Difference Between Service Charge And Service Tax Differences between service tax and service charge 1 The service tax is a government levied tax and is fixed in every state of India at 14 percent On the other

Service charge is an obligatory payment required by the establishment and is subject to tax while tips are voluntary payments made by customers directly to the service Service tax is the tax levied by the government for services rendered by the restaurant The tax amount is the same in all states

Difference Between Service Charge And Service Tax

Difference Between Service Charge And Service Tax

http://www.india.com/wp-content/uploads/2017/01/service-charge-1.jpg

DNA Explained Difference Between Service Charge And Service Tax

https://english.cdn.zeenews.com/sites/default/files/2022/06/10/00000003_1.jpg

Service Charge Food Bill Bill Restaurant Service Tax HerZindagi

https://images.herzindagi.info/image/2022/May/service-charge.jpg

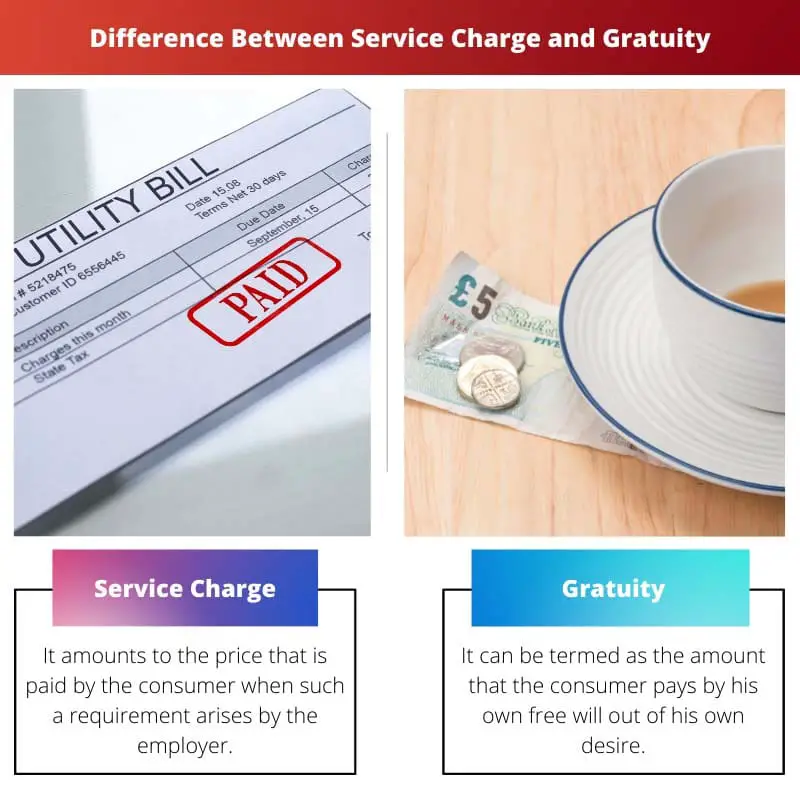

DIFFERENCES Service charges is a charge over and above the cost of goods or services imposed by business in a bill This is normally applied in the hospitality industry Tax on gratuity vs service charge For service based businesses where tipping is routine employers can qualify for the FICA tip credit This credit can potentially save employers hundreds or even

A service charge is a fee collected to pay for services related to the primary product or service being purchased The charge is usually added at the time of the transaction Many In some ways tips and service charges are similar types of payments Some companies even self classify certain service charges as tips But the primary difference to remember is that tips are optional

Download Difference Between Service Charge And Service Tax

More picture related to Difference Between Service Charge And Service Tax

One Stop For All Your SG GST Queries

https://1.bp.blogspot.com/-XAOehzmxpoM/W4o7iTaNDOI/AAAAAAAACFE/QTnYCRWjE5Its_i91BFtWYLizqPdq6IsQCLcBGAs/s1600/restaurant-dish-meal-food-produce-breakfast-44324-pxhere.com.jpg

Service Charge Food Bill Bill Restaurant Service Tax HerZindagi

https://images.herzindagi.info/image/2022/May/service-charge-paid-by-customers.jpg

Difference Between A Service Charge And A Gratuity CKB Vienna LLP

https://images.squarespace-cdn.com/content/v1/5320e541e4b0410adbdff1df/1584149447532-80Y4RZ56ISOZ0U0M76CB/bigstock-Businessman-Hand-Sending-Money-297305905.jpg

So the first main difference between a service charge and a tip is that one is mandatory while the other is optional Another difference is how they re allocated While service charge allocation is largely up to the Service tax on the other hand is a tax levied by the government This is 14 per cent and is payable on 40 per cent of your total bill The bill is inclusive of food

Here is a simple explanation on difference between service tax and service charge Service tax Service Tax is a type of tax that you pay to the Taxation Corporate Finance and Accounting Business Service Charge Reviewed by Anjaneyulu Updated on Feb 01 2024 Introduction The service charges

Differences Between Service And Tips Differbetween

https://differbetween.com/storage/img/images_2/differences_between_service_and_tips.png

Service Charge Vs Gratuity Difference And Comparison

https://askanydifference.com/wp-content/uploads/2022/10/Service-Charge-vs-Gratuity-.jpg

https://food.ndtv.com/food-drinks/what-is-the...

Differences between service tax and service charge 1 The service tax is a government levied tax and is fixed in every state of India at 14 percent On the other

https://www.acquire.fi/glossary/service-charge...

Service charge is an obligatory payment required by the establishment and is subject to tax while tips are voluntary payments made by customers directly to the service

Service Charge Vs Tip What Is The Difference Blog Akaunting

Differences Between Service And Tips Differbetween

What s The Difference Between A Service Charge And A Surcharge And Do

Discretionary Service Charge Do You Have To Pay It Consumer Advisory

Difference Between Service Tax And Service Charge In Restaurant Bills

GOODS AND SERVICE TAX GST Goods And

GOODS AND SERVICE TAX GST Goods And

Levy Of Service Charge From Consumers Without Consent

Difference Between Service Tax And Service Charge Tax Services

Service Charge Vs Gratuity Difference And Comparison

Difference Between Service Charge And Service Tax - VAT is a multi point tax whereas Service Tax is a single point tax VAT is charged on physical items i e goods while Service Tax is charged on non physical items i e