Can You Get A Refund On Social Security Tax Withheld You must first attempt to claim a Social Security or Medicare tax refund from your employer You can submit your refund claim to the Internal Revenue Service IRS on Form 843 if you can t get a full

Can I get a refund of Social Security taxes paid if I live in another country and I am not eligible for U S benefits Although we can t refund correctly paid U S Social Security Refund of taxes withheld in error If Social Security or Medicare taxes were withheld in error from pay that is not subject to these taxes contact the employer who withheld the

Can You Get A Refund On Social Security Tax Withheld

Can You Get A Refund On Social Security Tax Withheld

https://www.withholdingform.com/wp-content/uploads/2022/08/can-you-change-social-security-tax-withholding-online-fill-online.png

Social Security GuangGurpage

https://www.pgpf.org/sites/default/files/03-Should-We-Eliminate-the-Social-Security-Tax-Cap-graphic-2023.jpg

W2 Form Social Security Tax Withheld Universal Network

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2019/03/w2-form-social-security-tax-withheld.gif

Overpayments can occur in two main ways either by working multiple jobs that together exceed the tax cap or through a payroll error where a single employer withholds too much For 2024 any amount Do I Get a Refund on Social Security Taxes That Are Withheld Can I Include Social Security Withheld as a Deduction How to Recover Excess Social Security Deductions

How do I get my money back When you file your tax return there s a place on Form 1040 where you can indicate that you had too much money withheld for Social Security taxes 11 rowsWhen you file your tax return the following year you can claim a refund from the Internal Revenue Service IRS for Social Security taxes withheld that exceeded the

Download Can You Get A Refund On Social Security Tax Withheld

More picture related to Can You Get A Refund On Social Security Tax Withheld

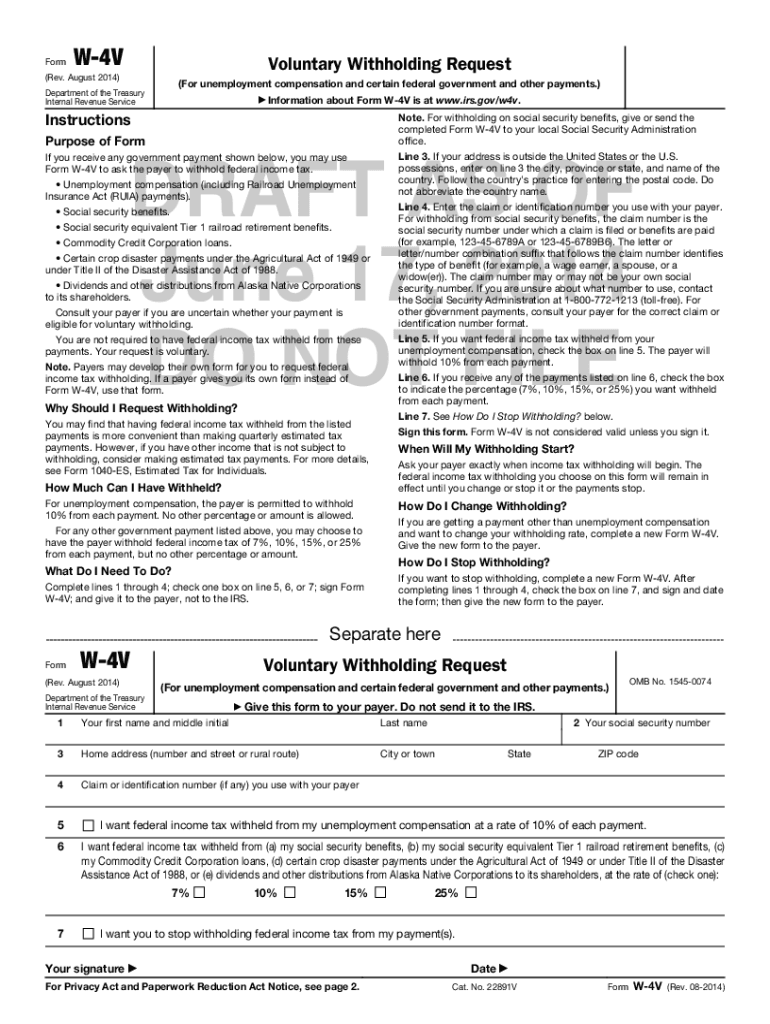

Social Security Use This IRS Form To Have Federal Income Tax Withheld

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AAV5DU4.img?w=1920&h=1080&m=4&q=89

Inflation Affects Social Security Taxes Withheld From Your Paycheck

https://images.mktw.net/im-587877?width=700&height=462

How To Get Your Social Security Tax Refund

https://silvertaxgroup.com/wp-content/uploads/2019/09/Social-Security-Tax-Refund.jpeg

You can ask us to withhold federal taxes from your Social Security benefit payment when you first apply If you are already receiving benefits or if you want to change or stop your If the same employer deducted too much Social Security tax contact them and ask them to fix the issue They should refund you the overpayment and adjust your

Generally speaking Social Security tax is withheld at a flat rate up to a maximum level of employment income and isn t subject to deductions or credits so you Add up the amounts that appear in this box if you have multiple W 2s then compare your total to the maximum Social Security tax for the year You can claim the

Social Security Tax Withholding What Do YOU Pay YouTube

https://i.ytimg.com/vi/b9kzyxNfirY/maxresdefault.jpg

Paying Off Credit Card In Full By Mistake Can You Get A Refund

https://www.creditcards.com/wp-content/uploads/Can-you-get-overpayment-back-if-you-paid-card-balance-in-full-by-mistake.jpg

https://www.thebalancemoney.com/soci…

You must first attempt to claim a Social Security or Medicare tax refund from your employer You can submit your refund claim to the Internal Revenue Service IRS on Form 843 if you can t get a full

https://faq.ssa.gov/en-us/Topic/article/KA-02801

Can I get a refund of Social Security taxes paid if I live in another country and I am not eligible for U S benefits Although we can t refund correctly paid U S Social Security

Social Security Tax Rate 2023 2024 Zrivo

Social Security Tax Withholding What Do YOU Pay YouTube

Here s The Average IRS Tax Refund Amount By State GOBankingRates

Can You Get A Refund On A Money Order ScoreSense

Social Security Cost Of Living Adjustments 2023

The Social Security Tax Was Withheld At The Rate Of 6 0 On The First

The Social Security Tax Was Withheld At The Rate Of 6 0 On The First

How To Calculate Federal Income Taxes Social Security Medicare

How Do I Have Tax Withheld From Social Security Retire Gen Z

What Is The Social Security Tax Facty

Can You Get A Refund On Social Security Tax Withheld - If your employer withheld too much Social Security tax in Box 4 or Medicare tax in Box 6 you will need to contact your employer for a refund of the excess FICA taxes withheld