Manitoba Seniors School Tax Rebate Web Farmland School Tax Rebate Up to 80 of school tax to a maximum of 5 000 Up to 60 of school tax to a maximum of 3 750 Up to 50 of school tax to a maximum of 3 125 Up to 40 of school tax to a

Web To be eligible for the Seniors School Tax Rebate you or your spouse common law partner must be 65 years of age or older by the end of the year December 31 own Web Seniors School Tax Rebate will be up to 235 minus 1 0 on family net income over 40 000 Seniors Education Property Tax Credit will be up to 200 minus 0 5 of family

Manitoba Seniors School Tax Rebate

Manitoba Seniors School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/school-taxes.png

No Rebate For High income Seniors Under Province s New Tax Plan

https://www.winnipegfreepress.com/wp-content/uploads/sites/2/2022/04/766527.jpg?w=1000

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/schooltaxrebate-header.jpg

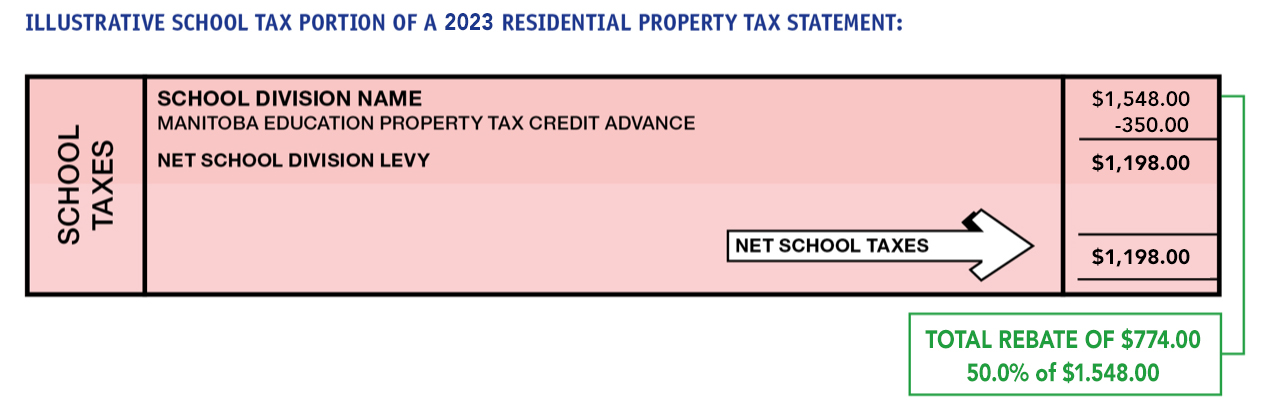

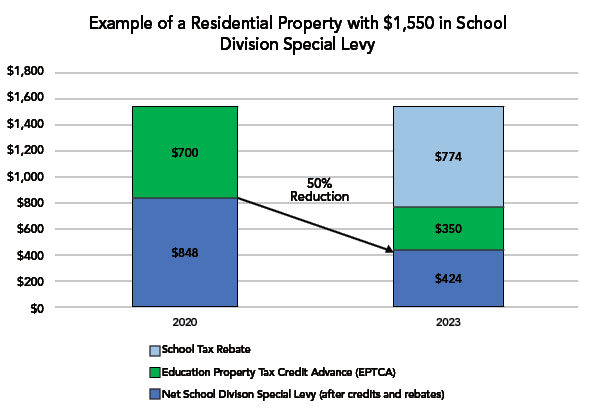

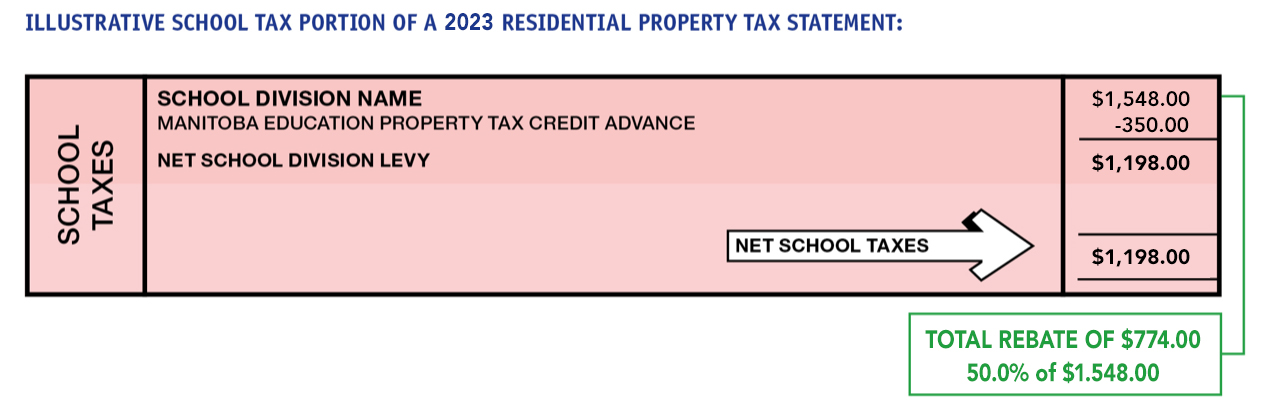

Web Tax Credit and Rebate Amounts 2020 2021 2022 2023 Education Property Tax Credit and Advance Up to 700 Up to 525 Up to 438 Up to 350 Seniors School Tax Web Seniors School Tax Rebate The Seniors School Tax Rebate provides savings for eligible Manitobans age 65 or older who own their own home or are responsible for the

Web Seniors School Tax Rebate Manitoba seniors who live in their own homes may be eligible for the Seniors School Tax Rebate Learn more Seniors with income under Web 20 mai 2022 nbsp 0183 32 The Manitoba government is ready to dish out education rebate cheques for the second straight year despite the NDP s objections to tax relief being extended to

Download Manitoba Seniors School Tax Rebate

More picture related to Manitoba Seniors School Tax Rebate

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/residential-example.jpg

School tax Rebate Clawback Rankles Winnipeg Senior Winnipeg Free Press

https://www.winnipegfreepress.com/wp-content/uploads/sites/2/2022/04/776759.jpg

Tuition Fee Tax Rebates Cancelled For Manitoba Graduates The Projector

https://theprojector.ca/wp-content/uploads/2018/04/04102018-TAXREBATE-OWCZAR-1080x1620.jpg

Web 20 janv 2023 nbsp 0183 32 A Probe Research poll commissioned by the Canadian Centre for Policy Alternatives found 58 per cent of survey respondents want the PC government to nix rebate cheques that would give the average Web a school tax credit of up to 175 for persons aged 55 and up whose family income is less than 23 750 a seniors school tax rebate of up to 470 for a senior whose family

Web New for Manitoba for 2022 The personal income levels used to calculate your Manitoba tax and the basic personal amount have increased The community enterprise Web 12 mai 2022 nbsp 0183 32 3 08 Manitoba s new education tax rebate was touted as a way to bring relief to working people seniors and lower income families but a CBC analysis found

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

https://i.ytimg.com/vi/rfW84weCMCs/maxresdefault.jpg

Education Taxes Being Axed For Seniors Winnipeg Free Press

https://www.winnipegfreepress.com/wp-content/uploads/sites/2/2022/04/MANITOBA_BUDGET_20120417_15.jpg

https://www.gov.mb.ca/schooltaxrebate

Web Farmland School Tax Rebate Up to 80 of school tax to a maximum of 5 000 Up to 60 of school tax to a maximum of 3 750 Up to 50 of school tax to a maximum of 3 125 Up to 40 of school tax to a

https://www.gov.mb.ca/finance/tao/sstr_faq.html

Web To be eligible for the Seniors School Tax Rebate you or your spouse common law partner must be 65 years of age or older by the end of the year December 31 own

A Promise That Keeps On Costing Winnipeg Free Press

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

No New Taxes In Budget 2016 SteinbachOnline Local News Weather

School Tax Rebates Are In The Mail Winnipeg For Free

Education Property Tax Rebates For Steinbach And Hanover Coming Later

Education Property Tax Cuts In Manitoba Examining Bill 71

Education Property Tax Cuts In Manitoba Examining Bill 71

Hearing Aid Grant For Manitoba Seniors

Manitoba Government Grants For Homeowners 37 Grants Rebates Tax

Manitoba Budget Highlights Tax Rebates And Credits More Intensive

Manitoba Seniors School Tax Rebate - Web 20 mai 2022 nbsp 0183 32 The Manitoba government is ready to dish out education rebate cheques for the second straight year despite the NDP s objections to tax relief being extended to