Car Mileage Reimbursement Verkko 10 tammik 2023 nbsp 0183 32 Mileage reimbursement is employer set compensation for work related use of your personal vehicle Some companies pay monthly car allowances while others might require you to track mileage for specific travel The Internal Revenue Service IRS has standard mileage rates if you list mileage deduction on your income tax

Verkko Mileage Reimbursement Calculator You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical charitable business or moving You can calculate mileage reimbursement in three simple steps Select your tax year Verkko 30 tammik 2023 nbsp 0183 32 Mileage reimbursement is when a company pays an employee to recoup the costs of driving a personal vehicle for work purposes Companies can choose to reimburse the exact amount an employee incurred on the trip or use a specific preset rate for each mile

Car Mileage Reimbursement

Car Mileage Reimbursement

https://irs-mileage-rate.com/wp-content/uploads/2021/08/mileage-reimbursement-form-in-word-and-pdf-formats-3.png

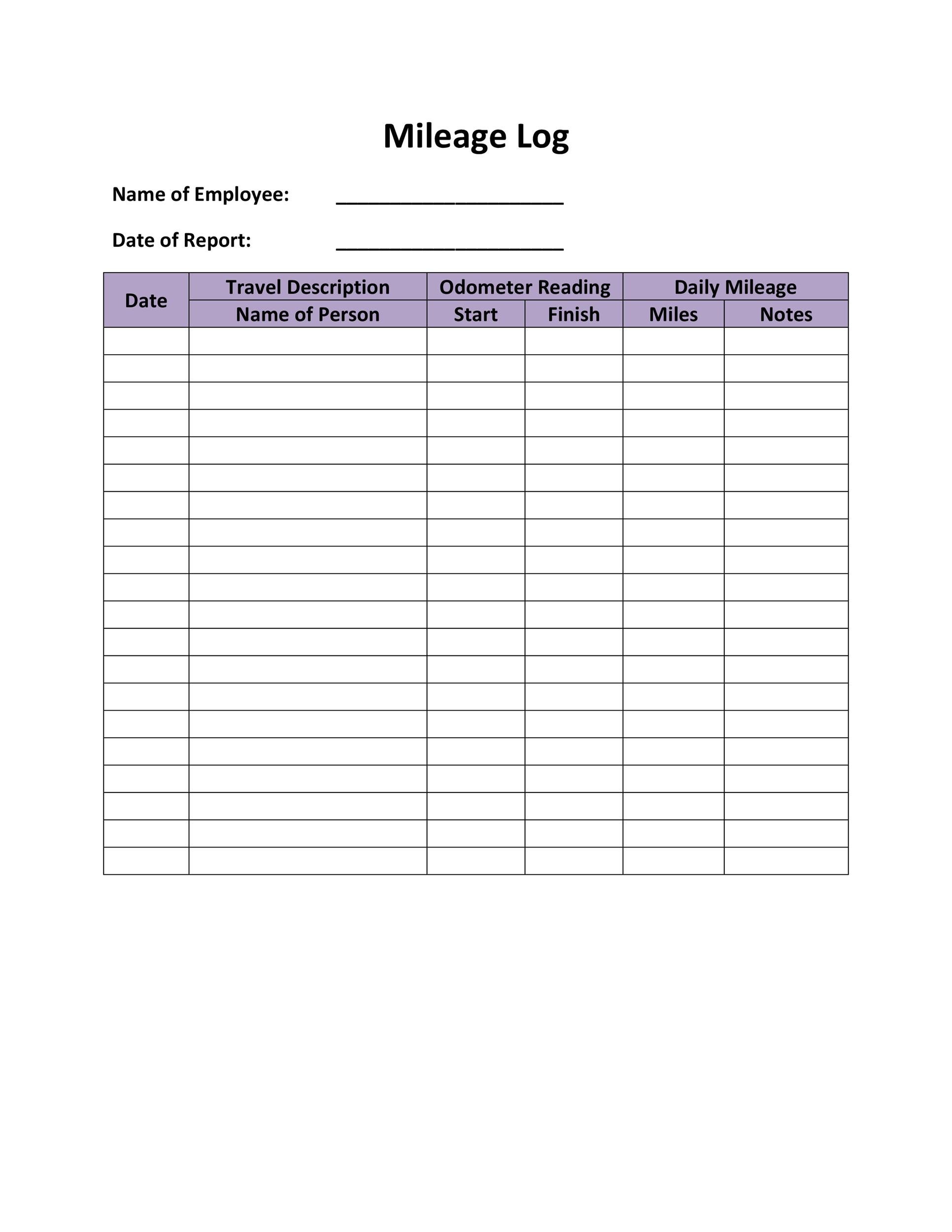

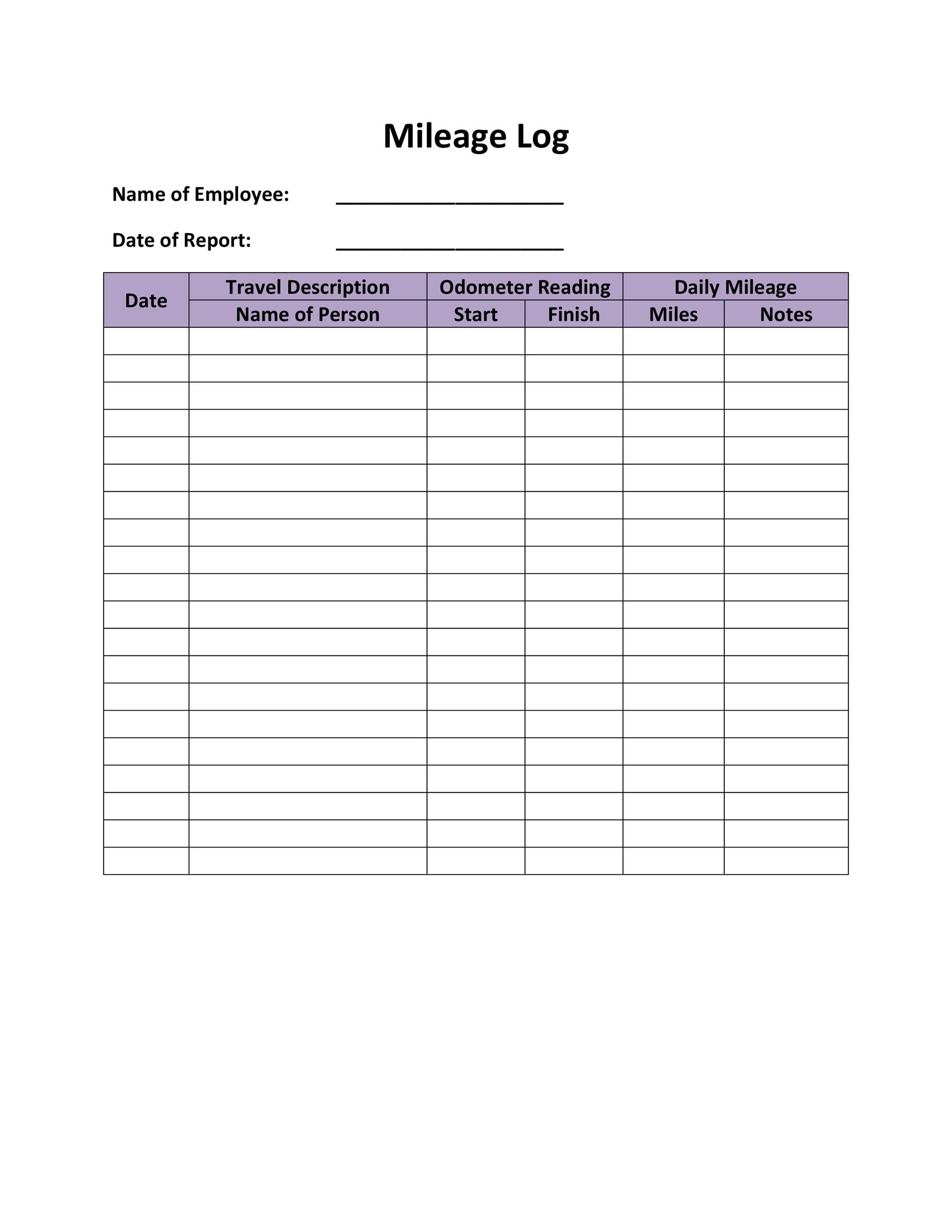

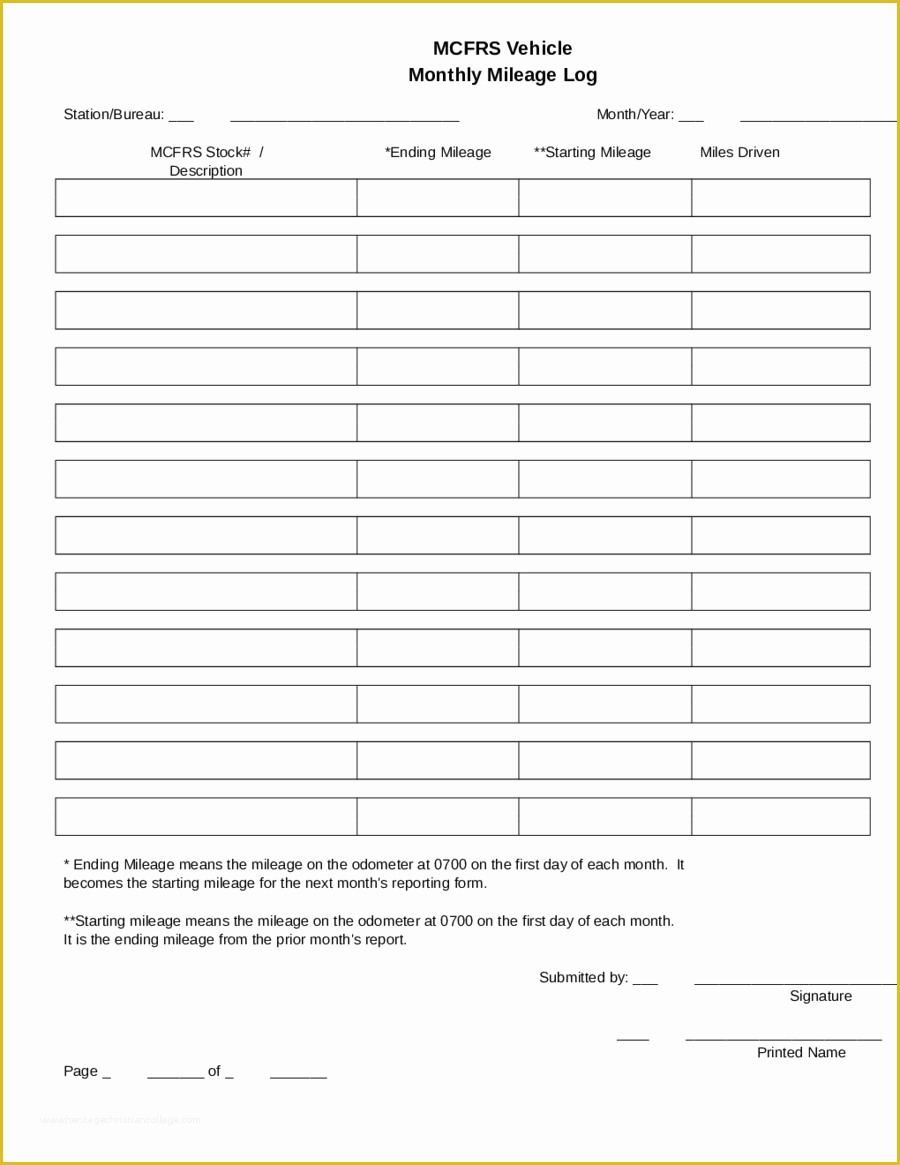

Free Printable Mileage Log FREE PRINTABLE TEMPLATES

https://templatelab.com/wp-content/uploads/2015/11/Mileage-Log-08.jpg

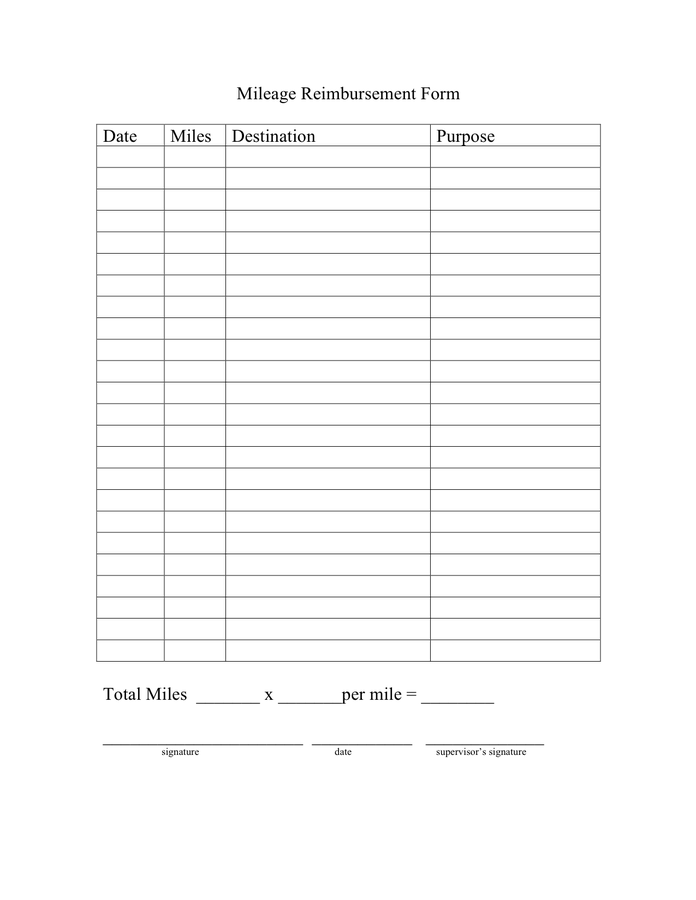

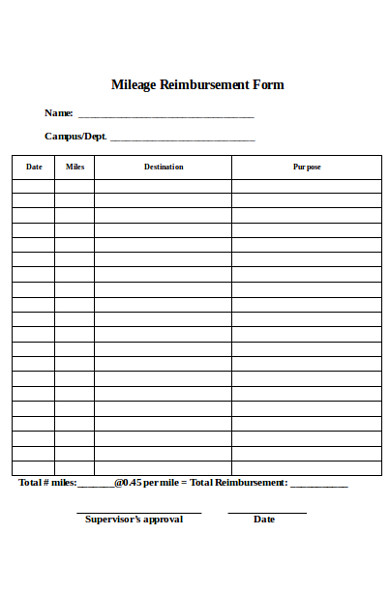

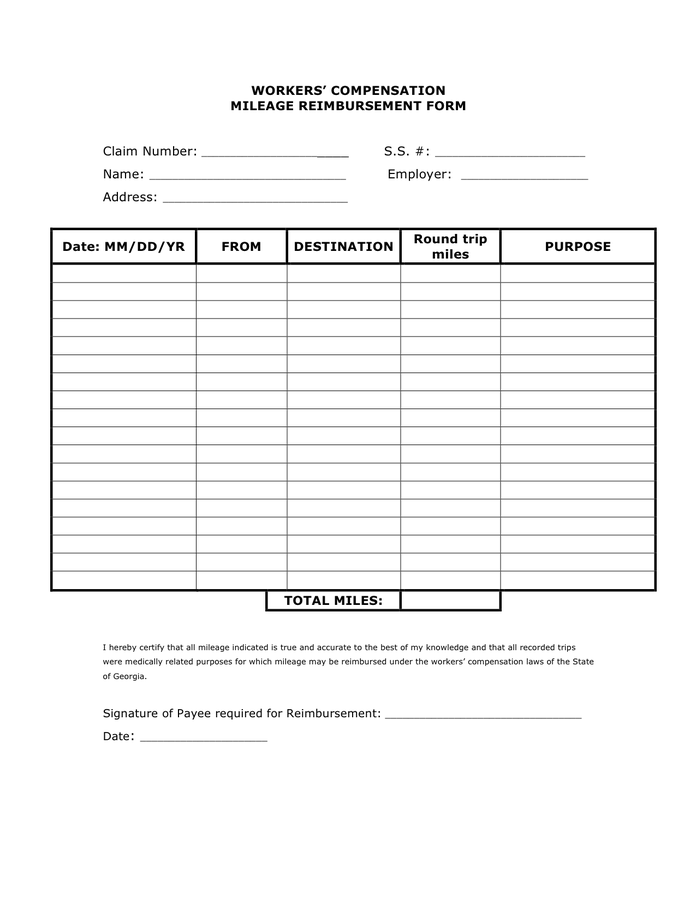

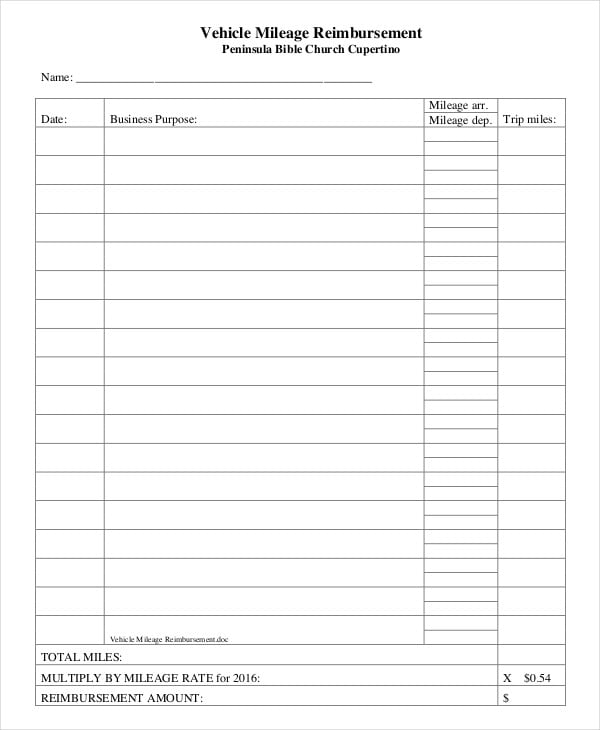

Mileage Reimbursement Form In Word And Pdf Formats

https://static.dexform.com/media/docs/5994/mileage-reimbursement-form-3_1.png

Verkko Corporate mileage reimbursement enables taxpayers to claim back money when using personal vehicles but the system is complex Here we explain how it works for both employees and business owners Each country has its own standard mileage rate We look at how the IRS and other revenue agencies calculate these benchmark figures Verkko In this article we focus on the specifics around car mileage for business purposes and the employee mileage reimbursement rules We ll also delve into the best practices from both an employee s and an employer s point of view covering the full spectrum with IRS Proof solutions

Verkko As a car allowance is given to the employee to buy their own personal vehicle they can claim a mileage allowance on top when using this car for work purposes A car allowance can help to cover fuel costs in general but claiming a mileage allowance on top is good for business What does car allowance cover Verkko 23 lokak 2023 nbsp 0183 32 Guidance on mileage reimbursement rates Each year the IRS sets a mileage reimbursement rate As of July 2022 the standard mileage rate is 0 625 per mile

Download Car Mileage Reimbursement

More picture related to Car Mileage Reimbursement

Gas Mileage Reimbursement Form Excel Templates

https://lh5.googleusercontent.com/proxy/j4mOQddD5-1FkIZi30o19VDVtHe4y6mELoZ0vyqyue5n7DWA4Mn1O_nkWkuM4K3Vrn59iIPd2SWrxRkfNaomxfjASorwF7clNsO67cCcr6H2lzJpzZQfjHgSIF2EteQ=s0-d

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

https://www.irstaxapp.com/wp-content/uploads/2023/01/2023-mileage-reimbursement-calculator-1-1024x576.png

Free IRS Mileage Reimbursement Form PDF Word Legal Templates

https://legaltemplates.net/wp-content/uploads/Employee-Mileage-Reimbursement-Form-Sample.png

Verkko 24 lokak 2023 nbsp 0183 32 The reimbursement might seem like a windfall to an employee with a car that gets great mileage but it all evens out more or less when it s time to get new tires pay for insurance get a tune up and simply make the monthly car payment The reimbursement has been a way to fairly compensate employees after the Tax Cuts Verkko On January 1 2022 the standard mileage rates for using a car also vans pickups or panel trucks changed to 58 5 cents per mile driven for business use How can I calculate mileage reimbursement Calculating mileage reimbursement is relatively simple you don t even need to use a mileage calculator for reimbursement

Verkko 3 hein 228 k 2021 nbsp 0183 32 You can track employees business mileage and multiply it by the IRS allowance each month When you use this reimbursement the amount is non taxable Using a FAVR system also results in a car allowance that isn t taxable This is another advantage of combining fixed and variable reimbursement Make a Company Car Verkko 28 marrask 2022 nbsp 0183 32 Add the monthly fixed reimbursement with the month s variable reimbursement 20 162 variable mileage rate x 2 800 monthly miles 560 variable 100 fixed 660 total monthly reimbursement How to calculate a CPM reimbursement A CPM mileage reimbursement program is a variable rate plan that

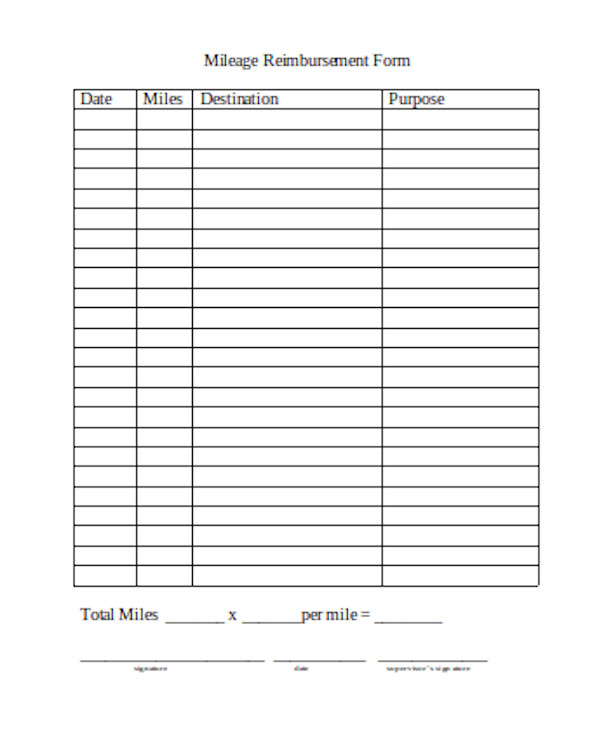

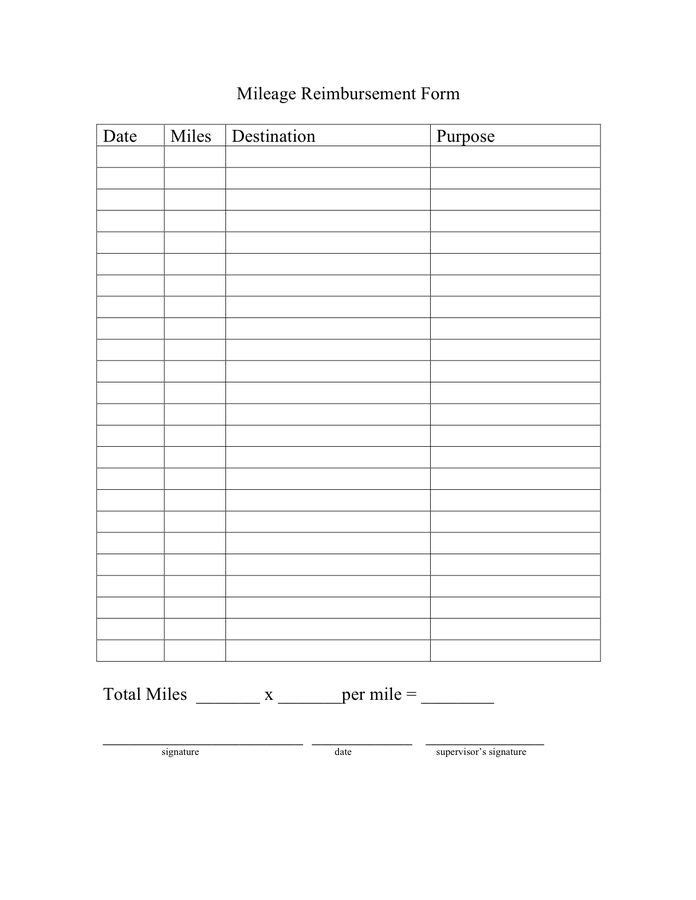

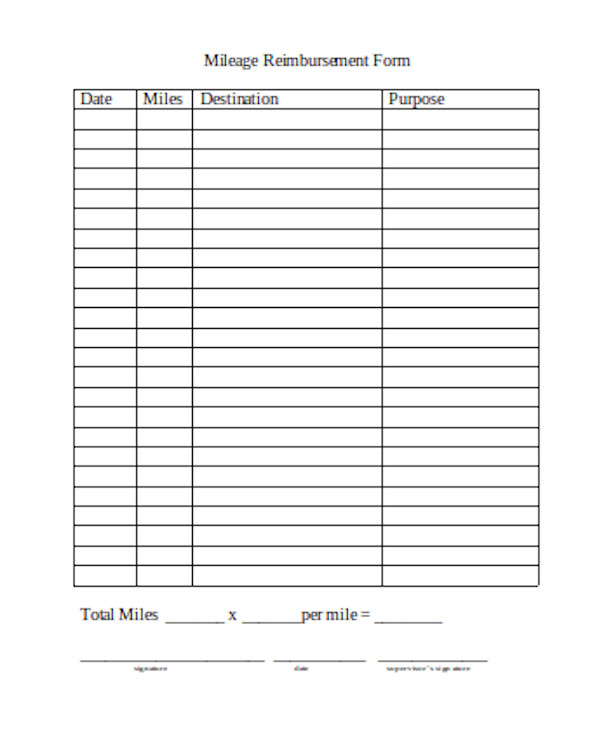

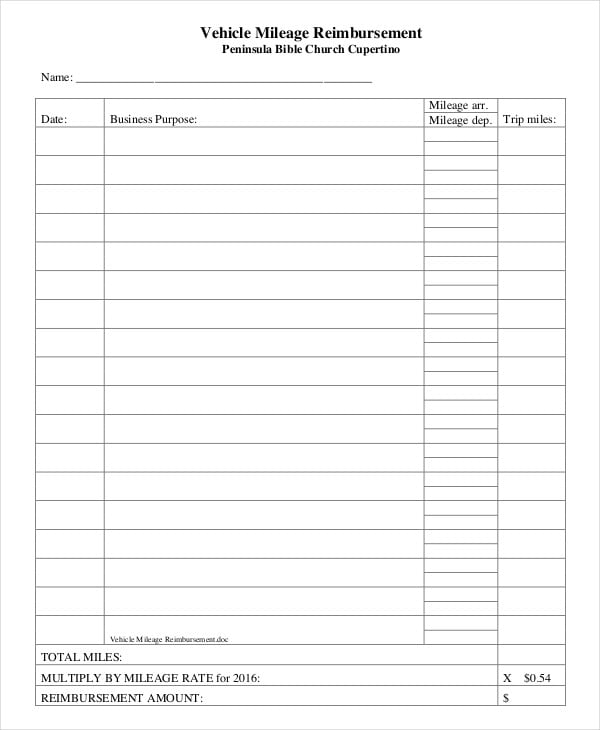

Mileage Reimbursement Form Excel Excel Templates

https://images.sampleforms.com/wp-content/uploads/2016/08/Basic-Mileage-Reimbursement-Form.jpg

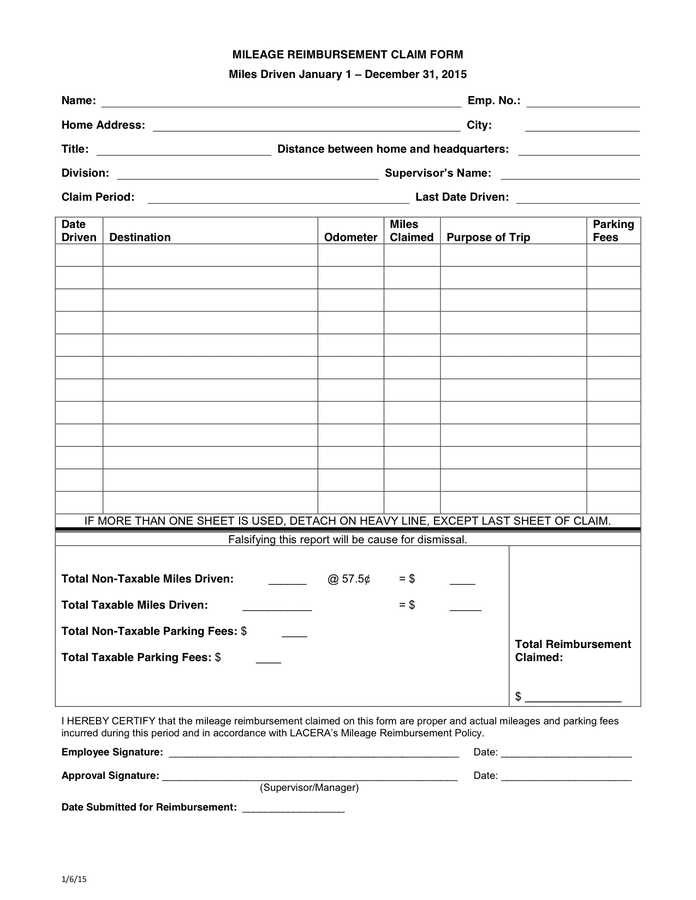

FREE 12 Mileage Reimbursement Forms In PDF Ms Word Excel

https://images.sampleforms.com/wp-content/uploads/2017/07/Sample-Mileage-Reimbursement-Form.jpg

https://www.indeed.com/career-advice/pay-salary/mileage-reimbursement

Verkko 10 tammik 2023 nbsp 0183 32 Mileage reimbursement is employer set compensation for work related use of your personal vehicle Some companies pay monthly car allowances while others might require you to track mileage for specific travel The Internal Revenue Service IRS has standard mileage rates if you list mileage deduction on your income tax

https://goodcalculators.com/mileage-reimbursement-calculator

Verkko Mileage Reimbursement Calculator You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical charitable business or moving You can calculate mileage reimbursement in three simple steps Select your tax year

Reimbursement Form Template FREE DOWNLOAD Printable Templates Lab

Mileage Reimbursement Form Excel Excel Templates

Vehicle Mileage Log Template Free Of 2019 Mileage Log Fillable

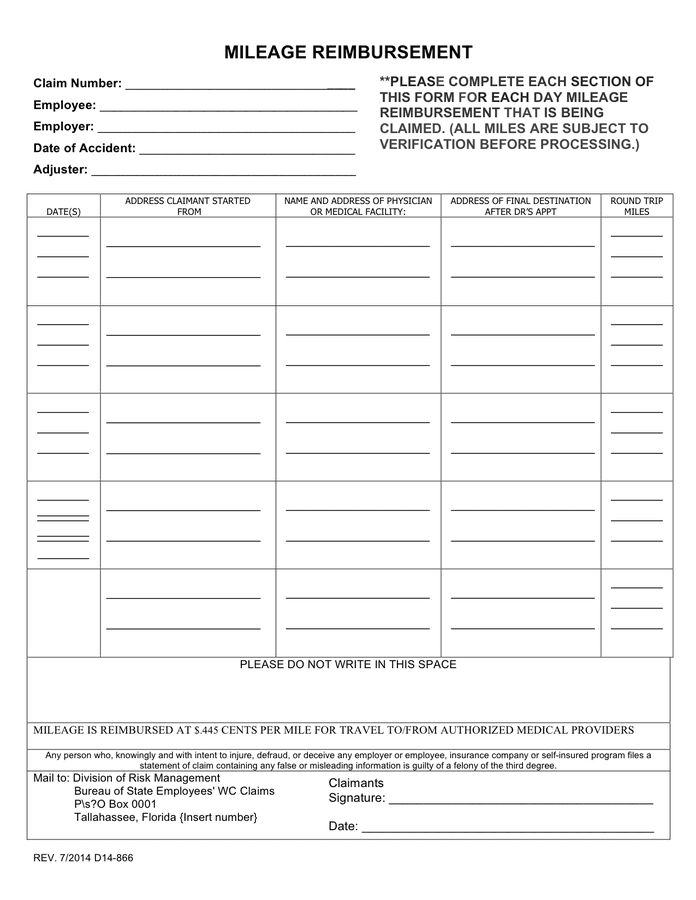

Workers Comp Mileage Reimbursement Form IRS Mileage Rate 2021

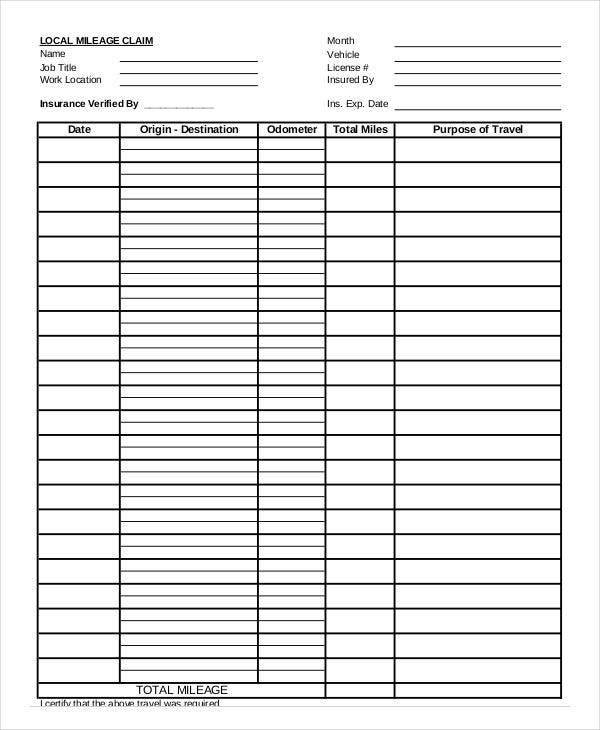

Mileage Reimbursement Form IRS Mileage Rate 2021

Mileage Reimbursement Form 10 Free Sample Example Format

Mileage Reimbursement Form 10 Free Sample Example Format

Per Diem Policy Template

FREE 11 Sample Mileage Reimbursement Forms In MS Word PDF Excel

Free Mileage Log Templates Smartsheet 52 OFF

Car Mileage Reimbursement - Verkko Corporate mileage reimbursement enables taxpayers to claim back money when using personal vehicles but the system is complex Here we explain how it works for both employees and business owners Each country has its own standard mileage rate We look at how the IRS and other revenue agencies calculate these benchmark figures