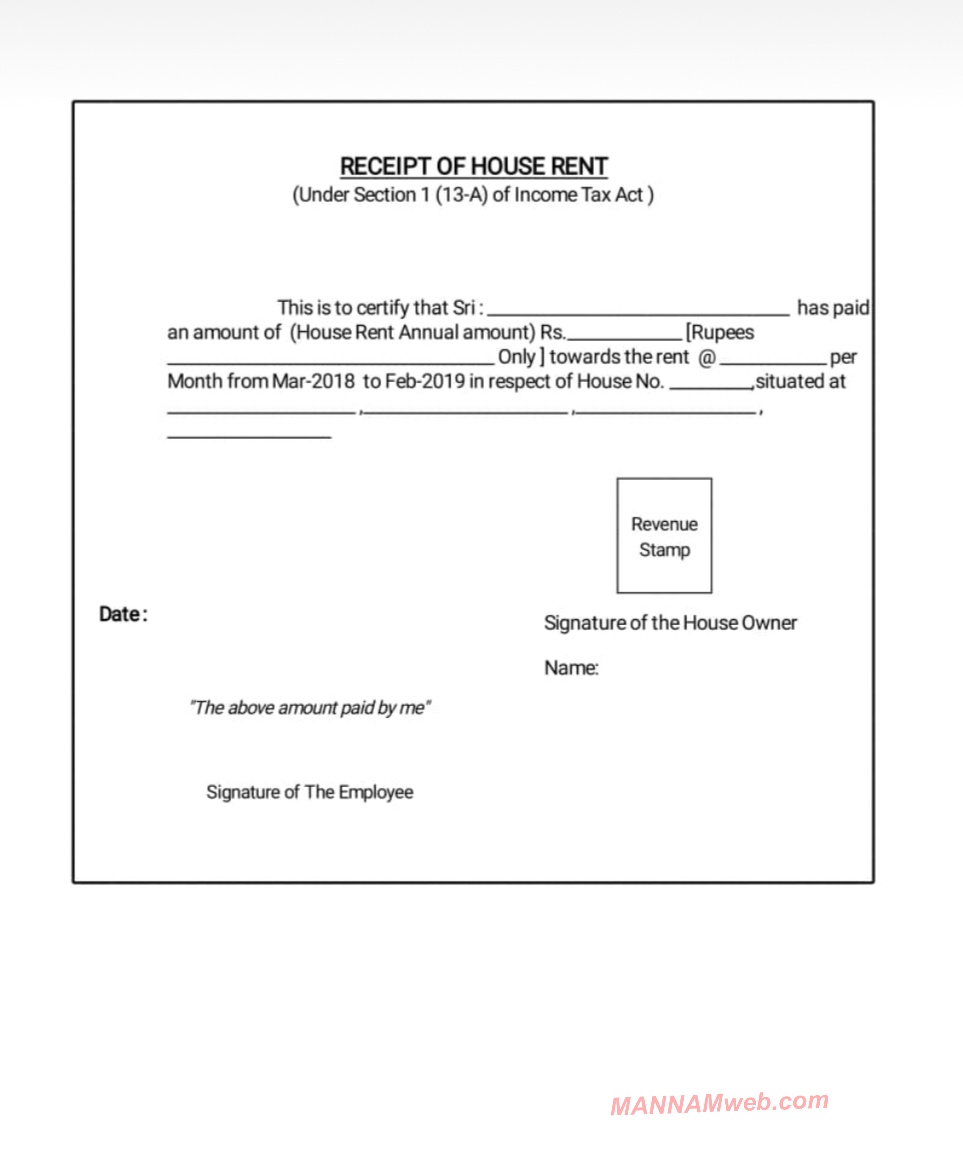

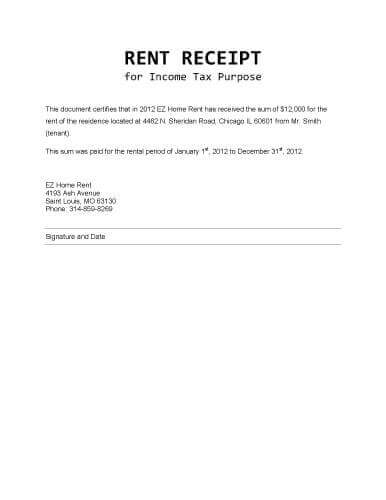

Tax Deduction For House Rent Paid Documents like rent receipts and rental agreements must be submitted to the employer to claim a house rent allowance deduction If the

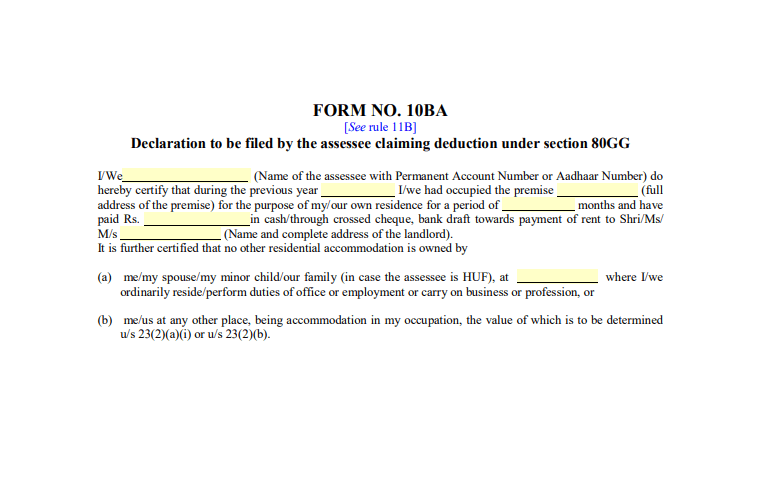

Section 80GG allows the Individuals to a deduction in respect of house rent paid by him for his own residence Such deduction is permissible To claim a deduction under Section 80GG of the Income Tax Act which pertains to the deduction for rent paid when HRA House Rent Allowance is not received you will need the following documents Rent Receipts You

Tax Deduction For House Rent Paid

Tax Deduction For House Rent Paid

https://i.ytimg.com/vi/Dj-5I2gkljI/maxresdefault.jpg

House Rent Receipt Form For Income Tax Returns MANNAMweb

https://2.bp.blogspot.com/-M1d2rNa_Ifw/XGAdyhaT33I/AAAAAAAAL4k/pYAkm3P2esUVhvx8I5XCQ5DRGfAdKmAHQCLcBGAs/s1600/IMG_20190210_181751.jpg

Know Income Tax Deduction For HRA House Rent Allowance

https://image.slidesharecdn.com/hra-191227124416/95/know-income-tax-deduction-for-hra-house-rent-allowance-1-638.jpg?cb=1577450691

When it comes to tax deductions for individuals living in rented accommodation there is good news for both salaried and non salaried individuals While salaried taxpayers can This section provides a tax deduction to individuals who do not receive house rent allowance HRA but still pay rent for their accommodation Let s break down Section 80GG how it works and how you can make the

Maximum of Rs 60 000 can be claimed as deduction in a financial year under Section 80GG of income tax act if you stay in rented accommodation furnished or unfurnished and paying house rent without receiving HRA component in If you don t receive HRA House Rent Allowance but pay rent you can still get a tax deduction on the rent paid under Section 80 GG of the Income Tax Act 1961 The maximum deduction permitted under Section 80

Download Tax Deduction For House Rent Paid

More picture related to Tax Deduction For House Rent Paid

Deduction In Respect Of Rent Paid Sec 80GG Eligibility Calculation

https://gstguntur.com/wp-content/uploads/2021/07/1620198931_form10ba.png

Section 80GG Claim Deduction For House Rent Paisabazaar

https://www.paisabazaar.com/wp-content/uploads/2017/05/01-768x511.jpg

Tax Deduction On House Rent U S 80GG Without HRA For Employees

https://blog.saginfotech.com/wp-content/uploads/2021/07/tax-deduction-house-rent-under-section-80gg.jpg

There are two key provisions that offer tax relief on rent paid House Rent Allowance HRA and Section 80GG HRA is part of your salary and is provided by employers The taxpayer can claim a deduction under Section 80GG of the Income Tax Act towards the expense paid for house rent Let us understand the eligibility criteria and

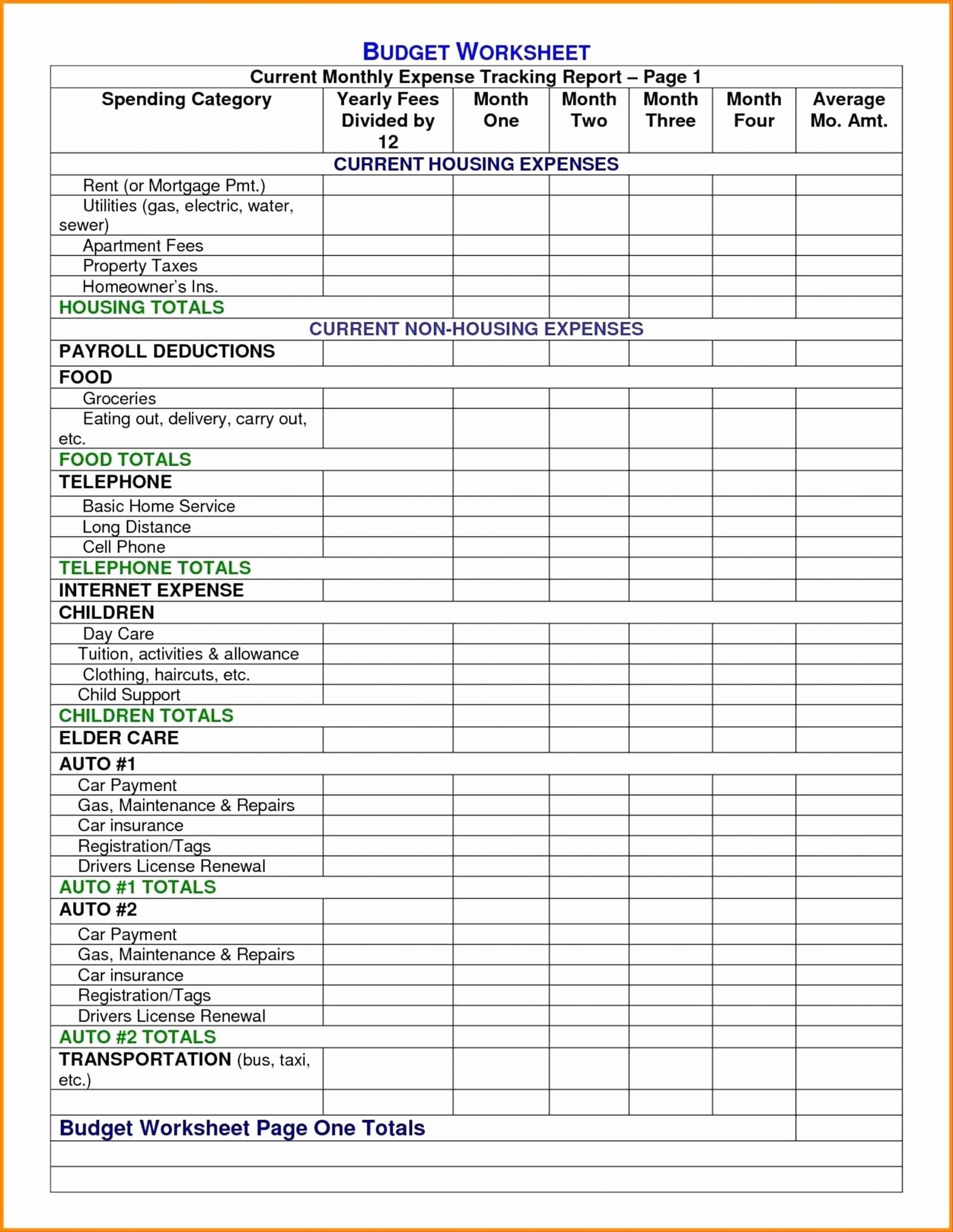

1 Property tax Check to see if you pay property taxes as part of your lease agreement If you do you can deduct that portion of your rent or any property tax you pay To learn which resources you need to file your taxes we spoke with a trusted tax professional to get the lowdown on tax deductions for renters and who qualifies for them

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Deduction For Rent Paid Section 80GG IndiaFilings

https://img.indiafilings.com/learn/wp-content/uploads/2017/09/12004022/Form-10BA.png

https://cleartax.in › hra-house-rent-allowa…

Documents like rent receipts and rental agreements must be submitted to the employer to claim a house rent allowance deduction If the

https://taxguru.in › income-tax

Section 80GG allows the Individuals to a deduction in respect of house rent paid by him for his own residence Such deduction is permissible

Deductions On Section 80 C 80ccc 80ccd UGC NET COMMERCE

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Rental Property Tax Deductions Worksheet Yooob Db excel

Income Tax Deduction For Rent Paid Section 80GG IndiaFilings

Income Tax Deduction For Purchase Or Construction Of House IndiaFilings

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

FREE Rent Receipt Templates Download Or Print Hloom

Rent Receipt Generator Online Generate Free House Rent Receipt Online

General Daily Update Sample House Rent Receipt Format Download Rent

Tax Deduction For House Rent Paid - The property tax for the house is Rs 20 000 making the net rental income Rs 1 00 000 After applying the 30 per cent standard deduction under income tax laws the final