Claiming A Tax Deduction For Personal Super Contributions Form To claim a tax deduction for personal super contributions we must receive your Notice of intent to claim a tax deduction for personal super contributions form online or pdf form

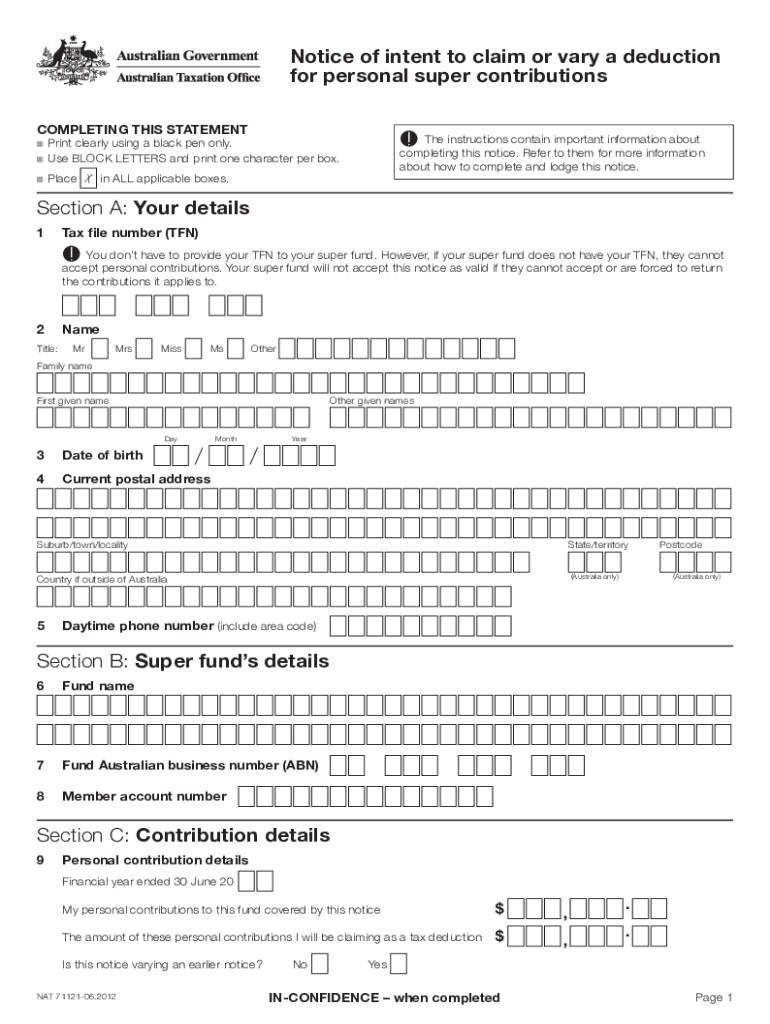

Step 1 Complete the Notice of intent to claim a tax deduction for personal super contributions form This tells us the amount you want to claim Step 2 Send the form To claim a tax deduction for personal super contributions you must send us your completed Notice of intent to claim a tax deduction for personal super contributions

Claiming A Tax Deduction For Personal Super Contributions Form

Claiming A Tax Deduction For Personal Super Contributions Form

https://www.quillgroup.com.au/wp-content/uploads/2017/07/Change-to-deductions-for-personal-super-contributions.jpg

Claiming A Deduction For Personal Super Contributions WL Advisory

https://www.wladvisory.com.au/wp-content/uploads/2022/01/Start-up-with-WL-Advisory-Logo.png

How To Claim Your Tax Deduction For Personal Super Contributions Before

http://static1.squarespace.com/static/6163818a87b45a450e96602d/6163830dc36999692e44abca/647fd7926dafa05b409e5ba9/1686102605992/shutterstock_531086104-scaled.jpg?format=1500w

How the claim process works Once you send your form in we will let you know we ve received your notice of intent to claim a tax deduction and confirm our agreement to the How to claim super contributions as a tax deduction It s easy to claim a tax deduction on money you add to your super You need to make a personal contribution and tell us you want to claim a deduction before 30

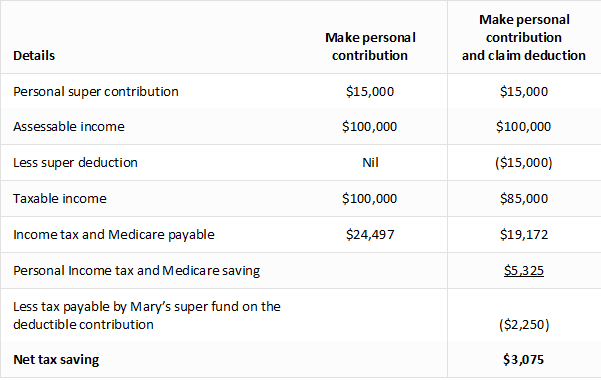

Key points Personal contributions are after tax payments to your super account You can claim these as a tax deduction if you meet certain conditions The tax deduction Once you have made the personal contribution you will need to inform your super fund of your intention to claim a tax deduction for that contribution by completing the required

Download Claiming A Tax Deduction For Personal Super Contributions Form

More picture related to Claiming A Tax Deduction For Personal Super Contributions Form

Personal Concessional Contributions Tips And Traps Adrian Chaudhary

https://vjc.com.au/wp-content/uploads/2018/06/Contributions.png

Personal Super Contributions Tax Deduction Your Complete Guide

https://superguy.com.au/wp-content/uploads/2022/06/Personal-Super-Contributions-Tax-Deduction.jpg

Deduction For Personal Super Contributions CareSuper

https://img.yumpu.com/37727014/1/500x640/deduction-for-personal-super-contributions-caresuper.jpg

For starters you can t claim a tax deduction for super contributions your employer makes on your behalf This includes your employer s compulsory Super To receive the deduction you ll need to complete a Notice of intent to claim or vary a deduction for personal super contributions form Notice of intent form before you

Yes certain superannuation contributions are tax deductible A tax deduction can be claimed by the contributor for certain contributions such as employer contributions For instructions on this form please go to https www ato gov au Forms Notice of intent to claim or vary a deduction for personal super contributions Who should

Did You Make A Personal Super Contribution In 2019 For Which You

https://www.prismaccounting.com.au/wp-content/uploads/2020/03/super-contribution-768x512.jpg

Xseedwealth Can I Claim A Tax Deduction For My Personal Super

https://www.xseedwealth.com.au/assets/Uploads/Pages/1231/_resampled/CroppedFocusedImageWzc0NSw0NTAsInkiLDIzXQ/tax-deduction.png

https://www. australiansuper.com /-/media/australian...

To claim a tax deduction for personal super contributions we must receive your Notice of intent to claim a tax deduction for personal super contributions form online or pdf form

https://www. australiansuper.com /superannuation/...

Step 1 Complete the Notice of intent to claim a tax deduction for personal super contributions form This tells us the amount you want to claim Step 2 Send the form

)

Claiming Deductions For Personal Super Contributions

Did You Make A Personal Super Contribution In 2019 For Which You

V letlen l Szemafor Hossz Super Fund Personal Visszan z Sz n szn

Should I Claim A Tax Deduction For My Personal Super Contributions

Claiming A Tax Deduction For Your Personal Super Contributions BUSSQ

Tax Return Personal Super Contributions Tax Deduction

Tax Return Personal Super Contributions Tax Deduction

Tax Deduction Letter Sign Templates Jotform

Notice Of Intent To Claim Fillable Form Printable Forms Free Online

Claiming A Tax Deduction For A Contribution To Your PAF Or Giving Fund

Claiming A Tax Deduction For Personal Super Contributions Form - How to claim super contributions as a tax deduction It s easy to claim a tax deduction on money you add to your super You need to make a personal contribution and tell us you want to claim a deduction before 30