Child Care Tax Credit 2023 Learn how to claim the child and dependent care tax credit for expenses related to care of a child under 13 or a dependent with a disability Find out the credit amount eligibility requirements qualifying expenses and how to

Learn how to claim the Child Tax Credit for each qualifying child who has a valid Social Security number Find out the eligibility factors income limits and other tax You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to

Child Care Tax Credit 2023

Child Care Tax Credit 2023

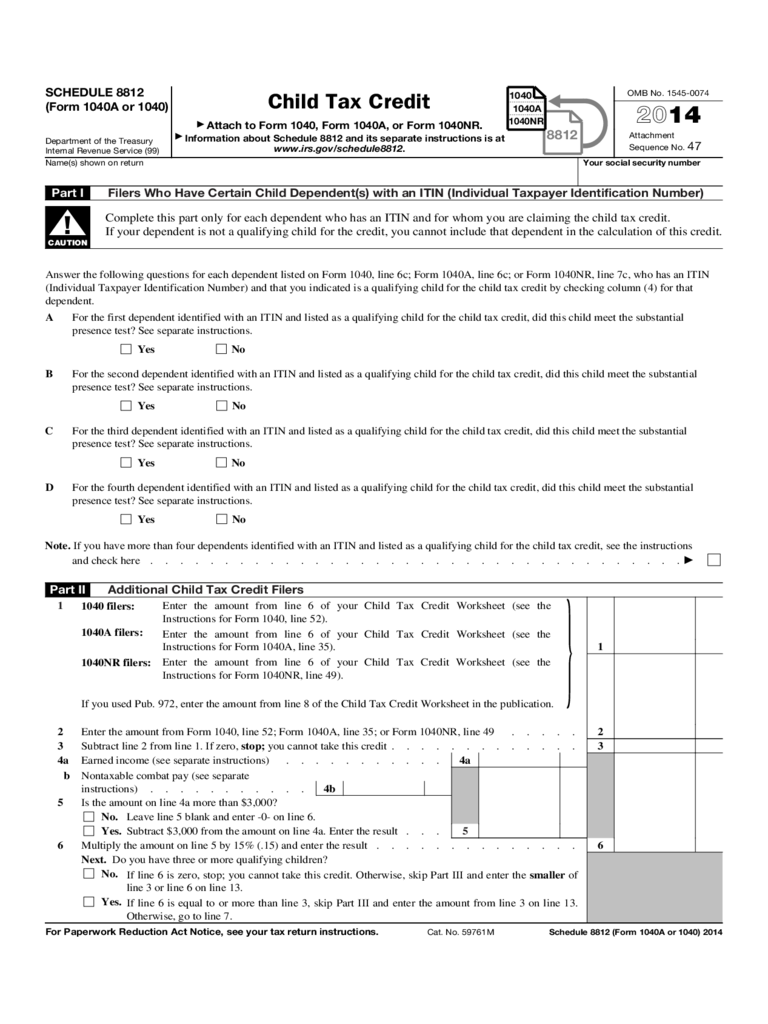

https://handypdf.com/resources/formfile/images/fb/source_images/child-tax-credits-form-irs-d1.png

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

Capital Gains

https://db0ip7zd23b50.cloudfront.net/dims4/default/4d55bc1/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2F21%2F13%2F3b31d5704e9fa71733f5f49524bd%2Fb22189fd0c8f4b6c8d791ab8728170de

If you paid someone to care for a child who was under age 13 when the care was provided and whom you claim as a dependent on your tax return you may qualify for the Child Learn how to claim the child and dependent care credit for 2021 which is fully refundable and worth up to 8 000 for two or more children Find out who qualifies what expenses count and what forms you need to file

Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax Learn how to claim a tax credit for child care expenses if you worked or looked for a job in 2023 Find out the eligibility requirements the amount you can deduct and how to

Download Child Care Tax Credit 2023

More picture related to Child Care Tax Credit 2023

Free Printable Daycare Tax Forms For Parents Printable Form

https://www.pdffiller.com/preview/100/315/100315789/large.png

Yearly Income Guidelines And Thresholds Beyond The Basics

https://www.healthreformbeyondthebasics.org/wp-content/uploads/2022/09/Thumbnail_YearlyGuidelines_CY2023.png

CHILD TAX CREDIT 2023 AMOUNT Tax Refund 2022 2023 IRS TAX REFUND UPDATE

https://i.ytimg.com/vi/uy_73yxbNpo/maxresdefault.jpg

See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit Child and Dependent Care Tax Credit CDCTC Overview Resource October 21 2024 First Five Years Fund Millions of American families are struggling to find quality

The deal would make it easier for low income families to qualify for the CTC and get more money back in their tax refund The CTC would rise to 1 800 per child in 2023 and Let s say you earned 57 250 and paid 16 050 in daycare expenses in 2023 for a single child under age 13 You can claim 20 of 3 000 or 600 as a credit If you owe the

Child Care Tax Credit Dates Librus

https://s-media-cache-ak0.pinimg.com/736x/06/05/27/060527e8a870eabbacbabf70af4b0408.jpg

Child Tax Credit Portal Now Open For Non filers How To Claim Up To

https://www.the-sun.com/wp-content/uploads/sites/6/2021/06/NINTCHDBPICT000653939782-7.jpg

https://www.nerdwallet.com › article › t…

Learn how to claim the child and dependent care tax credit for expenses related to care of a child under 13 or a dependent with a disability Find out the credit amount eligibility requirements qualifying expenses and how to

https://www.irs.gov › ... › individuals › child-tax-credit

Learn how to claim the Child Tax Credit for each qualifying child who has a valid Social Security number Find out the eligibility factors income limits and other tax

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

Child Care Tax Credit Dates Librus

Earned Income Credit Calculator 2021 DannielleThalia

New 2023 IRS Income Tax Brackets And Phaseouts

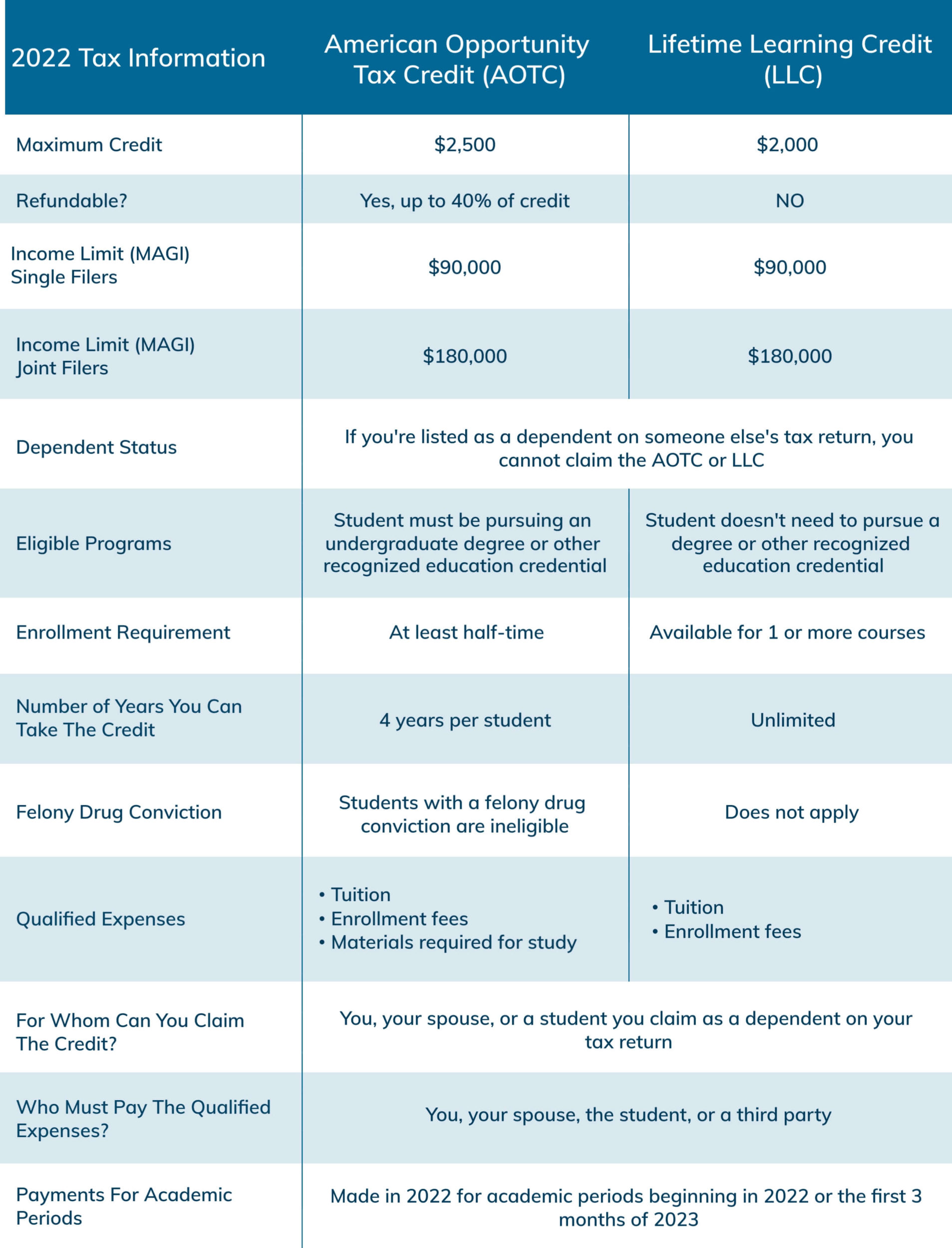

2022 Education Tax Credits Are You Eligible

What The New Child Tax Credit Could Mean For You Now And For Your 2021

What The New Child Tax Credit Could Mean For You Now And For Your 2021

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

Are They Doing Child Tax Credit Monthly Payments In 2022 Leia Aqui

Child Tax Credit Payments 06 28 2021 News Affordable Housing

Child Care Tax Credit 2023 - If you paid someone to care for a child who was under age 13 when the care was provided and whom you claim as a dependent on your tax return you may qualify for the Child