Cra Gst Due Dates The payment file due date will be March 31 2024 Important Considerations Electronic Filing The CRA encourages businesses to file their GST HST returns electronically using the GST HST Netfile system Electronic filing is convenient secure and ensures timely processing of returns and payments Payment Methods

Agency CRA administers the FNGST and the FNT on behalf of the First Nations For more information go to our webpages First Nations goods and services tax and First Nations tax The CRA s publications and personalized correspondence are available in braille large print e text and MP3 For more 1 Calculate the net tax 2 Complete the return 3 Send file the return 4 After you file 3 Send file the return What is the due date to file a GST HST return The personalized GST HST return Form GST34 2 will show the due date at the top of the form The due date of your return is determined by your reporting period

Cra Gst Due Dates

Cra Gst Due Dates

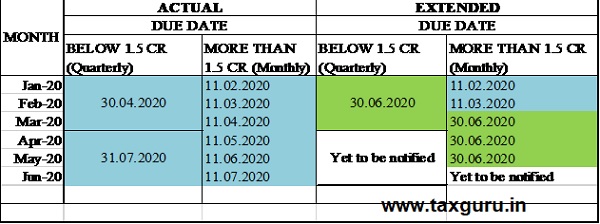

https://taxguru.in/wp-content/uploads/2020/05/GSTR-1-Quarterly-Monthly.jpg

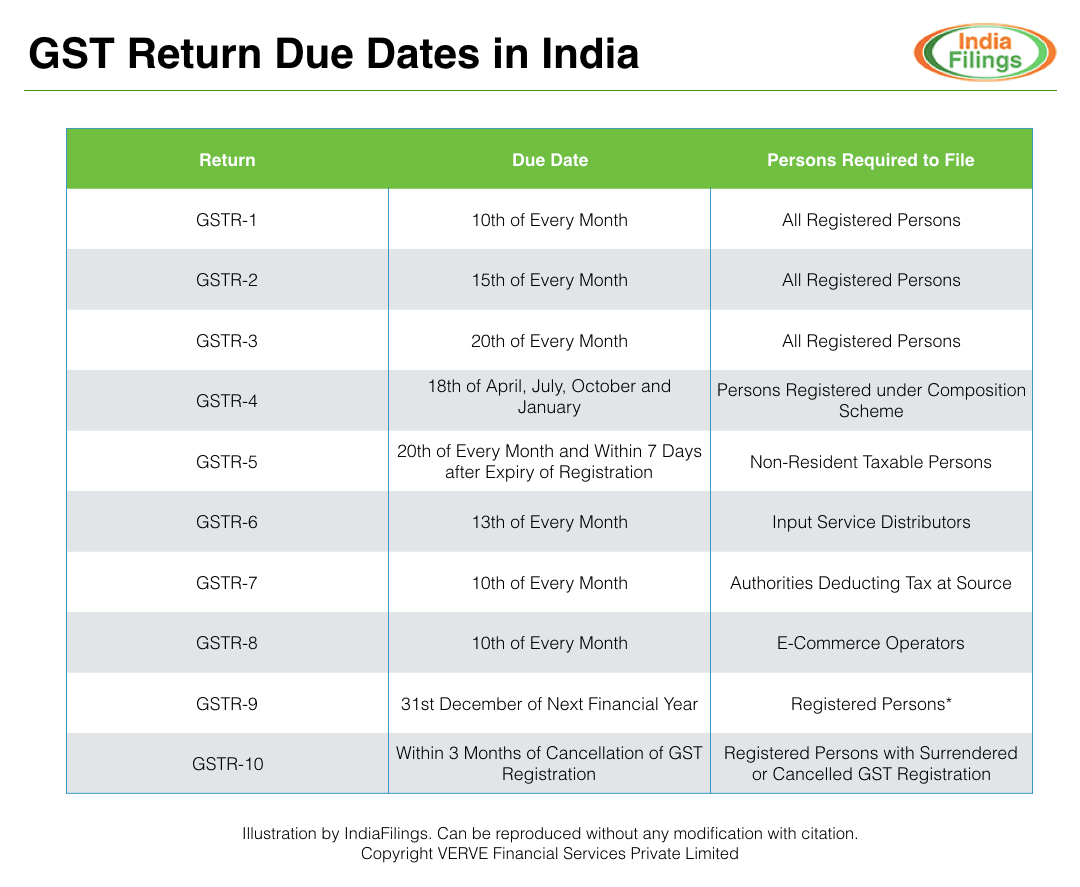

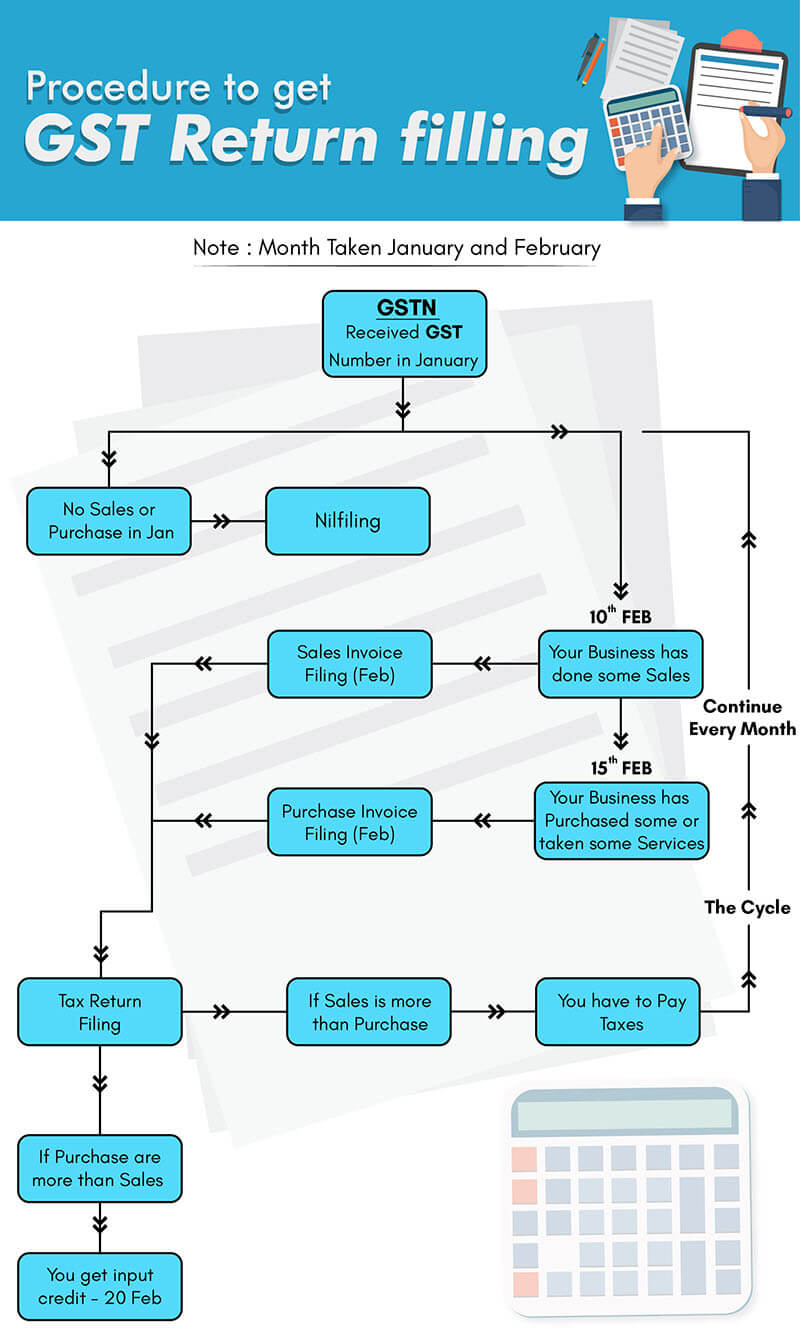

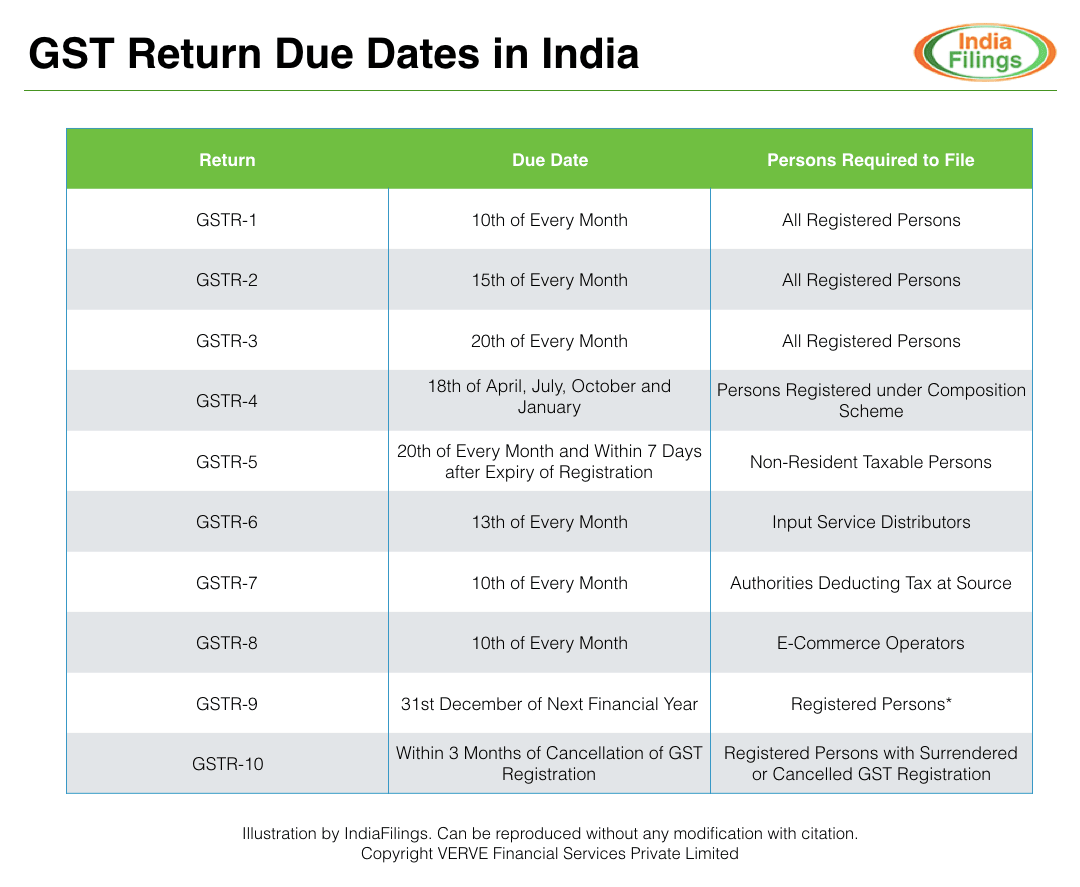

GST Return Filing Due Dates IndiaFilings Learning Centre

https://www.indiafilings.com/learn/wp-content/uploads/2017/06/GST-Return-Filing-Due-Dates.png

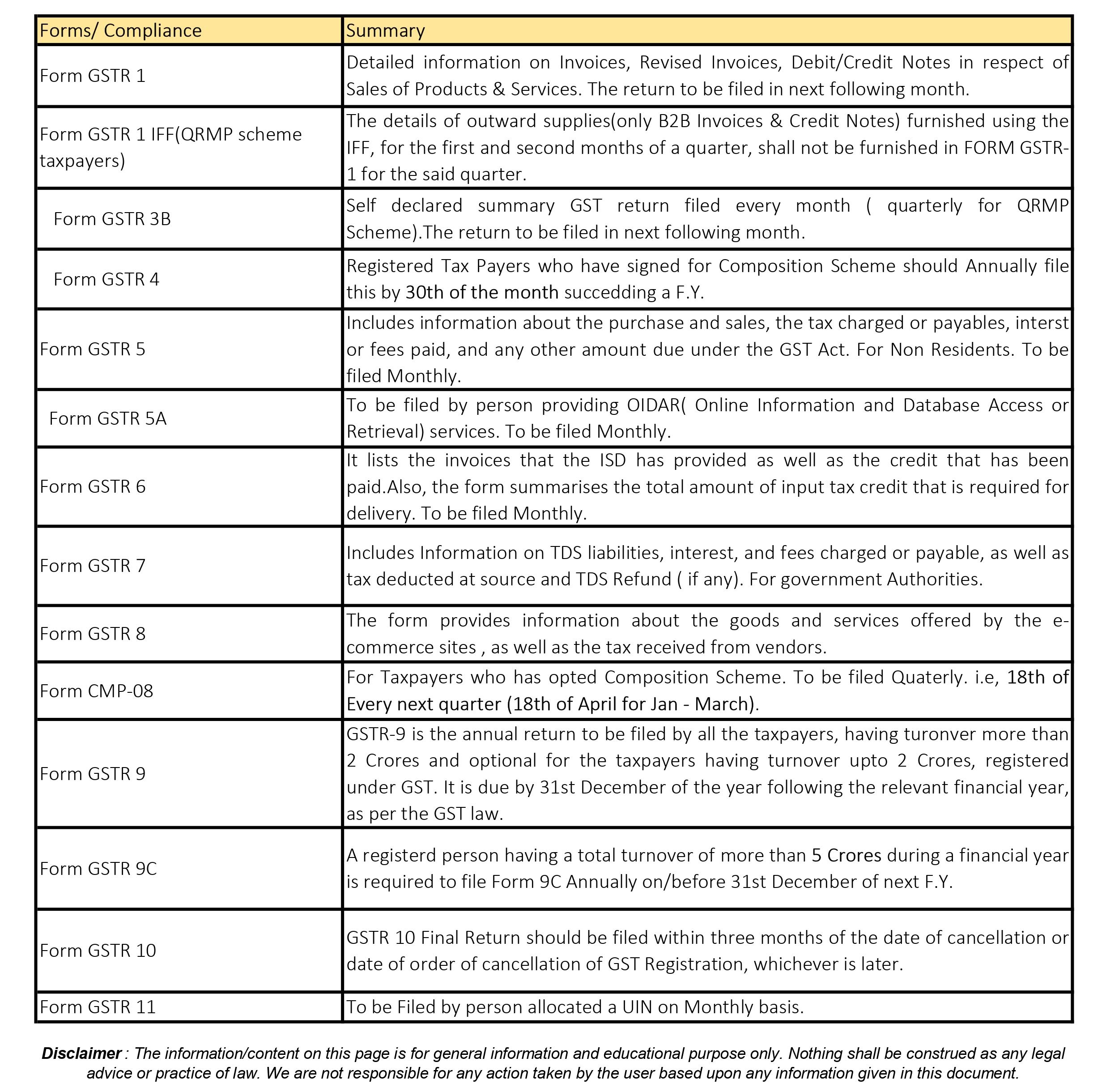

GST Return When To File GST Due Dates Other Important Dates

https://okcredit-blog-images-prod.storage.googleapis.com/2020/11/gst12.jpg

April 5 2024 July 5 2024 October 4 2024 You can receive your payments via direct deposit to your Canadian bank account If you d like to view your benefit information and amounts you can use the CRA Personal Tax Deadlines 2024 Self Employed If you or your spouse earned business income in 2023 then your tax return is due June 17 2024 Normally this would be June 15th but because that falls on a Saturday

For GST filed and paid annually the CRA payment deadline is April 30 and the filing deadline is June 15 GST HST Monthly and Quarterly Payment Deadline One Month After the End of the Reporting Perod GST HST Monthly and Quarterly Filing Deadline One Month After the End of the Reporting Perod GST HST quarterly instalment payments are due by April 30 July 31 October 31 and January 31 Learn about GST HST instalment dates penalties calculations and more GST HST Quarterly Instalment Payment Dates for Businesses in 2024 Savvy New Canadians

Download Cra Gst Due Dates

More picture related to Cra Gst Due Dates

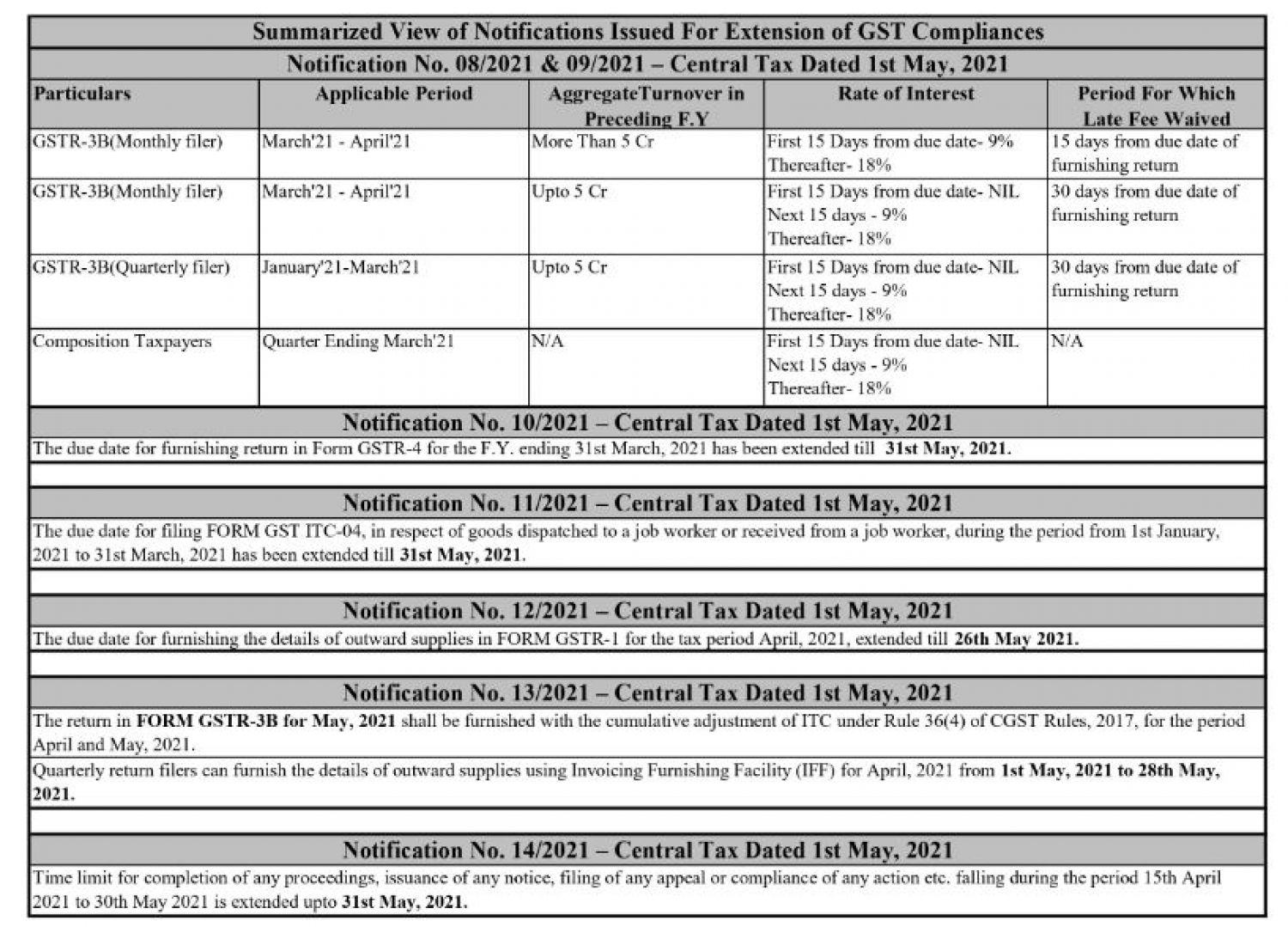

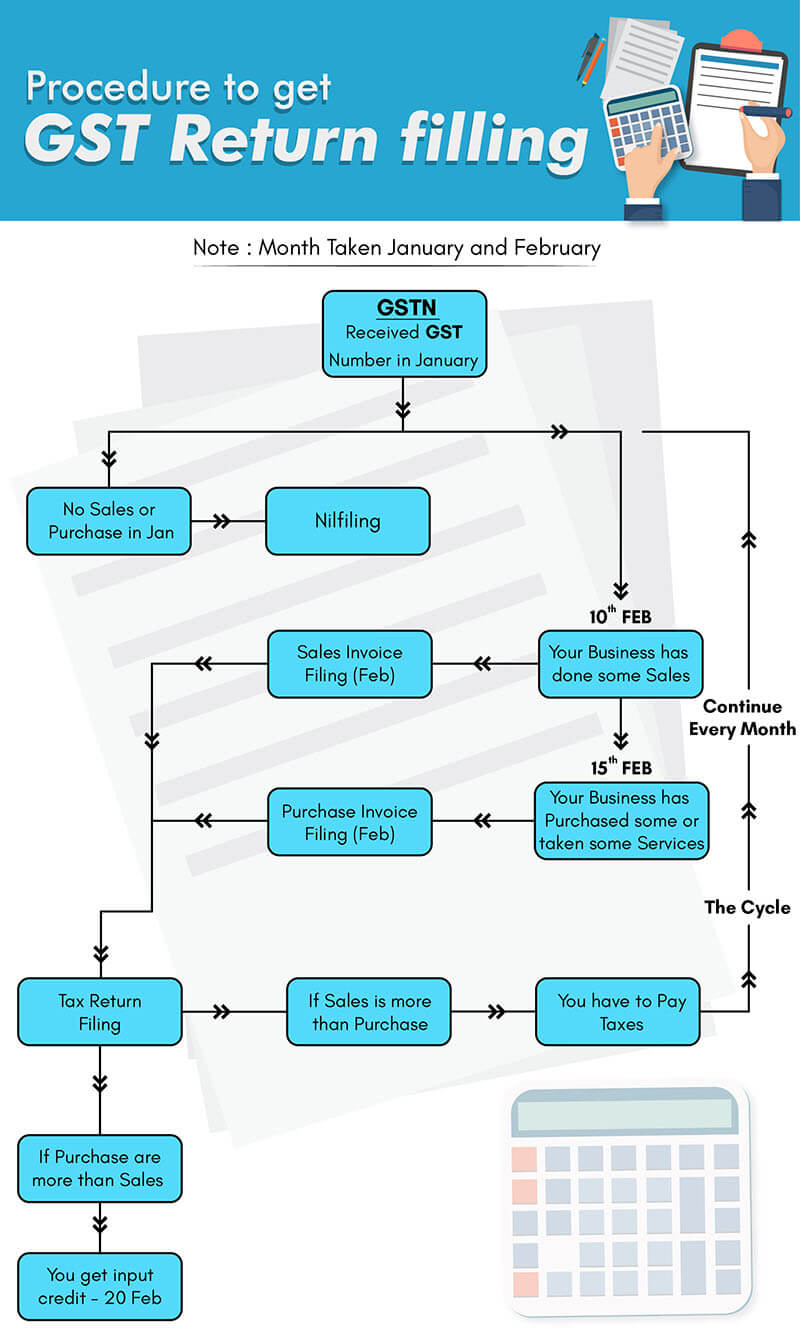

Due Dates Of Various GST Return Falling In Month Of April

https://carajput.com/art_imgs/extension-of-the-due-dates-for-different-gst-returns-in-april2021.jpg

GST Return Due Date For FY 2023 24

https://www.taxmani.in/wp-content/uploads/2022/04/GST-Return-Due-Date-for-FY-2022-23.png

Current GST Return Due Dates For GSTR 1 GSTR 3B GSTR 4 To 9 SAG Infotech

https://blog.saginfotech.com/wp-content/uploads/2017/03/important-gst-dates-for.jpg

When are the GST HST filing deadlines for self employment taxes Each business will have its own filing and payment deadlines also known as payment periods or reporting periods based on their revenues Below are the options Monthly Quarterly Annually without a December 31 fiscal year end date Annually with a December 31st year end A filing deadline of June 15th and a payment deadline of June 30th Annually with a year end other than December 31st three months following your fiscal year end A custom year end of August 31st would have a filing and payment deadline of November 30th

July 5 2024 October 4 2024 GST HST Payment Amounts If you qualify for the GST HST credit the amount you ll receive will depend on a few different factors These include your annual net income your partner s income if you have a spouse or common law partner and if you receive Canada Child Benefits Canada Whether it s GST HST due dates quarterly instalment payments or income tax deadline here s a list of key CRA dates in 2024 for Canadian sole proprietors

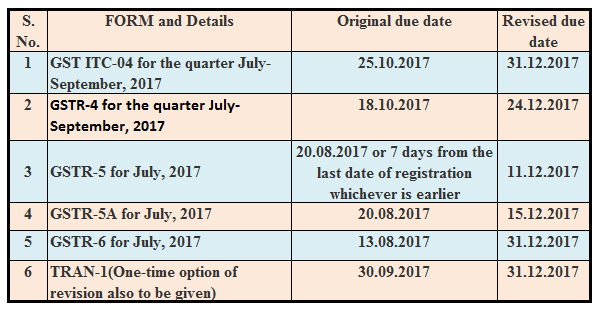

PROCESS FOR GST RETURN FILING SERVICES ONLINE CA CS ADV Service PUNE

https://legaldocs.co.in/img/gst-filling/gst-return-filling.jpg

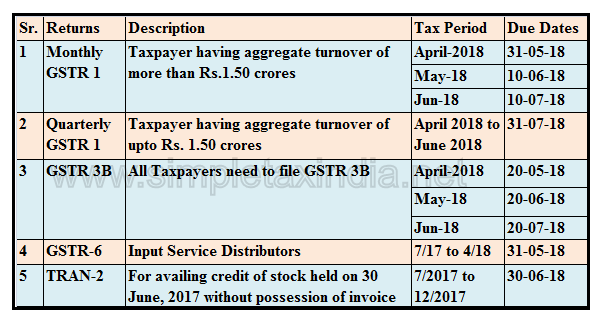

GST RETURN DUE DATE APRIL TO JUNE 2018 SIMPLE TAX INDIA

https://2.bp.blogspot.com/-0fwKc4UAD9w/Wtlc3oV1KfI/AAAAAAAASF0/vruSNQ-1l-YJru0Q-koJHgrK4-PZDK24gCLcBGAs/s1600/gst%2Breturn%2Bdue%2Bdates.png

https:// webtaxonline.ca /2024/02/19/all-you-should...

The payment file due date will be March 31 2024 Important Considerations Electronic Filing The CRA encourages businesses to file their GST HST returns electronically using the GST HST Netfile system Electronic filing is convenient secure and ensures timely processing of returns and payments Payment Methods

https:// publications.gc.ca /collections/collection...

Agency CRA administers the FNGST and the FNT on behalf of the First Nations For more information go to our webpages First Nations goods and services tax and First Nations tax The CRA s publications and personalized correspondence are available in braille large print e text and MP3 For more

GST COMPLIANCE CALENDAR FOR THE FY 2022 23 CA Rajput Jain

PROCESS FOR GST RETURN FILING SERVICES ONLINE CA CS ADV Service PUNE

GST Returns And Due Dates GST Service And Support Bangalore

GST Return Due Dates Accoxi

Find The List Of All The Important Due Dates For GST Compliance For

GST RETURN FILING DUE DATE AND PROCESS CHANGED SIMPLE TAX INDIA

GST RETURN FILING DUE DATE AND PROCESS CHANGED SIMPLE TAX INDIA

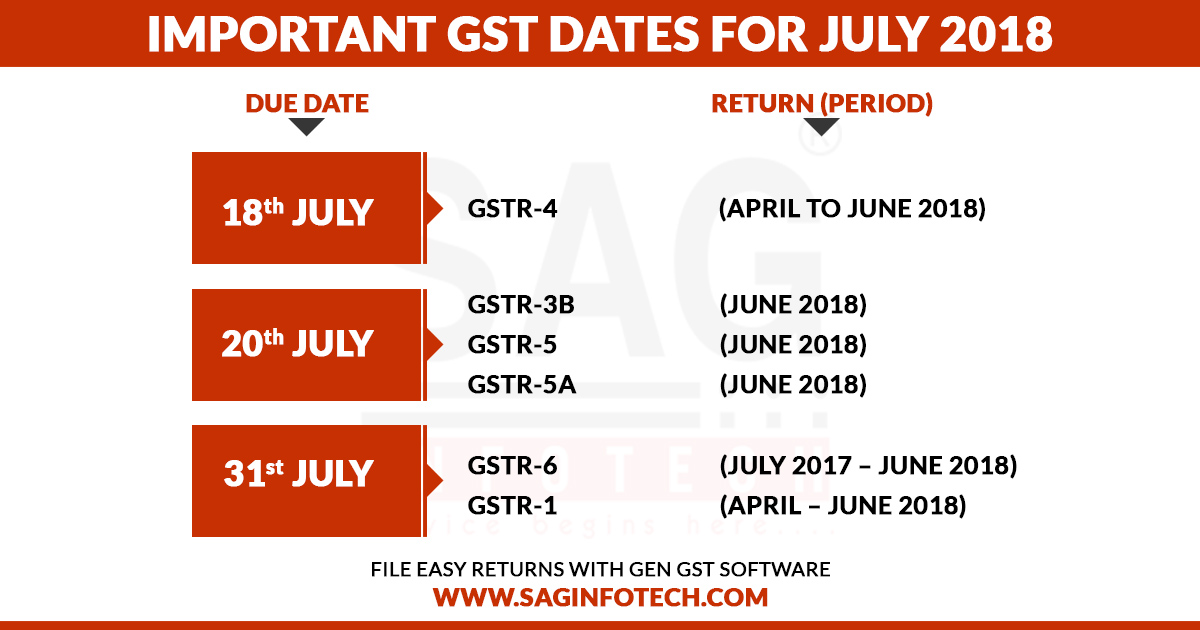

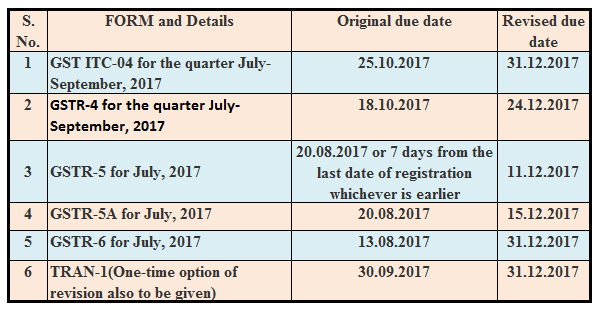

Due Dates For Filing GST Returns Updated In July 2018

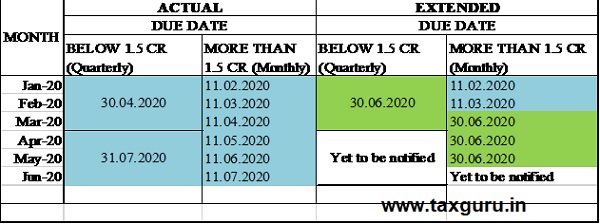

GST Due Dates Extensions Up to June 2020 Under This Lockdown Situation

October 2021 Due Dates For GST Income Tax And Other Compliances Your

Cra Gst Due Dates - GST HST quarterly instalment payments are due by April 30 July 31 October 31 and January 31 Learn about GST HST instalment dates penalties calculations and more GST HST Quarterly Instalment Payment Dates for Businesses in 2024 Savvy New Canadians