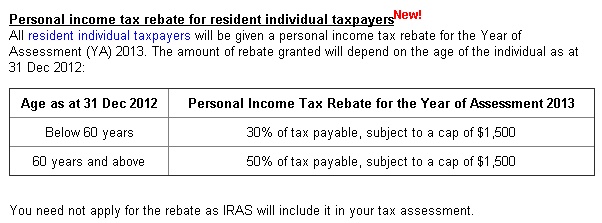

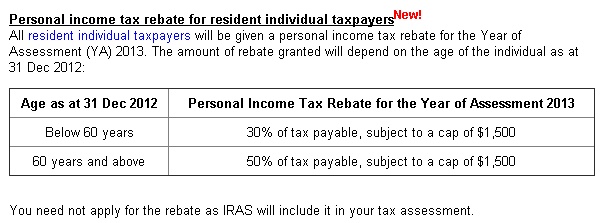

Company Tax Rebate Iras Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax Filing

Web Corporate Income Tax Income amp Deductions for Companies Taxable amp Non Taxable Income Taxable income is income that is subject to tax and not all income is taxable in Web Your company s tax payable for YA 2020 is therefore computed as follows Chargeable income before exempt amount Less Exempt amount Chargeable income after exempt

Company Tax Rebate Iras

Company Tax Rebate Iras

https://cdn1.npcdn.net/image/1618905210e3b8bb075144f9faf8856b273237113c.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1600&new_height=1600&w=-62170009200

Bulicenas Singapore Tax Rebates

https://2.bp.blogspot.com/-mWIID9_ikkA/UVBehKRVxiI/AAAAAAAABhY/Ld9isw9tW0E/s1600/IRAS+tax+rebate.jpg

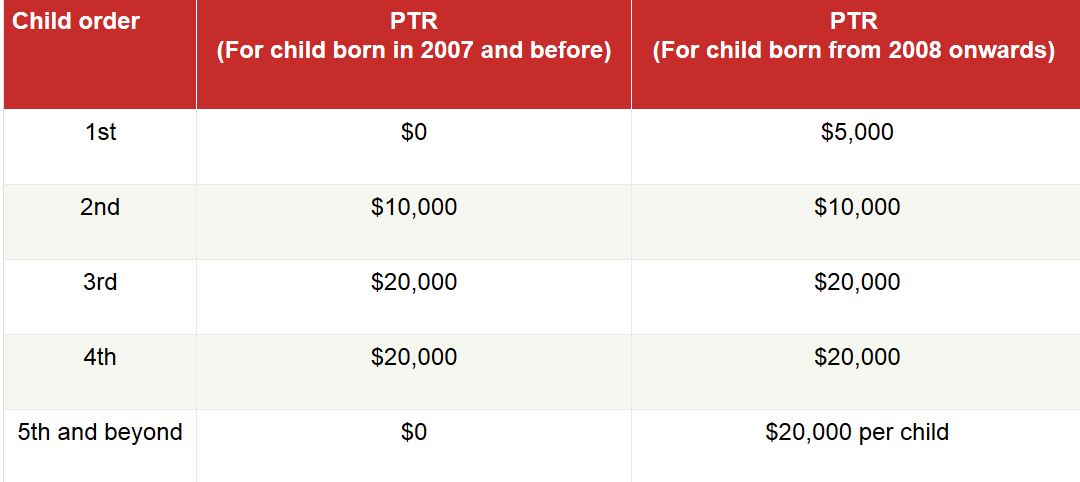

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

Web 18 f 233 vr 2020 nbsp 0183 32 A company s chargeable income is reduced by the tax exemption rates set by IRAS for each respective Year of Assessment Web 3 mai 2023 nbsp 0183 32 Corporate Income Tax Rebate The Corporate Income Tax Rebate is designed to provide relief to all companies in Singapore This relief provides a 25

Web Income amp Deductions for Companies Business Expenses Business expenses are expenses you have paid to run the business Not all business expenses are deductible Web 22 juil 2022 nbsp 0183 32 Income of VCCs In general VCCs are considered companies for tax purposes so will enjoy the same tax incentives and tax deductions as Singapore

Download Company Tax Rebate Iras

More picture related to Company Tax Rebate Iras

Pin On Tigri

https://i.pinimg.com/originals/10/8d/67/108d67ba03bfbe29e6cc964fb355f5ea.jpg

Government Rebate Program Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/11/983/11983077/large.png

Tax Rebate For New Incorporated Company Malaysia With New T C Jan 07

https://cdn1.npcdn.net/image/1641535704450e01ff4b818cb77f81d4656ac26d4b.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

Web 30 juil 2021 nbsp 0183 32 As announced in Budget 2021 there will no longer be corporate income tax rebate in 2021 for companies Previously companies received a 30 corporate income Web The guidance addresses various COVID 19 related payments to businesses and individuals certain employee benefits and the passing on of the property tax PT rebate benefit

Web 10 janv 2023 nbsp 0183 32 Corporate Income Tax Rate Your company is taxed at a flat rate of 17 of its chargeable income This applies to both local and foreign companies Corporate Web 30 nov 2022 nbsp 0183 32 Updated November 30 2022 Reviewed by Marguerita Cheng Fact checked by Yarilet Perez For many people converting a traditional individual retirement account

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Save On 2020 Taxes Fi Life

https://fi.life/assets/upload/malaysia-tax-relief-2020-mypf.png

https://www.iras.gov.sg/taxes/corporate-income-tax/basics-of-corporate...

Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax Filing

https://www.iras.gov.sg/taxes/corporate-income-tax/income-deductions...

Web Corporate Income Tax Income amp Deductions for Companies Taxable amp Non Taxable Income Taxable income is income that is subject to tax and not all income is taxable in

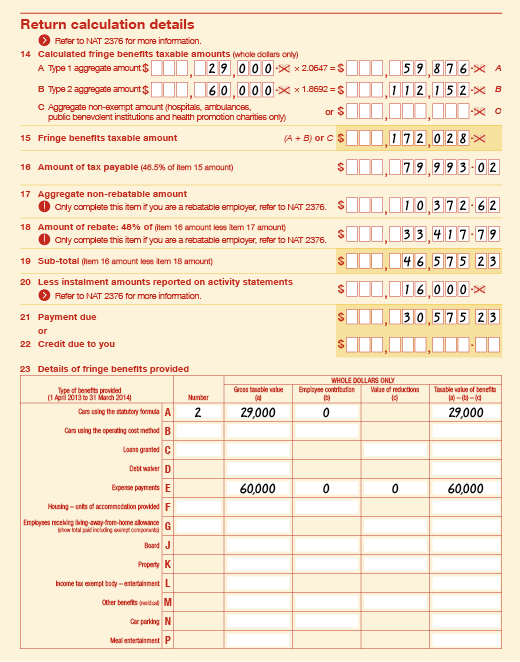

Rebatable Employers Australian Taxation Office

2007 Tax Rebate Tax Deduction Rebates

What Are The Best Ways To Manage Tax Rebates

Tips To Finding Tax Rebates Without The Hassle

Happy Bright Day Quotes

Redian

Redian

10 Things All Working Mums Should Know

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Download Form P87 For Claiming Uniform Tax Rebate DNS Accountants

Company Tax Rebate Iras - Web 6 mai 2020 nbsp 0183 32 Each company can stand to receive up to 15 000 in rebate under this Corporate Income Tax Rebate announced in the Unity Budget On top of that