Can You Deduct Student Loan Payments Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year

The student loan interest deduction allows for a tax break of up to 2 500 for interest payments on loans for higher education Here s how to qualify Reporting the amount of student loan interest you paid in 2023 on your federal tax return may count as a deduction A deduction reduces the amount of your income that is subject to tax which may benefit you by reducing the amount of tax you may have to pay

Can You Deduct Student Loan Payments

Can You Deduct Student Loan Payments

https://d.newsweek.com/en/full/1681444/joe-biden-student-loan-cancellation.jpg

Can You Deduct Property Taxes With A Standard Deduction

https://www.realized1031.com/hubfs/propertytaxes-1295797018.jpg#keepProtocol

Request Letter Not To Deduct Loan From Salary Account YouTube

https://i.ytimg.com/vi/sMoHw0WafZ8/maxresdefault.jpg

Student loan interest is deductible if your modified adjusted gross income or MAGI is less than 70 000 145 000 if filing jointly If your MAGI was between 70 000 and 85 000 175 000 if The interest you ve paid for any student loan public or private is tax deductible as long as the loan qualifies it doesn t only have to be federal student aid

Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know The student loan interest deduction is a tax deduction that allows you to write off up to 2 500 in student loan interest payments each year This is only for the interest portion of your student

Download Can You Deduct Student Loan Payments

More picture related to Can You Deduct Student Loan Payments

Can I Deduct Student Loan Interest SKP Accountants Advisors LLC

https://skpadvisors.com/wp-content/uploads/2022/01/Student-loan-debt_rsz.jpg

Can You Deduct Student Loan Interest On Your Tax Return Abdo

https://abdosolutions.com/wp-content/uploads/2023/09/Student-Loan-Interest-Social2.jpg

7 Ways To Lower Student Loan Payments Credit Debt

https://creditanddebt.org/wp-content/uploads/2023/10/iStock-1301217920-scaled.jpg

You can deduct from your federal income taxes up to 2 500 of the student loan interest you paid during a calendar year but you ll have to meet income If you paid student loan interest last year you could qualify for a tax deduction worth up to 2 500 You won t receive that money back as a refund since the student loan interest

[desc-10] [desc-11]

Student Loan Debt Update How Government Shutdown Affects Payments

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1gMelA.img?w=2500&h=1667&m=4&q=89

Student Loan Payment Pause What To Expect

https://imageio.forbes.com/specials-images/imageserve/1210427901/0x0.jpg?format=jpg&crop=5040,2835,x0,y69,safe&width=1200

https://www.irs.gov/taxtopics/tc456

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year

https://www.investopedia.com/terms/s/slid.asp

The student loan interest deduction allows for a tax break of up to 2 500 for interest payments on loans for higher education Here s how to qualify

Student Loan Interest Can You Deduct It On Your Tax Return Kelly CPA

Student Loan Debt Update How Government Shutdown Affects Payments

Are Student Loan Payments Tax Deductible

Can You Deduct Student Loan Interest On Your Tax Return Suttle

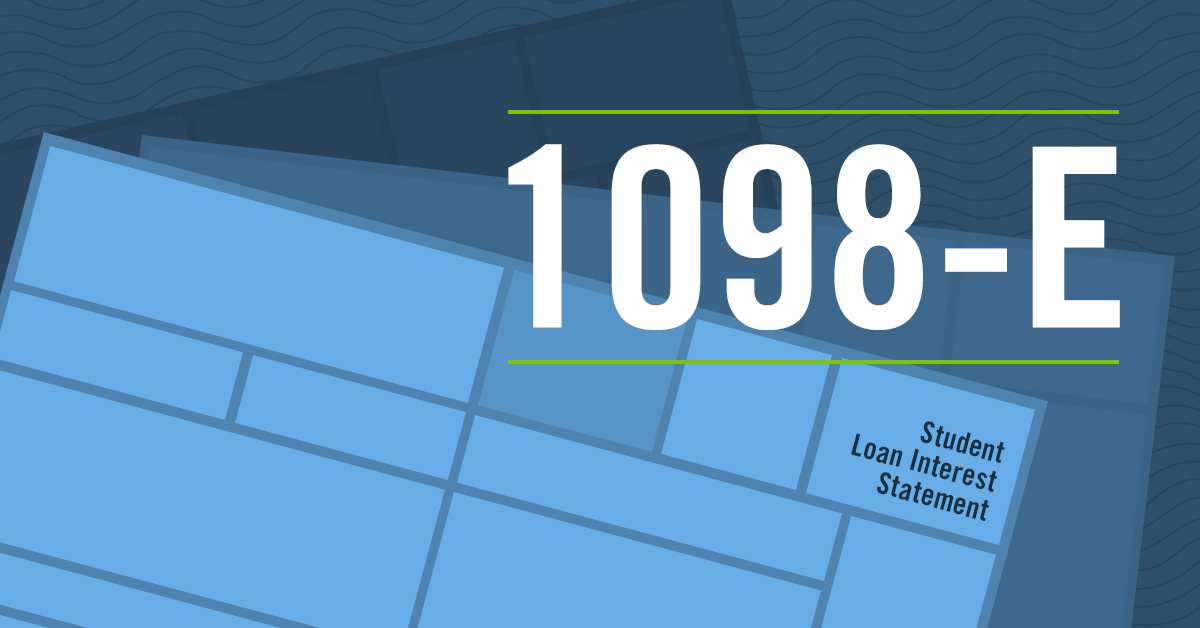

HOW TO DEDUCT STUDENT LOAN INTEREST ON YOUR TAXES 1098 E Blog

Student Loan Interest Can You Deduct It On Your Tax Return Business

Student Loan Interest Can You Deduct It On Your Tax Return Business

Some Student Loan Borrowers Get Inaccurate Bills After Miscalculations

Student Loan Payment Resumption Set To Test U S Economy

Student Loan Cancellation May Help More Borrowers But That Doesn t

Can You Deduct Student Loan Payments - The interest you ve paid for any student loan public or private is tax deductible as long as the loan qualifies it doesn t only have to be federal student aid