Day Care Tax Rebate While claiming daycare expenses toward a tax credit won t defray all the costs associated with child care it can help reduce them significantly This article will

Toronto Will you get a rebate on your child s care in Ontario The 10 a day opt in deadline is here Province extended deadline from Sept 1 to Nov 1 to allow Updated on December 30 2022 Reviewed by Ebony J Howard Fact checked by Hans Jasperson In This Article Photo The Balance Joshua Seong The Child and

Day Care Tax Rebate

Day Care Tax Rebate

https://www.latestrebate.com/wp-content/uploads/2023/02/5-best-photos-of-child-care-provider-tax-form-daycare-provider-tax-db-1243x2048.jpg

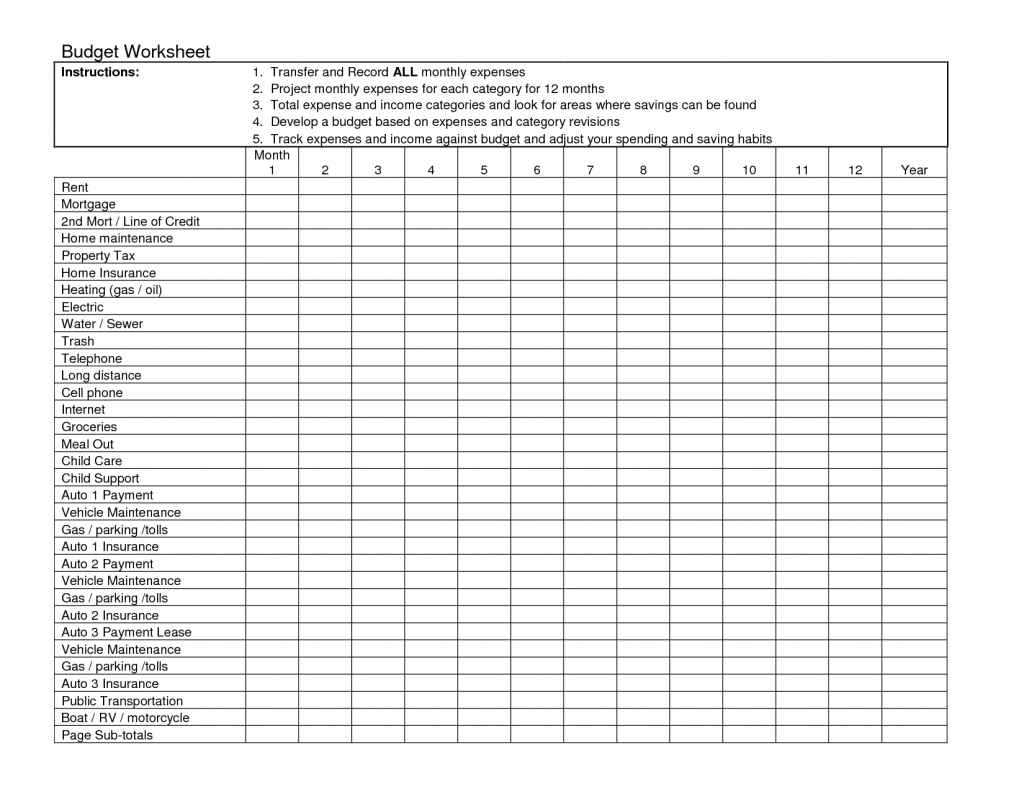

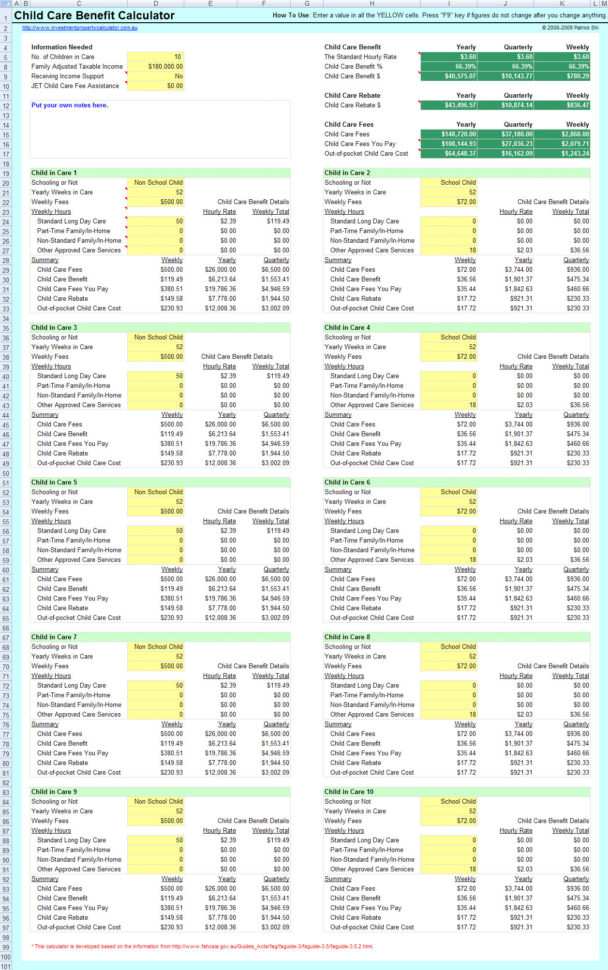

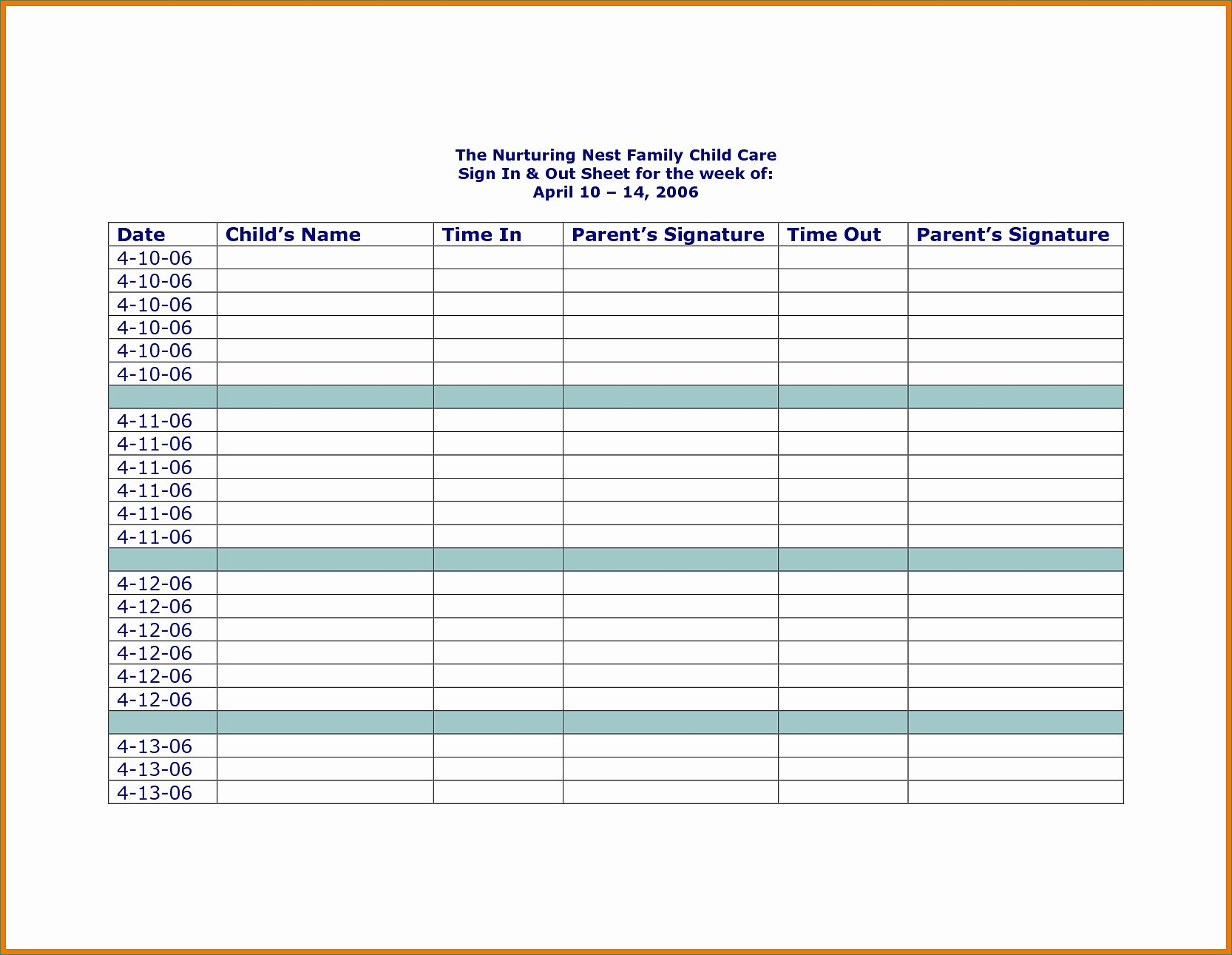

Family Day Care Tax Spreadsheet Printable Spreadshee Family Day Care

http://db-excel.com/wp-content/uploads/2019/01/family-day-care-tax-spreadsheet-throughout-free-child-care-benefit-calculator-608x970.jpg

Family Day Care Tax Spreadsheet Printable Spreadshee Family Day Care

http://db-excel.com/wp-content/uploads/2019/01/family-day-care-tax-spreadsheet-pertaining-to-child-care-receipt-template-excel-daycare-uis-payment-spreadsheet.jpg

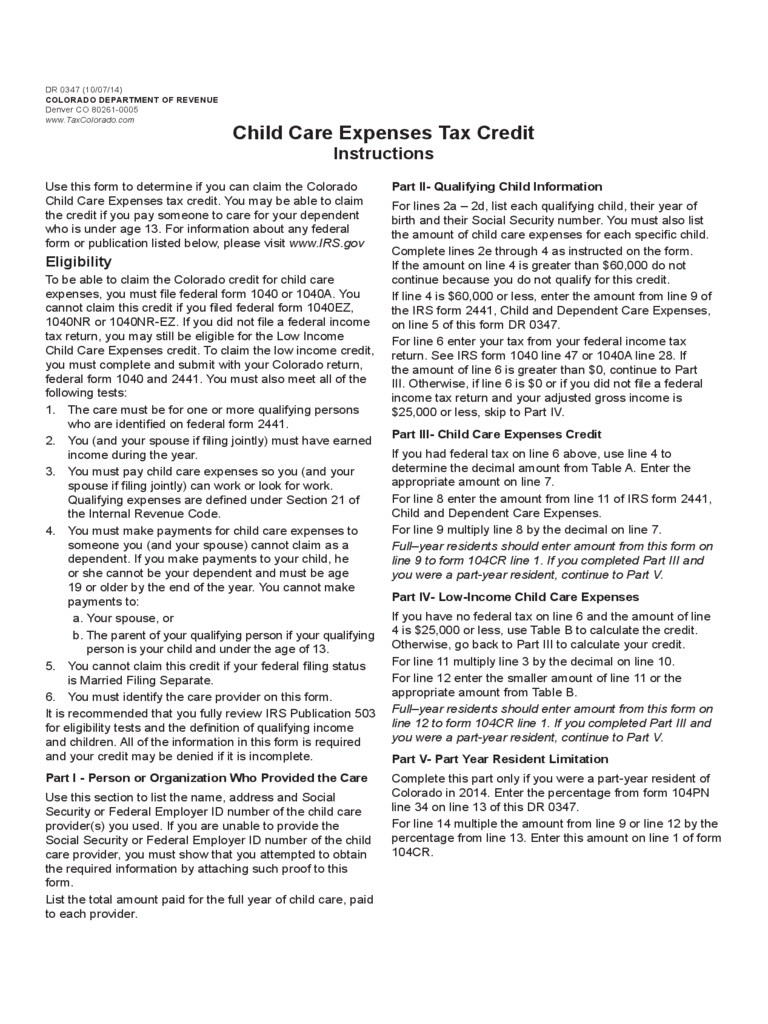

The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a The following FAQs can help you learn if you are eligible and if eligible how to calculate your credit Further information is found below and in IRS Publication 503

Discover how taxes and rebates influence daycare costs for parents Learn about tax policies and rebates designed to ease the financial burden of childcare Explore global For most families the rebate would range from 57 to 60 per cent of their daycare fees The maximum annual refunds would be 6 750 per child under age six

Download Day Care Tax Rebate

More picture related to Day Care Tax Rebate

Family Day Care Tax Spreadsheet With 75 Daycare Payment Receipt

https://db-excel.com/wp-content/uploads/2019/01/family-day-care-tax-spreadsheet-with-75-daycare-payment-receipt-mommysmoneysavingmadness-receipt-768x1086.jpg

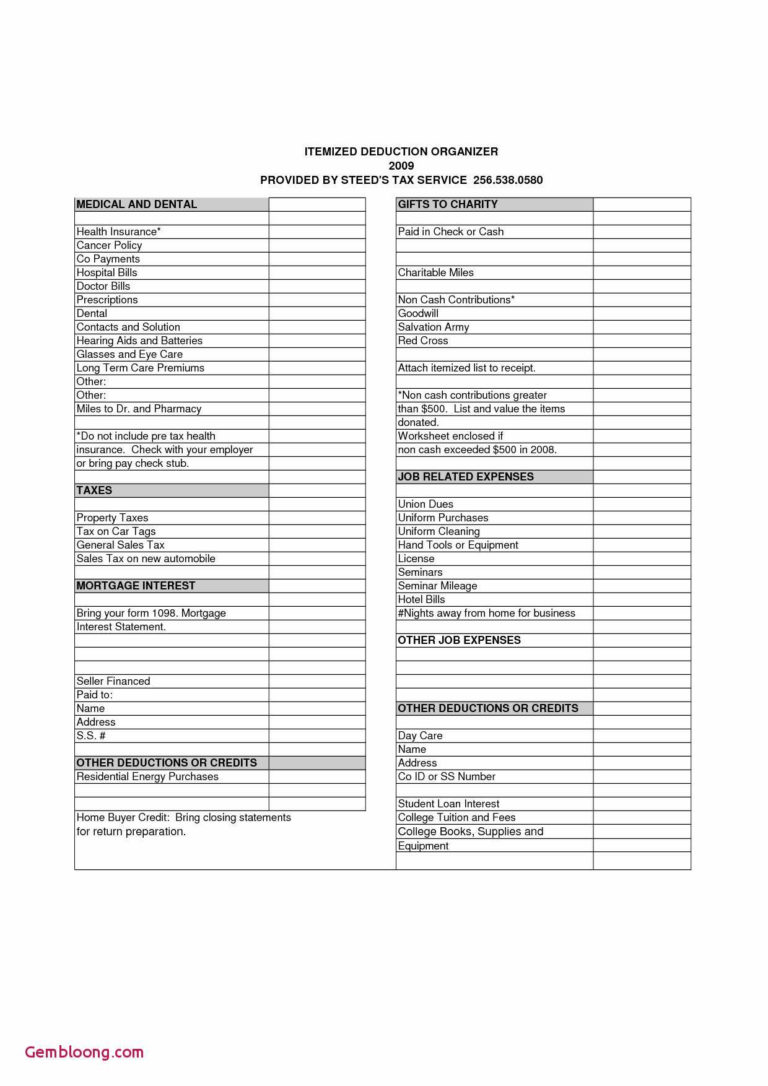

2023 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/fb/source_images/child-care-expenses-tax-credit-colorado-d1.png

Day Care Tax Deductions Starting A Daycare Childcare Business

https://i.pinimg.com/736x/a6/6a/c6/a66ac6a932b601e863d17aa326a063a6.jpg

Your child care credit would be based on 6 000 The maximum you could write off would be 1 200 6 000 x 20 For 2021 only you d be entitled to a 50 credit based on If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a

Part of Tax Free Childcare You can get up to 500 every 3 months up to 2 000 a year for each of your children to help with the costs of childcare This goes up to All families earning up to 180 000 will be eligible for a 25 percent rebate on their early childhood education ECE expenses up to a maximum of 75 per week The

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/child-care-tax-credit-payment-dates-2022-drift-hestia-bloger-1.jpg

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/child-care-tax-credit-payment-dates-2022-drift-hestia-bloger.jpg

https://www.care.com/c/daycare-tax-credit-what-is-it-benefits

While claiming daycare expenses toward a tax credit won t defray all the costs associated with child care it can help reduce them significantly This article will

https://www.cbc.ca/news/canada/toronto/ont-child-care-1.6637051

Toronto Will you get a rebate on your child s care in Ontario The 10 a day opt in deadline is here Province extended deadline from Sept 1 to Nov 1 to allow

Family Day Care Tax Spreadsheet Printable Spreadshee Family Day Care

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

Daycare Business Income And Expense Sheet To File Your Daycare Business

Daycare Receipt Form Fill Out And Sign Printable PDF Template SignNow

Family Day Care Tax Spreadsheet Printable Spreadshee Family Day Care

Lovely Child Care Receipt Invoice Daycare Forms Childcare Receipt

Lovely Child Care Receipt Invoice Daycare Forms Childcare Receipt

Child Care Expenses Tax Credit Colorado Free Download

Day Care Tax Worksheet DOCUMENT INFO Classroom Ideas Pinterest

The Benefits Of Using A Child Care Receipt Template In 2023 Free

Day Care Tax Rebate - Child Care Tax Credits Information for Parents Wisconsin Department of Children and Families SKU B 17 Program Child Care Information Center CCIC Category For