Car Mileage Tax Relief Calculator Verkko add up the mileage for each vehicle type you ve used for work take away any amount your employer pays you towards your costs sometimes called a mileage

Verkko The mileage tax relief calculator uses the current approved mileage rates of 45p per mile for the first 10 000 business miles and 25p per mile for every business mile after Verkko Company car and car fuel calculator company cars You can calculate car and car fuel benefits by using our interactive calculator

Car Mileage Tax Relief Calculator

Car Mileage Tax Relief Calculator

https://forrestbrown.co.uk/wp-content/uploads/2021/09/Stocksy_txp24f5e82ftaB300_Medium_3370983.jpg

Vehicle Mileage Tax Is It Promising SuperKilometerFilter

https://superkilometerfilter.com/wp-content/uploads/2021/11/Is-vehicle-mileage-tax-truly-promising.jpeg

4 Tips On How To Look For The Ideal Tax Relief Company Cecra

https://www.cecra.org/wp-content/uploads/2020/08/tax-relief-paper-calculator.png

Verkko 3 lokak 2023 nbsp 0183 32 The mileage rates for 2023 are 45p per mile for the first 10 000 miles for cars and vans 25p per mile after that for cars and vans 24p per mile for motorcycles 20p per mile for cycles Use the Verkko Mileage tax or Mileage Allowance Relief MAR makes it possible to claim up to 45p per mile for the first 10 000 miles travelled by car or van After 10 000 it s 25p per mile

Verkko Entitlement to mileage allowance relief uses their own vehicle car van motor cycle or cycle for business travel and receives less mileage allowance payments Verkko 12 hein 228 k 2022 nbsp 0183 32 Mileage allowance relief is a tax deduction employees can claim if they ve incurred business mileage They can only claim it if their employers haven t reimbursed the full amount Employers can

Download Car Mileage Tax Relief Calculator

More picture related to Car Mileage Tax Relief Calculator

Here s The Real Story On Tax Relief RateMuse

https://i0.wp.com/blog.ratemuse.com/wp-content/uploads/2019/10/tax_relief.png?fit=1200%2C978&ssl=1

Explaining The Vehicle Mileage Tax Pilot Program That s Included In The Latest Infrastructure Bill

https://media.smallbiztrends.com/2021/08/vehicle-mileage-tax.png

Vehicle Mileage Tax Proposed To Pay For Infrastructure YouTube

https://i.ytimg.com/vi/Ejp7gbGaPmE/maxresdefault.jpg

Verkko 30 marrask 2018 nbsp 0183 32 The employee can therefore claim tax relief on 163 4 875 the maximum tax free payment available less 163 1 725 amount employer pays 163 3 150 If employees pay tax at the basic rate they Verkko Mileage Allowance Payments 480 Appendix 3 Work out the appropriate percentage for company car benefits 480 Appendix 2 Check how much tax relief you can claim for

Verkko 14 maalisk 2021 nbsp 0183 32 Mileage Allowance Relief MAR is a tax relief that allows you to pay less tax based on how much your employer has paid you when reimbursing you for your work related mileage It s also Verkko 2 lokak 2023 nbsp 0183 32 To calculate your reimbursement you simply follow the below miles x rate 5 000 x 0 45 2250 GBP However do keep in mind that following HMRC s

Mileage Allowance Relief Calculator CALCULATORUK CVG

https://i2.wp.com/scrn-cdn.omnicalculator.com/finance/[email protected]

How Much Does Mileage Affect Car Value 2024 Update Motorway

https://motorway-blog.imgix.net/2021/08/mileage-car-value-2048x1366.jpg?auto=compress

https://www.gov.uk/tax-relief-for-employees/vehicles-you-use-for-work

Verkko add up the mileage for each vehicle type you ve used for work take away any amount your employer pays you towards your costs sometimes called a mileage

https://www.taxrebateservices.co.uk/.../mileage-tax-relief-calculator

Verkko The mileage tax relief calculator uses the current approved mileage rates of 45p per mile for the first 10 000 business miles and 25p per mile for every business mile after

Mileage Tax Relief And Other Deductions For Foreign Workers YouTube

Mileage Allowance Relief Calculator CALCULATORUK CVG

Free Images Number Pen Macro Balance Paper Close Up Cash Font Banking Commerce Tax

Mileage Tax Calculator TaxScouts

Easily Calculate Your Business Mileage Tax Deduction YouTube

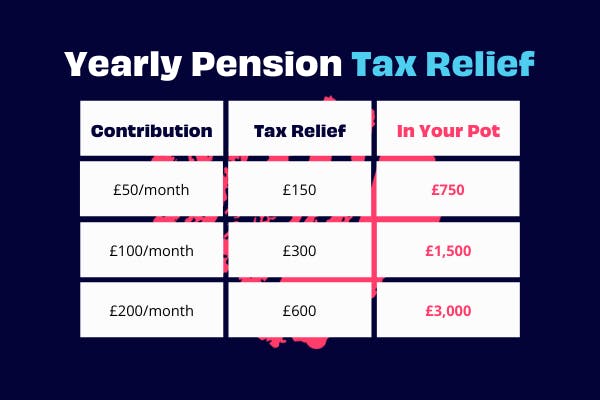

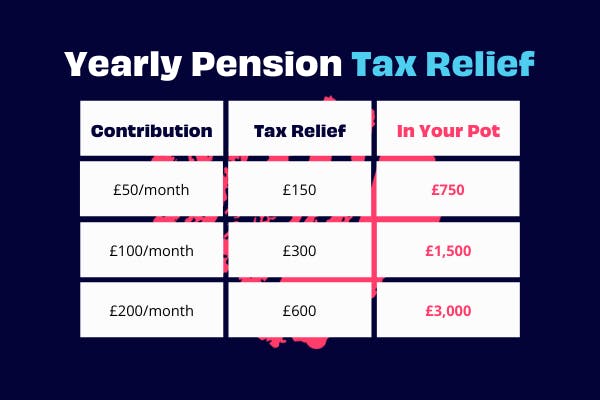

Self Employed Pension Tax Relief Explained Penfold Pension

Self Employed Pension Tax Relief Explained Penfold Pension

California Mileage Tax Rate Wanita Bachman

What Is The HMRC Mileage Tax Relief Policy

How To Calculate Mileage Reimbursement Remember If You Don t Reimburse For Business Mileage

Car Mileage Tax Relief Calculator - Verkko Entitlement to mileage allowance relief uses their own vehicle car van motor cycle or cycle for business travel and receives less mileage allowance payments