Child Care Tax Credit Cra The above limits can be found in the Canada Revenue Agency CRA form T778 Child Care Expenses which is filed with the tax return to make a claim for child

By applying for the CCB you also register your children for the goods and services tax harmonized sales tax GST HST credit climate action incentive payment CAIP Also known as the Child Care Expense Deduction the T778 is only available to taxpayers with an eligible child or children It features various parts that allow you to claim child

Child Care Tax Credit Cra

Child Care Tax Credit Cra

https://cdn.mos.cms.futurecdn.net/Q6FW9iHViwDjjo7YZxrHj3.jpg

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Child And Dependent Care Credit LO 7 3 Calculate Chegg

https://media.cheggcdn.com/media/c7a/c7a7e54f-d046-435c-826a-3945e90aad03/php4ulBhq

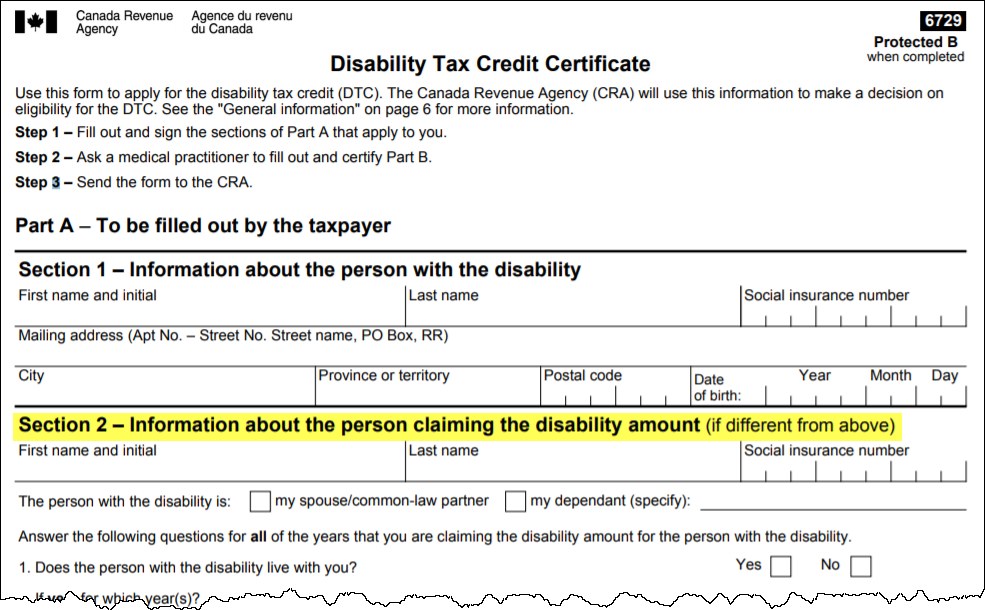

How we calculate it what are the related federal provincial and territorial child benefit and credit programs administered by the Canada Revenue Agency CRA What s new for As payments are handled by the Canada Revenue Agency CRA you ll need to file your income taxes to be eligible But you don t need to include any CCB funds you receive in your taxable income

The Canada child benefit CCB provides a tax free monthly payment to families to help them with the cost of raising children under the age of 18 You must meet specific criteria to qualify for the The CRA provides a fixed amount per child that you can claim based on their age and eligibility for the Disability Tax Credit DTC The maximum claimable amount is two thirds of the lower income

Download Child Care Tax Credit Cra

More picture related to Child Care Tax Credit Cra

2022 Income Tax Brackets Chart Printable Forms Free Online

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

Child Care Tax Credit 2021 2022 Requirements What It Is Sittercity

https://www.sittercity.com/wp-content/uploads/2020/02/GettyImages-1180592592-1-scaled-e1581105297103.jpg

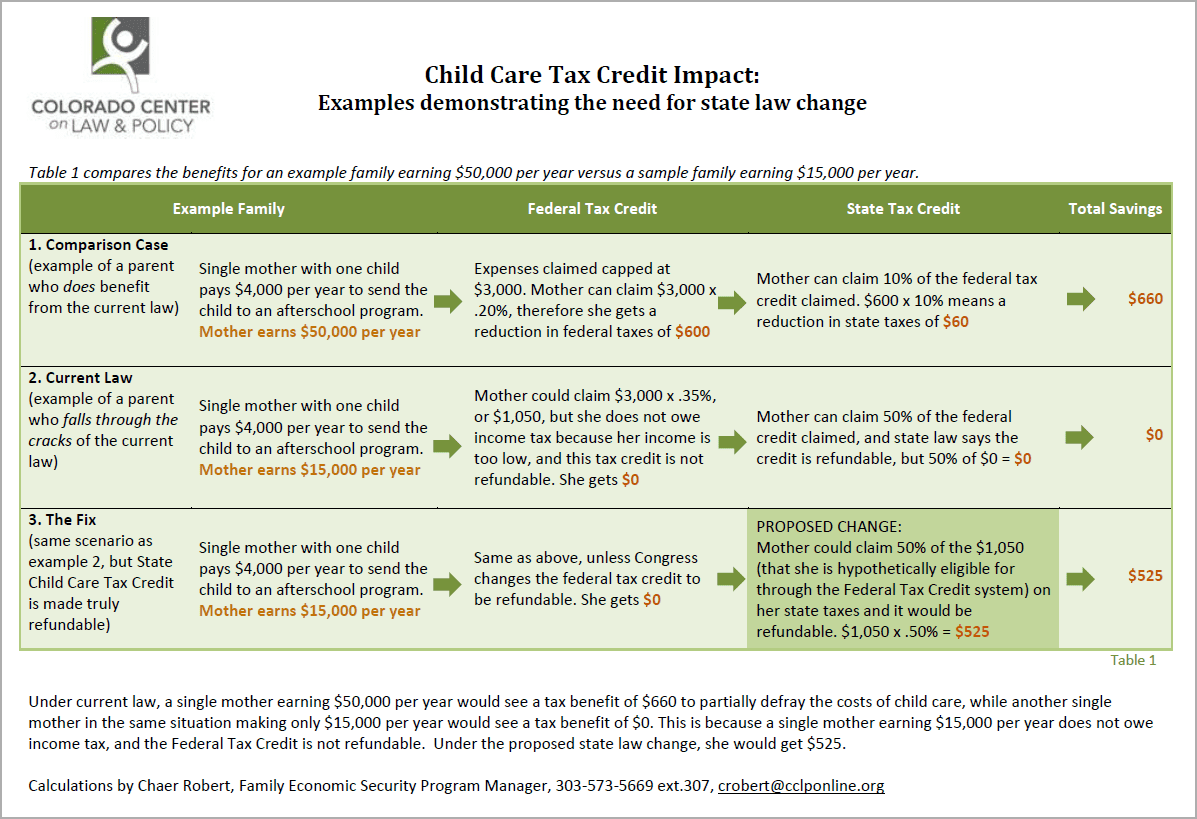

Fixing The Child Care Tax Credit EOPRTF CCLP

http://cclponline.org/wp-content/uploads/2014/02/Child-Chare-Tax-Credit-Impact-Chart.png

The Canada child benefit CCB is a tax free monthly payment made to eligible families to help with the cost of raising children under 18 years of age The CCB may include the child disability benefit The Ontario Child Care Tax Credit known as Ontario Childcare Access and Relief from Expenses CARE Tax Credit puts more money in the pockets of families and provides

The CRA Form T778 Child Care Expenses Deduction lists these rates as well as further explanations about claiming childcare expenses File your taxes with You can use form T778 Child care expenses deduction to claim child care expenses you paid for your child ren in 2023 You can claim child care expenses if you or your

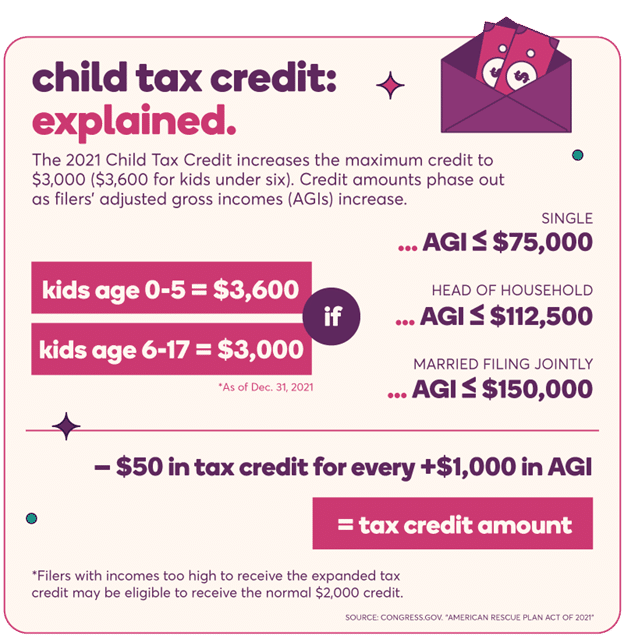

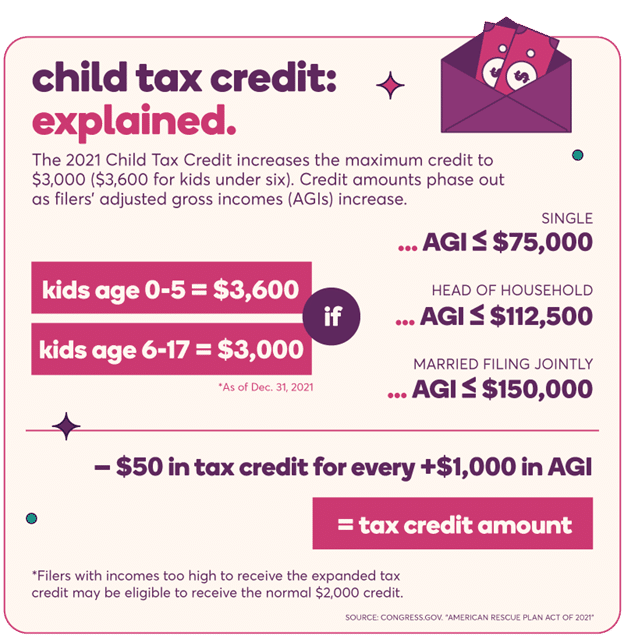

Child Tax Credit Payments Begin Arriving Today For Almost One Million

https://wpcdn.us-east-1.vip.tn-cloud.net/www.wtvq.com/content/uploads/2021/07/q/z/child-tax-credit-infographic.png

Child Care Tax Credit Dates Librus

https://s-media-cache-ak0.pinimg.com/736x/06/05/27/060527e8a870eabbacbabf70af4b0408.jpg

https://www.taxtips.ca/filing/child-care-costs.htm

The above limits can be found in the Canada Revenue Agency CRA form T778 Child Care Expenses which is filed with the tax return to make a claim for child

https://publications.gc.ca/collections/collection...

By applying for the CCB you also register your children for the goods and services tax harmonized sales tax GST HST credit climate action incentive payment CAIP

FSA Or Tax Credit Which Is Best To Save On Child Care

Child Tax Credit Payments Begin Arriving Today For Almost One Million

Tax Credit Or FSA For Child Care Expenses Which Is Better

Cra Tax Forms 2023 Printable Printable Forms Free Online

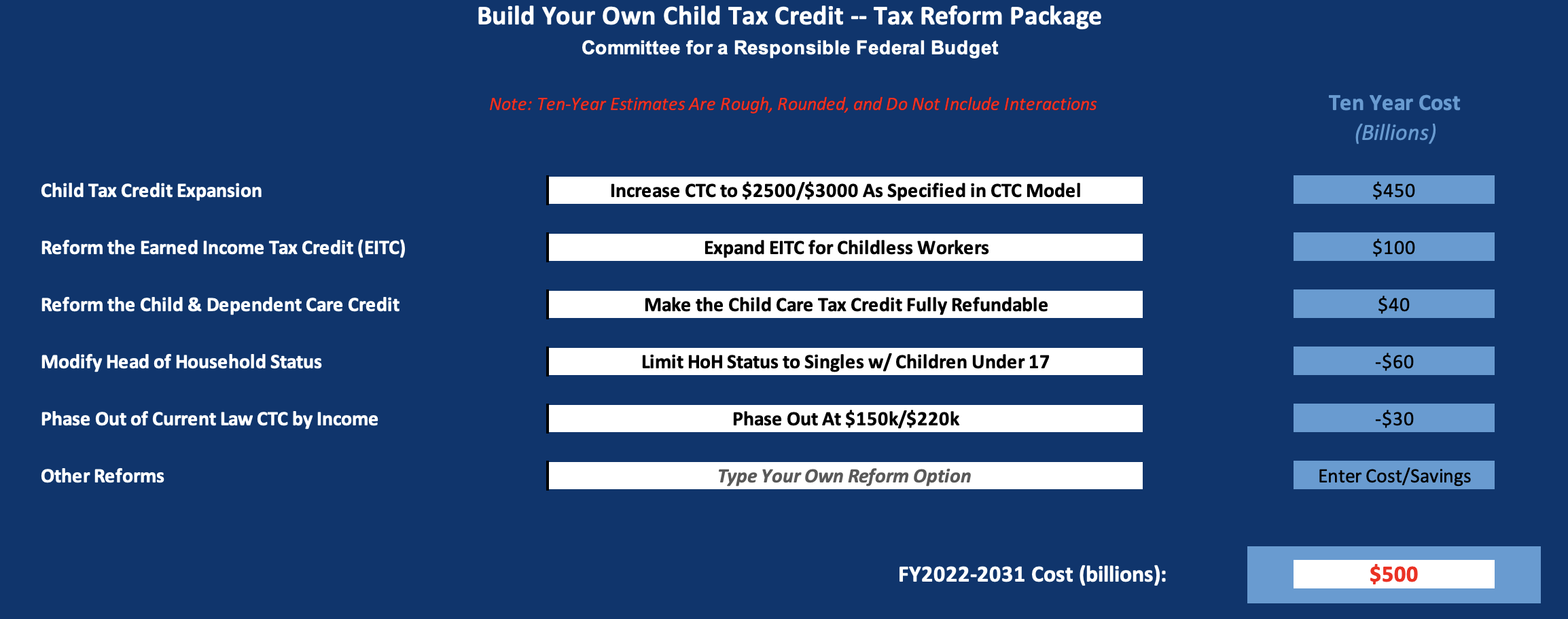

Build Your Own Child Tax Credit 2 0 2022 01 06

What Do I Do If I Haven t Received Child Tax Credit In August

What Do I Do If I Haven t Received Child Tax Credit In August

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

Child Care Contract Template Free Printable Templates

Child Care Tax Credit Cra - In Income Tax Folio S1 F3 C1 Child Care Expense Deduction Canada Revenue Agency CRA outlines some criteria it considers when determining whether