Concept Of Service Under Service Tax As per Section 65B Service means any activity carried out by a person for another for consideration and includes certain declared services Declared services

Attention to Service tax which is an exciting phenomenon amongst the indirect taxes The Service tax net is rapidly expanding and it promises a robust future This book here In accordance with clause 44 of the newly inserted Sec 65B of the Finance Act 1994 effective from July 1 2012 the term service means any activity for

Concept Of Service Under Service Tax

Concept Of Service Under Service Tax

https://daijiworld.ap-south-1.linodeobjects.com/iWeb/daijiworld/images3/rayan_100521_Payment1.jpg

Services Marketing Notes Introduction To Services Marketing 1

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/a32eddb646143df35c87478e7c633a95/thumb_1200_1553.png

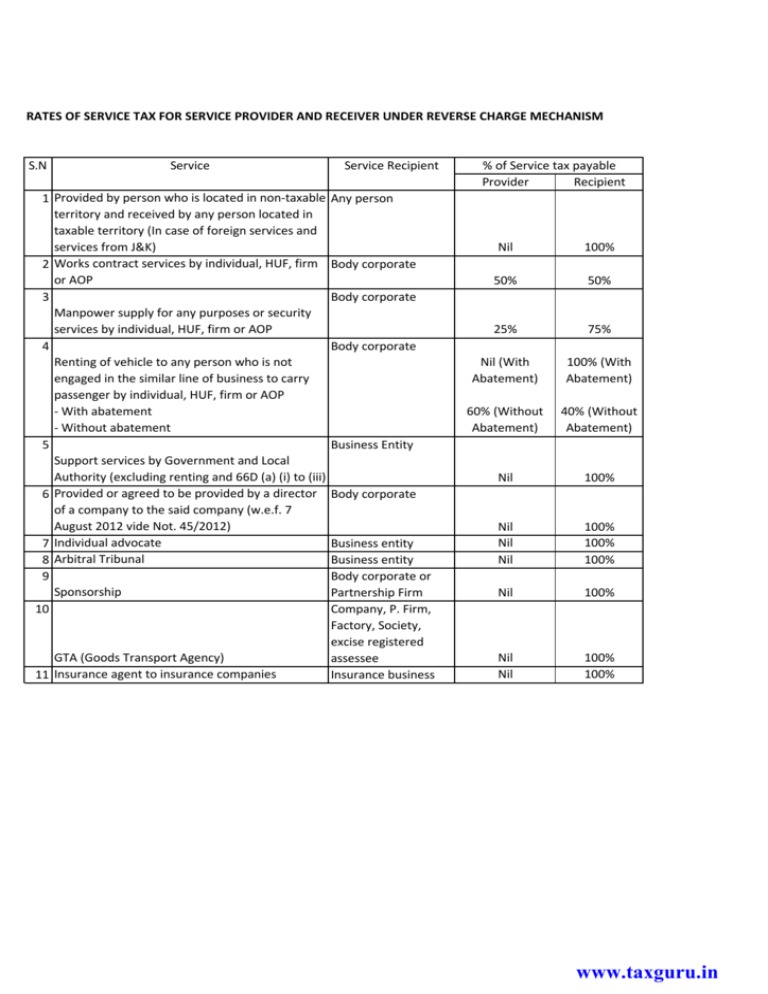

RCM And Abatement Under Service Tax

https://s3.studylib.net/store/data/008231834_1-eefff3e40f4004dbcf2cf86ff0ef6778-768x994.png

The FM has announced that the new service tax law would come into effect from July 1 2012 With hardly a few weeks left for the new service tax to come into effect it s To have service there must be a service provider rendering services to some other person s who shall be recipient of such service Under the Finance Act

Introduction of new rules for taxation of services necessitate a guide that gives a bird s eye view of all relevant provisions of service tax law This publication is an attempt to be Service tax was a tax levied by the Government of India on services provided or agreed to be provided excluding services covered under the negative list and considering the

Download Concept Of Service Under Service Tax

More picture related to Concept Of Service Under Service Tax

Service Tax For Catering Business

http://www.indiafilings.com/learn/wp-content/uploads/2015/08/Service-tax-for-catering-business.jpg

Service Automation Framework SAF Oppia fi Oppimisen Verkkokauppa

https://res.cloudinary.com/oppia/image/upload/w_auto,q_auto/oppia/img/courses/service_au_course_1354_ad51f6a20dce130a035fcddf7b30dcd3.jpeg

Standardized Service Contract Devamanthrils

https://i0.wp.com/blog.gurtam.com/wp-content/uploads/2013/10/SLA.jpg

The year 1994 95 introduced the concept of Service Tax This marked a paradigm shift in the area of taxation with the introduction of taxation on three services Since then The concept of Intermediary services was embodied in Goods and Services Tax Act from the Service Tax regime Intermediary has been defined under section

Definition Service tax is a tax levied by the government on service providers on certain service transactions but is actually borne by the customers It is categorized under On 17 May 2023 ZATCA issued a circular 2303001 Circular to provide guidance on the treatment of Permanent Establishments PE in the context of Double Taxation

Fundamentals Of Service Marketing Dreambook Publishing

https://www.dreambookpublishing.com/wp-content/uploads/2021/08/ljsd.png

Service Tax Rules Export Of Services Rules Under Service Tax TaxGuru

https://taxguru.in/wp-content/uploads/2016/02/Export-of-Services-Rules-Under-Service-Tax.jpg

https://taxguru.in/service-tax/service-tax-concept-service.html

As per Section 65B Service means any activity carried out by a person for another for consideration and includes certain declared services Declared services

http://kb.icai.org/pdfs/PDFFile5b28b5074f7f83.35444189.pdf

Attention to Service tax which is an exciting phenomenon amongst the indirect taxes The Service tax net is rapidly expanding and it promises a robust future This book here

Conventions Open To General Public Not A Convention Service Under

Fundamentals Of Service Marketing Dreambook Publishing

APPLICATION OF MARKETING IN SERVICES Due To The Tertiaryization Of

After Service Marine Commercial YANMAR New Zealand

What Is Negative List Under Service Tax

Avoid Poor Service Ace Steel Metal Supplier

Avoid Poor Service Ace Steel Metal Supplier

Concept Of Service For Secure Electronic Or Wireless Payment Stock

Exemptions Under Service Tax Part 1

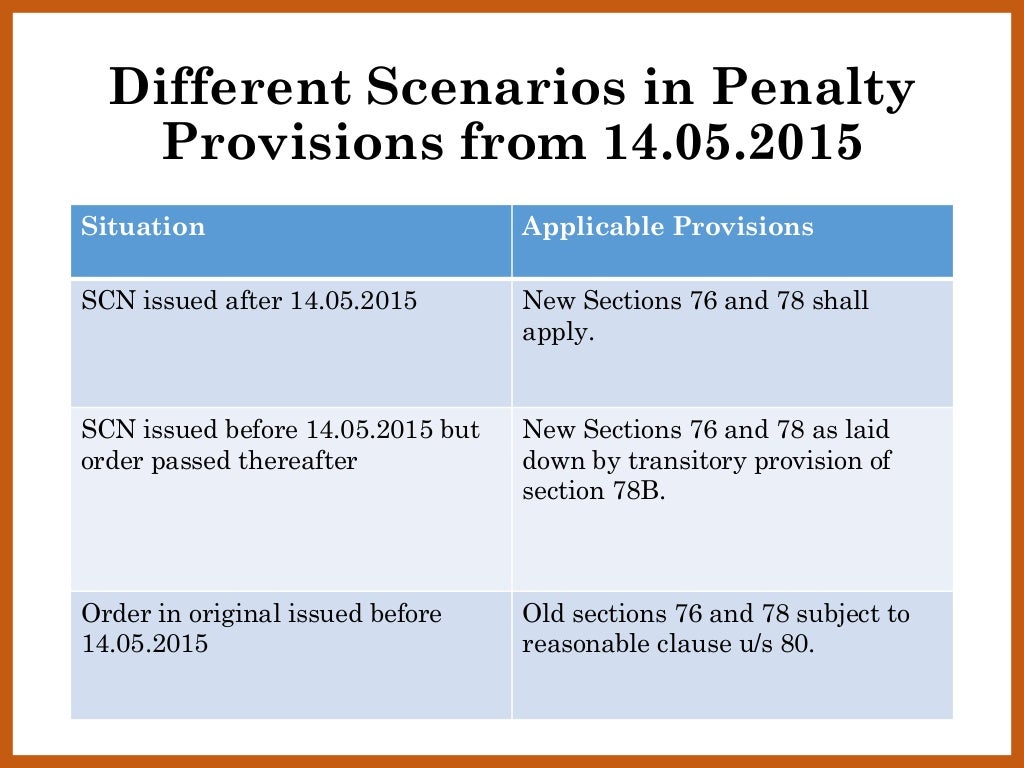

Penalties After 14 5 2015 Under Service Tax

Concept Of Service Under Service Tax - The FM has announced that the new service tax law would come into effect from July 1 2012 With hardly a few weeks left for the new service tax to come into effect it s