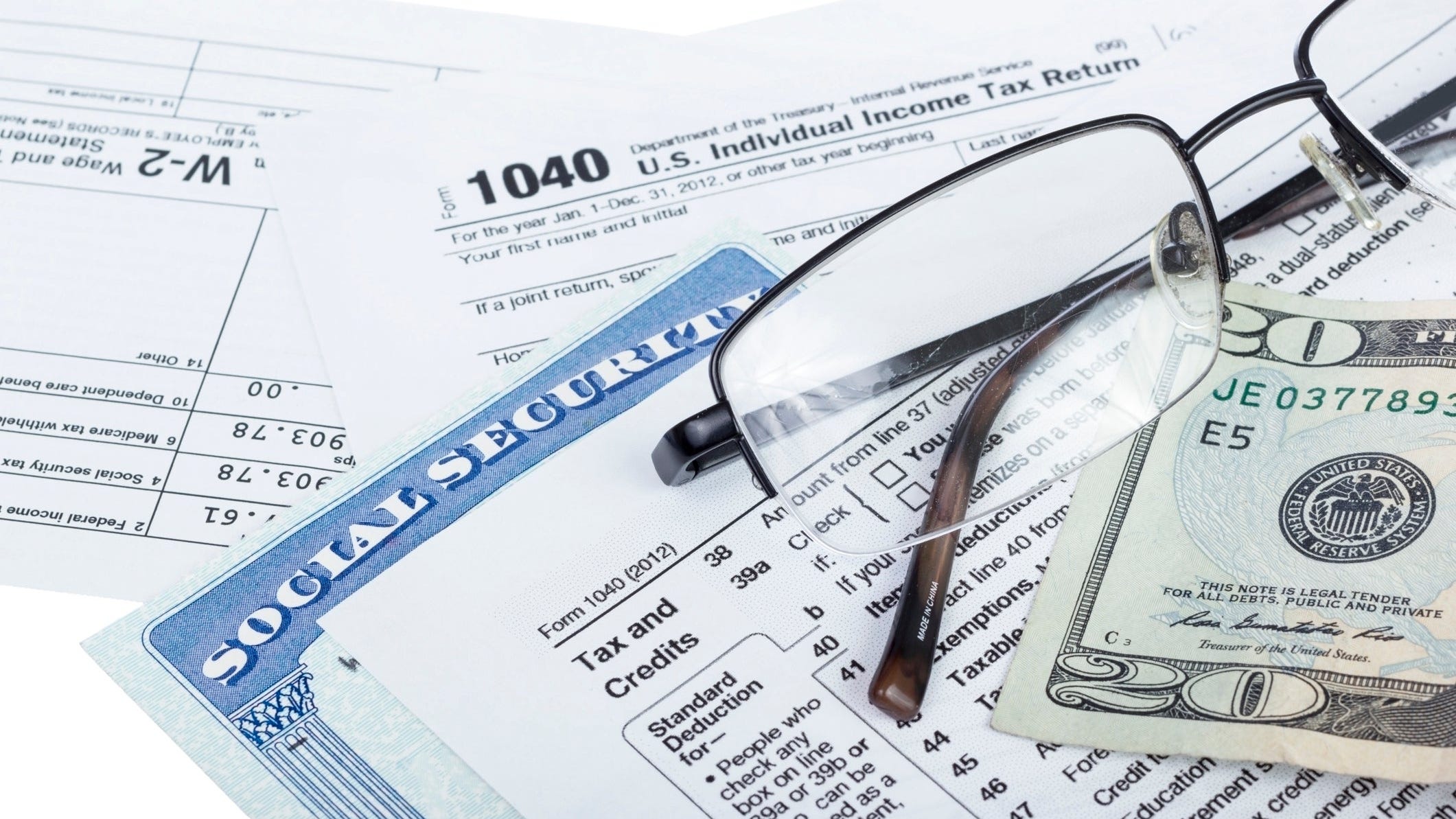

Do You Get Money Back From Social Security Tax Withheld You might overpay Social Security and Medicare taxes for a number of reasons Some workers are exempt from paying these taxes The government will give the money back

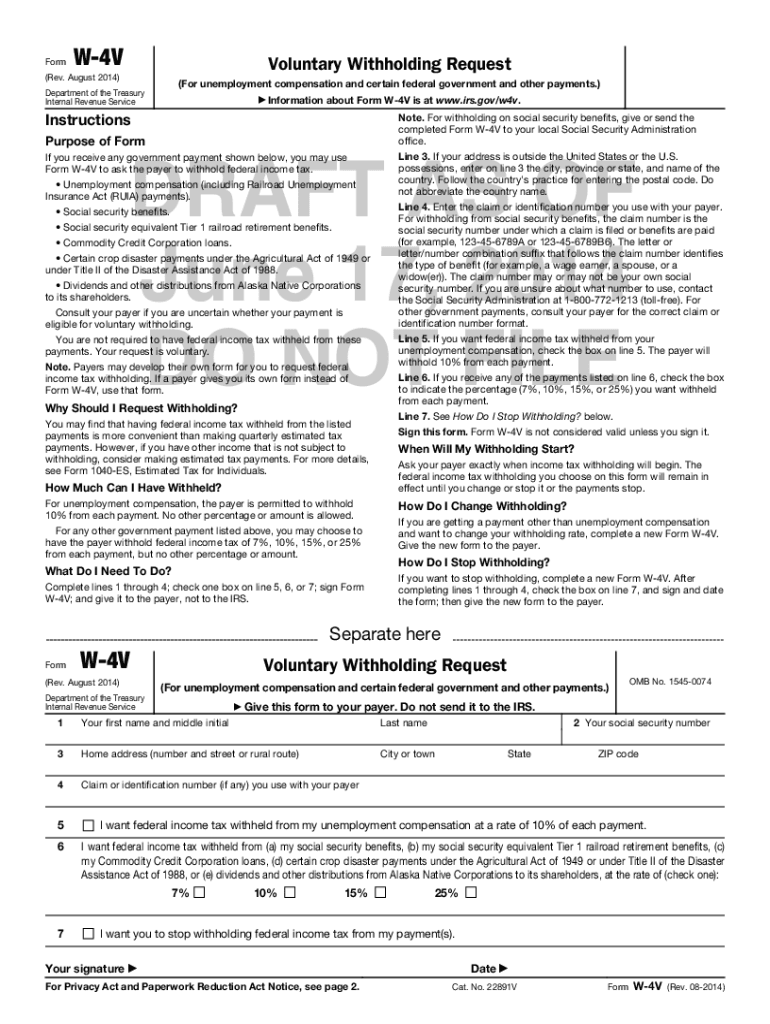

You can ask us to withhold federal taxes from your Social Security benefit payment when you first apply If you are already receiving benefits or if you want to change or stop your withholding Although we can t refund correctly paid U S Social Security taxes and contributions you still may be able to get benefits based on those tax contributions

Do You Get Money Back From Social Security Tax Withheld

Do You Get Money Back From Social Security Tax Withheld

https://www.gannett-cdn.com/-mm-/9e1f6e2ee20f44aa1f3be4f71e9f3e52b6ae2c7e/c=0-110-2121-1303/local/-/media/2020/03/08/USATODAY/usatsports/MotleyFool-TMOT-3a93e1ff-6cd31771.jpg?width=2121&height=1193&fit=crop&format=pjpg&auto=webp

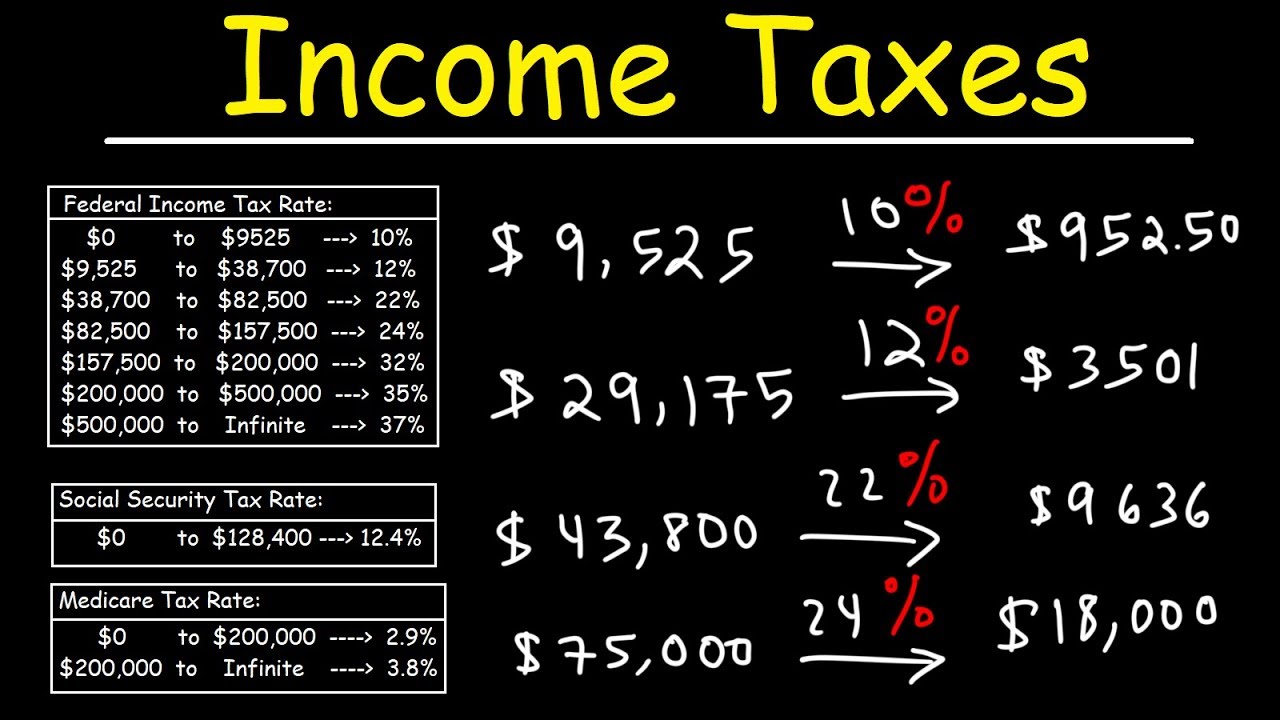

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Social Security Tax Withholding Form 2022 WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/08/can-you-change-social-security-tax-withholding-online-fill-online.png

Yes you can get a refund when too much Social Security tax is withheld from you The procedure depends on whether the excess withholdings were caused by multiple employers exceeding You can have federal taxes withheld from benefits If you expect to owe taxes on your benefits you can effectively prepay part of the bill by having taxes withheld from your

As a general rule if Social Security is the only source of income it might not be taxable However the IRS will likely tax some of your Social Security benefits if you have If you get Social Security you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes See Withholding Income Tax From Your Social Security

Download Do You Get Money Back From Social Security Tax Withheld

More picture related to Do You Get Money Back From Social Security Tax Withheld

Do You Get Money Back From Tax Return TAXW

https://i.pinimg.com/originals/17/27/3d/17273d993581f4e2957cfa954d327852.jpg

How Do I Get A Cash App Refund Quick Solution

https://media.licdn.com/dms/image/D4D12AQEc19pXdVG-6A/article-cover_image-shrink_720_1280/0/1687347396098?e=2147483647&v=beta&t=Ssms5pQF9NxlIhyKXKQZFeX2JoZgpUUN6zuiDWD4OpA

A Way To Cut Tax On Social Security Benefits

https://thirdage.com/field/image/Social-Security-and-Taxes-730x430.jpg

Do I pay Social Security tax or income tax on my Social Security benefit payments If you earn between 25 000 and 34 000 per year as a single filer or 32 000 to You may be entitled to a refund if you paid both tier 1 RRTA tax and Social Security tax which combined exceed the Social Security wage base If you had more than one

If you expect to owe taxes on your Social Security benefits you can either make quarterly estimated tax payments to the IRS or have federal taxes withheld from your benefits The money you contribute to FICA won t directly impact how much you receive in Social Security benefits nor how much you ll pay for Medicare coverage FICA and withholding

Taxes On Social Security Benefits Inflation Protection

https://i.ytimg.com/vi/juj4YsXOdkc/maxresdefault.jpg

56 Of Social Security Households Pay Tax On Their Benefits Will You

http://seniorsleague.org/assets/TSCL_SocialSecurity_Chart.jpg

https://www.thebalancemoney.com/social-security...

You might overpay Social Security and Medicare taxes for a number of reasons Some workers are exempt from paying these taxes The government will give the money back

https://www-origin.ssa.gov/benefits/retirement/planner/taxwithold.html

You can ask us to withhold federal taxes from your Social Security benefit payment when you first apply If you are already receiving benefits or if you want to change or stop your withholding

Social Security Cost Of Living Adjustments 2023

Taxes On Social Security Benefits Inflation Protection

Do You Include Employee Social Security Taxes In Ui Taxes Yuri Shwedoff

Do You Know What Amount I Earn Today 200 Do You Get Money In

34 Best Photos How To Refund On Cash App How To Get Money Back From

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

The Social Security Tax Was Withheld At The Rate Of 6 0 On The First

Maximize Your Paycheck Understanding FICA Tax In 2023

MONEY Makes The World Go Round Baamboozle Baamboozle The Most

Do You Get Money Back From Social Security Tax Withheld - As a general rule if Social Security is the only source of income it might not be taxable However the IRS will likely tax some of your Social Security benefits if you have