Child Disability Tax Credit Amount Approved applicants who are 18 years and older on the last day of the year may claim the base disability amount Those who are 17 years and younger on the last day of the

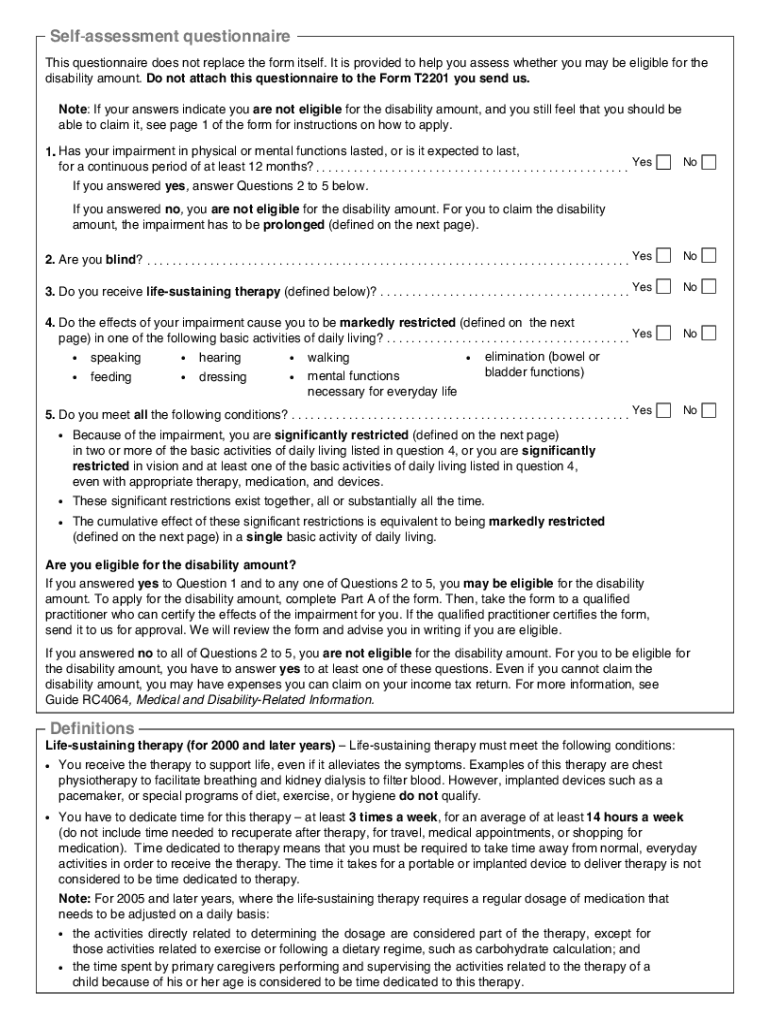

The disability tax credit DTC is a non refundable tax credit that helps people with disabilities or their supporting family member reduce the amount of income tax they A thorough Guide To Understanding the Canada Child Disability Tax Credit the conditions eligible for benefits and the application process for claiming

Child Disability Tax Credit Amount

Child Disability Tax Credit Amount

https://www.connectedinmotion.ca/wp-content/uploads/2022/09/CIM-Blog-DisabilityTaxCredit-05734.jpg

Canadian Disability Benefits Disability Tax Credit YouTube

https://i.ytimg.com/vi/OWvsWPBeleA/maxresdefault.jpg

Disability Tax Credit Easy to Understand Guide With Life Examples

https://i0.wp.com/accessiblewallet.com/wp-content/uploads/2022/11/Sample-Calculation-of-Disability-Tax-Credit-in-Ontario.jpg?w=700&ssl=1

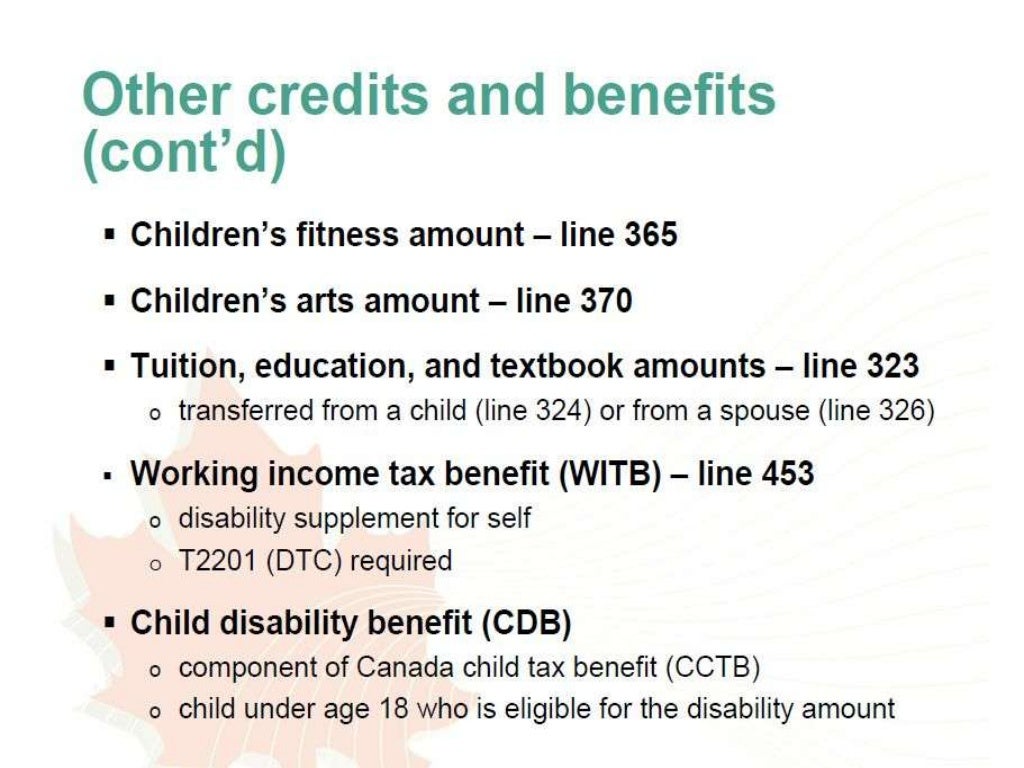

What is the Disability Tax Credit Base Amount for 2023 What is the Disability Tax Credit Supplemental Amount for 2023 Calculating Your 10 Year Retroactive Disability Tax Credit Payment Once approved for the Disability Tax Credit you can file for non refundable tax credits on both the federal and provincial tax forms The amount you receive will depend on many

The Child Disability Benefit CDB is a tax free benefit in Canada designed to provide additional financial assistance to families caring for a child who has a medical How Much Is The Disability Tax Credit The amount of the federal disability amount tax credit is 9 872 for 2024 9 428 for 2023 with a supplement of 5 758 for 2024 5 500 for 2023 for taxpayers under 18 years of age

Download Child Disability Tax Credit Amount

More picture related to Child Disability Tax Credit Amount

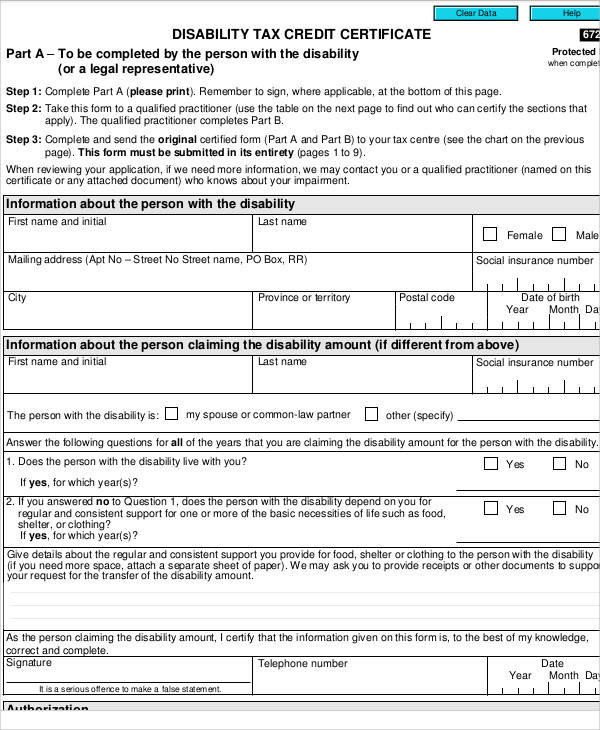

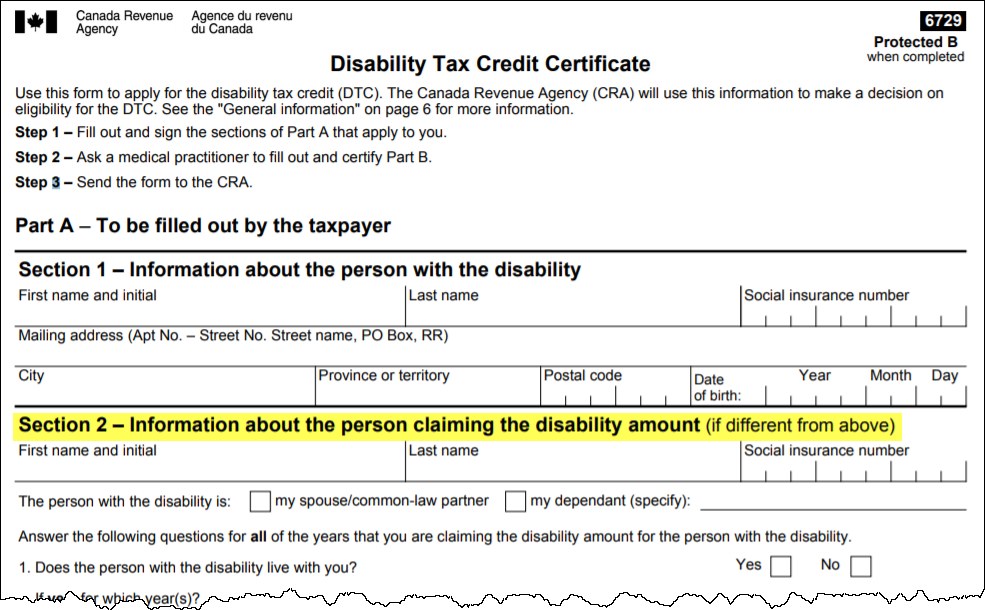

2017 Disability Tax Credit Guide T2201 Form Eligibility Child

https://disabilitycreditcanada.com/wp-content/uploads/2017_Disability_Tax_Credit_Guide.jpg

What Is The Disability Tax Credit RightFit Advisors

https://rightfitadvisors.ca/wp-content/uploads/What-is-the-disability-tax-credit-1.jpg

The Disability Tax Credit Infographic

https://aidecanada.ca/images/default-source/autism-funding-for-18/0002e9bd83f81fc14010b914cc375123bcbd.jpg?sfvrsn=e817d739_1

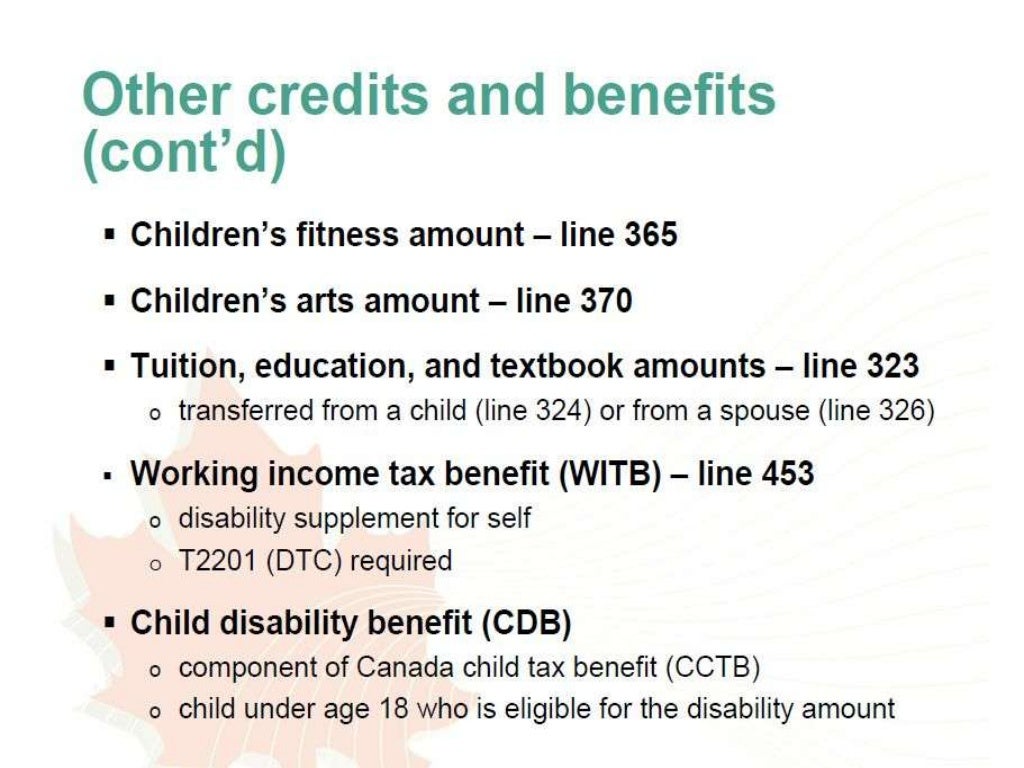

The DTC is a non refundable tax credit intended to reduce income tax payable for people with a disability and or those who support them It consists of the A related service the child disability benefit CDB provides tax free monthly payments to families who care for a child under age 18 with a severe and

If your family cares for a disabled child then you may qualify to receive monthly financial help from the government It s called the child disability benefit CDB How much can you claim for the disability tax credit For 2022 the federal non refundable disability amount is 8 870 for an adult up to 5 174 for an additional

Child Disability Benefit Disability Tax Credit Canada

http://beta.disabilitytaxcreditcanada.com/wp-content/uploads/2019/01/Disability-Tax-Credit-Family-Enjoys.jpg

Child Tax Credit 2022 Age Limit Latest News Update

https://i2.wp.com/www.cpabr.com/assets/htmlimages/Articles/child tax credit payments chart.JPG

https://www.canada.ca/.../disability-tax-credit/claiming-dtc.html

Approved applicants who are 18 years and older on the last day of the year may claim the base disability amount Those who are 17 years and younger on the last day of the

https://www.canada.ca/en/revenue-agency/services...

The disability tax credit DTC is a non refundable tax credit that helps people with disabilities or their supporting family member reduce the amount of income tax they

Child Tax Disability Benefits Tax Benefits Canada

Child Disability Benefit Disability Tax Credit Canada

Are Taxes Taken Out Of Disability Disability Talk

What The New Child Tax Credit Could Mean For You Now And For Your 2021

Cra Tax Forms 2023 Printable Printable Forms Free Online

Disability Tax Credit

Disability Tax Credit

Child Disability Tax Credit Registered Disability Savings Plan TBC

Disability Tax Credit Form Fill Out Sign Online DocHub

Free Info Session Tax Tips For People With Disabilities And Their

Child Disability Tax Credit Amount - The Child Disability Benefit CDB is a tax free benefit in Canada designed to provide additional financial assistance to families caring for a child who has a medical