Current Ev Tax Credit Rules Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use

The federal EV tax credit is worth up to 7 500 for qualifying new electric vehicles and 4 000 for qualifying used electric vehicles The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive

Current Ev Tax Credit Rules

Current Ev Tax Credit Rules

https://electrek.co/wp-content/uploads/sites/3/2021/08/EV-Registration-Hero.png?w=1600

Lawmakers Try To Delay EV Tax Credit Requirements

https://i.kinja-img.com/gawker-media/image/upload/c_fill,f_auto,fl_progressive,g_center,h_675,pg_1,q_80,w_1200/14bb001fb0a96378884c82ce9957d8d4.png

The TRUTH Behind The New EV Tax Credit Rules A Fact check Analysis DBUNK

https://dbunk.com/wp-content/uploads/2023/03/6.jpg

We ve done the due diligence of gathering each EV that s currently eligible to earn the full 7500 credit and listed them below While plug in hybrid models are also eligible for government The Eliminating Lavish Incentives to Electric ELITE Vehicles Act S 541 specifically repeals the 7 500 tax credit for new electric vehicles EVs eliminates the tax

For up to date information on eligibility requirements for the Clean Vehicle Credit or for additional detail see the information from the IRS For a list of incentives by vehicle see How to Claim the New Clean Vehicle Tax Credit Starting on Jan 1 2024 eligible consumers will have the option to transfer the value of the tax credit to dealers that meet certain requirements in exchange for an equivalent reduction in the

Download Current Ev Tax Credit Rules

More picture related to Current Ev Tax Credit Rules

New EV Tax Credits The Details Virginia Automobile Dealers Association

https://vada.com/wp-content/uploads/2022/08/EV-Tax-Credits-Facebook-Post.png

The IRA s EV Tax Credits AAF

https://www.americanactionforum.org/wp-content/uploads/2022/08/The-IRAs-EV-Tax-Credits-Infographic.png

Has Federal EV Tax Credit Been Saved The Green Car Guy

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

Now 25 EVs and plug in hybrids across 10 brands qualify for the credit The Biden Administration s EV tax credit rules mandate building vehicles in North America for eligibility and The IRS recently published new procedural rules in the Treasury Regulations that go into effect July 5 2024 with revised credits that can save taxpayers up to 7 500 on certain new EVs and up to 4 000 on certain

EVs that qualify for federal tax credits Jan 2025 Per the IRS the following EVs qualify for federal tax credits if purchases between January 1 and December 31 2025 Currently 21 vehicles are eligible for federal tax credits up to 7 500 That will change on April 18 when Treasury s new guidance goes into effect How many EVs will

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/23366599/ahawkins_220221_5115_0007.jpg)

Foreign Automakers Are Big Mad About The New EV Tax Credit The Verge

https://duet-cdn.vox-cdn.com/thumbor/0x0:2040x1360/2400x1600/filters:focal(1020x680:1021x681):format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/23366599/ahawkins_220221_5115_0007.jpg

Payne How EV Tax Credit Bills Disadvantage Foreign Domestic Models

https://www.gannett-cdn.com/presto/2021/11/02/PDTN/af46539a-106d-4d75-bc9e-c93935bf56ca-EVcredits_FordMustangMachEGT.jpg?crop=3181

https://www.irs.gov › clean-vehicle-tax-credits

Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use

https://www.nerdwallet.com › article › taxe…

The federal EV tax credit is worth up to 7 500 for qualifying new electric vehicles and 4 000 for qualifying used electric vehicles

Why Getting A 7 500 EV Tax Credit Will Be Easier In 2024 WSJ

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/23366599/ahawkins_220221_5115_0007.jpg)

Foreign Automakers Are Big Mad About The New EV Tax Credit The Verge

New US EV Tax Credit Here s Everything You Need To Know

EV Tax Credit Rules Are About To Get A Lot More Complicated Auto Recent

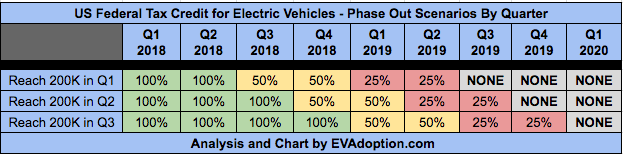

Updated Federal EV Tax Credit Phase Out Scenarios Nov 24 2017

Why Buying An Electric Vehicle Just Got More Confusing TIME

Why Buying An Electric Vehicle Just Got More Confusing TIME

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Main.png)

New Clean Vehicle Tax Credit Plan Means Most EVs No Longer Qualify

EV Tax Credit Restrictions Could Reshape Automakers Supply Chains

The EV Tax Credit Can Save You Thousands If You re Rich Enough Grist

Current Ev Tax Credit Rules - We ve done the due diligence of gathering each EV that s currently eligible to earn the full 7500 credit and listed them below While plug in hybrid models are also eligible for government