Can You Write Off Miles Driven To Work Driving your vehicle a lot of work can mean a lot of extra miles and added costs Luckily you can claim a tax write off for mileage in specific circumstances While not everyone qualifies it s worth the time to check into the rules as the mileage deduction can add up to significant tax savings

Yes you can write off mileage for work but there are specific guidelines and conditions that you need to meet in order to do so As an employee you may be able to deduct unreimbursed business miles driven as part of your work duties If you drive 36 000 miles a year with 18 000 miles dedicated to business use you can deduct 50 of your actual expenses If you qualify you can claim this deduction as an employee business expense using Form 2106

Can You Write Off Miles Driven To Work

Can You Write Off Miles Driven To Work

https://i.ytimg.com/vi/YiXKILVi2J4/maxresdefault.jpg

Can You Write Off Home Improvements Next Level Homes

https://nlhbuilders.com/jjwp/wp-content/uploads/2022/04/JamboJon-NLH.png

Your Guide To Business Miles Vs Commuting Miles

https://flyfin.tax/_next/image?url=https:%2F%2Fdem95u0op6keg.cloudfront.net%2Fflyfin-website%2Ftax-tips-cluster%2FBusinessVsCommutingHeader.jpg&w=828&q=10

If you re a freelancer or independent contractor you can save on taxes by deducting business miles driven for work Business miles include trips between worksites client meetings and business errands but not commuting miles between home and a primary workplace Claiming unreimbursed mileage would help you offset the work related driving costs you incurred throughout the year But deducting mileage for business on your tax return can be a tricky process It s important to follow the mileage deduction rules

Claiming a tax deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to write off their driving costs In the past taxpayers had more Mileage is an allowable deduction if you re self employed or own your own business You can choose between the standard mileage rate or the actual cost method where you keep track of what you paid for gas and maintenance

Download Can You Write Off Miles Driven To Work

More picture related to Can You Write Off Miles Driven To Work

How To Write Off Business Expenses Knowdemia

https://i0.wp.com/knowdemia.com/wp-content/uploads/2021/11/how-to-write-off-business-expenses.jpg?w=735&ssl=1

020 How Fast Can You Write YouTube

https://i.ytimg.com/vi/GeGVQL3L_RQ/maxresdefault.jpg

How To Write A Research Grant Proposal Paperpal

https://www.paperpal.com/blog/wp-content/uploads/2022/08/pexels-karolina-grabowska-7680637-scaled.jpg

What drives can I write off You can write off any drive related to your business This includes Even if you re not always on the road meeting clients I bet you drive for work a fair amount All those trips are costing you money through gas and wear and tear on your car You can write off miles driven to work if you have a home office have multiple work places or have no regular place of work Otherwise it s a no go

[desc-10] [desc-11]

FuseWorks Careers

https://www.fuse.work/media/website_pages/about-us/careers/Driven_568x568a.png

Yes We Are All Human except For The Bots Whomever They Are I Like

https://miro.medium.com/v2/resize:fit:1358/1*V9XQEUI-qq35oOfDSh5ryA.jpeg

https://www.hrblock.com › ... › mileage-deduction-rules

Driving your vehicle a lot of work can mean a lot of extra miles and added costs Luckily you can claim a tax write off for mileage in specific circumstances While not everyone qualifies it s worth the time to check into the rules as the mileage deduction can add up to significant tax savings

https://www.ncesc.com › can-i-write-off-mileage-for-work

Yes you can write off mileage for work but there are specific guidelines and conditions that you need to meet in order to do so As an employee you may be able to deduct unreimbursed business miles driven as part of your work duties

Explicaci n Detallada De write off away for Significado Uso

FuseWorks Careers

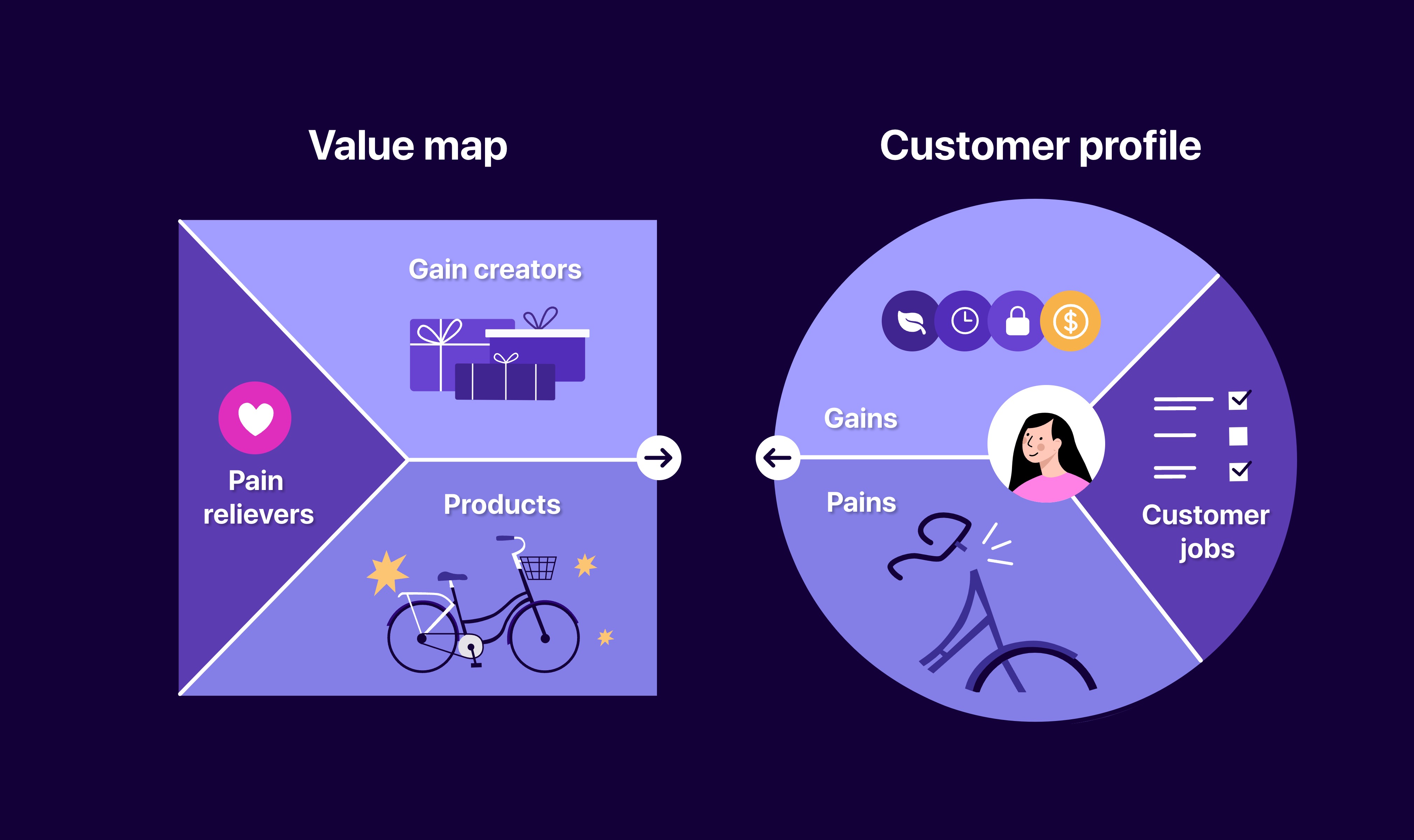

Value Propositions Examples How To Write Them Successfully

Where Do You Put Quotation Marks Sonic Hours

How Much Should I Charge For Writing Can You Write 10000 Words In A

How To Calculate Your Business Mileage Deduction

How To Calculate Your Business Mileage Deduction

1984 Quotes That Are Way Too Timely Tom Liam Lynch Ed D

Professional To Write My Resume Professional Resume Service Near Me

Your Guide To Business Miles Vs Commuting Miles

Can You Write Off Miles Driven To Work - If you re a freelancer or independent contractor you can save on taxes by deducting business miles driven for work Business miles include trips between worksites client meetings and business errands but not commuting miles between home and a primary workplace