Can You Write Off Student Loan Payments Verkko 11 lokak 2022 nbsp 0183 32 The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan

Verkko 3 hein 228 k 2023 nbsp 0183 32 The online application for student loan forgiveness is still live and you can still apply for student loan debt relief The administration can still collect applications during the stay Remember when applying only apply on the Federal Student Aid website Check back with the TurboTax blog for more up to date information Verkko 11 jouluk 2023 nbsp 0183 32 The student loan interest deduction is a tax deduction that allows you to write off up to 2 500 in student loan interest payments each year

Can You Write Off Student Loan Payments

Can You Write Off Student Loan Payments

https://imageio.forbes.com/specials-images/imageserve/649d7c6d4674233895324234/0x0.jpg?format=jpg&width=1200

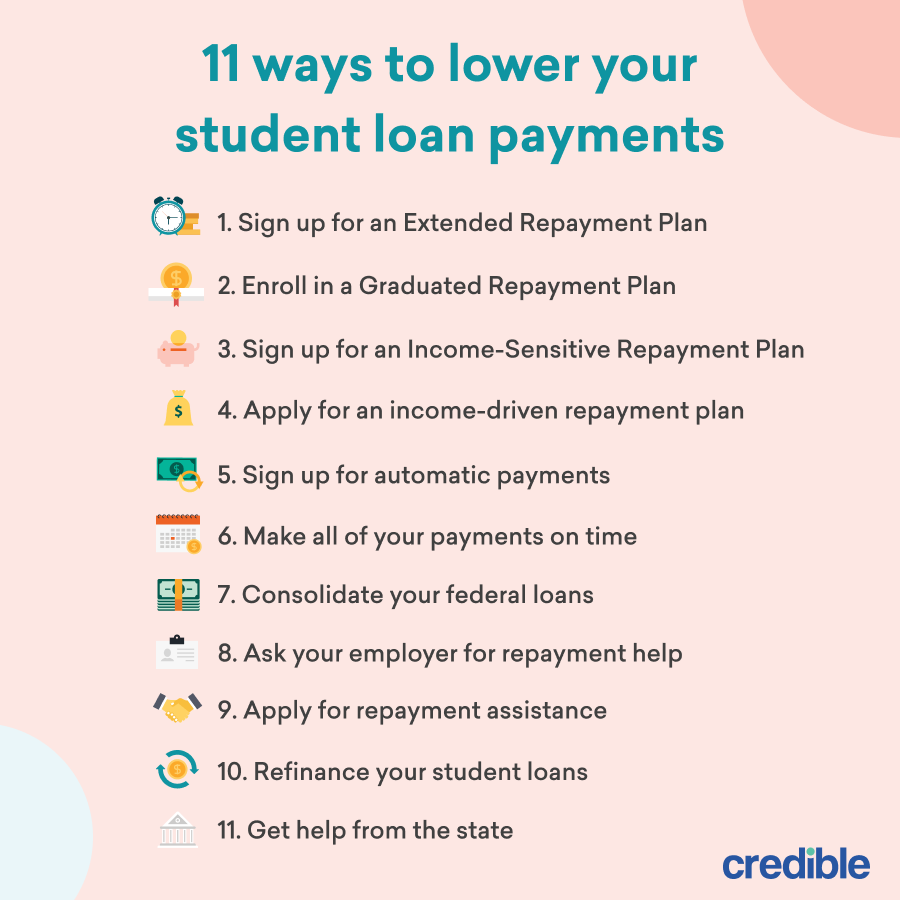

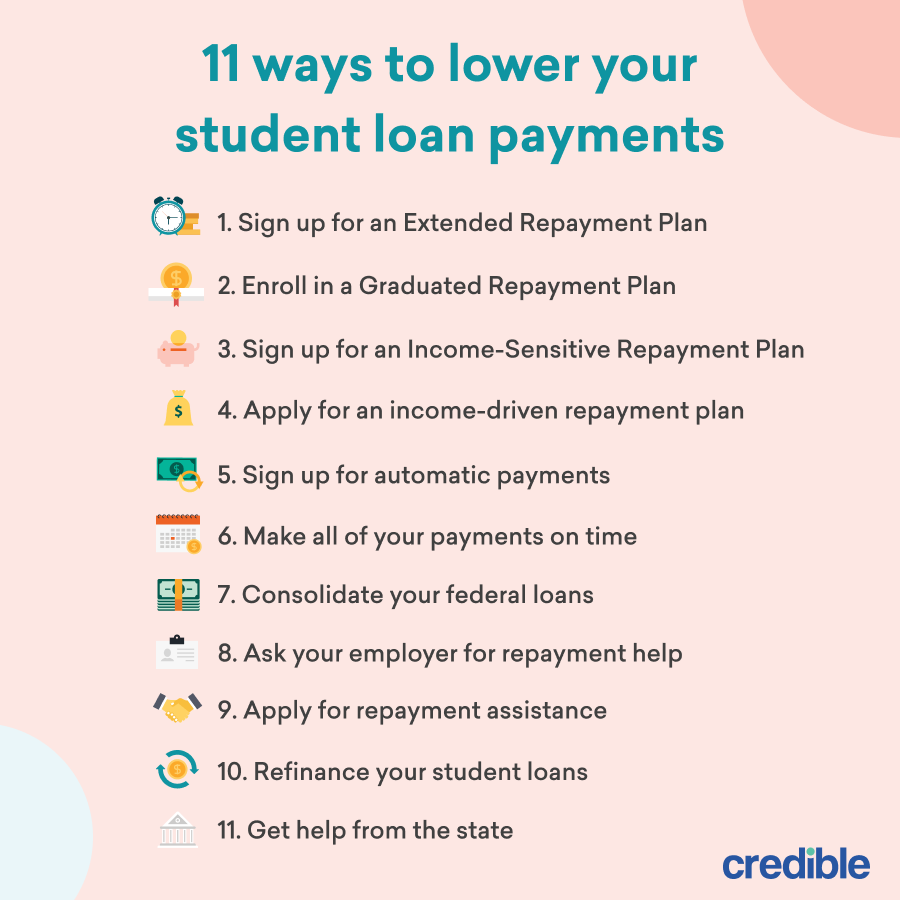

7 Ways To Lower Student Loan Payments Credit Debt

https://creditanddebt.org/wp-content/uploads/2023/10/iStock-1301217920-scaled.jpg

How To Quickly Pay Off Student Loan With Low Income Student Loan

https://i.pinimg.com/originals/21/76/5d/21765d7a4f16cce9a3750a753f0bb234.png

Verkko 10 marrask 2022 nbsp 0183 32 If you have student loans don t forget about them at tax time Student loans can impact your federal income tax return in several ways from reducing your taxable income to losing your Verkko 25 tammik 2023 nbsp 0183 32 Who can deduct student loan interest If your MAGI is less than 85 000 175 000 if filing jointly you can deduct student loan interest paid on federal and private student

Verkko You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a qualified student loan Your filing status isn t married filing separately Your MAGI is less than a specified amount which is set annually and Verkko The loans for your course will be written off when you re 65 When Plan 2 loans get written off Plan 2 loans are written off 30 years after the April you were first due to

Download Can You Write Off Student Loan Payments

More picture related to Can You Write Off Student Loan Payments

Student Loan Debt Update How Government Shutdown Affects Payments

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1gMelA.img?w=2500&h=1667&m=4&q=89

Student Loan Payment Pause What To Expect

https://imageio.forbes.com/specials-images/imageserve/1210427901/0x0.jpg?format=jpg&crop=5040,2835,x0,y69,safe&width=1200

Some Student Loan Borrowers Get Inaccurate Bills After Miscalculations

https://www.washingtonpost.com/wp-apps/imrs.php?src=https://arc-anglerfish-washpost-prod-washpost.s3.amazonaws.com/public/S5P2SZ2YUH2XSNR2IH4BODFQBM.JPG&w=1440

Verkko 22 lokak 2023 nbsp 0183 32 Parents who help a child repay student loans generally can t take the write off unless they are also legally liable on the loans Verkko 12 jouluk 2023 nbsp 0183 32 When you use student loan funds to finance your education if you are eligible the IRS allows you to claim qualifying expenses that you pay with those funds towards educational tax credits A tax deduction is also available for the interest payments you make when you start repaying your qualified education loans

Verkko 19 jouluk 2023 nbsp 0183 32 You can earn up to 180 000 which is the level at which the phase out ends Those phase outs change in 2024 to be between 80 000 and 95 000 for single filers and between 165 000 and 195 000 for those who are married and filing jointly Keep in mind that the pandemic led to the March 2020 which paused student loan Verkko 26 lokak 2023 nbsp 0183 32 Student Loan Interest Deduction is a tax deduction for interest paid on post secondary education loans during the tax year in the U S the deduction amount being the lesser of 2 500 or the

How To Save Money While Still Making Student Loan Payments

https://image.cnbcfm.com/api/v1/image/105762661-1551291170304studentloans.jpg?v=1551291174&w=1920&h=1080

When Do Student Loan Payments Resume What You Need To Know

https://closetconfessions.co/wp-content/uploads/2023/08/student-loans.jpg

https://www.forbes.com/advisor/taxes/student-loan-interest-tax-deduction

Verkko 11 lokak 2022 nbsp 0183 32 The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan

https://blog.turbotax.intuit.com/tax-deductions-and-credits-2/...

Verkko 3 hein 228 k 2023 nbsp 0183 32 The online application for student loan forgiveness is still live and you can still apply for student loan debt relief The administration can still collect applications during the stay Remember when applying only apply on the Federal Student Aid website Check back with the TurboTax blog for more up to date information

Student Loan Payments Set To Resume What Borrowers Need To Know About

How To Save Money While Still Making Student Loan Payments

Attorney General Warns Of Student Loan Scams As Payments Resume FOX31

Here s What You Need To Know About Student Loan Payments Cbs8

More Jobs Eligible For Student Loan Forgiveness Under Expanded Rules

Operation Fresh Start Student Loans Avelina Lindberg

Operation Fresh Start Student Loans Avelina Lindberg

How To Prepare For Student Loan Payments Restarting In 2022 NFCC

Student Loan Payments Pause Is Extended Through May 1 Pigeon Week

Ways That You Can Fix Your Student Loan Payments Problems By Bobette

Can You Write Off Student Loan Payments - Verkko You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a qualified student loan Your filing status isn t married filing separately Your MAGI is less than a specified amount which is set annually and