Cash Back Taxable Income Key Takeaways Whether credit card rewards are taxable as income depends on how the rewards are received If earned through the use of the card like a cash back bonus the rewards are viewed by

The cash back you earn by spending money on your credit card is not taxable If you earn cash back without needing to spend any money it might be taxable The cash back you earn via a business credit card affects the expenses you report Most credit card rewards earned by meeting a spending requirement fall under the same rule and are not considered taxable income If you collect 200 in cash back for spending 1 500 in

Cash Back Taxable Income

Cash Back Taxable Income

https://res.cloudinary.com/moneygeek/image/upload/v1695989746/Is_Cash_Back_Taxable_9ba99ec331.jpg

What Income Is Taxable Blog hubcfo

http://blog.hubcfo.com/wp-content/uploads/2015/04/What-Income-is-Taxable.png

Is Real Estate Agent Cash Back Taxable In US 1099 MISC USA

https://www.am22tech.com/wp-content/uploads/2020/01/real-estate-cash-back-taxable.webp

Whether credit card rewards are taxable depends on how you earned them If you received cash or miles for instance for simply opening an account you might have to pay taxes on the amount If you didn t have to charge purchases on your card in order to receive the welcome bonus the value of that reward is considered taxable income For example you opened a new Prime Visa

A 2010 memorandum from the IRS says cash back earned via credit card spending is not considered taxable income However if you receive it as part of opening a bank account where you didn t have to complete minimum spending you must report it as income Many companies offer cash back rewards for purchasing their product but is this reward considered taxable income Watch this video to learn more about cash back rewards and taxable income

Download Cash Back Taxable Income

More picture related to Cash Back Taxable Income

Easy Ways To Reduce Your Taxable Income In Australia Tax Warehouse

https://www.taxwarehouse.com.au/wp-content/uploads/money-1673582_1280-1024x769.png

Filling Tax Form Tax Payment Financial Management Corporate Tax

https://static.vecteezy.com/system/resources/previews/025/022/780/original/filling-tax-form-tax-payment-financial-management-corporate-tax-taxable-income-concept-composition-with-financial-annual-accounting-calculating-and-paying-invoice-3d-rendering-png.png

120k Salary Effective Tax Rate V s Marginal Tax Rate MH Tax 2024

https://mh.icalculator.com/img/og/MH/100.png

If you receive a cash reward when you refer someone to sign up for a new card this is technically considered taxable income For the most part the IRS treats credit card cash rewards as discounts rather than taxable supplemental income since you are not getting the cash in exchange for anything The cash rewards are an incentive to purchase something and thereby reduce your taxable income

[desc-10] [desc-11]

Cash Or Credit Free Stock Photo Public Domain Pictures

https://www.publicdomainpictures.net/pictures/250000/velka/cash-or-credit.jpg

85k Salary Effective Tax Rate V s Marginal Tax Rate KR Tax 2024

https://kr.icalculator.com/img/og/KR/100.png

https://www.investopedia.com/ask/answers/110614/...

Key Takeaways Whether credit card rewards are taxable as income depends on how the rewards are received If earned through the use of the card like a cash back bonus the rewards are viewed by

https://www.moneygeek.com/.../is-cash-back-taxable

The cash back you earn by spending money on your credit card is not taxable If you earn cash back without needing to spend any money it might be taxable The cash back you earn via a business credit card affects the expenses you report

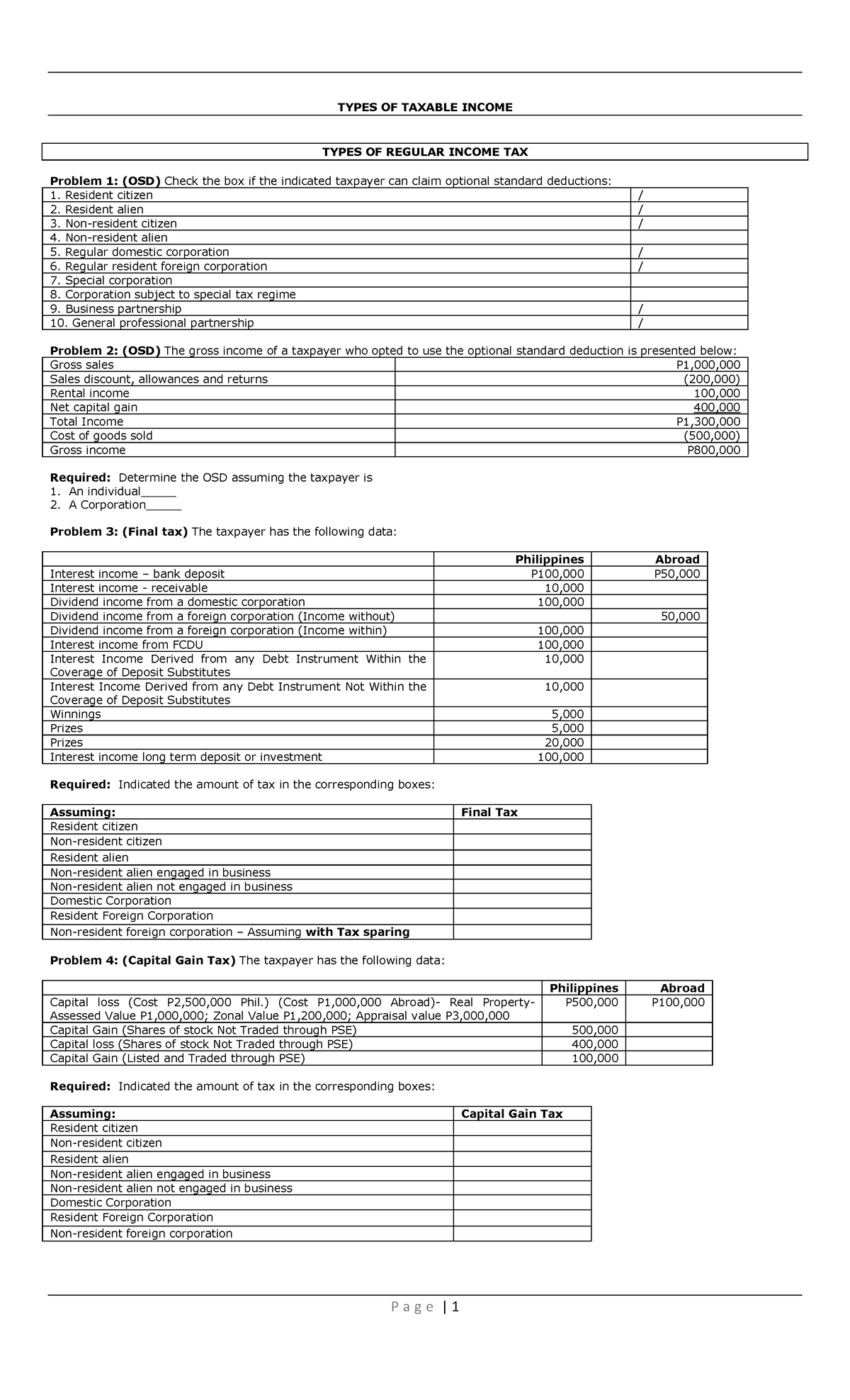

10 Types Of Taxable Income Student TYPES OF TAXABLE INCOME TYPES OF

Cash Or Credit Free Stock Photo Public Domain Pictures

Income Tax Overview Booklet CIBC Private Wealth Page 2

Are Your Cash Back Rewards Taxable Max My Money

Income Tax Income Tax Credit Www gotcredit With An Act Flickr

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

80k Salary Effective Tax Rate V s Marginal Tax Rate BF Tax 2024

Income Tax Calculator How To Save Money On Income Tax New Regime

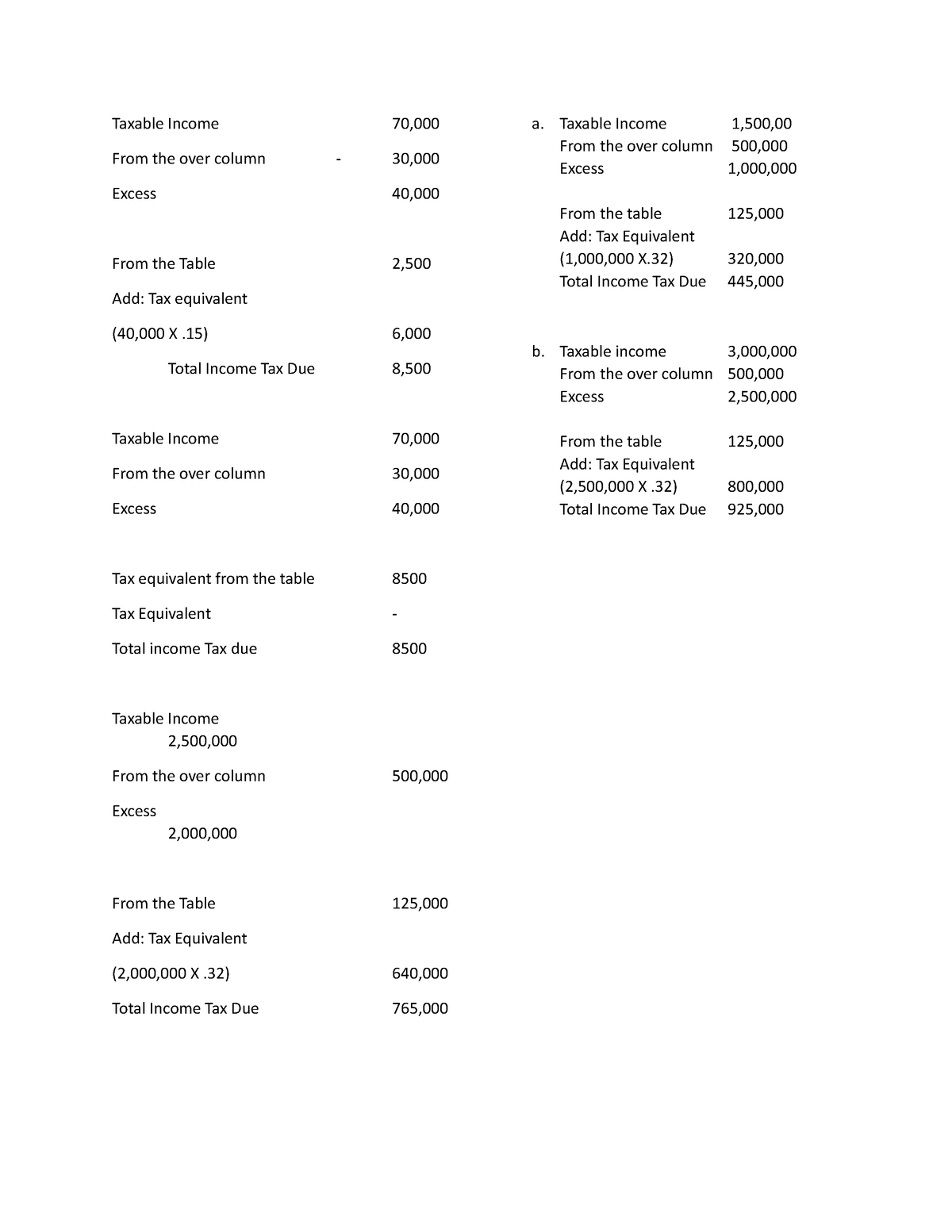

Taxable Income Notes Taxable Income 70 Taxable Income 70 From The

Cash Back Taxable Income - Whether credit card rewards are taxable depends on how you earned them If you received cash or miles for instance for simply opening an account you might have to pay taxes on the amount