Dependent Care Tax Credit 2023 You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent who isn t able to care for themselves The credit can be up to 35 of your employment related expenses

Topic no 602 Child and dependent care credit You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to

Dependent Care Tax Credit 2023

Dependent Care Tax Credit 2023

https://mfiworks.com/wp-content/uploads/2021/05/the-child-tax-credit-and-the-dependent-care-credit.jpg

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

Earned Income Credit 2022 Calculator INCOMEBAU

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

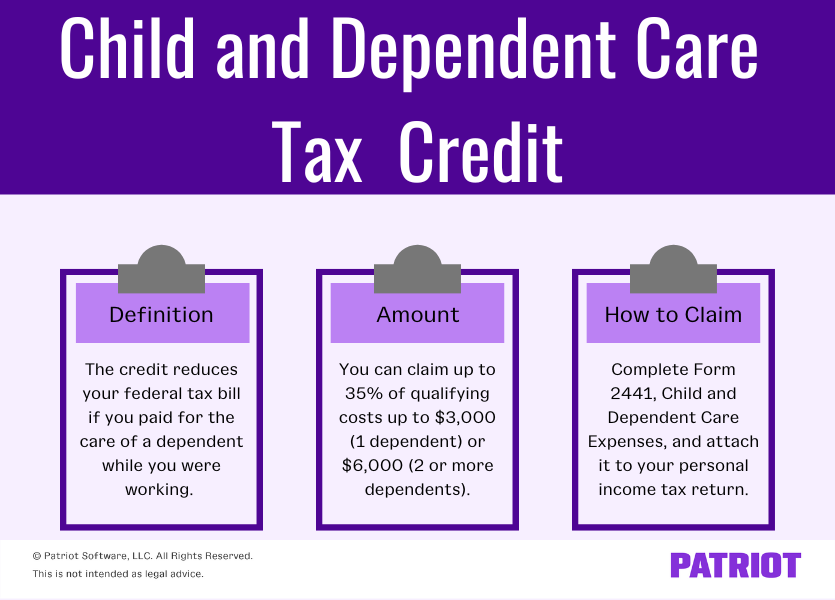

You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Find out how the child and dependent care credit works if you qualify and how to

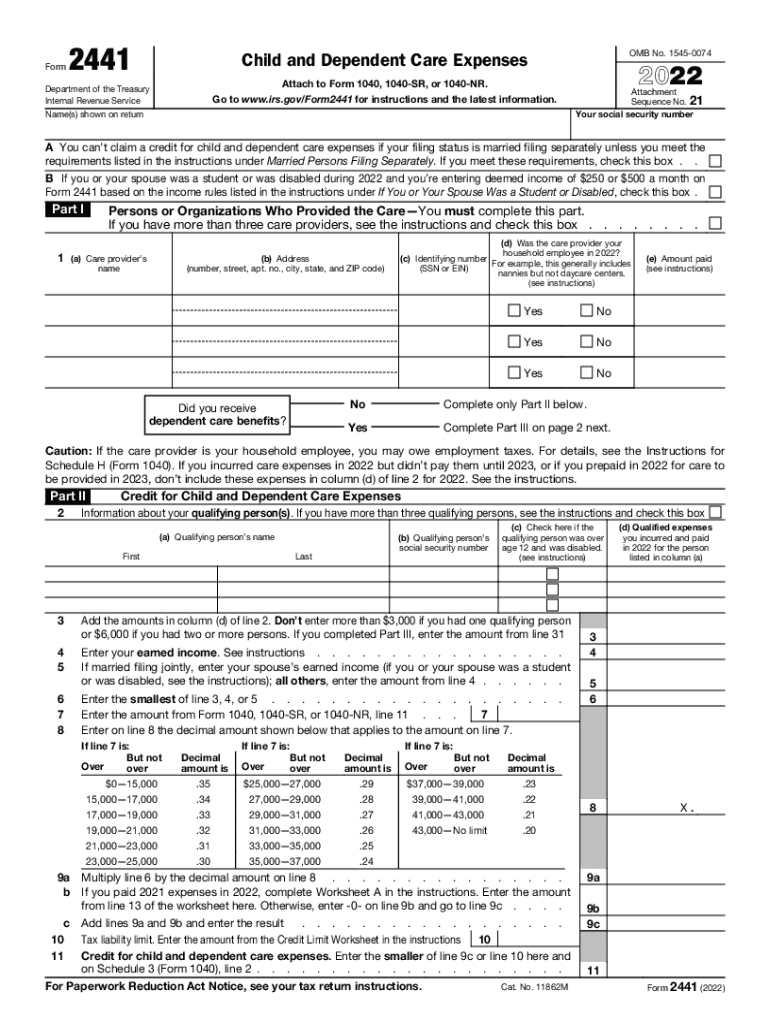

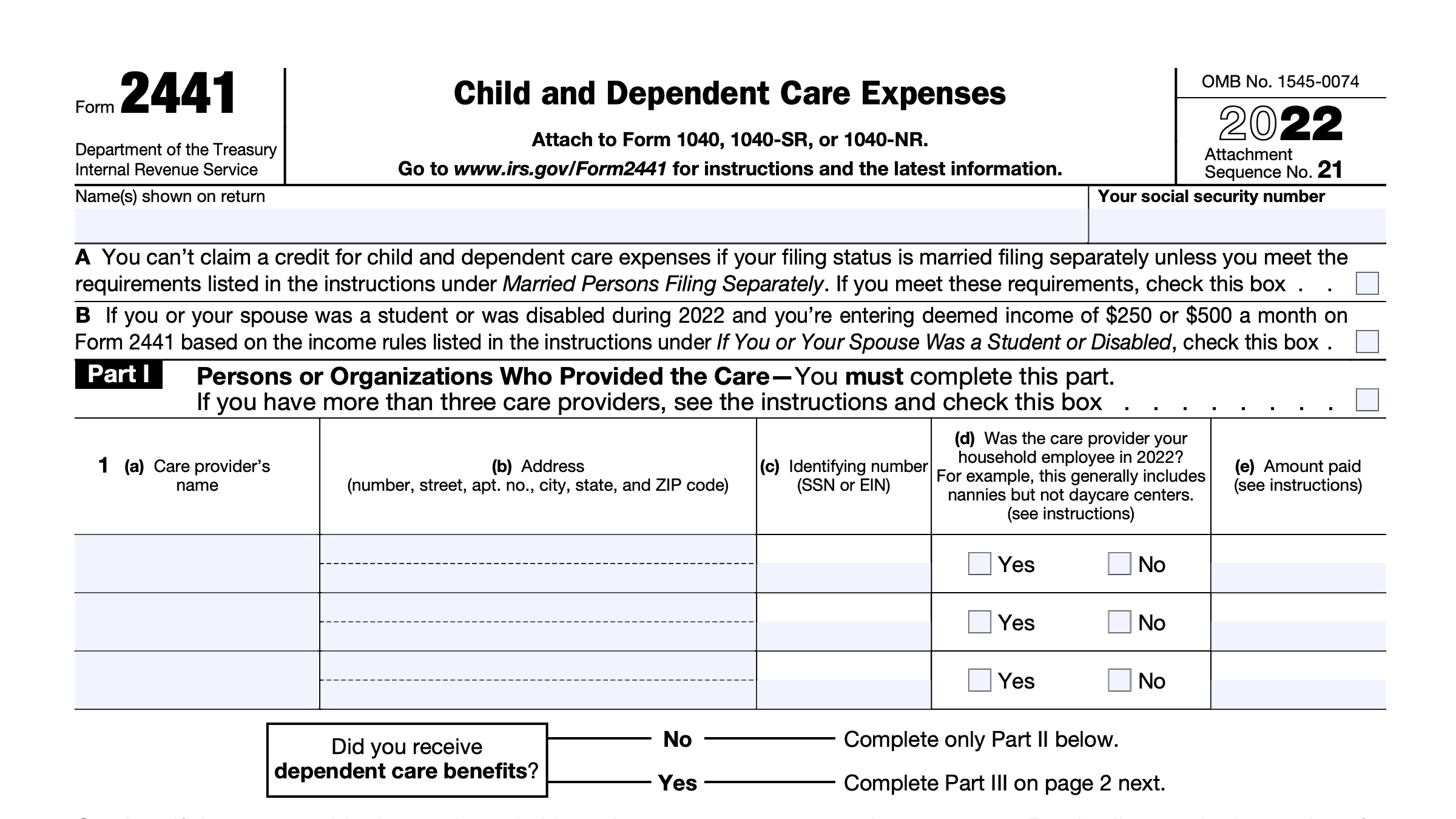

What is the child and dependent care credit This credit allows taxpayers to reduce their tax by a portion of their child and dependent care expenses The credit may be claimed by taxpayers who in order to work or look for work pay someone to take care of their qualifying person A qualifying person is a Qualifying child under age 13 Child and Dependent Care Expenses Tax Year 2023 To be able to claim the credit for child and dependent care expenses you must file Form 1040 1040 SR or 1040 NR and meet the qualifying tests You must have paid expenses for the care of a qualifying individual to enable you or your spouse to work or actively look for work

Download Dependent Care Tax Credit 2023

More picture related to Dependent Care Tax Credit 2023

Does 2022 Get Child Credit Leia Aqui What Is The Tax Break For 2022

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

Child And Dependent Care Credit 2022 2024 Form Fill Out And Sign

https://www.signnow.com/preview/624/654/624654191/large.png

Child And Dependent Care Credit Reduce Your Tax Liability

https://www.patriotsoftware.com/wp-content/uploads/2022/08/child-and-dependent-care-credit-2.png

The Child and Dependent Care Tax Credit is a credit that taxpayers could claim if they ve spent money on qualifying care expenses for their child or other eligible dependent while they work or seek work Take advantage of the 2021 child care credit and receive a refundable tax credit of up to 8 000 This tax season an often overlooked tax credit could put up to 8 000 back in families

[desc-10] [desc-11]

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

https://static.twentyoverten.com/5afae91ee233a94fd2b8b963/bGO8AFn9_9/1616431373979.png

Record High Inflation Brings Changes To Your Tax Bill And Tax Bracket

https://tehcpa.net/wp-content/uploads/2022/09/2023-tax-bracket-married-couple.png

https://www.irs.gov/publications/p503

You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent who isn t able to care for themselves The credit can be up to 35 of your employment related expenses

https://www.irs.gov/taxtopics/tc602

Topic no 602 Child and dependent care credit You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a

2022 Education Tax Credits Are You Eligible

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

IRS Form 2441 Instructions Child And Dependent Care Expenses

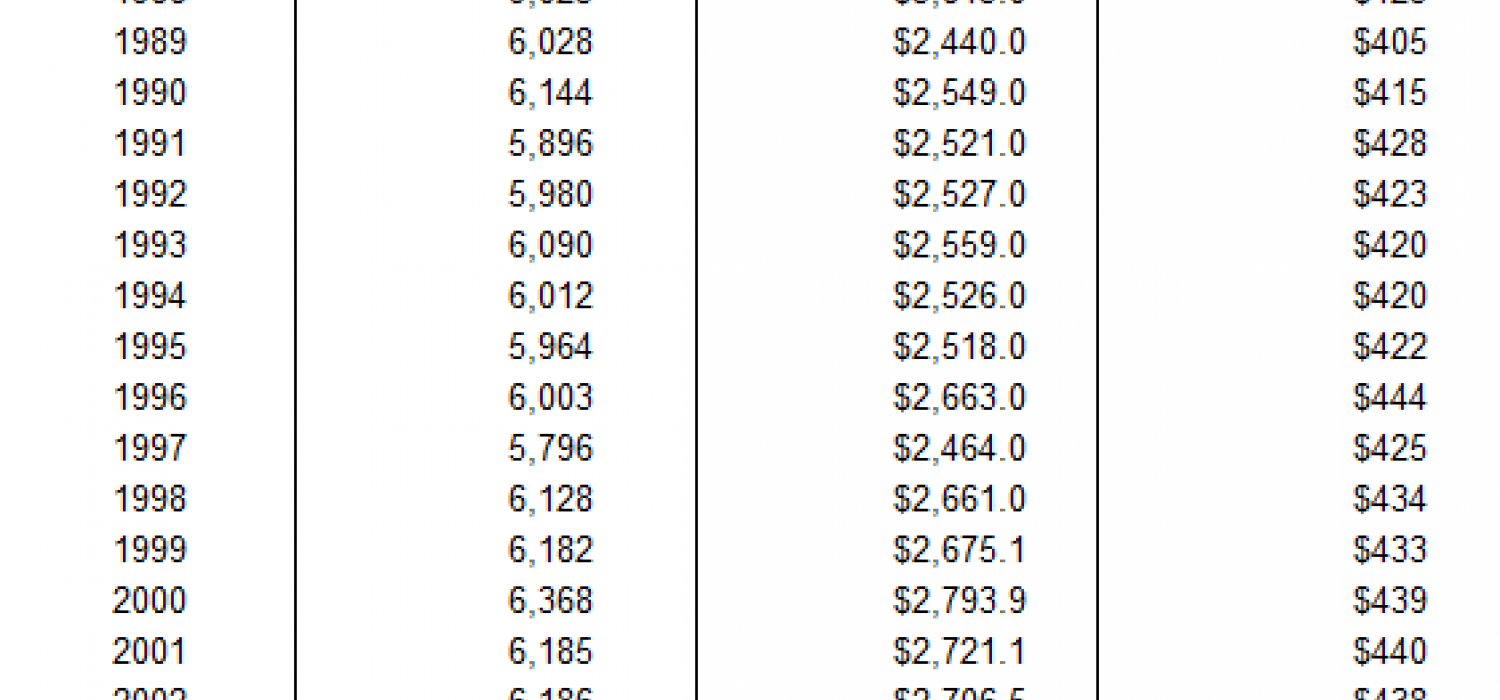

Dependent And Child Care Credits Tax Policy Center

New 2023 IRS Income Tax Brackets And Phaseouts R themind garden

Care Credit Printable Application Printable Word Searches

Care Credit Printable Application Printable Word Searches

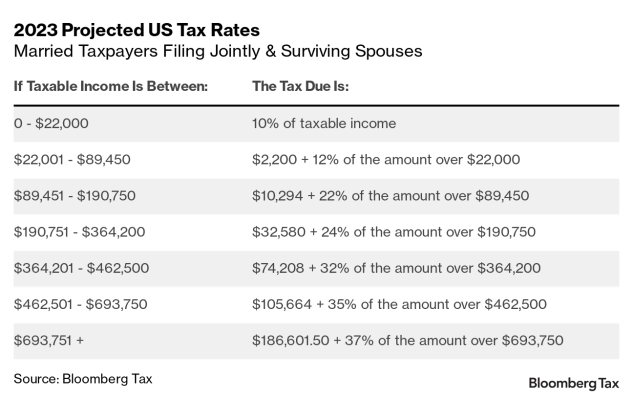

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

Married Taxpayers Filing Jointly

Dependent Care Tax Credit 2023 - [desc-12]