Can You Claim Mechanical Repairs On Tax In a nutshell although car repairs can put a dent in your wallet the ability to deduct these expenses for tax purposes can lighten the financial burden for those eligible However the complexities of tax laws mean it s crucial to stay

Mechanic tax deductions allow auto repair shop owners to reduce their income tax bill and keep more of their hard earned revenue It s important to understand the available tax deductions and how to apply them to make sure Mechanics and Painting Company owners can save thousands by incorporating their business as an S Corp election Mechanics can save thousands or even tens of thousands of dollars on self employment tax versus

Can You Claim Mechanical Repairs On Tax

Can You Claim Mechanical Repairs On Tax

https://www.laurenson.co.nz/wp-content/uploads/2022/11/Your-car-as-a-business-expense.jpg

Why The Right To Repair Policy Is Good For Entrepreneurs Economy24

https://media.citizen.co.za/wp-content/uploads/2022/09/right-to-repair-franchise.jpg

ERC Credits What Is It And How Can You Claim It

https://www.cleantechloops.com/wp-content/uploads/2021/08/tax-evasion.jpg

The rule for business owners and landlords is that you can generally deduct amounts paid for repairs and maintenance if the expenses don t have to be capitalized However some isolated energy related tax credits are Car repairs are tax deductible as part of a group of car related expenses However only certain individuals are eligible to claim a tax deduction related to car expenses This includes business owners other self employed workers

Expenses for repairs and maintenance are included You can also claim related expenses such as insurance vehicle registration fees and property taxes on your vehicle but the Internal Oil changes repairs and regular checkups are all tax deductible if you drive for work

Download Can You Claim Mechanical Repairs On Tax

More picture related to Can You Claim Mechanical Repairs On Tax

What Can You Claim On Income Protection YouTube

https://i.ytimg.com/vi/dj0vSVj6R8Y/maxresdefault.jpg

Self Employed Expenses What Can You Claim YouTube

https://i.ytimg.com/vi/bn1yWtJ8Znw/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYZSBWKFgwDw==&rs=AOn4CLBf2I-ETexLjoKCoAz_yHWs5bjRBA

Can You Claim Mortgage Insurance On Taxes CountyOffice YouTube

https://i.ytimg.com/vi/0lscCl-acdk/maxresdefault.jpg

You may be able to reduce your taxes by deducting unreimbursed job related expenses if attributable to self employment they may be deductible on Schedule C You should keep You can also claim the work related cost of repairing and insuring your tools and equipment and any interest charges you incur on money you borrowed to purchase these items You claim

If you are an employee and you purchased tools to use at work you may be able to deduct the cost of your tools as a job related expense You ll need to itemize deductions In general you can expect to deduct 70 of your car expenses toward your deduction Seems pretty simple right There is one caveat For a taxpayer to be eligible to claim car repairs and

Can You Claim Home Improvements On Your Taxes CountyOffice YouTube

https://i.ytimg.com/vi/Kt1oSzozBIc/maxresdefault.jpg

Can You Claim Insurance For Flooded Car cars monsoon waterlogging

https://i.ytimg.com/vi/xyp6VB7gGoo/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYHyBYKHIwDw==&rs=AOn4CLAYxFoXFlm6IN-b1RxPY7gXq3B_Qw

https://triplogmileage.com › tax › are-car-re…

In a nutshell although car repairs can put a dent in your wallet the ability to deduct these expenses for tax purposes can lighten the financial burden for those eligible However the complexities of tax laws mean it s crucial to stay

https://www.goldenappleagencyinc.com › bl…

Mechanic tax deductions allow auto repair shop owners to reduce their income tax bill and keep more of their hard earned revenue It s important to understand the available tax deductions and how to apply them to make sure

Can You Claim Home Improvements On Taxes CountyOffice YouTube

Can You Claim Home Improvements On Your Taxes CountyOffice YouTube

What Losses Can You Claim Under The Criminal Injuries Compensation Act

CIS What Expenses Can You Claim In Your Construction Business CIS

What Expenses Can You Claim When Working From Home YouTube

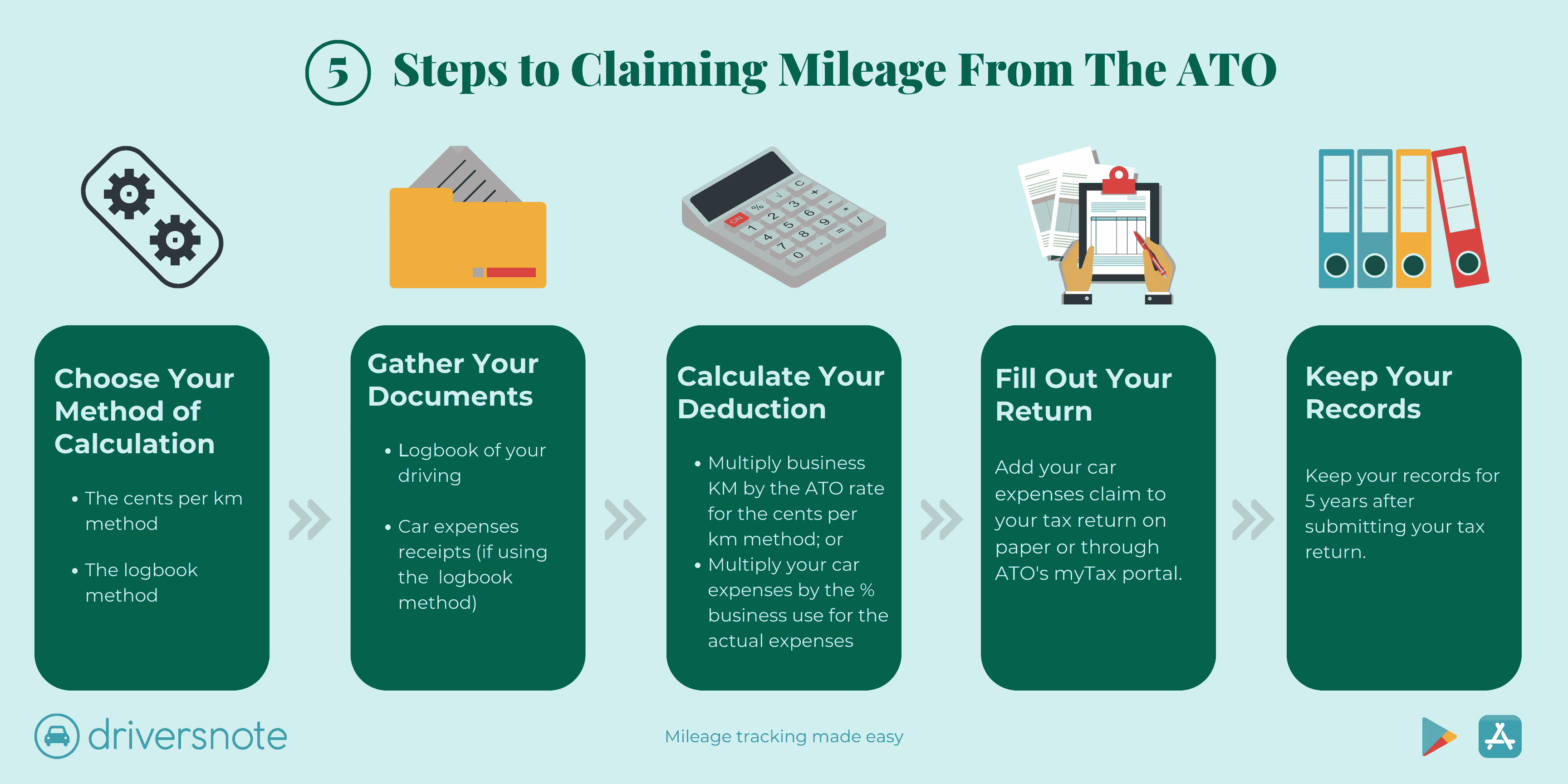

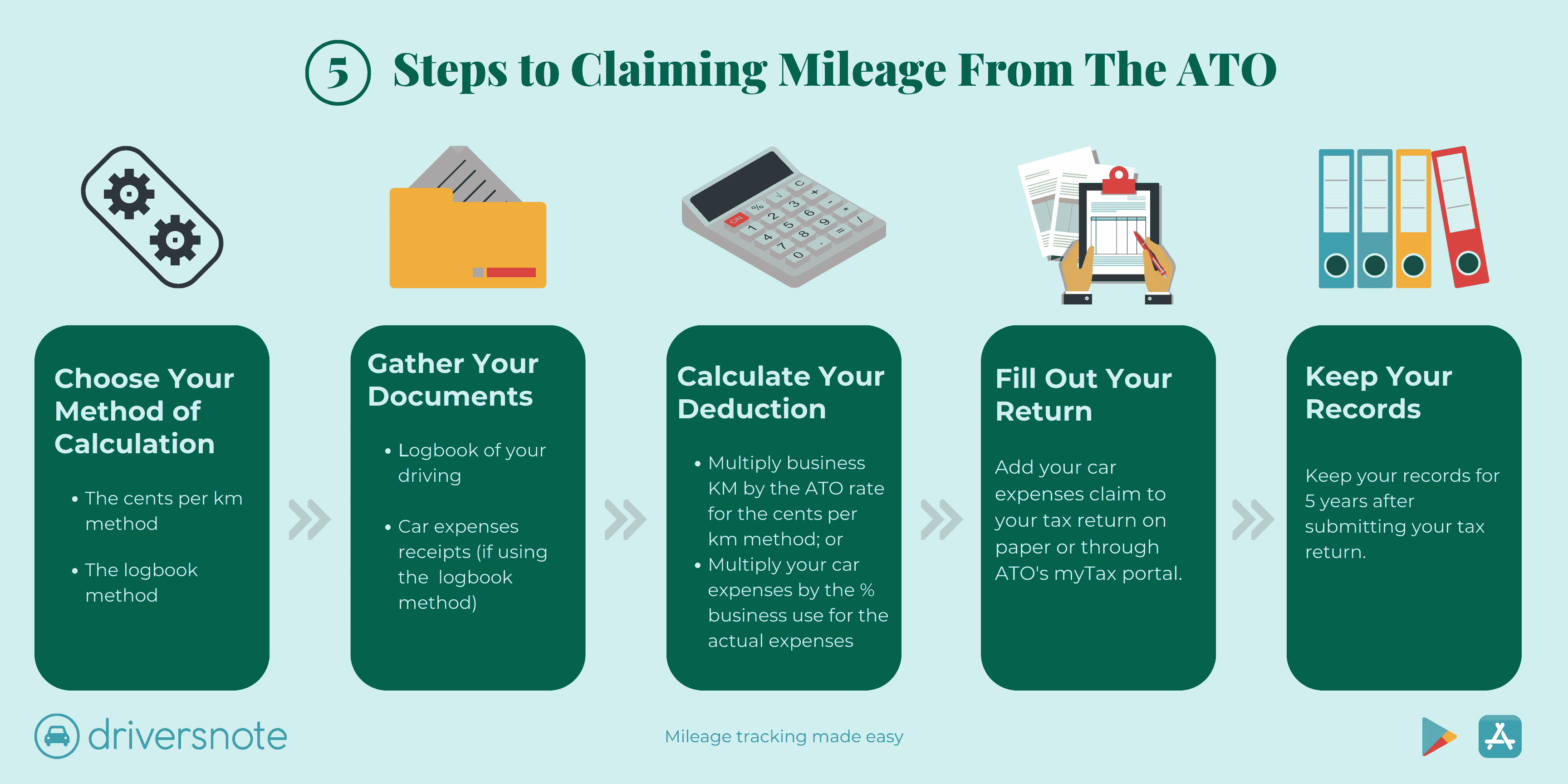

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

Can You Claim Mortgage Interest On Taxes CountyOffice YouTube

Can You Claim Assisted Living Expenses On Taxes CountyOffice

Tax Credits In 2023 Which Ones Can You Claim For Maximum Savings

Can You Claim Mechanical Repairs On Tax - In some instances car repairs can be deducted from a federal tax return However not all taxpayers can take advantage of this write off We encourage you to talk with