Claiming Tax Credits What counts as income Usually what you re entitled to is based on your income for the last tax year 6 April 2023 to 5 April 2024 Income includes money from employment before

Guidance and forms for claiming or renewing tax credits Including childcare costs payment dates leaving or coming to the UK overpayments and Credits and deductions You can use credits and deductions to help lower your tax bill or increase your refund Credits can reduce the amount of tax due

Claiming Tax Credits

Claiming Tax Credits

https://i.ytimg.com/vi/qMqoZPg4y_4/maxresdefault.jpg

Are You Claiming The Correct Tax Credits ITAS Accounting

https://itasaccounting.ie/wp-content/uploads/2019/07/38482863171_ff0e852f8e_c.jpg

Claiming R D Tax Credits Retroactively Incentax

https://incentaxllc.com/wp-content/uploads/2020/10/calculating-research-and-development-tax-credits.jpg

The term tax credit refers to an amount of money that taxpayers can subtract directly from the taxes they owe This is different from tax deductions which lower the amount of an individual s A tax credit is a dollar amount that you can subtract from your income tax to reduce your overall tax liability So while a tax refund simply represents the difference between the

If you re 18 or over you can use the Turn2us benefits calculator to check if it s worth claiming tax credits You ll need to enter details of the other benefits you claim If you d 10 Tax Credits You May Qualify for This Year Claiming credits could wipe out your tax bill and even result in a refund By Maryalene LaPonsie Reviewed by Tanza Loudenback CFP

Download Claiming Tax Credits

More picture related to Claiming Tax Credits

Tax Credit Vs Tax Deduction What s The Difference Guide

https://www.expatustax.com/wp-content/uploads/2022/05/Tax-Credit-vs-Tax-Deduction.jpg

R D Tax Credits COVID 19 Update Blue Garnet

https://bluegarnet.co.uk/wp-content/uploads/2020/06/claiming-tax-credits.jpg

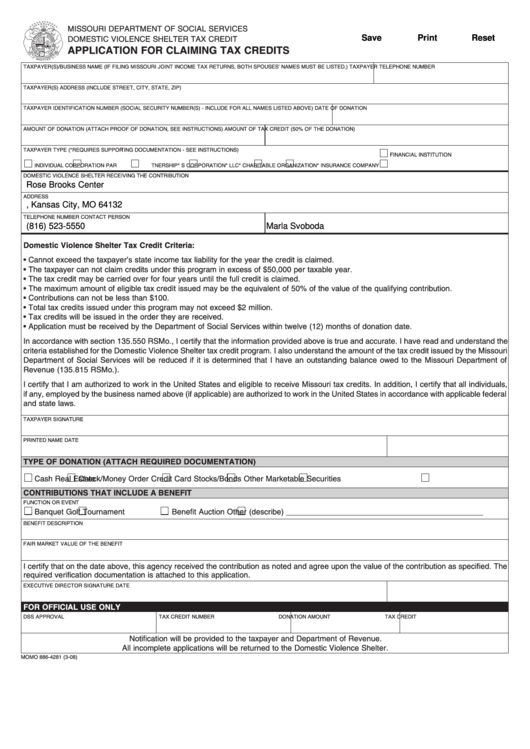

Fillable Application For Claiming Tax Credits Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/65/657/65736/page_1_thumb_big.png

Making a claim You can make a claim for working tax credits by phoning the HMRC tax credits helpline You should do this as soon as you can as it can take up to 6 weeks to A tax credit is a dollar for dollar reduction of a tax bill which can reduce what a taxpayer owes or potentially increase their refund

Find out what information to include on your tax credits application if you re self employed When you claim tax credits you ll need to give details of your total income You ll also need to work out your income when you renew your tax credits each year

Curious About Tax Breaks For Homeowners No One Knows Them Better Than

https://i.pinimg.com/originals/4c/9c/70/4c9c7048997bbeb1f91747edd3b1b1c5.jpg

Taxation Theory Practice Law Proof Reading Services

https://seofiles.s3.amazonaws.com/seo/media/cache/5c/cc/5ccce734cbe9552d691afb4234d446a9.jpg

https://www.gov.uk/claim-tax-credits/what-counts-as-income

What counts as income Usually what you re entitled to is based on your income for the last tax year 6 April 2023 to 5 April 2024 Income includes money from employment before

https://www.gov.uk/government/collections/tax...

Guidance and forms for claiming or renewing tax credits Including childcare costs payment dates leaving or coming to the UK overpayments and

The Tax Deductions And Credits You Can Claim In Australia Your

Curious About Tax Breaks For Homeowners No One Knows Them Better Than

Georgia Tax Credits For Workers And Families

Tax Credits Are Hidden Benefit For Homeowners

Claiming Advance Child Tax Care Credits For Tax Year 2021 Haugen Law

Personal Exemptions And Standard Deductions And Tax Credits Oh My

Personal Exemptions And Standard Deductions And Tax Credits Oh My

Student Tax Credits In Canada Loans Canada

Potential Claims Arising From The Use and Abuse Of Research And

The Complete List Of Tax Credits MAJORITY

Claiming Tax Credits - Working tax credit is a means tested benefit paid by HMRC to support people on a low income Find out how to claim working tax credit whether you re eligible to