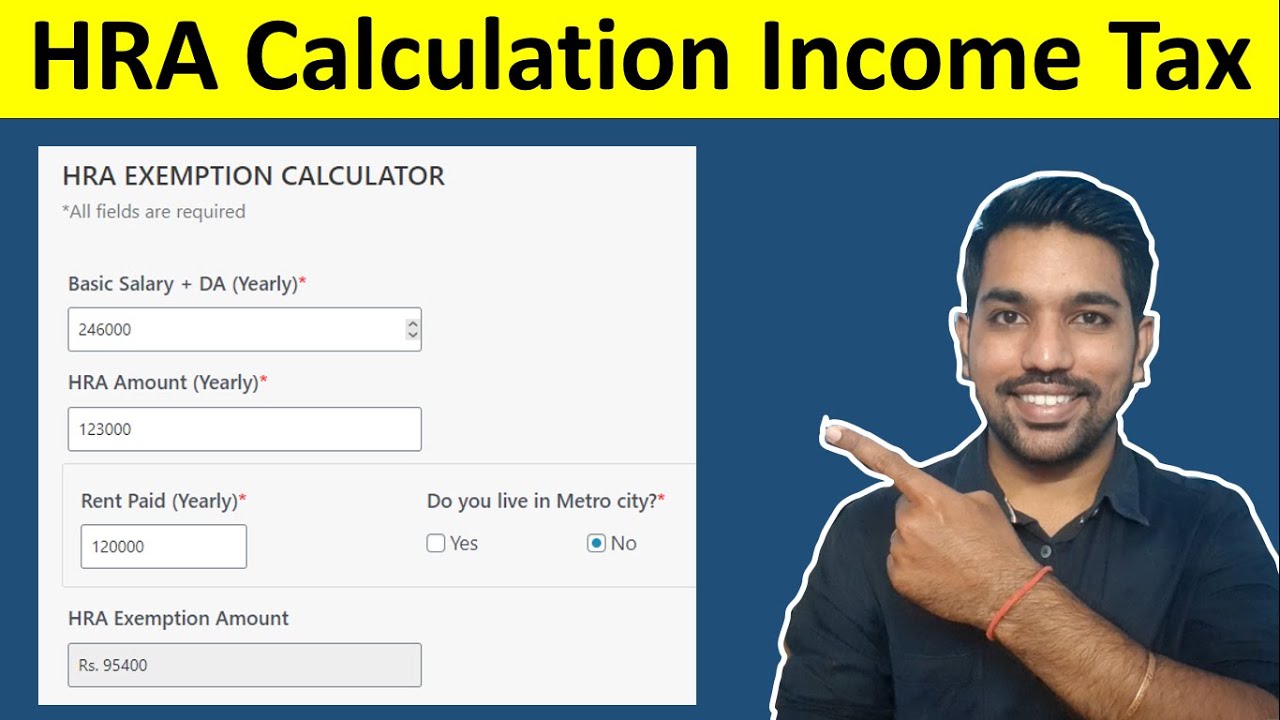

Deduction For House Rent Paid Salaried employees who receive house rent allowance as a part of salary and pay rent can claim HRA exemption to reduce their taxable salary wholly or partially Which section

Section 80GG allows the Individuals to a deduction in respect of house rent paid by him for his own residence Such deduction is permissible subject to the following conditions 4 bedroom detached house for sale in READY NOW PRIVATE DEVELOPMENT Buttermilk Close LU5 for 650 000 Marketed by Sell New St Neots

Deduction For House Rent Paid

Deduction For House Rent Paid

https://i.ytimg.com/vi/J5KugtFfmJw/maxresdefault.jpg

Deduction In Income For House Rent Paid Under 80GG YouTube

https://i.ytimg.com/vi/6JiKmejIq68/maxresdefault.jpg

Material Requirement Form House Rent Deduction In Income Tax Section

https://www.indiafilings.com/images/Deduction-for-Rent.png

To claim a deduction under Section 80GG of the Income Tax Act which pertains to the deduction for rent paid when HRA House Rent Allowance is not received you will need Section 80GG of Income Tax Act allows deduction on rent paid for those who reside in rented houses Read the calculation of deduction eligibility

An individual paying rent for a furnished unfurnished accommodation can claim the deduction for the rent paid under Section 80 GG of the Income tax Act provided he is not paid HRA as a part of his salary by If you don t receive HRA House Rent Allowance but pay rent you can still get a tax deduction on the rent paid under Section 80 GG of the Income Tax Act 1961 The maximum deduction permitted under Section 80

Download Deduction For House Rent Paid

More picture related to Deduction For House Rent Paid

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

https://kmgcollp.com/wp-content/uploads/2022/01/Deduction-in-income-tax-where-House-rent-is-paid-and-HRA-not-received.jpg

Rental Property Tax Deductions A Comprehensive Guide Credible Cash

https://i.pinimg.com/originals/8e/f4/2c/8ef42c9ab3dffc9b087a7a496909a1de.png

RENT PAID FOR RESIDENCE IS ALSO ELIGIBLE FOR DEDUCTION

https://thetaxtalk.com/wp-content/uploads/2018/02/100-1.png

Section 80GG is a special provision under Chapter VI A of the Income Tax Act 1961 which provides tax reprieve to those who do not avail house rent allowance To become eligible for Section 80GG provides tax deductions for rent paid by individuals who do not receive House Rent Allowance HRA from their employers The deduction applies to both

If you re a salaried employee living in a rented house you can claim deductions on the rent you pay under certain conditions There are two key provisions that offer tax relief on Maximum of Rs 60 000 can be claimed as deduction in a financial year under Section 80GG of income tax act if you stay in rented accommodation furnished or unfurnished and paying house rent without receiving HRA component in

House Rent Deduction Raised From Rs 24 000 To Rs 60 000 Hindustan Times

https://images.hindustantimes.com/rf/image_size_800x600/HT/p2/2016/03/01/Pictures/buyers-treated-shift-their-lender-loan-borrowers_51f1e82a-df15-11e5-a1fb-86e627e3731c.jpg

Deduction Towards House Rent Allowance HRA In The Income Tax

https://thetaxtalk.com/wp-content/uploads/2021/04/Untitled-831.jpg

https://cleartax.in › hra-house-rent-allowance

Salaried employees who receive house rent allowance as a part of salary and pay rent can claim HRA exemption to reduce their taxable salary wholly or partially Which section

https://taxguru.in › income-tax

Section 80GG allows the Individuals to a deduction in respect of house rent paid by him for his own residence Such deduction is permissible subject to the following conditions

Section 80GG Deduction For Rent Paid Income Tax Returns Income Tax

House Rent Deduction Raised From Rs 24 000 To Rs 60 000 Hindustan Times

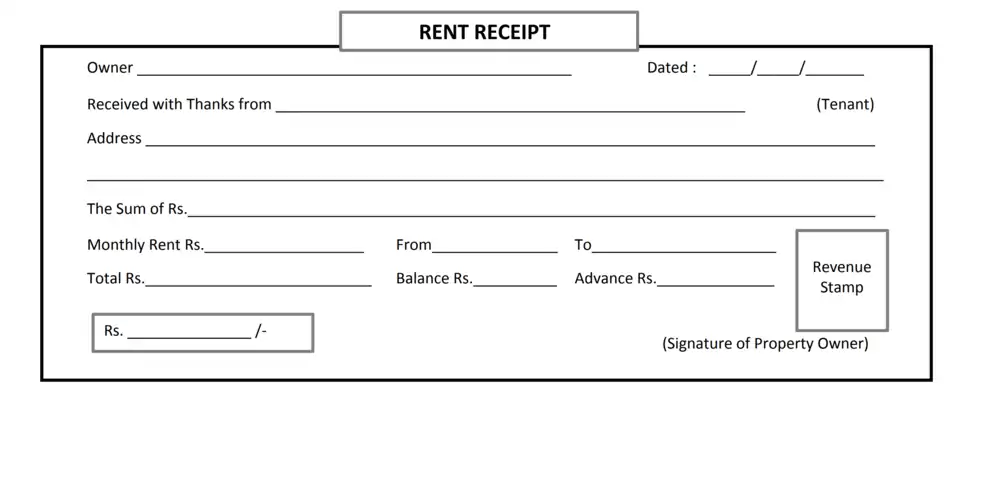

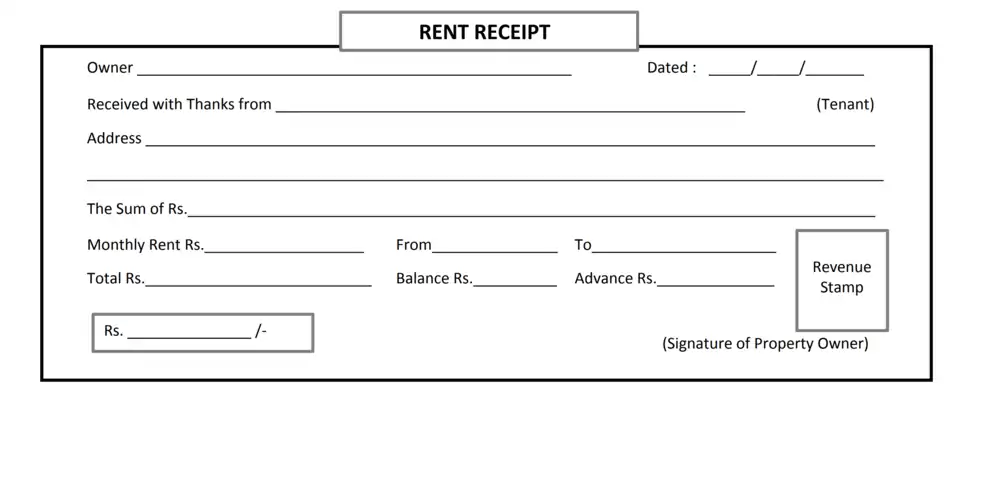

Rent Receipt Rent Receipt Forms Rent Receipt Template Etsy

Deduction For Rent Paid Under Section 80GG With Auto Fill Income Tax

How To Get The Rent Receipt From Paytm Application Paytm Blog

Rent Receipt Format PDF Free Download

Rent Receipt Format PDF Free Download

House Rent Deduction HRA

Clarification Regarding Deduction House Rent Allowance And 5

House Rent Prediction With Machine Learning AI Summary

Deduction For House Rent Paid - If you don t receive HRA House Rent Allowance but pay rent you can still get a tax deduction on the rent paid under Section 80 GG of the Income Tax Act 1961 The maximum deduction permitted under Section 80