Dependent Tax Deduction 2023 Learn how to claim dependents for tax credits or deductions such as Child Tax Credit Earned Income Tax Credit and more Find out the rules and requirements

Key Takeaways The Child Tax Credit can reduce your taxes by up to 2 000 per qualifying child age 16 or younger If you do Your standard deduction is limited if someone else can claim you as a dependent For the 2023 tax year dependents can claim either 1 250 or their earned

Dependent Tax Deduction 2023

Dependent Tax Deduction 2023

https://www.deel.com/hs-fs/hubfs/Imported_Blog_Media/603cee49df09b50310a13fdc_form w4.png?width=1067&name=603cee49df09b50310a13fdc_form w4.png

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

This publication discusses some tax rules that affect every person who may have to file a fed eral income tax return It answers some basic questions who must file who should For the 2023 tax year the child and dependent care tax credit is 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents to cover day

Beginning in tax year 2023 if a taxpayer can be claimed as a dependent on another person s tax return the standard deduction is limited to the greater of 1 250 or In 2023 exemption deductions are replaced by an increased Standard Deduction a larger Child Tax Credit worth up to

Download Dependent Tax Deduction 2023

More picture related to Dependent Tax Deduction 2023

Tax Rates Absolute Accounting Services

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

Should You Take The Standard Deduction On Your 2021 2022 Taxes

https://www.taxdefensenetwork.com/wp-content/uploads/2021/12/20212022-Standard-Deduction-65-scaled.jpg

2022 Federal Tax Brackets And Standard Deduction Printable Form

https://www.millerkaplan.com/wp-content/uploads/2021/11/Ordinary-Income-Tax-Brackets_2022-1024x914.png

For 2023 the standard deduction for dependents is limited to the greater of 1 250 or your earned income plus 400 but the total can t be more than the normal standard deduction available for A dependent tax deduction can lower your overall tax liability Here are the IRS rules for dependents and how much you can qualify to get deducted

Take note of some sweet tax relief by way of certain tax credits that can come along with claiming dependents on taxes To claim qualifying dependents you must dig into the You can claim a child spouse relative and even a friend as a tax dependent to lower your taxes This is how the IRS determines who can qualify

2021 Taxes For Retirees Explained Cardinal Guide

https://cardinalguide.com/app/uploads/2021/02/Standard_deductions_2021-751x550.jpg

Does The Child And Dependent Care Credit Phase Out Completely Latest

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

https://www.irs.gov/credits-deductions/individuals/dependents

Learn how to claim dependents for tax credits or deductions such as Child Tax Credit Earned Income Tax Credit and more Find out the rules and requirements

https://turbotax.intuit.com/tax-tips/famil…

Key Takeaways The Child Tax Credit can reduce your taxes by up to 2 000 per qualifying child age 16 or younger If you do

:max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png)

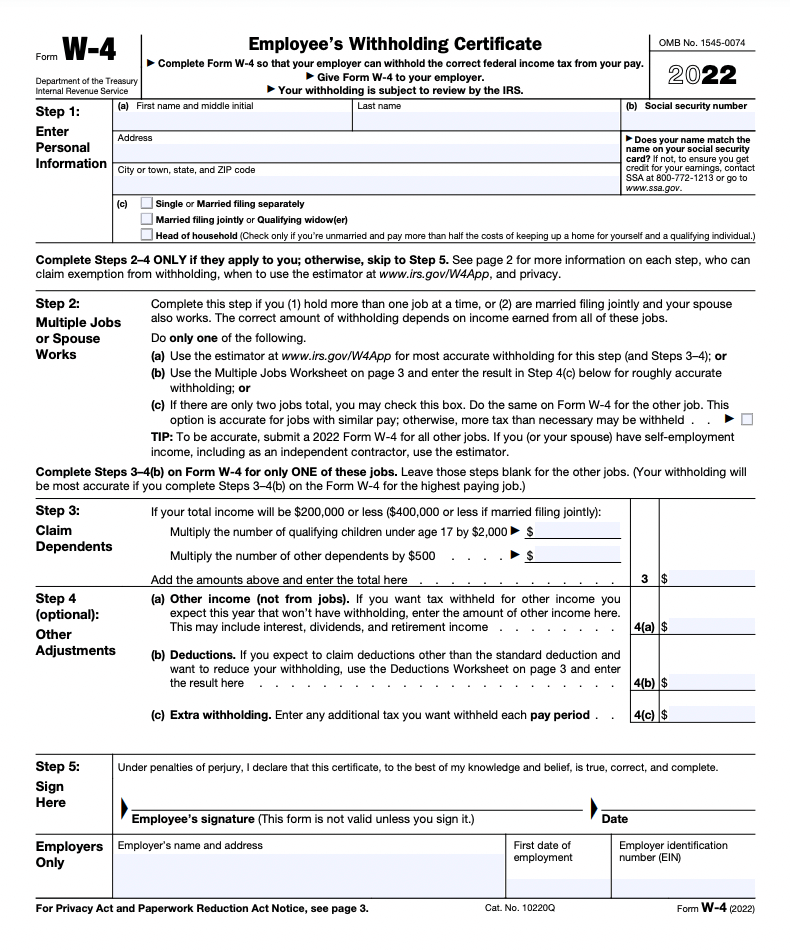

W4 Form 2023 Printable Employees Withholding Certificate W 4 Imagesee

2021 Taxes For Retirees Explained Cardinal Guide

Michigan 2022 Withholding Tables Tripmart

2022 2023

2022 Tax Brackets Married Filing Jointly Irs Printable Form

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

State Income Tax Rates And Brackets 2021 Tax Foundation

2023 IRS Limits The Numbers You Have Been Waiting For

2023 Earnings Tax Withholding Tables All Finance News

Dependent Tax Deduction 2023 - Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional