Income Tax Rebate Other Than 80c Web 26 d 233 c 2022 nbsp 0183 32 Best 10 Tax Saving Investment Options Other Than 80C 1 Tax saving with NPS under Section 80CCD 1B Taxpayers can save additional tax by investing up to

Web 21 mars 2020 nbsp 0183 32 14 tax saving investment options beyond Section 80C limit Most people are aware of claiming tax deduction of Rs 1 5 lakh under Section 80C of the Income Tax Web 3 avr 2023 nbsp 0183 32 If your parents are above 60 years and you are below 60 you can claim up to Rs 75 000 and in case you are above 60 then the amount will shoot up to Rs 1 00 000

Income Tax Rebate Other Than 80c

Income Tax Rebate Other Than 80c

https://i.ytimg.com/vi/1KL7ecIvZBY/maxresdefault.jpg

Tax Savings Options Other Than Sec 80C For FY 2017 18 BasuNivesh

http://www.basunivesh.com/wp-content/uploads/2017/06/Tax-Savings-options-other-than-Sec.80C-for-FY-2017-18.jpg

Save Tax Other Than 80C Tips And Tricks To Save Tax Legally

https://i.ytimg.com/vi/0k8jHhY9Z5A/maxresdefault.jpg

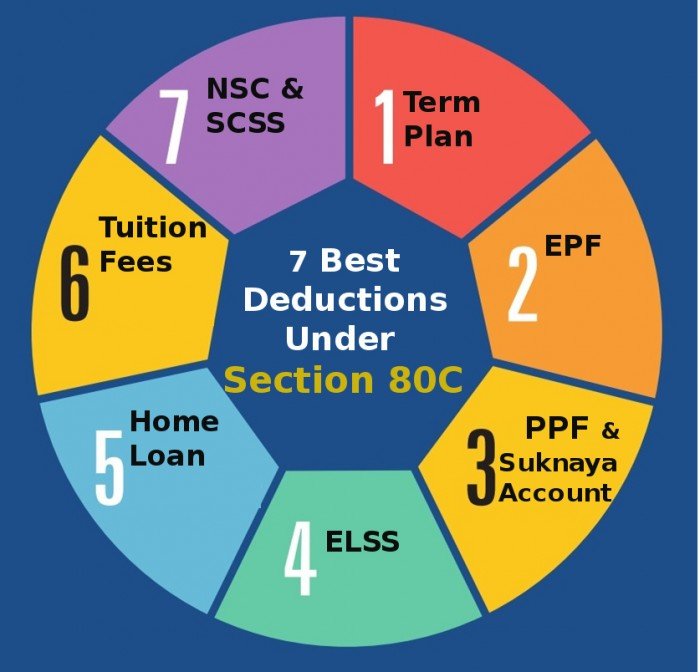

Web 3 ao 251 t 2018 nbsp 0183 32 You can save up to Rs 46 800 tax deductions of up to Rs 1 50 000 a year in taxes by investing in ELSS which is covered under Section 80C of the Income Tax Act Web 9 d 233 c 2021 nbsp 0183 32 December 9 2021 18 15 IST Many taxpayers exhaust the limit of Rs 1 5 lakh under Section 80C and yet want to bring save more tax The last date to save tax for the

Web All About Tax Saving Investments Other Than 80C Section 80C is the most well known provision of the Income Tax Act of 1961 under which a rebate of up to Rs 1 5 Lakh is Web Maximum rebate for a Mediclaim policy for an individual and spouse and kids is Rs 25 000 An additional rebate of up to Rs 25 000 for the premium paid for parents Mediclaim

Download Income Tax Rebate Other Than 80c

More picture related to Income Tax Rebate Other Than 80c

80C TO 80U DEDUCTIONS LIST PDF

https://wealthtechspeaks.in/wp-content/uploads/2017/04/Tax-Deduction-Under-Section-80C.png

Budget 2014 Impact On Money Taxes And Savings

http://i1.wp.com/apnaplan.com/wp-content/uploads/2014/07/Investments-to-Save-Tax-under-Section-80C.png?fit=757%2C475

12 Ways To Save Taxes Other Than 80C Omozing

https://s3-ap-southeast-1.amazonaws.com/com.ft.uploads/wp-content/uploads/2021/03/15103028/Tax.png

Web 18 juil 2023 nbsp 0183 32 You are a resident individual Your total income after reducing the deductions under chapter VI A Section 80C 80D and so on does not exceed Rs 5 lakh in an FY Web 11 janv 2023 nbsp 0183 32 These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA In this article we will discuss at

Web 30 janv 2022 nbsp 0183 32 Other than the 80C these acts can also be used to save money on income taxes 1 Interest Earned on Deposits in Savings Accounts Section 80TTA offers a Web 1 avr 2016 nbsp 0183 32 Under Section 80C of the Income Tax Act of 1961 certain deductions are provided to taxpayers to lower their taxes And if this is not enough to meet your

Income Tax Calculator Top 5 Tax Saving Tips Other Than Section 80C Benefit

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi-5ylG1IrhF_gQCGCJQVsWieIXvX1vIfrwUMJUVHcArKU7nR94_nImSU_-7Zb-pNu8_zCi49z-JxnkjOapwHCDh_OSX2tUhrv3sTjRSMu73x9d5CcviroaYMiCuOWuVfdmFTsHODYBV40ga9rwy1QNySxrEEXnh4ntyMfSdzjYSltbLw_sFsxZQopx/s1920/Untitled design.jpg

What Are The Tax Saving Options Other Than 80 C 80C

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhF3pKhk47PKh8qNt69pKcLBGTBKkFs3-y7QVd7HELfzLkO2f33F1ZjNGTItz6-vkWXZj7Vseb6D4venu67-fZgMy70dnuZF5uQ5gxNMRA0isK75C7LhbKZyKdwRkuEGr6M1_lHY8UFnXCXIDNG9TFBb6K89xHpj49XsXWVUB_s2dd_iLUHa2ubr7V3fw/s1920/20230221_154454_0000.png

https://www.etmoney.com/learn/saving-schemes/beyond-section-80c-10...

Web 26 d 233 c 2022 nbsp 0183 32 Best 10 Tax Saving Investment Options Other Than 80C 1 Tax saving with NPS under Section 80CCD 1B Taxpayers can save additional tax by investing up to

https://www.financialexpress.com/money/income-tax/14-tax-saving...

Web 21 mars 2020 nbsp 0183 32 14 tax saving investment options beyond Section 80C limit Most people are aware of claiming tax deduction of Rs 1 5 lakh under Section 80C of the Income Tax

Tax Saving Options Other Than 80C Investments YouTube

Income Tax Calculator Top 5 Tax Saving Tips Other Than Section 80C Benefit

Reduce Your Tax Liability Beyond Section 80C Jupiter

Why Is 80C The Best Tax Saving Instrument

Post Office TD Time Diposit Investment 2021 Income Tax Rebate 80c

HOW TO SAVE TAX UNDER SECTION 80 C WHAT COMES UNDER SECTION 80C FULL

HOW TO SAVE TAX UNDER SECTION 80 C WHAT COMES UNDER SECTION 80C FULL

80ccc Pension Plan Investor Guruji

What Are The Tax Saving Investments Other Than Section 80C For Senior

Income Tax Calculation FY 2022 23 Salary 9 Lakh

Income Tax Rebate Other Than 80c - Web The answer is yes There are many tax exemptions other than Section 80C included in the Act Some of them being Here is an overview of how to save tax other than Section