Can You Claim Vat Back On Mileage Employers who are registered for VAT can claim back input tax on the fuel element of any mileage payments they make for business mileage Calculating the input tax The input

As an employer you can only reclaim the VAT on your employees mileage expenses if you re paying your employees a mileage allowance for using their own vehicle for work Partially exempt businesses can only claim for a portion of VAT back on their input tax on expenses relating to VAT taxable sales 2 When it comes to claiming VAT on

Can You Claim Vat Back On Mileage

Can You Claim Vat Back On Mileage

https://gg.myggsa.co.za/how-far-back-can-you-claim-vat-in-south-africa-.jpg

Can You Claim Vat On Petrol In South Africa Greater Good SA

https://gg.myggsa.co.za/can-you-claim-vat-on-petrol-in-south-africa-.jpg

Can You Still Collect Vat When Yo Leave South Africa Greater Good SA

https://gg.myggsa.co.za/can-you-still-collect-vat-when-yo-leave-south-africa-.jpg

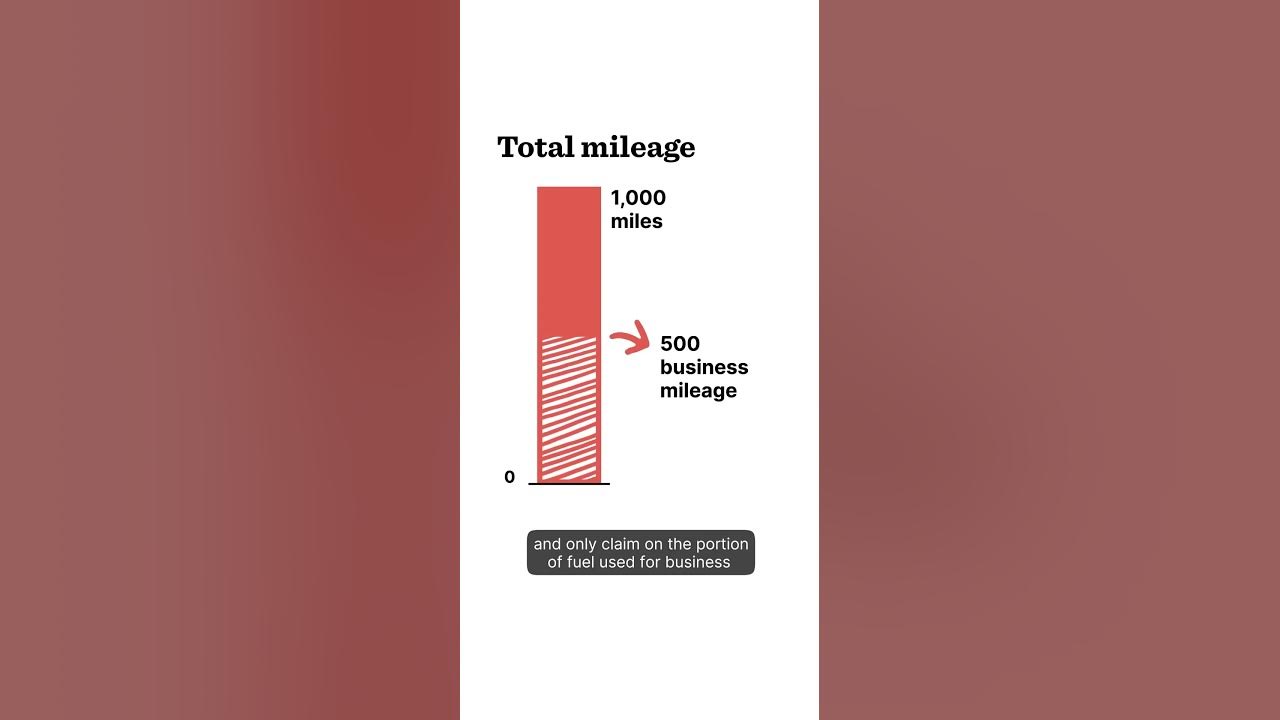

Only reclaim the VAT on fuel you use for business trips you ll have to keep detailed mileage records You might choose not to reclaim any VAT for example if your business As mentioned in the introduction you can only claim back the VAT on mileage claims which relate to the fuel amount So how much of the 45 pence or 25 pence

Employers who use or provide their employees with company cars can claim back VAT on business mileage Whenever you pay your employees a mileage As VAT is charged on fuel HMRC allow you to claim back the VAT from the fuel portion of the mileage To calculate this they use their advisory fuel rate which

Download Can You Claim Vat Back On Mileage

More picture related to Can You Claim Vat Back On Mileage

Can A Company Claim Vat On Accommodation In South Africa Greater Good SA

https://gg.myggsa.co.za/can-a-company-claim-vat-on-accommodation-in-south-africa-.jpg

Who Can Claim Vat In South Africa Greater Good SA

https://gg.myggsa.co.za/who-can-claim-vat-in-south-africa-.jpg

Can You Claim Back VAT Without Receipt Accountant s Answer

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/10/Can-you-claim-back-VAT-without-a-receipt.jpg

VAT isn t reclaimable on the whole mileage amount claimed instead it is only reclaimable on the fuel element of the mileage This fuel element is determined by HMRC and it is When driving a car for business you are likely claiming mileage expenses This means that the business you work for can claim VAT Or if you re a business owner with

Yes If you are a VAT registered business you can reclaim the VAT element of the mileage payment made to employees There are specific rules that need to adhere to Yes you can reclaim VAT on fuel when it comes to road fuel used for business miles or on a company car This is the simplest option when it comes to claiming back some of that

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

https://img.hechtgroup.com/can_i_claim_vat_back_on_a_commercial_property.png

Can You Claim VAT Back On Fuel YouTube

https://i.ytimg.com/vi/749I1hBjINc/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ab4HgAKAD4oCDAgAEAEYfyA3KDUwDw==&rs=AOn4CLDi0gj9PvsXVLxYspSIj3mVyqob1g

https://www.taxinsider.co.uk/claiming-vat-on...

Employers who are registered for VAT can claim back input tax on the fuel element of any mileage payments they make for business mileage Calculating the input tax The input

https://www.rac.co.uk/.../claiming-vat-on-mileage

As an employer you can only reclaim the VAT on your employees mileage expenses if you re paying your employees a mileage allowance for using their own vehicle for work

How To Claim Back VAT VAT Guide Xero UK

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

What Can I Claim Vat Back On In South Africa Greater Good SA

Can You Claim VAT On Travel Expenses Tapoly

Can You Claim Vat Back On Fuel Without A Receipt 2024 Updated

Can You Claim Back VAT On A Staff Christmas Party

Can You Claim Back VAT On A Staff Christmas Party

Can You Claim VAT Back On Fuel YouTube

VAT On Electric Cars Explained Can You Reclaim VAT On Electric Vehicles

Can You Claim VAT On Fuel In South Africa Greater Good SA

Can You Claim Vat Back On Mileage - As VAT is charged on fuel HMRC allow you to claim back the VAT from the fuel portion of the mileage To calculate this they use their advisory fuel rate which