Child Care Tax Credit 2022 Income Limit Web 11 Juni 2021 nbsp 0183 32 The following FAQs can help you learn if you are eligible and if eligible how to calculate your credit Further information is found below and in IRS Publication 503 Child and Dependent Care Expenses For information regarding changes to the credit for 2021 only see Q6 through Q14

Web IRS Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or Web 9 Nov 2023 nbsp 0183 32 The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents This means that the maximum

Child Care Tax Credit 2022 Income Limit

Child Care Tax Credit 2022 Income Limit

https://www.the-sun.com/wp-content/uploads/sites/6/2022/07/LG-CHILD-TAX-CREDIT-OFFPLAT.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

T22 0194 Repeal Child Tax Credit CTC Earned Income Threshold And

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/t22-0194.gif?itok=gxJwVQVm

Tax Credits For Pa Families Worth Billions Of Dollars Are On The Table

https://whyy.org/wp-content/uploads/2023/06/k5599q2kgasyp4ybvk59gb2nfc.jpeg

Web 24 Aug 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit Web Vor 3 Tagen nbsp 0183 32 For the 2023 tax year returns filed in 2024 the child tax credit is worth up to 2 000 per qualifying dependent The credit is also partially refundable through the additional child

Web 19 Okt 2023 nbsp 0183 32 Limits on who can provide care You can claim the credit for money you paid for care as long as the person you paid was not one of the following people Your spouse A parent of the child being cared for for example you couldn t claim the credit if you pay your ex spouse to care for the children you have together Web 2 Jan 2024 nbsp 0183 32 Your or your spouse s earned income for each month is 250 if there is one qualifying person 500 if two or more qualifying individuals See the topic Earned Income Limit in Publication 503 PDF for further information Care providers You must identify all persons or organizations that provide care for your child or dependent You

Download Child Care Tax Credit 2022 Income Limit

More picture related to Child Care Tax Credit 2022 Income Limit

CTC 2023 Amount Why Am I Not Getting The Full Child Care Tax Credit

https://phantom-marca.unidadeditorial.es/af5a567259649b4e9a356908733dee46/resize/1320/f/jpg/assets/multimedia/imagenes/2023/01/19/16741182908664.jpg

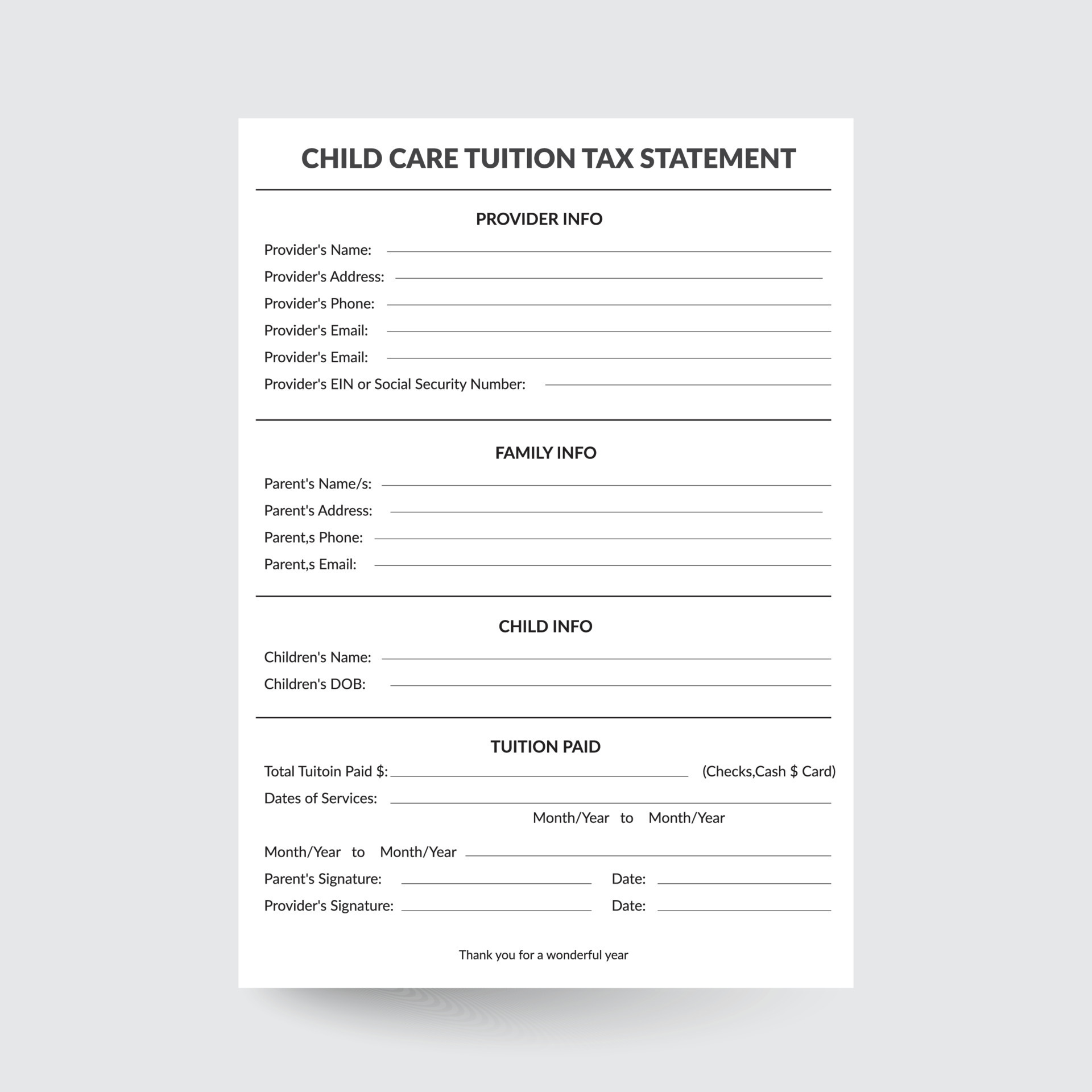

ChildCare Tax Statement Child Tax Statement Daycare Tax Form Daycare

https://static.vecteezy.com/system/resources/previews/022/464/124/original/childcare-tax-statement-child-tax-statement-daycare-tax-form-daycare-tax-childcare-form-printable-daycare-daycare-provider-daycare-payment-form-tuition-receipt-free-vector.jpg

Are They Doing Child Tax Credit Monthly Payments In 2022 Leia Aqui

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/11/GettyImages-1398954446.jpg

Web 4 Apr 2022 nbsp 0183 32 This tax credit is a percentage that is based on your adjusted gross income of the amount of work related childcare expenses that you paid over the course of the year You may use up to 3 000 of Web 11 Feb 2022 nbsp 0183 32 Who is eligible Parents and people with dependents who paid for the care of a qualifying individual in order to work or look for work during 2021 are eligible for the expanded tax credit A

Web 31 Jan 2022 nbsp 0183 32 What is the amount of the Child Tax Credit for 2021 added January 31 2022 Q A3 How much of the Child Tax Credit can I claim on my 2021 tax return added January 31 2022 Q A4 How did the IRS determine the amount of my advance Child Tax Credit payments added January 31 2022 Q A5 Web February 8 2023 in Tax Credits 0 The Childcare Tax Credit is a valuable tax credit for families who pay for childcare It can help offset the costs of care for a qualifying child or dependent and is based on your taxable income and the amount you spend on maintenance It should be noted that IRC 21 covered both childcare and dependent care

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Recent Bills Offer Needed Updates To Child Care Food Assistance Program

https://www.ffyf.org/wp-content/uploads/2023/12/iStock-1450003713-scaled.jpg

https://www.irs.gov/newsroom/child-and-dependent-care-credit-faqs

Web 11 Juni 2021 nbsp 0183 32 The following FAQs can help you learn if you are eligible and if eligible how to calculate your credit Further information is found below and in IRS Publication 503 Child and Dependent Care Expenses For information regarding changes to the credit for 2021 only see Q6 through Q14

https://www.irs.gov/.../understanding-the-child-and-dependent-care-credit

Web IRS Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or

The Ins And Outs Of The Child And Dependent Care Tax Credit For 2023

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

Child Tax Credit 2022 Three 250 Direct Payments Going Out This Month

ChildCare Tax Statement Daycare Tax Form Graphic By Watercolortheme

Child And Dependent Care Tax Credit What Is It How Does It Work

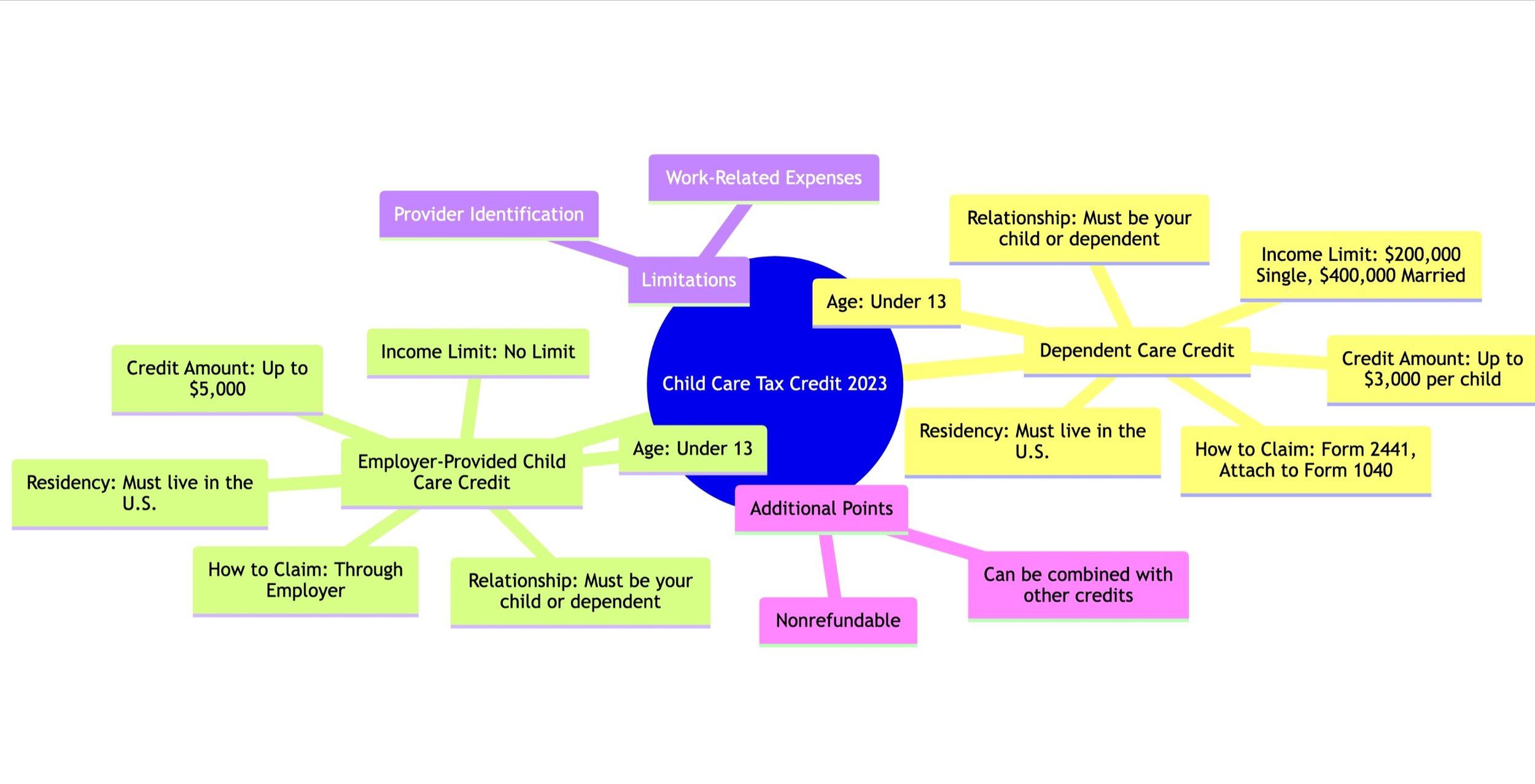

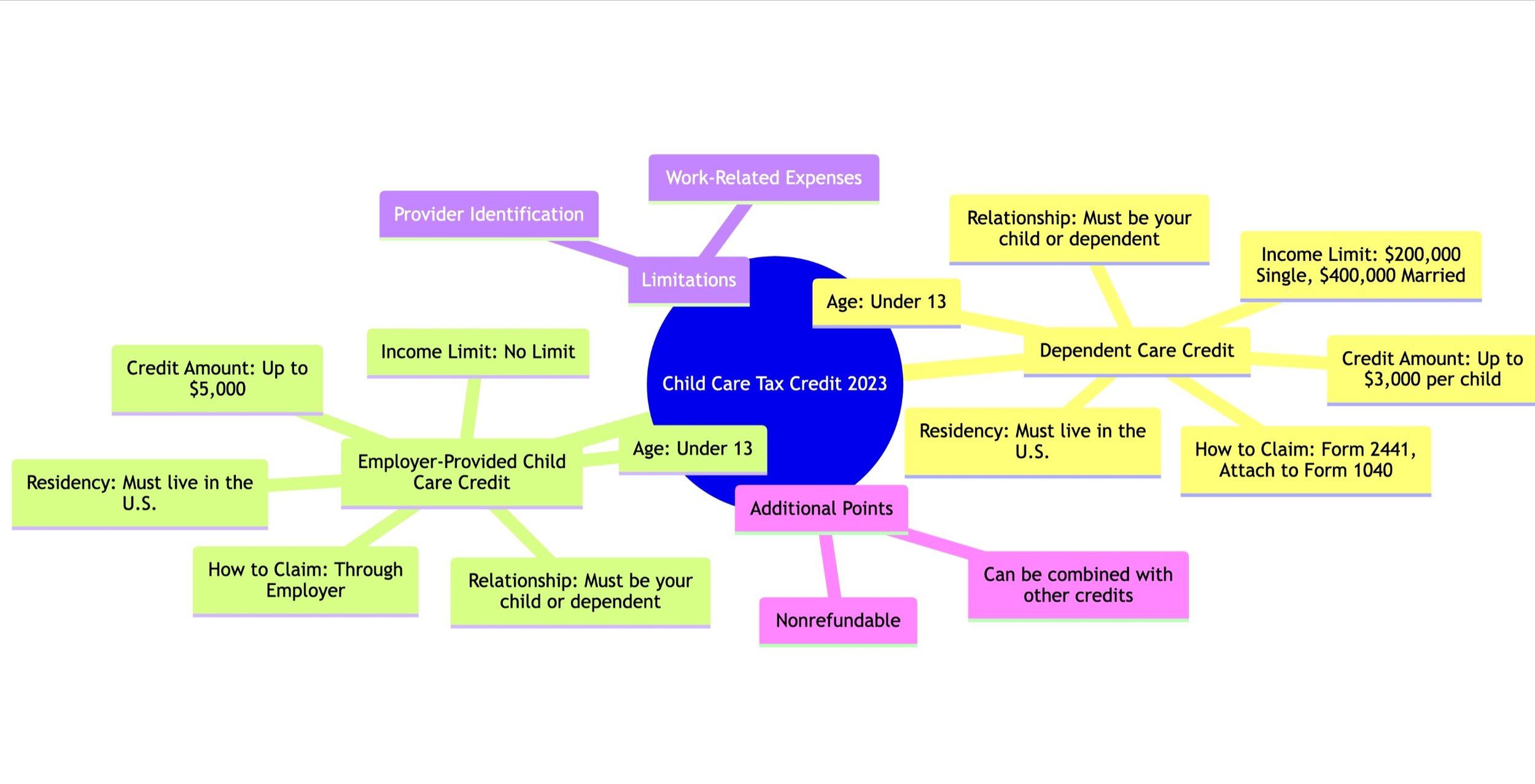

Understanding The 2023 Child Care Tax Credit Types Eligibility And

Understanding The 2023 Child Care Tax Credit Types Eligibility And

Tax Statement Customize Child Care Business Daycare Parents Tuition

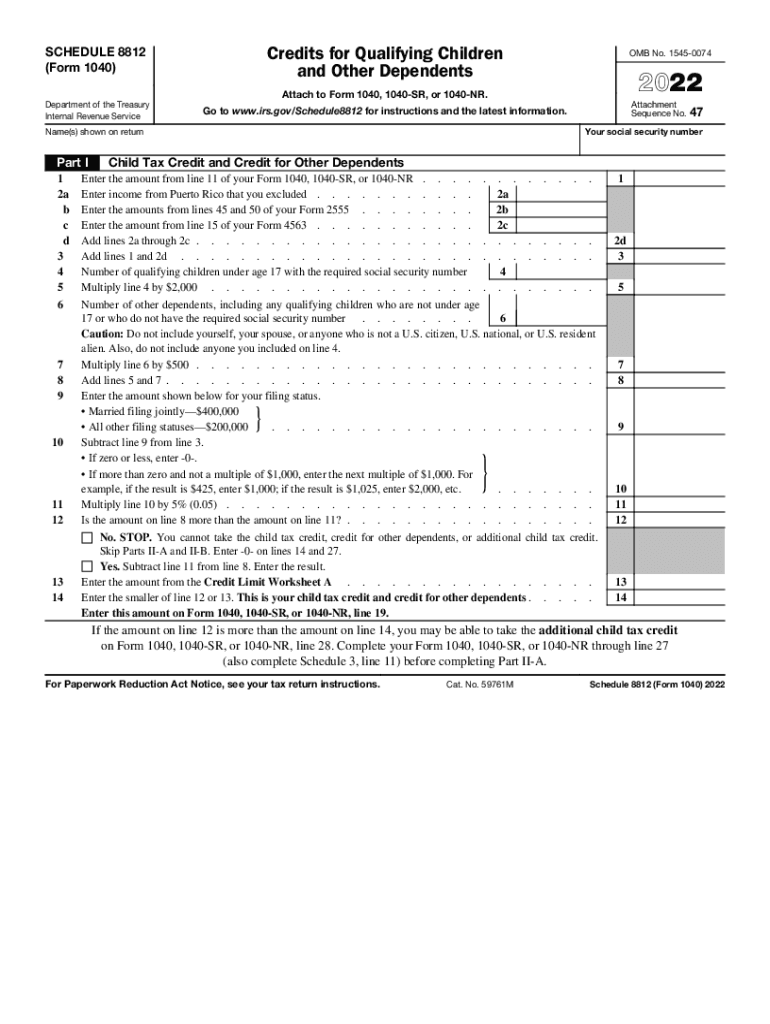

2022 Form IRS 1040 Schedule 8812 Fill Online Printable Fillable

Child Tax Credit State s New Child Care Tax Credit Allows Up To 6 000

Child Care Tax Credit 2022 Income Limit - Web 19 Okt 2023 nbsp 0183 32 Limits on who can provide care You can claim the credit for money you paid for care as long as the person you paid was not one of the following people Your spouse A parent of the child being cared for for example you couldn t claim the credit if you pay your ex spouse to care for the children you have together