Dental Hygienist Tax Credit Verkko 9 maalisk 2023 nbsp 0183 32 What are qualifying expenses Dental expenses Nursing home and additional nursing care expenses Additional diet expenses for coeliacs and diabetics Additional health care expenses for a child Additional expenses for a kidney patient How do you claim health expenses Dental expenses Routine dental care

Verkko 19 marrask 2019 nbsp 0183 32 TFSAs allow you to earn tax free investment income For example if you have 50 000 in your TFSA invested and it earns 5 2 500 you won t have to report the 2 500 on your personal tax return When you withdraw from a TFSA there will also be no taxes to pay Check with CRA to determine your TFSA balance Verkko 10 hein 228 k 2013 nbsp 0183 32 For 2013 you can also get as much as a 50 credit off the first 2 000 invested If you qualify you can deduct as much as 5 500 in IRA contributions up from 5 000 in 2012 As your adjusted gross income increases the tax credit disappears

Dental Hygienist Tax Credit

Dental Hygienist Tax Credit

https://i.pinimg.com/originals/6b/85/29/6b852910e88e335fddadc2e5fb478d37.jpg

Dental Hygienist Licensing Exam Easy Entry

https://www.samikshapublication.com.np/image/cache/catalog/OUR PUBLICATION/Dental Hygienist License Easy Entry 2nd Edition.indd-500x700.png

Dental Hygienist Associate Degree Northeast Wisconsin Technical College

https://www.nwtc.edu/cms/getattachment/766e7722-7087-4c0b-8a66-2f7cd43324b4/Dental-Hygienist-105081

Verkko This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction It explains how to treat reimbursements and how to figure the deduction Verkko 23 marrask 2012 nbsp 0183 32 If you do not have to complete a tax return to get tax relief on your business expenses you will need to write to HMRC or fill in a form P87 If self employed however you can get tax relief on

Verkko For 2021 the credit is up to 70 of up to 10 000 in qualified wages and employee health insurance including dental costs per full time employee for each calendar quarter beginning Jan 1 and ending Dec 31 Therefore the maximum amount you can receive is 7 000 per quarter per employee Verkko 1 huhtik 2021 nbsp 0183 32 Now up to 6 000 can qualify for the credit although the 5 000 still applies to reimbursement accounts The child tax credit has doubled From 1 000 to 2 000 per child under the age of 17 Eligibility income limits have substantially increased from 75 000 to 200 000 single filers and from 110 000 to 400 000 married filing

Download Dental Hygienist Tax Credit

More picture related to Dental Hygienist Tax Credit

Dental Hygienist Family Guy Guys Blog Fictional Characters

https://i.pinimg.com/originals/20/8e/f4/208ef40f161a56f1601b30e3e9d776aa.jpg

Bipartisan Bill Would Provide Tax Credit For PPE Dimensions Of Dental

https://dimensionsofdentalhygiene.com/wp-content/uploads/2020/06/ddh-covid19-627.jpg

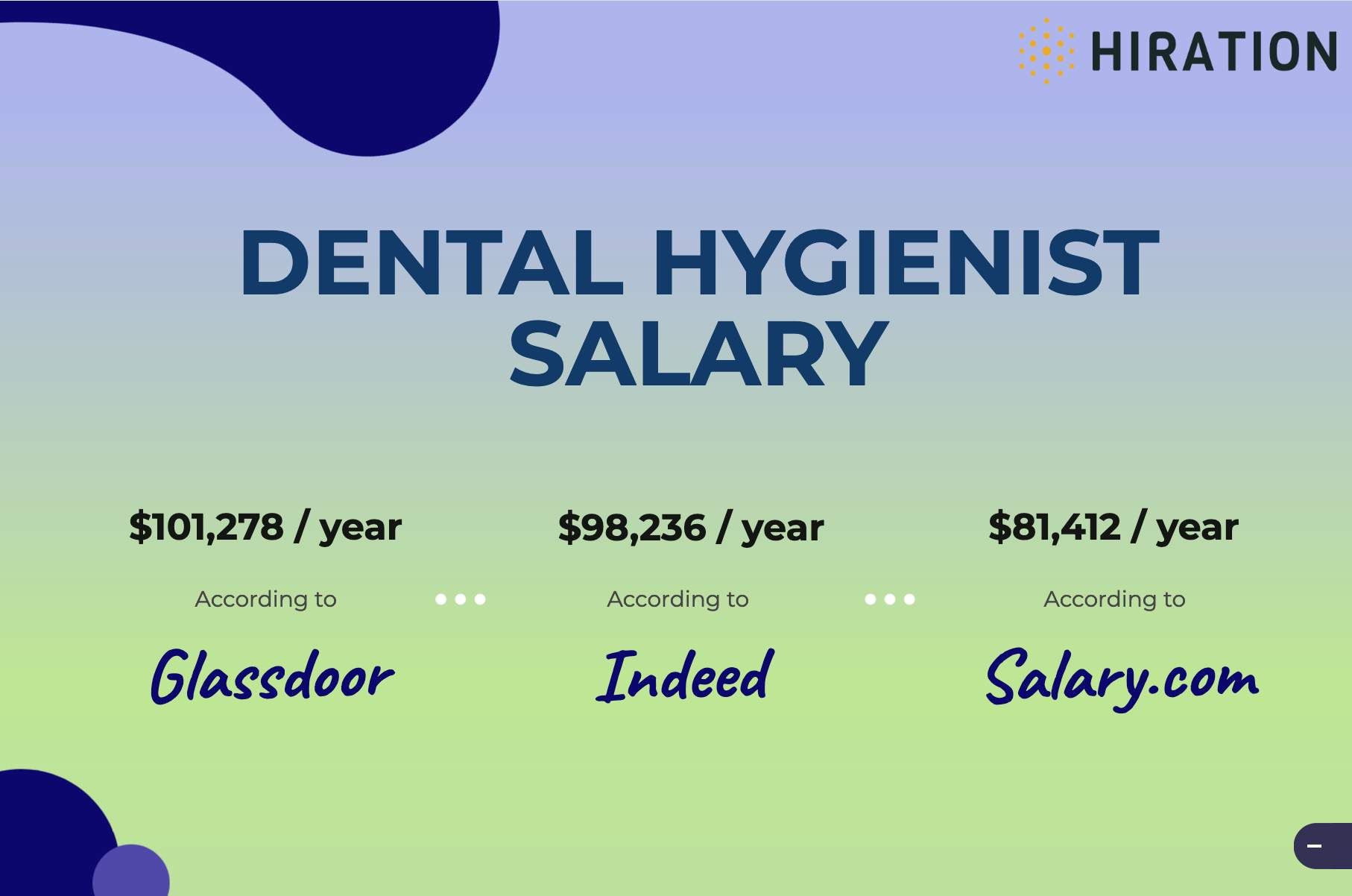

Dental Hygienist Salary In The US Factors Affecting Pay In 2023

https://s3-us-west-2.amazonaws.com/hiration/ghost/2023/08/Screenshot-2023-08-11-at-3-compressed.jpg

Verkko Dimensions of Dental Hygiene is a monthly peer reviewed journal that reconnects practicing dental hygienists with the nation s leading educators and researchers Dimensions is committed to the highest standards of professionalism accuracy and integrity in our mission of education supporting oral health professionals and those Verkko This tax savings tool was designed to help businesses recover from the losses incurred during the most trying times of the pandemic Although many dental practice owners have heard of this tax credit some still have misconceptions about it

Verkko 23 tammik 2023 nbsp 0183 32 As a dental hygienist I am not a tax expert but I believe these definitions are clear in nearly all states dental hygienists would be considered employees not independent contractors The Reporting of Compensation All compensation must be reported to the IRS either by the employer or the independent Verkko 17 elok 2020 nbsp 0183 32 The credit consists of dollar for dollar tax offsets which can be claimed on top of the normal deduction of your research and development costs The average federal R amp D tax credit yields 6 8 percent on qualified costs such as wages to labor supply costs or payments to third party contractors who assist in relevant activities

The Dental Hygienist s Guide To Nutritional Care

https://papyruspub.com/wp-content/uploads/2022/09/The-Dental-Hygienists-Guide-to-Nutritional-Care.jpg

Dentist Vs Dental Hygienist The Differences Manor House Dental

https://manorhousedental.com/wp-content/uploads/2021/11/image1.jpg

https://www.revenue.ie/en/personal-tax-credits-reliefs-and-exemptions/...

Verkko 9 maalisk 2023 nbsp 0183 32 What are qualifying expenses Dental expenses Nursing home and additional nursing care expenses Additional diet expenses for coeliacs and diabetics Additional health care expenses for a child Additional expenses for a kidney patient How do you claim health expenses Dental expenses Routine dental care

https://www.oralhealthgroup.com/features/financial-tips-tricks-and...

Verkko 19 marrask 2019 nbsp 0183 32 TFSAs allow you to earn tax free investment income For example if you have 50 000 in your TFSA invested and it earns 5 2 500 you won t have to report the 2 500 on your personal tax return When you withdraw from a TFSA there will also be no taxes to pay Check with CRA to determine your TFSA balance

Dental Hygienist Logo LogoDix

The Dental Hygienist s Guide To Nutritional Care

Dental Hygienist Gifts Dental Gifts Gifts For Dentist Dental Hygiene

Dental Hygienist Salary Connecticut Your Trusted Dental Care Partner

DENTAL HYGIENIST TAX DEDUCTIONS YOU NEED TO KNOW Tax Accountant

DENTAL HYGIENIST TAX DEDUCTIONS YOU NEED TO KNOW Tax Accountant

Distressed Dental Hygienist And Dental Assistants T Shirt 4LVS

Dental Hygienist Wizehire Online Recruiting Service To Grow Your

What Does A Dental Hygienist Do University Of Bridgeport

Dental Hygienist Tax Credit - Verkko 12 kes 228 k 2023 nbsp 0183 32 Are Dental Expenses Tax Deductible 1 Claim Dental Expenses Helping maintain the dental hygiene of others requires a lot of equipment you need to buy dental instruments and equipment to use daily Dental hygienists also have to wear scrubs masks and gloves while providing dental care to patients