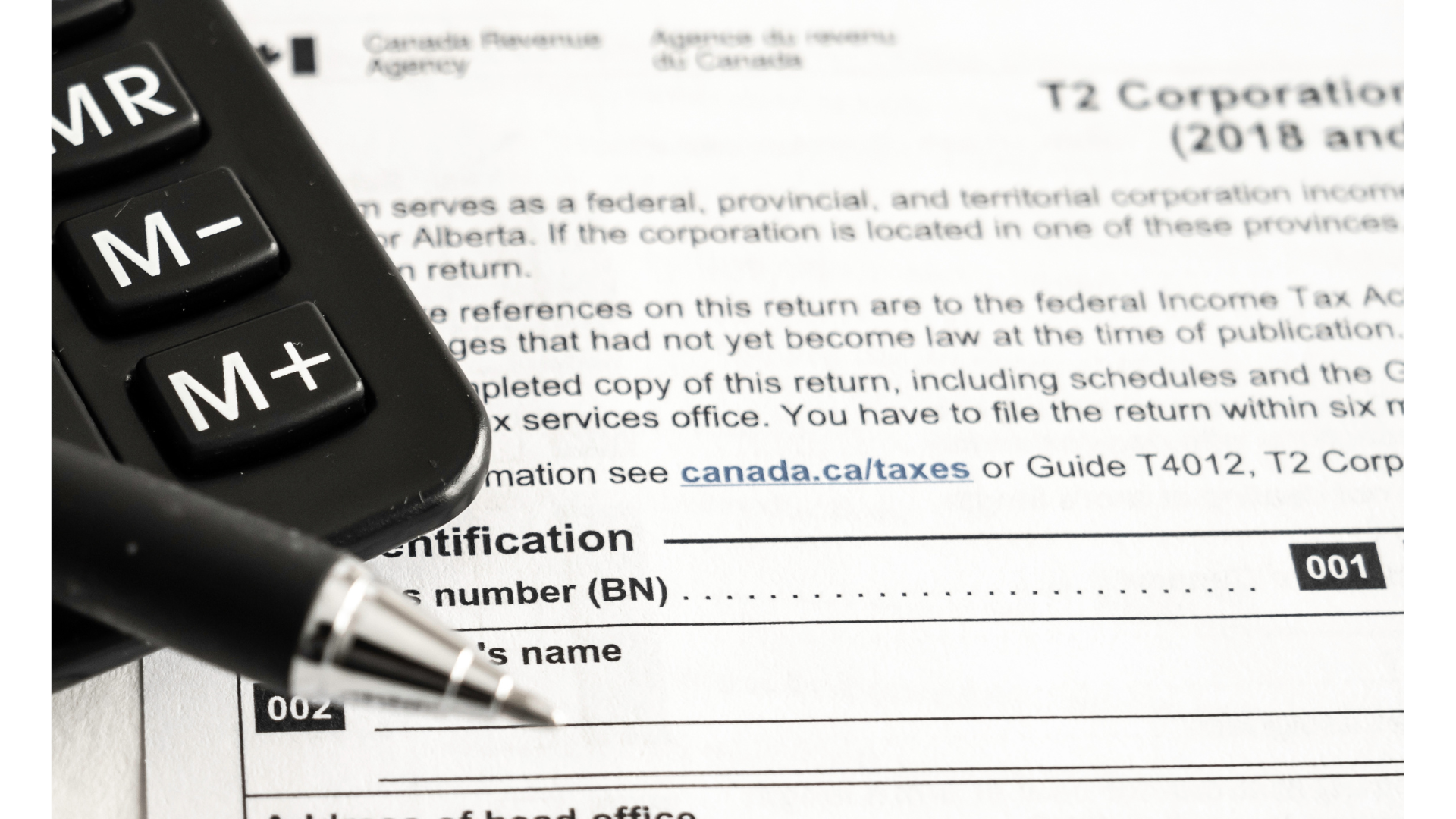

Corporate Tax Return Online Canada This form serves as a federal provincial and territorial corporation income tax return unless the corporation is located in Quebec or Alberta If such is the case you have to

As of January 22 2024 businesses incorporated under the CBCA need to file information on individuals with significant control ISC some of which will be made available to the File your annual return online for 12 File now Not sure when to file Search for a federal corporation to find out if your annual return is due What you need to know about

Corporate Tax Return Online Canada

Corporate Tax Return Online Canada

https://i.pinimg.com/originals/af/71/4f/af714f0b0570f1274e5c8b8c62df3292.png

Filing Your Tax Return Online Canada Using Simple Tax Part 2 YouTube

https://i.ytimg.com/vi/4e8DSxfCmi0/maxresdefault.jpg

Simplified Income Tax Return Online TaxNodes

https://www.taxnodes.com/gif/itr1.gif

With UFileT2 corporate tax software you can prepare and file tax returns for Canadian corporations Free EFILE for Corporation Internet filing Step by step interview Buy Benefits Features Made for Windows File a tax return for your incorporated business easily File your T2 returns Answer questions about your

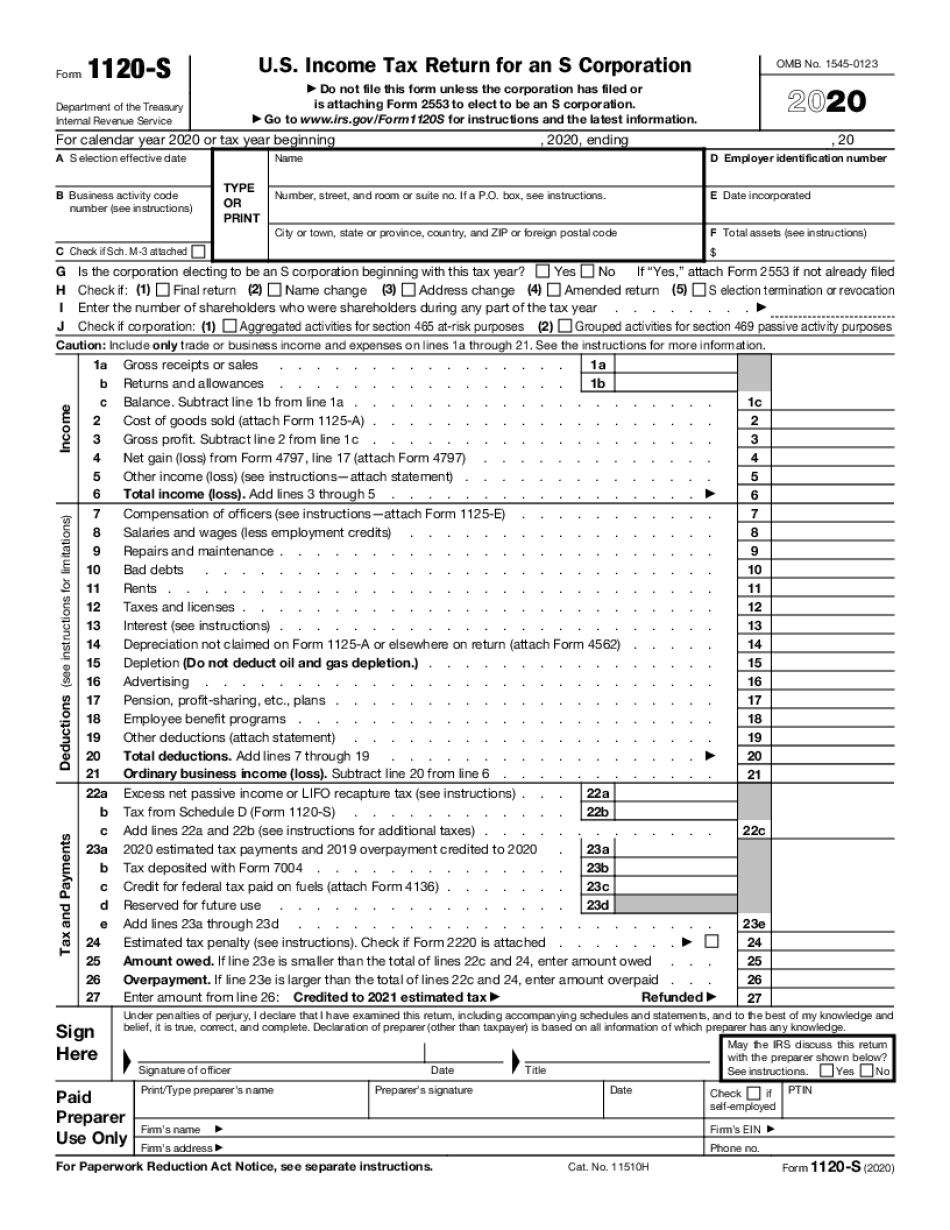

Incorporated businesses will need to file the T2 corporate tax return each tax season Learn what you ll need from your clients and how to file How Do I Get a T2 Online The T2 form is available online as a PDF file you can complete online or print for mailing delivery to the CRA You can find the form through CRA s

Download Corporate Tax Return Online Canada

More picture related to Corporate Tax Return Online Canada

Simplified Income Tax Return Online TaxNodes

https://www.taxnodes.com/gif/itr2.gif

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Draht Verantwortlicher F r Das Sportspiel Vermuten States Of Jersey

https://www.thebalance.com/thmb/n0qY5_o0VzoZ5tk64K_PBHbmHrs=/1333x1000/smart/filters:no_upscale()/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif

VAT REQUIREMENTS FOR ARTISTS SOCIAL MEDIA INFLUENCERS SMI s

https://www.flyingcolourtax.com/wp-content/uploads/2020/09/international-taxation-2.jpg

Discover our online software for your T2 tax returns T2Inc is the online solution to help you with your corporate income tax returns Electronically file your corporation s tax return using T2 Corporation Internet Filing UFileT2 is certified annually by the Canada Revenue Agency Revenu Qu bec and the Alberta

The Canada Revenue Agency encourages corporations to file federal taxes online and the policy is mandatory for most corporations with excess of 1 million in Corporation Internet Filing allows corporations that meet the eligibility criteria to file their 2002 or subsequent year corporation income tax returns directly to the CRA through

Tax And Accounting Services Synapse Tax

https://synapsetax.ca/wp-content/uploads/2022/10/corporate-tax.png

Canada T2 Corporation Income Tax Return 2020 2022 Fill And Sign

https://www.pdffiller.com/preview/531/94/531094278/large.png

https://www.canada.ca/en/revenue-agency/services/...

This form serves as a federal provincial and territorial corporation income tax return unless the corporation is located in Quebec or Alberta If such is the case you have to

https://ised-isde.canada.ca/cc/lgcy/hm.html?locale=en_CA

As of January 22 2024 businesses incorporated under the CBCA need to file information on individuals with significant control ISC some of which will be made available to the

Tax Return Bank2home

Tax And Accounting Services Synapse Tax

Question And Answer 07 5120 43 Canadian Tax Principles 2020 2021 Byrd

How To Prepare Corporation Income Tax Return For Business In Canada

Complete Your Income Tax Return Online By Isle Of Man Government

How To File Your Income Tax Return Online U Taxgoal

How To File Your Income Tax Return Online U Taxgoal

Want To Change Your Canada Tax Return After Linghitumo tk

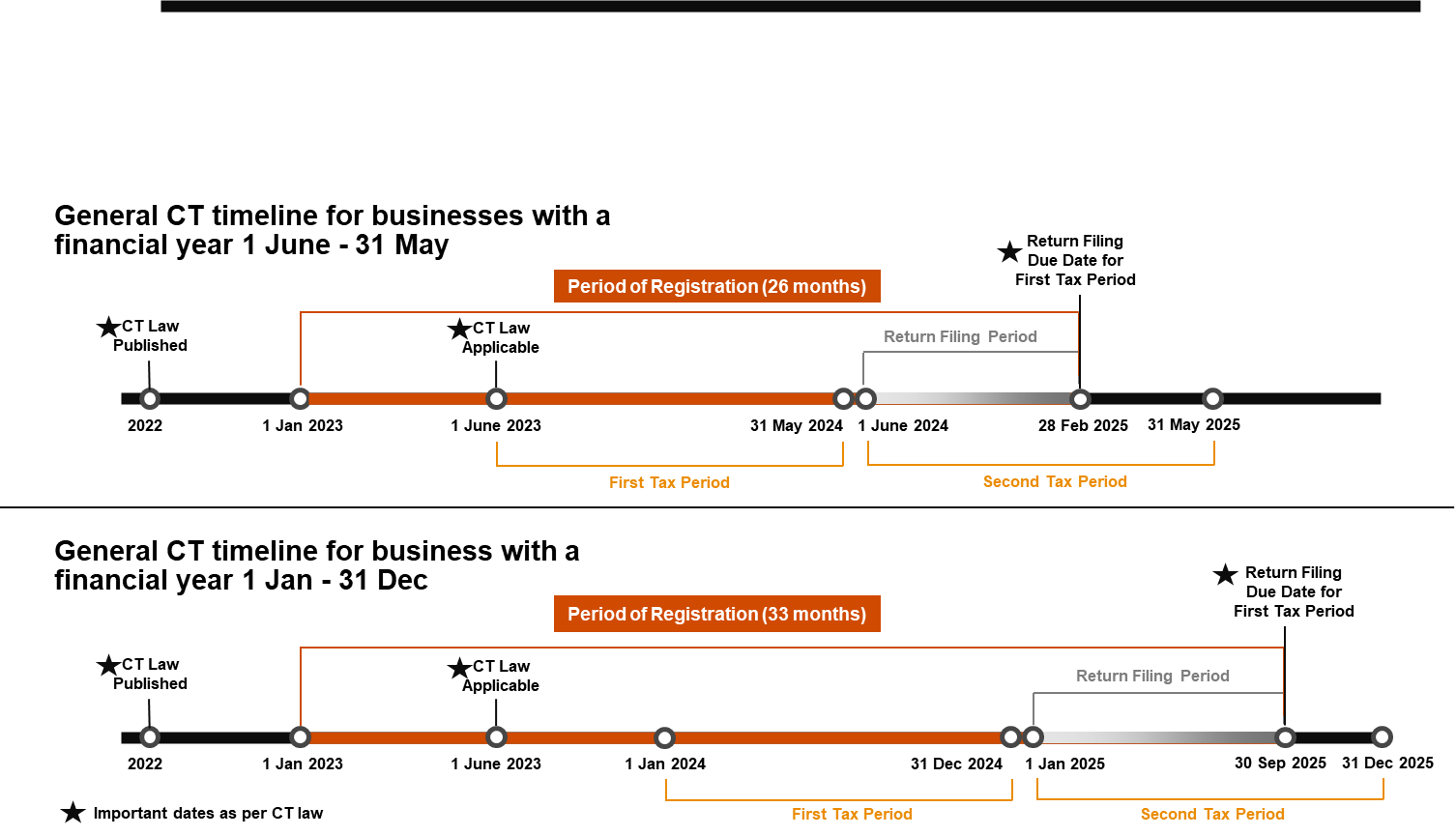

Federal Tax Authority Corporate Tax Topics

Self Assessment Tax Returns Sterling Accountancy Services

Corporate Tax Return Online Canada - Filing a corporation s income tax return can either be completed by hand and mailed to the Canada Revenue Agency CRA or it can be completed online