Can You Deduct Education Expenses You may be able to deduct the cost of work related education expenses paid during the year if you re A self employed individual An Armed Forces reservist A qualified

You can deduct the costs of qualifying work related education as business expenses This is education that meets at least one of the following two tests The education is There are three possible ways to deduct qualified education expenses on your tax return The tuition and fees deduction is available to all taxpayers Then there

Can You Deduct Education Expenses

Can You Deduct Education Expenses

https://static.wixstatic.com/media/00455c_6093ac72bd9a4df69aa2490a37a78676~mv2.png/v1/fit/w_735%2Ch_1000%2Cal_c/file.png

Mattina Kent Gibbons ClientLine Newsletter August 2021 Deduct

https://cdn.ltmclientmarketing.com/WEBCL/articles/2021Aug/Deduct_Business_Expenses.jpg

Preparing House For Sale Tax Deduction How To Get Benefits Tax

https://i.pinimg.com/originals/dc/b4/4f/dcb44f4207d6c494ab1ed28d943b00e1.jpg

Education expenses can be complex but we ll simplify them for you Here are examples of what you can and can t deduct You can deduct Tuition Enrollment You can t deduct education expenses if the course Isn t related to your job Qualifies you for a new trade or profession Is required to meet the minimum educational

Tax credits and deductions can help offset college expenses for yourself or your dependents What Are the Different Types of Education Tax Credits An education tax credit allows you to The Tuition and Fees Deduction was extended through the end of 2020 and allows you to deduct up to 4 000 from your income for qualifying tuition expenses paid for you your spouse or your

Download Can You Deduct Education Expenses

More picture related to Can You Deduct Education Expenses

What Expenses Can You Deduct

https://media-exp1.licdn.com/dms/image/D4D12AQEysguo1ZrG9Q/article-cover_image-shrink_720_1280/0/1668097283422?e=2147483647&v=beta&t=N0yLW9sBK2U1GqNuXs2uchc77KuUiE89ALiMe8MV1GM

Can You Deduct Rent On Taxes Planning Made Simple

https://www.planningmadesimple.com/wp-content/uploads/2023/02/1080x720-Canyoudeductrentonyourtaxesrewrite-1676167295.jpg

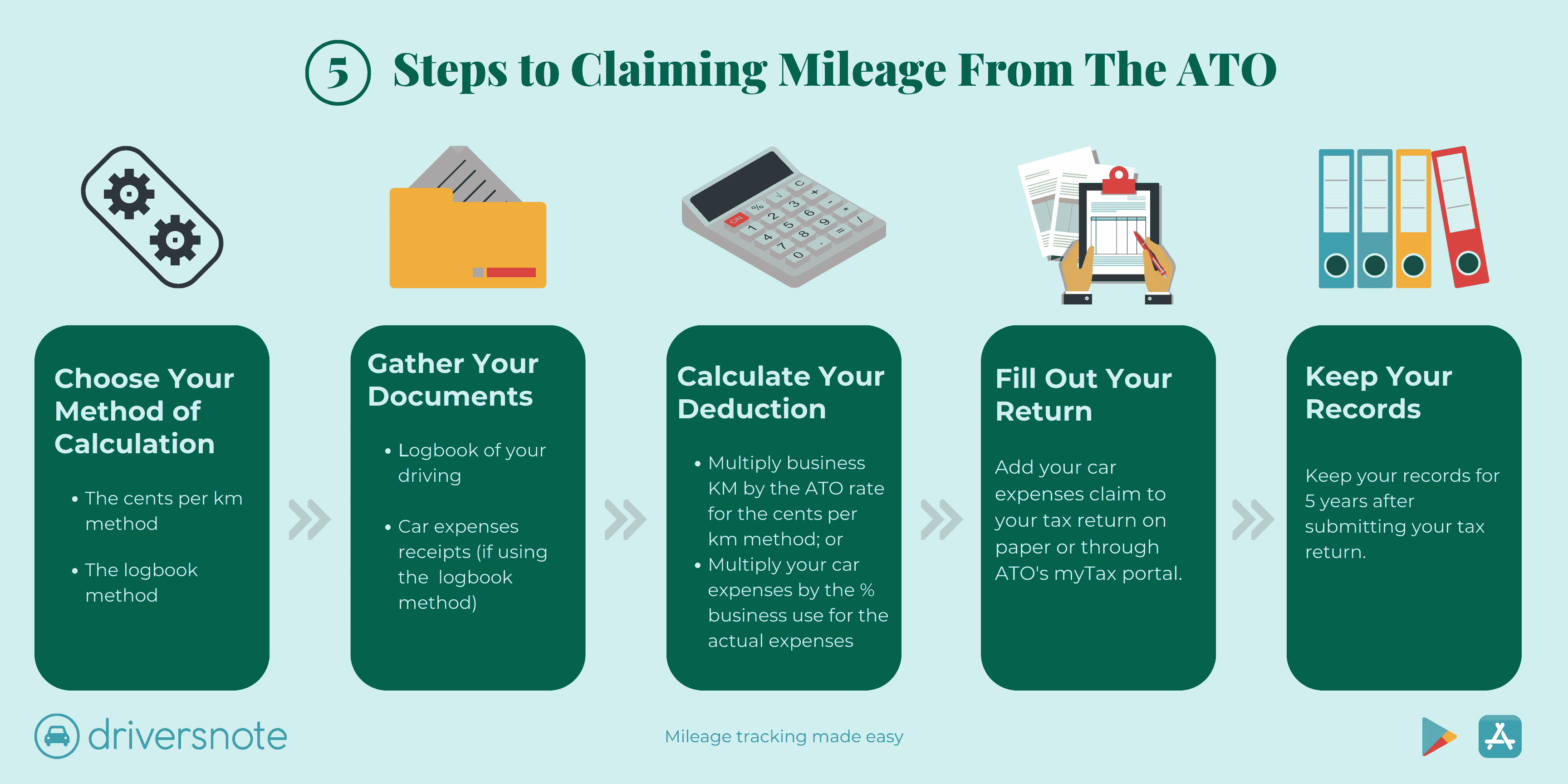

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

You will need this form in order to calculate the qualified expenses that you can claim According to the IRS you must reduce any amount of qualified expenses by the amount If you claim the full lifetime learning credit you can t take tax free 529 withdrawals for the first 10 000 in tuition expenses you claimed for the credit but you can withdraw money tax free

In general qualified tuition and related expenses for the education tax credits include tuition and required fees for the enrollment or attendance at eligible post secondary Here s how to deduct educational expenses for employees and business owners and when these benefits are taxable to employees

What Can You Deduct Blockchain Education Network

https://learn.blockchainedu.org/wp-content/uploads/Undestanding-Crypto-Taxes-4-1.jpg

Can You Deduct Your Montessori Preschool Expenses In AZ Happenings

https://happeningsineducation.files.wordpress.com/2020/03/can-you-deduct-your-montessori-preschool-expenses-in-az.jpg

https://www.irs.gov/taxtopics/tc513

You may be able to deduct the cost of work related education expenses paid during the year if you re A self employed individual An Armed Forces reservist A qualified

https://www.irs.gov/newsroom/tax-benefits-for...

You can deduct the costs of qualifying work related education as business expenses This is education that meets at least one of the following two tests The education is

How To Deduct Education Expenses Flyfin AI Tax Engine

What Can You Deduct Blockchain Education Network

Can You Deduct Your Home Office Expenses YouTube

Education Deductions What Tax Forms Do I File

Can I Deduct Moving Expenses Simpleetax YouTube

Can Education Expenses Be Deducted AZexplained

Can Education Expenses Be Deducted AZexplained

7 Top Tax Deductions For Your Small Business Excess Logic Surplus

Can I Include Training Expenses As A Tax Deduction Finance Zacks

List Of Tax Deductions Here s What You Can Deduct

Can You Deduct Education Expenses - Generally if you claim a business deduction for work related education and you drive your car to and from school the amount you can deduct for miles driven from January 1