Child Tax Credit Refundable Vs Nonrefundable Nonrefundable tax credits can reduce the amount of tax you owe but they do not increase your tax refund or create a tax refund when you wouldn t have already had one Refundable tax credits can result in a tax refund if the total of these credits is greater than the tax you owe

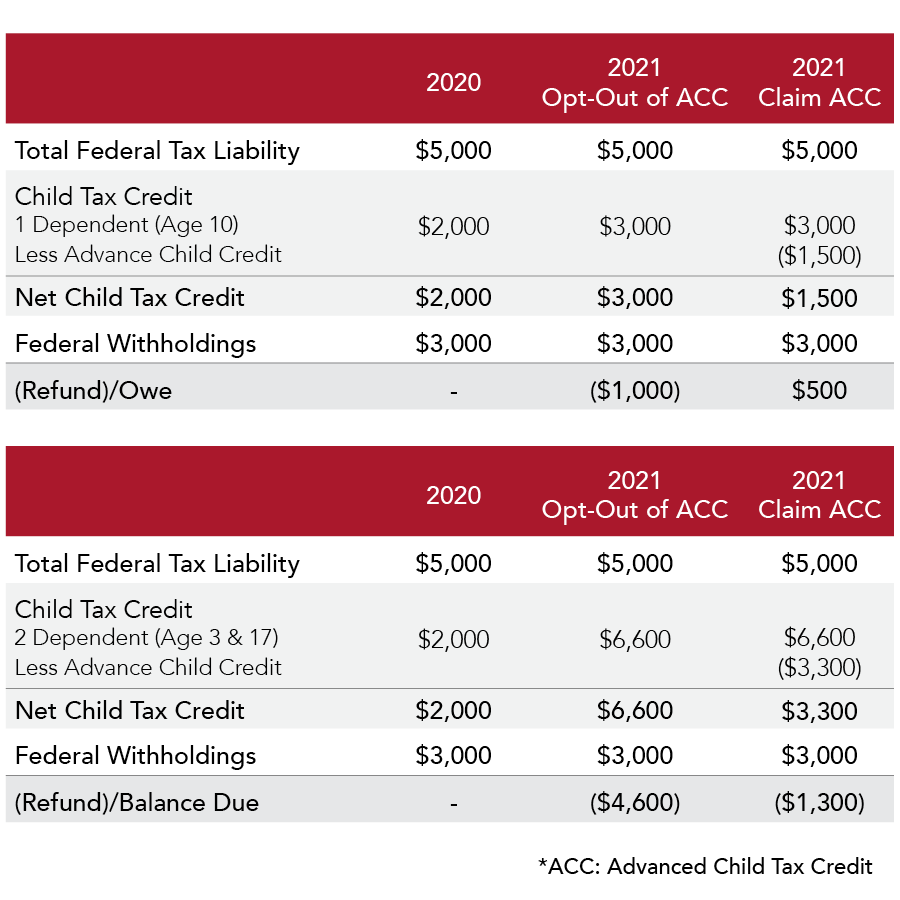

The tax credit is refundable if you don t owe any taxes which means you can claim the child tax credit as a refund But unlike other credits the Internal Revenue Service IRS limits the A1 The Child Tax Credit is a fully refundable tax credit for families with qualifying children The American Rescue Plan expanded the Child Tax Credit for 2021 to get more help to more families The credit increased from 2 000 per child in 2020 to 3 600 in 2021 for each child under age 6

Child Tax Credit Refundable Vs Nonrefundable

Child Tax Credit Refundable Vs Nonrefundable

https://i.ytimg.com/vi/W2ASF0pEb_k/maxresdefault.jpg

What Is The Difference Between Refundable And Nonrefundable Credits

https://www.taxpolicycenter.org/sites/default/files/styles/original_optimized/public/book_images/3.5.2.1.png?itok=oGNqlZoH

Refundable V Non refundable Tax Credits What s The Difference YouTube

https://i.ytimg.com/vi/38DAHVg252Q/maxresdefault.jpg

The child tax credit credit for other dependents and the additional child tax credit are entered on Form 1040 The intake and interview sheet along with the Volunteer Resource Guide Tab G Nonrefundable Credits are critical tools Refundable tax credit vs Nonrefundable tax credit Refundable Tax Credit A refundable tax credit allows taxpayers to lower their tax liability to below zero When this occurs the government owes the taxpayer a refund The additional child

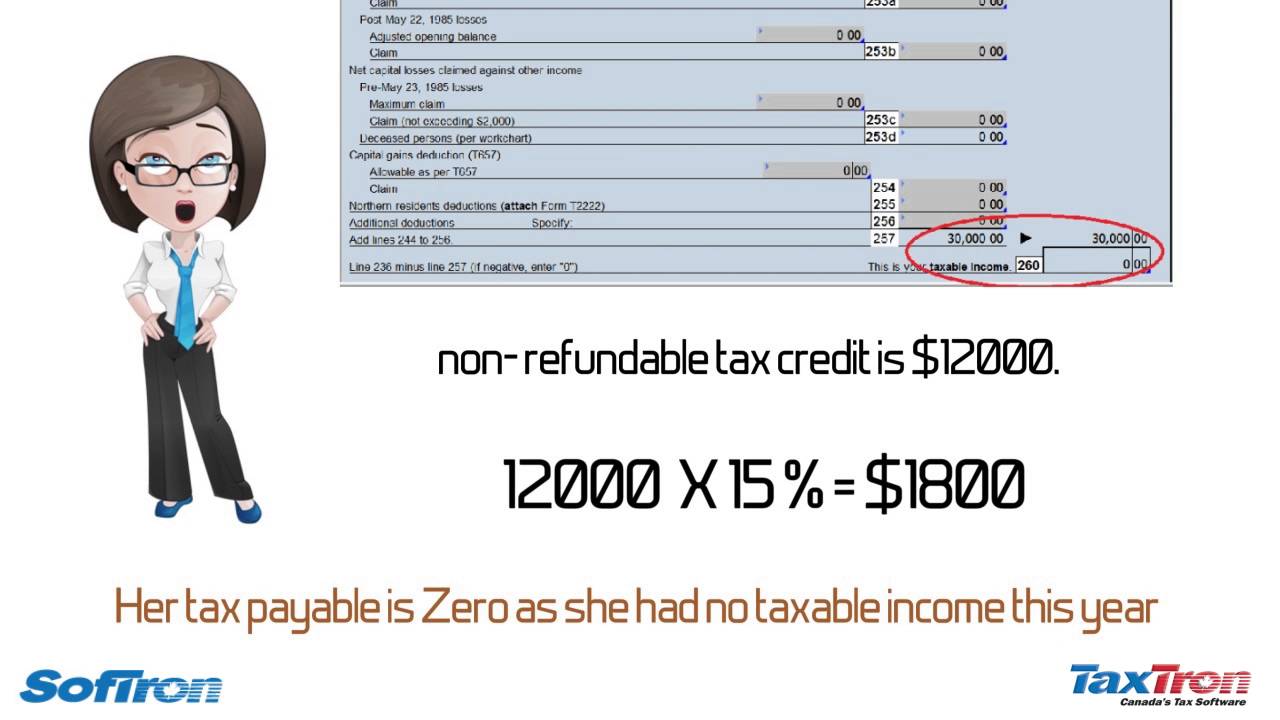

A nonrefundable tax credit allows taxpayers to lower their tax liability to zero but not below zero The child tax credit is a nonrefundable tax credit Nonrefundable Child Tax Credit Example A portion of the Child Tax Credit is refundable for 2023 This portion is called the Additional Child Tax Credit ACTC For 2023 up to 1 600 per child may be refundable

Download Child Tax Credit Refundable Vs Nonrefundable

More picture related to Child Tax Credit Refundable Vs Nonrefundable

Maximize Tax Savings A Guide To Refundable Vs Non Refundable Tax Credits

https://proaccountingsrvcs.com/wp-content/uploads/2022/02/1-2.png

What Is The Difference Between Refundable And Nonrefundable Credits

http://www.taxpolicycenter.org/sites/default/files/4.3.2-figure1_0.png

2021 Child Tax Credit What Should I Know Collins Consulting

https://hs-2666538.f.hubspotemail.net/hub/2666538/hubfs/21021005_-_Child_Tax_Credit_Tables2.png?upscale=true&width=1200&upscale=true&name=21021005_-_Child_Tax_Credit_Tables2.png

The Child Tax Credit helps families with qualifying children get a tax break You may be able to claim the credit even if you don t normally file a tax return Who Qualifies You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States Most tax credits are nonrefundable but some including the earned income tax credit EITC and a portion of the child tax credit CTC are fully or partially refundable The most widely claimed refundable credits are the EITC and the CTC

The amount of a refundable tax credit that exceeds income tax liability is refunded to taxpayers Most tax credits are nonrefundable Notable exceptions include the fully refundable earned income tax credit EITC the premium tax credit for health insurance PTC the refundable portion of the child tax credit CTC known as the additional Both refundable and nonrefundable tax credits lower your tax bill dollar for dollar Nonrefundable credits only apply to your tax liability while refundable tax credits can wipe out your tax bill and provide a refund for the remaining credit

Refundable Vs Non Refundable Tax Credits Williams CPA Associates

https://i0.wp.com/williamscpa.us/wp-content/uploads/2019/04/WilliamsCPA-and-Associates-Refundable-vs.-Non-Refundable-Tax-Credits.jpg?fit=800%2C536

Refundable Vs Non Refundable Tax Credits IRS

https://www.irs.com/wp-content/uploads/2018/11/refundable-vs-nonrefundable-tax-credits-irs-federal.jpg

https://turbotax.intuit.com/tax-tips/tax...

Nonrefundable tax credits can reduce the amount of tax you owe but they do not increase your tax refund or create a tax refund when you wouldn t have already had one Refundable tax credits can result in a tax refund if the total of these credits is greater than the tax you owe

https://www.forbes.com/advisor/taxes/what-is-the-child-tax-credit

The tax credit is refundable if you don t owe any taxes which means you can claim the child tax credit as a refund But unlike other credits the Internal Revenue Service IRS limits the

Refundable Vs Nonrefundable Tax Credits

Refundable Vs Non Refundable Tax Credits Williams CPA Associates

Refundable Vs Non Refundable Tax Credits Wessel Company

TAX TIP REFUNDABLE Vs NONREFUNDABLE CREDIT YouTube

Refundable Vs Nonrefundable Tax Credits Experian

Non Refundable Vs Refundable Tax Credits What s The Difference

Non Refundable Vs Refundable Tax Credits What s The Difference

Difference Between Refundable And Nonrefundable Tax Credits Canada

Refundable Child Tax Credit Heaven Alvarez LLC

What Is The Difference Between Non refundable And Refundable Tax

Child Tax Credit Refundable Vs Nonrefundable - The child tax credit credit for other dependents and the additional child tax credit are entered on Form 1040 The intake and interview sheet along with the Volunteer Resource Guide Tab G Nonrefundable Credits are critical tools