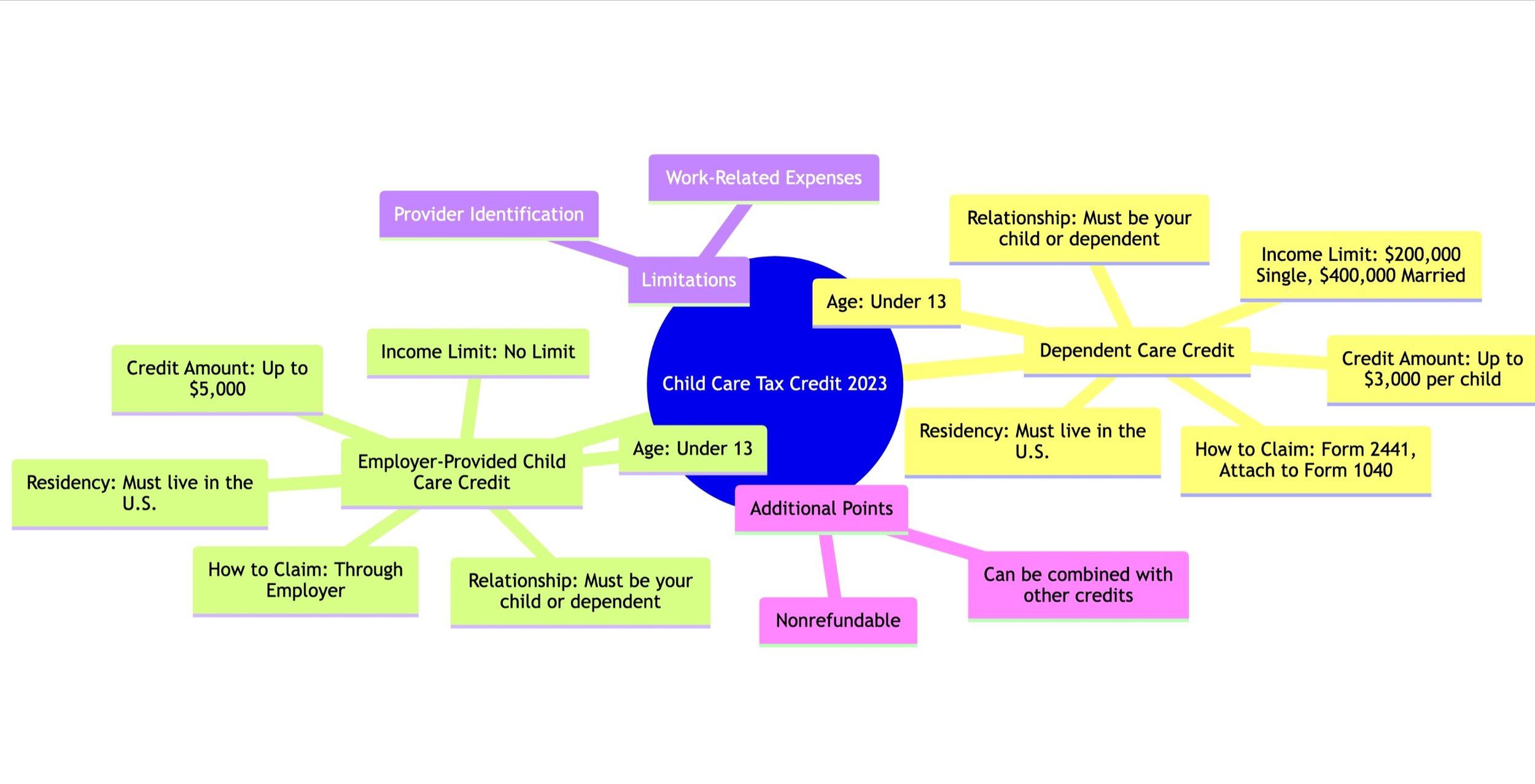

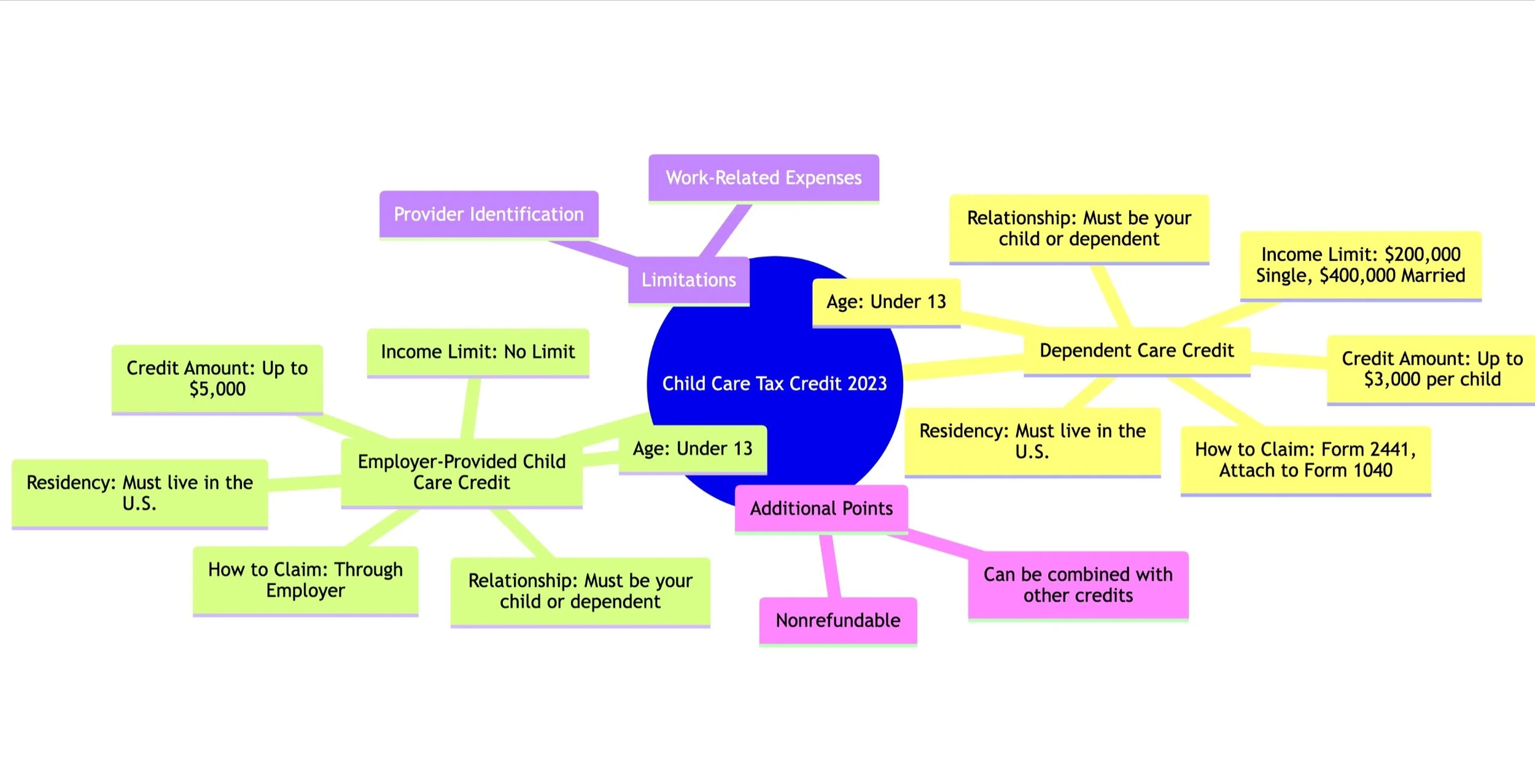

Child Care Tax Credit 2023 Vs 2022 The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to care

See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit The CDCTC allows taxpayers to decrease expenses for child care children under the age of 13 and adult dependents by claiming the credit on their annual income taxes The credit a family receives is calculated by multiplying the amount of expenses by the family s adjusted gross income AGI

Child Care Tax Credit 2023 Vs 2022

Child Care Tax Credit 2023 Vs 2022

https://images.squarespace-cdn.com/content/v1/5d940768938dd828fc033675/77a228a5-aaee-47f8-a4be-e62a1c4783b2/Web+capture_25-10-2023_224527_showme.redstarplugin.com.jpeg

Your Child Care Tax Credit May Be Bigger On Your 2021 Tax Return

https://cdn.mos.cms.futurecdn.net/Q6FW9iHViwDjjo7YZxrHj3.jpg

DAYCARE TAX STATEMENT Childcare Center Printable End Of The Etsy In

https://i.pinimg.com/originals/32/9e/c2/329ec24df04c77c70081e4a28267c980.jpg

For tax year 2022 the child tax credit is 2 000 per child under 17 who s claimed on your tax return as a dependent Last year the credit was bumped up to 3 000 per child You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities

FAQs about the Child and Dependent Care Credit expansion due to the ARPA Claiming the Credit Q1 Q17 Work related expenses Q18 Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The child tax credit is a nonrefundable tax credit available to taxpayers with dependent children under the age of 17 The credit can reduce your tax bill on a dollar for dollar basis

Download Child Care Tax Credit 2023 Vs 2022

More picture related to Child Care Tax Credit 2023 Vs 2022

Child Tax Credits Ending In 2022 Dailynationtoday

https://www.the-sun.com/wp-content/uploads/sites/6/2022/01/EP_CTC_END_2022_COMP-1.jpg

Earned Income Credit 2022 Calculator INCOMEBAU

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

Child And Dependent Care Tax Credit Get Ahead Colorado

https://images.squarespace-cdn.com/content/v1/6564d2f2c8c33123bbdaba64/1701106456150-IKN3BRGKF064ZU8LV88C/Other+Tax+Credits_Learn.jpg?format=1000w

Topic no 602 Child and dependent care credit You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a Like dependent care FSAs the dependent care tax credit is for care expenses for children younger than 13 plus minors and adults unable to care for themselves For the 2022 2023 tax year you can claim 3 000 in expenses for one dependent or 6 000 for two or more dependents

The child tax credit CTC allows eligible parents and caregivers to reduce their tax liability and might even result in a tax refund However not everyone can claim the credit and credit Take advantage of the 2021 child care credit and receive a refundable tax credit of up to 8 000 This tax season an often overlooked tax credit could put up to 8 000 back in families

Credit Score Needed For Care Credit 2022 CreditScoreAdvice

https://www.creditscoreadvice.net/wp-content/uploads/allegro-october-2022-local-802-afm.jpeg

Does 2022 Get Child Credit Leia Aqui What Is The Tax Break For 2022

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

https://www.nerdwallet.com/article/taxes/child-and...

The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to care

https://finance.yahoo.com/personal-finance/child...

See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

Credit Score Needed For Care Credit 2022 CreditScoreAdvice

Child Tax Credit Portal Now Open For Non filers How To Claim Up To

Are They Doing Child Tax Credit Monthly Payments In 2022 Leia Aqui

Child Tax Credit

Georgia Tax Credits For Workers And Families

Georgia Tax Credits For Workers And Families

The Earned Income Tax Credit EITC Refund Schedule For 2022 2023

CURRENT CHILD CARE TAX CREDIT Download Table

2022 Education Tax Credits Are You Eligible

Child Care Tax Credit 2023 Vs 2022 - For tax year 2022 the child tax credit is 2 000 per child under 17 who s claimed on your tax return as a dependent Last year the credit was bumped up to 3 000 per child