Can You Pay Franchise Tax Board With Credit Card Business Bank account Web Pay Free Credit card service fee Payment plan setup fee Check or money order Electronic funds transfer EFT for corporations

Starting in May 2014 a credit card payment option for businesses was added Corporations partnerships and limited liability companies LLC now have the option to Make a payment Franchise Tax Board FTB Pay with your checking or savings account credit card or set up a payment plan Other payment options available Launch

Can You Pay Franchise Tax Board With Credit Card

Can You Pay Franchise Tax Board With Credit Card

https://i.pinimg.com/736x/3a/1a/98/3a1a988626f6d84baf007fa28c88a01d.jpg

Franchise Tax Free Of Charge Creative Commons Post It Note Image

https://www.picpedia.org/post-it-note/images/franchise-tax.jpg

What Are Credit Card Receipt Privacy Laws Top Class Actions

https://s40123.pcdn.co/wp-content/uploads/2020/05/child-paying-with-credit-card.jpg.optimal.jpg

Yes you may pay amounts due by credit card on returns filed online If you select to pay by credit card you will be routed to the credit card vendor to make payment You must In this short video we show you how you can pay your personal taxes with the California Franchise Tax Board by Credit Card online I hope you enjoy this mat

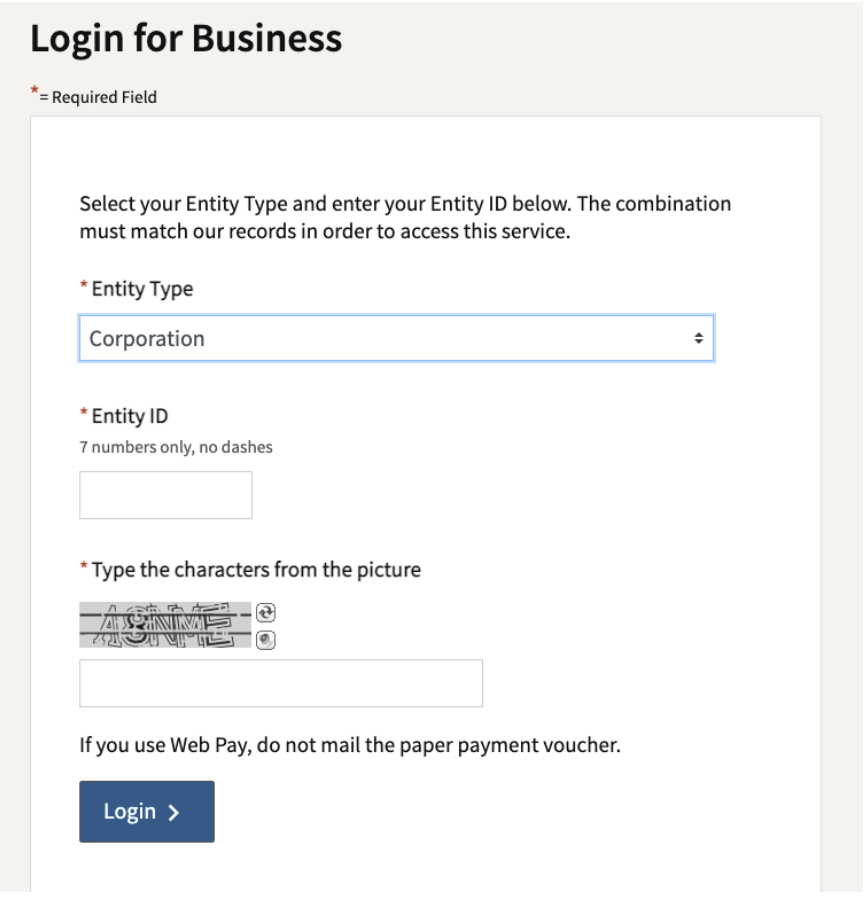

Partnerships should use their 12 digit CA Secretary of State number or their 9 digit Franchise Tax Board ID numbers How to Pay Taxes With a Credit Card Online To In this video we are showing you how you can pay your California Franchise Tax Board FTB Business Taxes with a credit card Yes you can pay

Download Can You Pay Franchise Tax Board With Credit Card

More picture related to Can You Pay Franchise Tax Board With Credit Card

Can You Pay Taxes With A Personal Loan

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA19pAmQ.img?w=1600&h=1600&m=4&q=74

Common Small Business Tax Questions And Answers Business Tax Questions

https://businesstaxquestions.com/wp-content/uploads/2022/04/money-5000789_1280-1024x1024.png

Flat Design Of Payment And Finance With Credit Card Credit Money And

https://static.vecteezy.com/system/resources/previews/016/715/266/original/flat-design-of-payment-and-finance-with-credit-card-credit-money-and-shopping-card-or-business-card-free-png.png

The Web Pay service is secure fast and convenient There s no need to register and payments can be scheduled a year in advance Your client can also make a payment To make a credit card payment you need to have the following information available Credit Card Issued by American Express Discover Network MasterCard or Visa

You can pay with a credit card or through an electronic funds transfer from your bank account To pay by mail you will need to send a check or money order along with a The short answer is yes You may pay federal taxes and taxes owed to some states with a credit card Whether you should however depends on your financial situation and

Are You Getting All The Tax Deductions For Your Pleasanton Rental

https://advantagepms.com/wp-content/uploads/2022/04/are-you-getting-the-tax-deductions-for-your-rental-property-min.png

Franchise Tax Board Lawson Mechanical

https://www.lawsonmechanical.com/wp-content/uploads/Franchise-Tax-Board-2.jpg

https://www.ftb.ca.gov/pay/payment-options.html

Business Bank account Web Pay Free Credit card service fee Payment plan setup fee Check or money order Electronic funds transfer EFT for corporations

https://landmarktaxgroup.com/how-to-pay-the-state...

Starting in May 2014 a credit card payment option for businesses was added Corporations partnerships and limited liability companies LLC now have the option to

California Tax Boutique TAX RESOLUTION

Are You Getting All The Tax Deductions For Your Pleasanton Rental

How To Submit California Franchise Tax Payments Heard

Payment Agreement How To Set Up A Payment Plan With The IRS Marca

How Do I Pay My Credit Card With A Gift Card Leia Aqui How Do I

Pay Taxes With Credit Card For Convenience And Security

Pay Taxes With Credit Card For Convenience And Security

California Franchise Tax Board Doplet

California State Income Tax Brackets And How Your Income Is Taxed Ask

Can You Pay Off One Credit Card With Another Credit Card Credit One Bank

Can You Pay Franchise Tax Board With Credit Card - Partnerships should use their 12 digit CA Secretary of State number or their 9 digit Franchise Tax Board ID numbers How to Pay Taxes With a Credit Card Online To