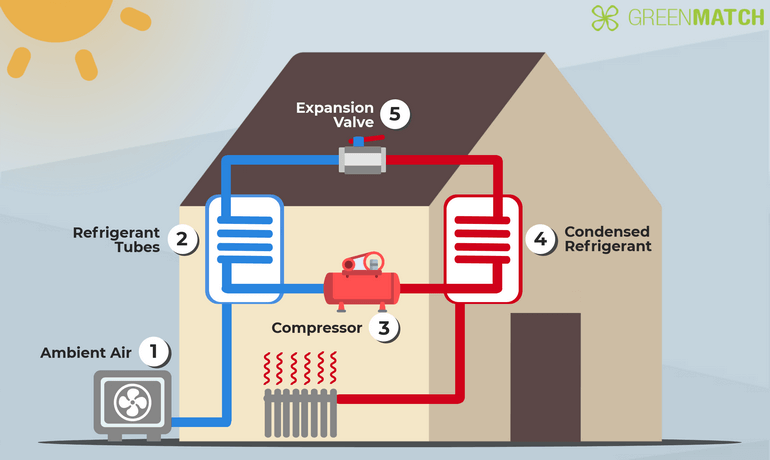

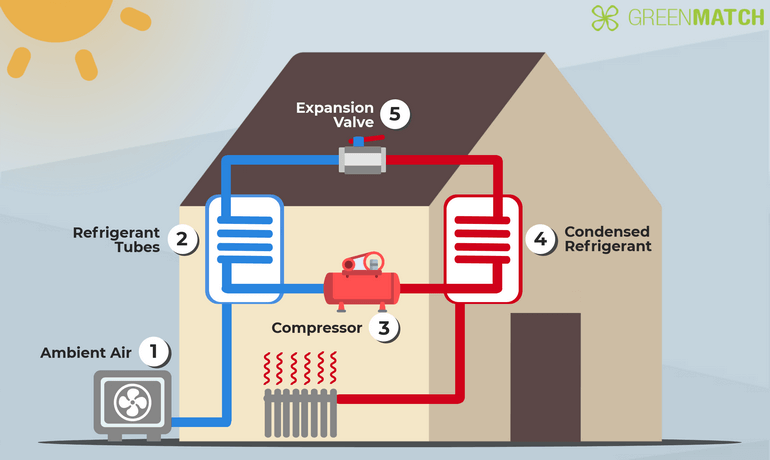

What Is A Heat Pump Deely House

https://www.deelyhouse.com/wp-content/uploads/2020/01/how-air-source-heat-pump-works.png

What Texans Needs To Know About Heat Pumps

https://publicinterestnetwork.org/wp-content/uploads/2022/12/51322503903_6b8b80baa4_o-scaled.jpg

https://www.irs.gov/credits-deductions/frequently...

Under the Energy Efficient Home Improvement Credit a taxpayer can claim the credit only for qualifying expenditures incurred for an existing home or for an addition to or

https://sealed.com/resources/heat-pum…

The 25c tax credit allows taxpayers to claim certain home energy upgrades like heat pumps to reduce their tax burden In 2023 the maximum federal tax credit for installing a heat pump increased to 30 of your project costs up to

There Are 6 Heat Pumps On The Roof That Are Causing Vibrations In My

What Is A Heat Pump Deely House

He Wants Europe To Exchange Oil And Natural Gas For Heat Pumps SEB

Hpc2023 Annex 63

Heat Pumps On The Rise In 2023 Energy Info

8 Things To Consider Before Getting A Heat Pump Installed Foreign Policy

8 Things To Consider Before Getting A Heat Pump Installed Foreign Policy

Heat Pump FAQs Consumer NZ

Air Source Heat Pumps On Deck To Deliver Energy Cost Savings

Heat Pump What Is It And How Does It Work Sun Aire Comfort Systems

Can You Claim Heat Pumps On Taxes - Installing alternative energy equipment in your home such as solar panels heat pumps windows doors and roofing can qualify you for a credit up to 30 of your total cost