Child Tax Credit 2023 Vs 2022 Verkko 2 maalisk 2023 nbsp 0183 32 It applies for both 2022 and 2023 Table Of Contents What is the child tax credit Will the child tax credit change for 2023 What about the dependent tax credit Is the

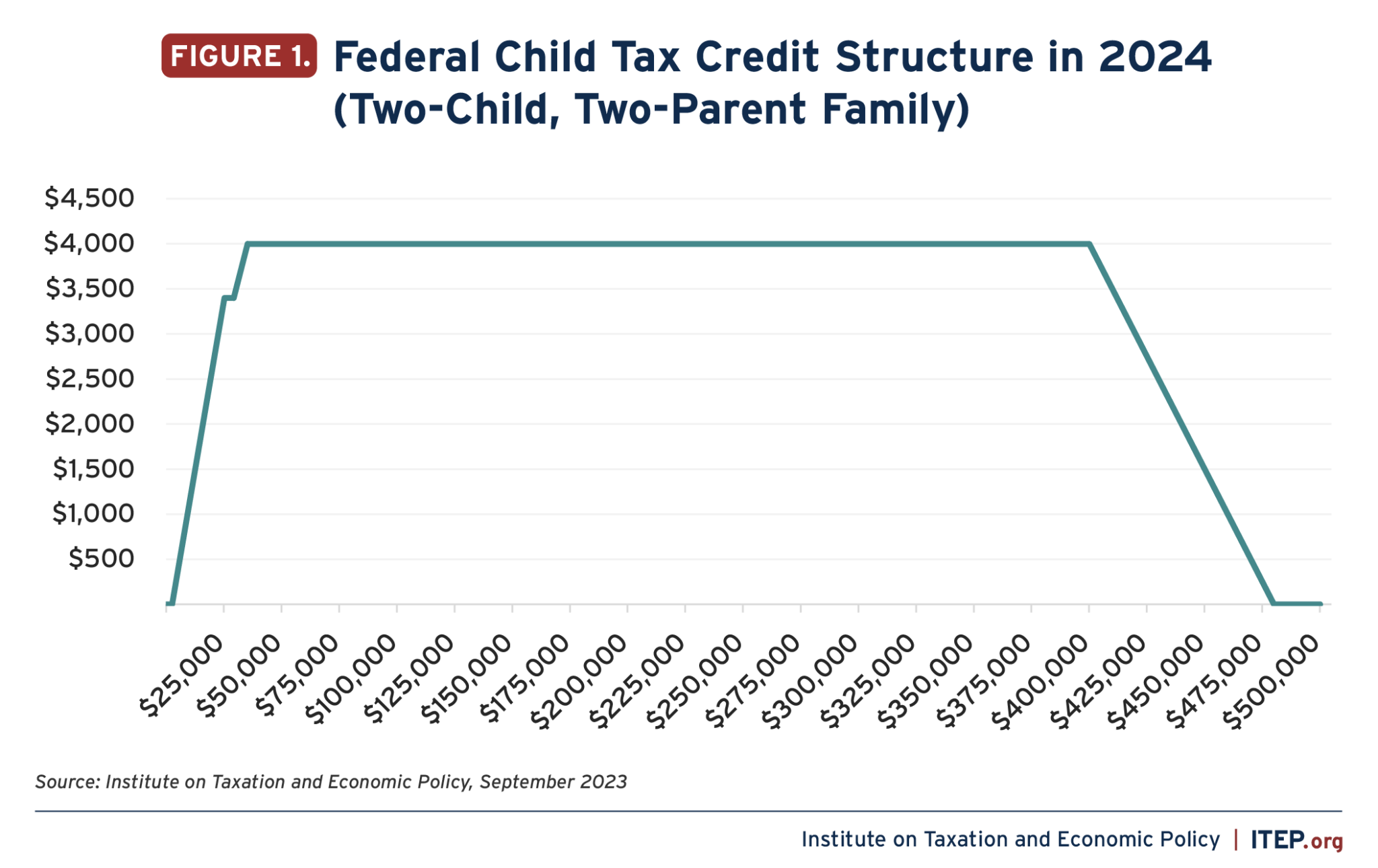

Verkko 27 marrask 2023 nbsp 0183 32 For the 2024 tax year tax returns filed in 2025 the child tax credit will be worth 2 000 per qualifying child with 1 700 being potentially refundable through the additional Verkko 14 jouluk 2023 nbsp 0183 32 The 2023 child tax credit is worth up to 2 000 per qualifying child However the credit is not fully refundable which means that you cannot receive the entire 2 000 back as a tax

Child Tax Credit 2023 Vs 2022

Child Tax Credit 2023 Vs 2022

https://phantom-marca.unidadeditorial.es/bd65e507c2f7cab0f40f0ac3d67670be/crop/106x0/1168x709/resize/1320/f/jpg/assets/multimedia/imagenes/2022/12/16/16711816684903.png

Child Tax Credit 2022 Huge Direct Payments Worth Up To 750 To Go Out

https://www.the-sun.com/wp-content/uploads/sites/6/2022/07/LG-CHILD-TAX-CREDIT-OFFPLAT.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

2021 Monthly Child Tax Credit Payments Pulse Financial Planning

https://www.pulsefinancialplanning.com/wp-content/uploads/2021/06/AdobeStock_398838549-scaled-e1623082802704.jpeg

Verkko 3 helmik 2023 nbsp 0183 32 Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for kids 5 and younger or 3 000 for those 6 through 17 Additionally you can t receive a Verkko 6 jouluk 2022 nbsp 0183 32 Those who got 3 600 per dependent in 2021 for the CTC will if eligible get 2 000 for the 2022 tax year For the EITC eligible taxpayers with no children who received roughly 1 500 in 2021 will now get 500 in 2022 The Child and Dependent Care Credit returns to a maximum of 2 100 in 2022 instead of 8 000 in 2021

Verkko 19 lokak 2023 nbsp 0183 32 Child Tax Credit in 2023 2022 2020 and earlier tax years To claim the Child Tax Credit for 2023 2022 2020 and earlier tax years you must determine if your child is eligible All of these seven qualifying tests have to be met Verkko 30 elok 2022 nbsp 0183 32 The FSA 2 0 would increase the maximum annual child tax credit from 2 000 to 4 200 for each child under age 6 and 3 000 for each child ages 6 through 17 paid out in monthly

Download Child Tax Credit 2023 Vs 2022

More picture related to Child Tax Credit 2023 Vs 2022

2021 Child Tax Credit Steadfast Bookkeeping Co

https://www.steadfastbookkeeping.com/wp-content/uploads/sites/5584/2021/08/IMG_0686-scaled.jpg

Lindsey Huff Gossip Child Tax Credit Xmas Payments 2023

https://www.nalandaopenuniversity.com/wp-content/uploads/2023/07/CHILD-TAX-CREDIT-2023.jpg

Are They Doing Child Tax Credit Monthly Payments In 2022 Leia Aqui

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/11/GettyImages-1398954446.jpg

Verkko 15 jouluk 2022 nbsp 0183 32 This tax year it s a maximum of 2 000 per child per year When the Trump tax cuts expire in 2025 the credit is scheduled to return to its previous level of 1 000 per child Parents must earn Verkko 6 maalisk 2023 nbsp 0183 32 This portion of the child tax credit allows you to receive up to 1 500 per child as a refund even after your tax bill is reduced to zero For example Tim and Martha are a couple with a kid

Verkko 24 elok 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit Verkko 15 jouluk 2023 nbsp 0183 32 The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000

Herbert Mclaughlin Viral Child Tax Credit 2023 Refundable

https://sfo2.digitaloceanspaces.com/itep/CTC-2023-v2.png

Child Tax Credit 2022 Three 250 Direct Payments Going Out This Month

https://www.the-sun.com/wp-content/uploads/sites/6/2022/09/SC-CTC-Blog-Off-Plat-copy-2.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

https://www.wsj.com/articles/child-tax-credit-federal-taxes-e9ab72e7

Verkko 2 maalisk 2023 nbsp 0183 32 It applies for both 2022 and 2023 Table Of Contents What is the child tax credit Will the child tax credit change for 2023 What about the dependent tax credit Is the

https://www.nerdwallet.com/article/taxes/qualify-child-child-care-tax-credit

Verkko 27 marrask 2023 nbsp 0183 32 For the 2024 tax year tax returns filed in 2025 the child tax credit will be worth 2 000 per qualifying child with 1 700 being potentially refundable through the additional

Tax Season 2022 What To Know About Child Credit And Stimulus Payments

Herbert Mclaughlin Viral Child Tax Credit 2023 Refundable

New Bill Could Expand The Child Tax Credit Here s What To Know For

Biden Wants To Increase Child Tax Credit In 2024 Budget Proposal

Child Tax Credit 2023 Get Up To 3 600 Per Child

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

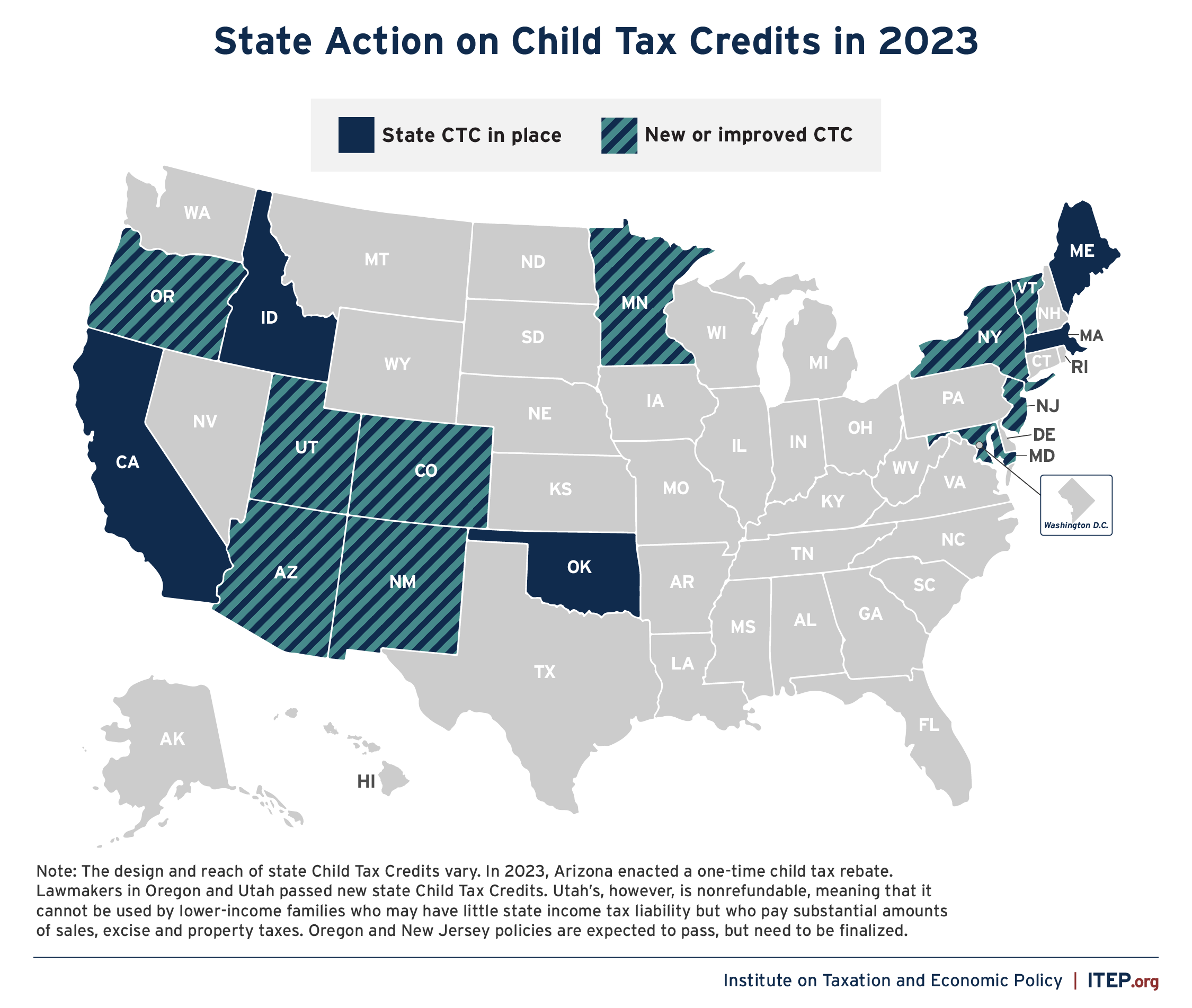

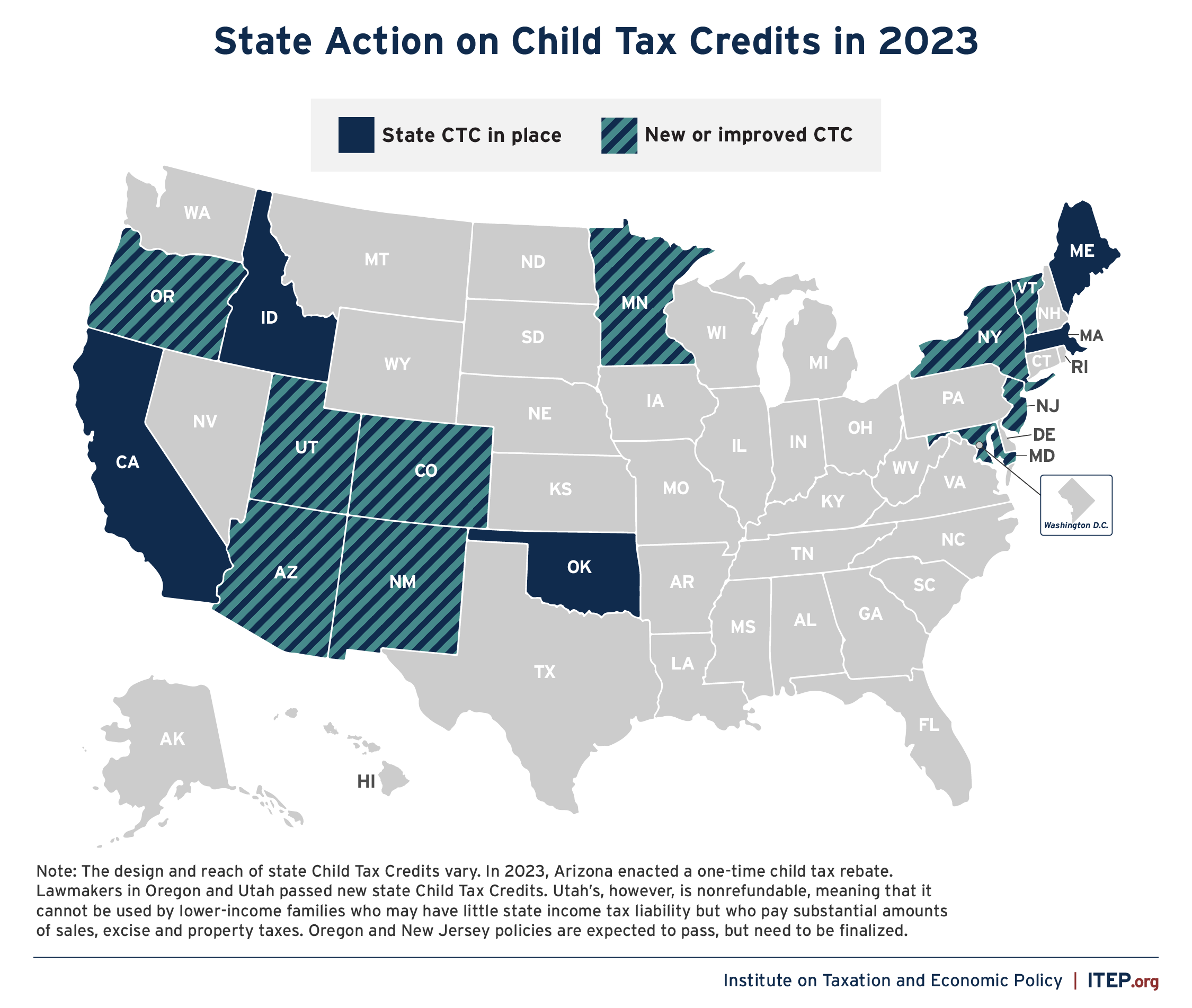

States Are Boosting Economic Security With Child Tax Credits In 2023 ITEP

Proposal Would Expand Child Tax Credit The Iola Register

Child Tax Credit 2023 Requirements Payment Schedule Credit Amount

Child Tax Credit 2023 Vs 2022 - Verkko 6 jouluk 2022 nbsp 0183 32 Those who got 3 600 per dependent in 2021 for the CTC will if eligible get 2 000 for the 2022 tax year For the EITC eligible taxpayers with no children who received roughly 1 500 in 2021 will now get 500 in 2022 The Child and Dependent Care Credit returns to a maximum of 2 100 in 2022 instead of 8 000 in 2021