Construction Employee Tax Deductions Building and construction employees guide to income allowances and claiming deductions for work related expenses Last updated 2 June 2024 Print or

For example a construction worker can claim a deduction for the cost of steel capped boots You can also claim the costs you incur to repair replace or clean protective Contractors and other self employed workers can deduct home office expenses advertising expenses accounting fees phone bills equipment depreciation travel and car expenses healthcare and retirement

Construction Employee Tax Deductions

Construction Employee Tax Deductions

https://static.helloskip.com/blog/2022/03/Untitled-design--11-.png

Your 2017 Tax Preparation Checklist The Motley Fool

https://g.foolcdn.com/editorial/images/436027/tax-form_tax-deductions_gettyimages-515708887.jpg

List Of Common Expenses And Tax Deductions For Construction Workers And

https://i.pinimg.com/736x/73/2b/59/732b594bbc8f5e70b135bf6e7bf635ae.jpg

Discover which expenses and tax deductions are applicable to construction workers and contractors with QuickBooks comprehensive list Maximize your savings today Here s a list of the most common taxes independent contractors can deduct There s a good chance that several of these will pertain to you 1 Self employment tax

A construction worker can deduct everything from his work boots to vehicle related costs Maximize your tax return with these 5 common tax deductions Top 20 construction common tax deductions It is important to note that tax deductions can vary depending on the specific circumstances of each construction

Download Construction Employee Tax Deductions

More picture related to Construction Employee Tax Deductions

Top 5 Business Tax Deductions For Employers Accountabilities

https://acctable.com/wp-content/uploads/2022/03/Blog-11-Top-5-business-tax-deductions-for-employers-1200-×-800-px_png.png

FunctionalBest Of Self Employed Tax Deductions Worksheet

https://i.pinimg.com/474x/e6/3e/e8/e63ee8d396dea4070503cc153faf2de5.jpg

Tax Deductions And Credits Related To Education Expenses

https://www.news-leader.com/gcdn/-mm-/7c21ed12de51b2069102c72640f276f692d07445/c=0-576-2826-2173/local/-/media/Springfield/2015/02/06/B9315102848Z.1_20150206184910_000_GJL9496JB.1-0.jpg?width=2826&height=1597&fit=crop&format=pjpg&auto=webp

If you are a construction worker you need to prepare for tax season in order to save money Tax deductions you qualify for can help you reduce your tax Read ahead to see the most common tax deductions available in 2022 What expenses can I claim as a construction worker As independent contractors

Learn about four commonly overlooked construction tax deductions contractors need to know Ensure you maximize your tax deductions Schedule C Box 25 Your Comcast bill is a tax write off You need internet to do your job From safety gear to legal fees here are the write offs all self employed constructor

10 2014 Itemized Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2009/12/itemized-deductions-worksheet_449393.png

List Of 14 Commonly Overlooked Personal Tax Deductions Credits For

https://i.pinimg.com/originals/fb/a7/87/fba7872a222b85d6e456752b73fc1e0c.jpg

https://www.ato.gov.au/individuals-and-families/...

Building and construction employees guide to income allowances and claiming deductions for work related expenses Last updated 2 June 2024 Print or

https://www.ato.gov.au/individuals-and-families...

For example a construction worker can claim a deduction for the cost of steel capped boots You can also claim the costs you incur to repair replace or clean protective

Standard Deduction 2020 Self Employed Standard Deduction 2021

10 2014 Itemized Deductions Worksheet Worksheeto

Personal Exemptions And Standard Deductions And Tax Credits Oh My

Tax Reduction Company Inc

Tax Deductions For Construction Workers What Can You Claim

3 Types Of Tax Deductions And How To Track Them Artofit

3 Types Of Tax Deductions And How To Track Them Artofit

Tax Deductions Master List It Always Helps To Know The Types Of Tax

Tax Deductions For The Self Employed Invoicera Blog

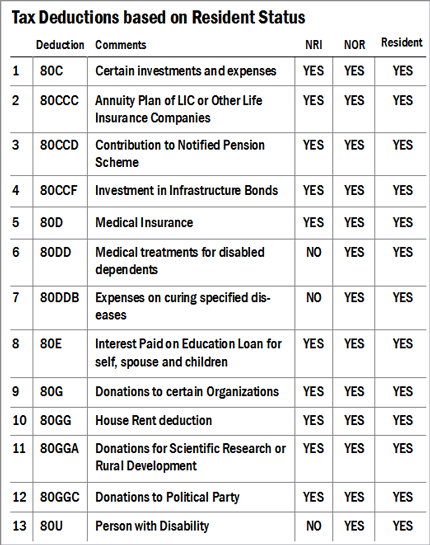

All About Tax Deductions To Save Taxes Value Research

Construction Employee Tax Deductions - Discover which expenses and tax deductions are applicable to construction workers and contractors with QuickBooks comprehensive list Maximize your savings today