Child Tax Credit 2023 California Use our EITC calculator or review the 2023 CalEITC credit table to calculate how much you may get when you file your tax year 2023 return These related cash back credits include CalEITC the state s Young Child Tax Credit YCTC and Foster Youth Tax Credit FYTC and Federal EITC

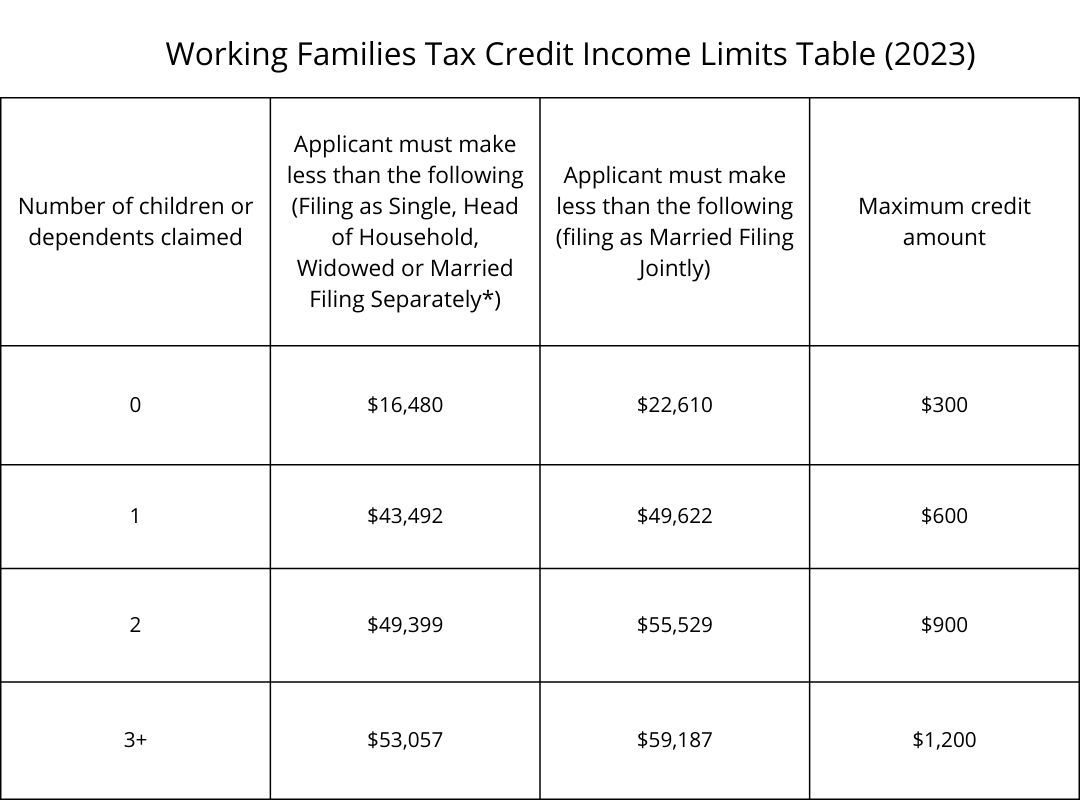

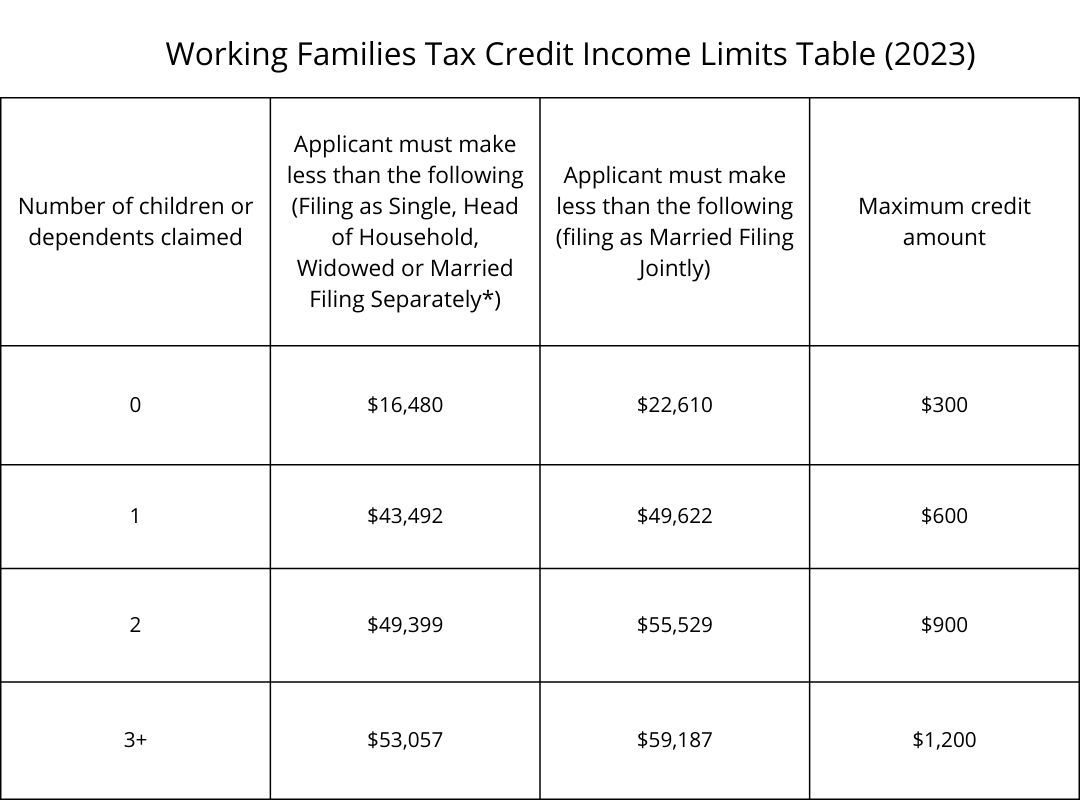

You may qualify to claim the 2023 credit for child and dependent care expenses if you and your spouse RDP paid someone in California to care for your child or other qualifying person while you worked or looked for employment You can qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and the annual income thresholds To see if you qualify how to apply or claim prior tax years visit the IRS page

Child Tax Credit 2023 California

Child Tax Credit 2023 California

https://i.ytimg.com/vi/jZkTfYSsaw8/maxresdefault.jpg

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

Child Tax Credit 2023 Changes Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/100/19/100019284/big.png

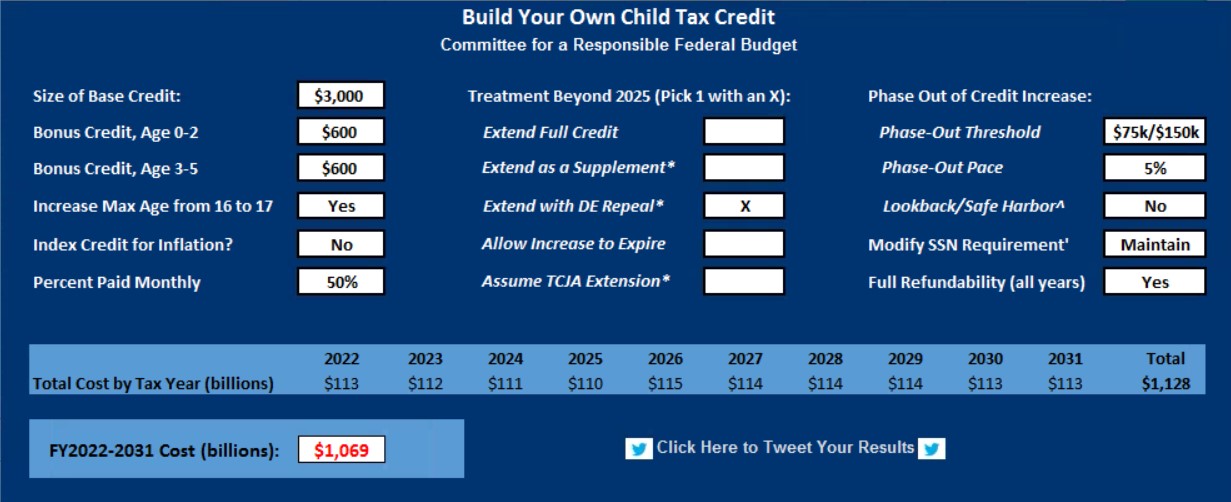

The Child Tax Credit is a tax benefit to help families who are raising children Nearly all families with kids will qualify Couples making less than 150 000 and single parents also called Head of Household making less than 112 500 will qualify for the additional 2021 Child Tax Credit amounts How the child tax credit will look in 2023 Will Congress approve more monthly child tax credit payments How the scaled down child tax credit could impact the 2023 tax filing season

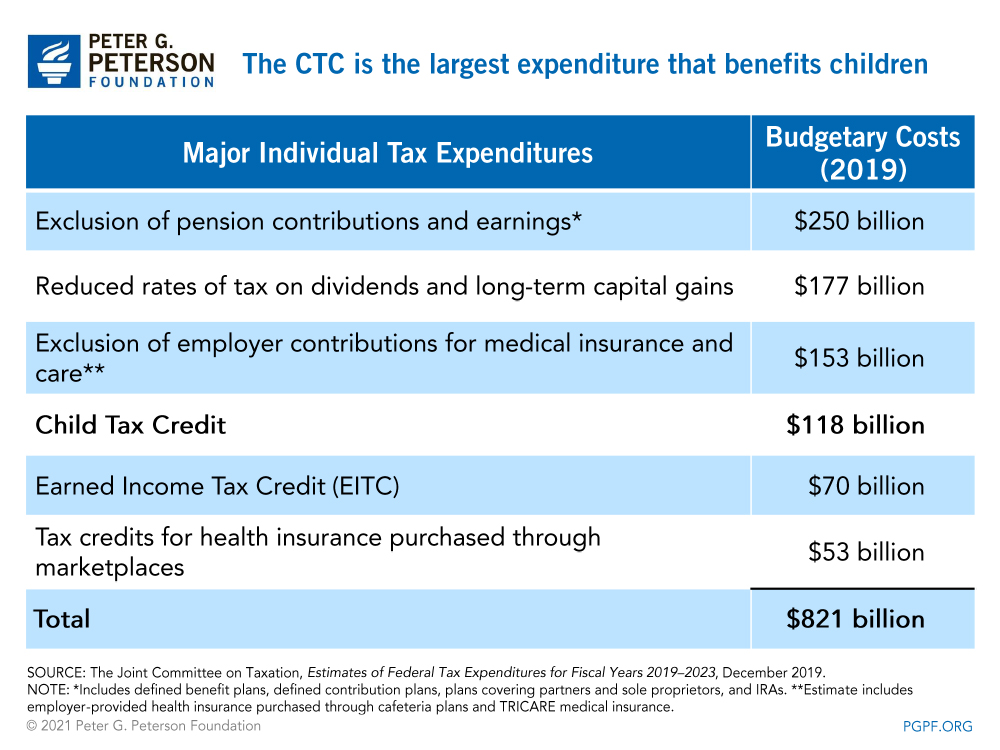

The Child Tax Credit CTC can reduce the amount of tax you owe by up to 2 000 per qualifying child If you end up owing less tax than the amount of the CTC you may be able to get a refund using the Additional Child Tax Credit ACTC See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit

Download Child Tax Credit 2023 California

More picture related to Child Tax Credit 2023 California

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/t22-0188.gif?itok=6FfQuMuW

What Is The Child Tax Credit And How Much Of It Is Refundable

https://i0.wp.com/www.brookings.edu/wp-content/uploads/2021/01/Who-gets-the-Child-Tax-Credit-in-2020_by-income.png?w=768&crop=0%2C0px%2C100%2C9999px&ssl=1

What The New Child Tax Credit Could Mean For You Now And For Your 2021

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit you The Young Child Tax Credit YCTC available to CalEITC eligible families with children under age 6 These credits reduce the amount of state income tax California families and individuals owe based on how much they earn from

[desc-10] [desc-11]

T14 0047 Eliminate Income Threshold For The Refundable Child Tax

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/T14-0047.gif?itok=5kNtR7oI

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

https://www.ftb.ca.gov/.../eligibility-and-credit-information.html

Use our EITC calculator or review the 2023 CalEITC credit table to calculate how much you may get when you file your tax year 2023 return These related cash back credits include CalEITC the state s Young Child Tax Credit YCTC and Foster Youth Tax Credit FYTC and Federal EITC

https://www.ftb.ca.gov/forms/2023/2023-3506-instructions.html

You may qualify to claim the 2023 credit for child and dependent care expenses if you and your spouse RDP paid someone in California to care for your child or other qualifying person while you worked or looked for employment

Your First Look At 2023 Tax Brackets Deductions And Credits 3

T14 0047 Eliminate Income Threshold For The Refundable Child Tax

Who Is Eligible For The Child Tax Credit In 2022 Leia Aqui Can You

Child Tax Credit Form Free Download

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

How Much Would A Child Tax Credit Be For A 2023 Leia Aqui What Is The

How Much Would A Child Tax Credit Be For A 2023 Leia Aqui What Is The

How Much Would A Child Tax Credit Be For A 2023 Leia Aqui What Is The

Child Tax Credit Form Free Download

Child Tax Credit 2022 Schedule Payments

Child Tax Credit 2023 California - See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit