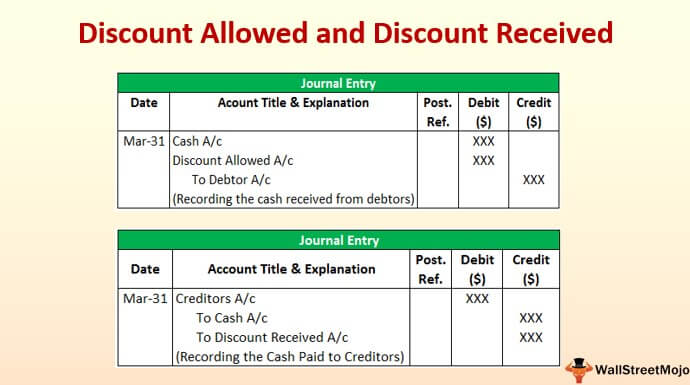

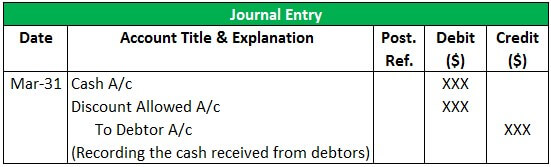

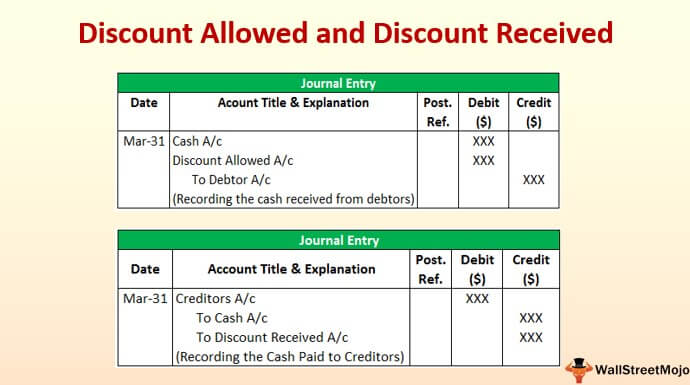

Discount Received Journal Entry With Vat Guide to what is Discount Allowed and what Discount is Received Here we discuss its journal entries including examples advantages differences

Points to be remembered that VAT is not income or expenses of the company This is charged on the goods or services on invoice amount If any discount exist on invoice Journal Entries of Accounting for Sales Discounts The two journal entries as shown below At the time of origination of the sales the seller has no idea whether the buyer

Discount Received Journal Entry With Vat

Discount Received Journal Entry With Vat

https://www.wallstreetmojo.com/wp-content/uploads/2020/07/Discount-Allowed-and-Discount-Received.jpg

Journal Entry For Discount Allowed And Received GeeksforGeeks

https://media.geeksforgeeks.org/wp-content/uploads/20220414190101/CDex-660x320.PNG

Discount Allowed And Discount Received Journal Entries With Examples

https://www.wallstreetmojo.com/wp-content/uploads/2020/07/Discount-Allowed-and-Discount-Received-Journal-Entry-1.4.jpg

Journal Entries for VAT The accurate treatment of VAT by following the requirements of International Account Standards IAS is compulsory for every company You have to pass the Accounting for purchase discounts requires two journal entries Purchase Invoice Posted At the date of purchase the business does not know whether they will settle the outstanding amount early and take the purchases

Accounting for discounts Prompt payment discounts also known as settlement or cash discounts are offered to credit customers to encourage prompt payment of their account Discount Received Income Statement Crediting discount received has the effect of reducing gross purchases by the amount of cash discount received Consequently payables are

Download Discount Received Journal Entry With Vat

More picture related to Discount Received Journal Entry With Vat

Journal Entry For Discount Received Examples TutorsTips

https://tutorstips.com/wp-content/uploads/2018/03/Discount-Received-Feature-Image.png

Journal Entry For Discount Received Explained With Animated Examples

https://i.ytimg.com/vi/dbqK7ue4Atw/maxresdefault.jpg

Example Journal Entry With VAT

https://docs.oracle.com/en/applications/jd-edwards/cross-product/9.2/eoatp/images/gr0018.gif

Symptom You created a Customer Invoice with Applied Discounts Once the Journal Entry for this Invoice is posted you notice that the system is calculating Tax for the applied discount Overview Some suppliers may provide a discount when the company makes an early payment e g within 10 days of credit purchase Likewise when the company receives the discount by

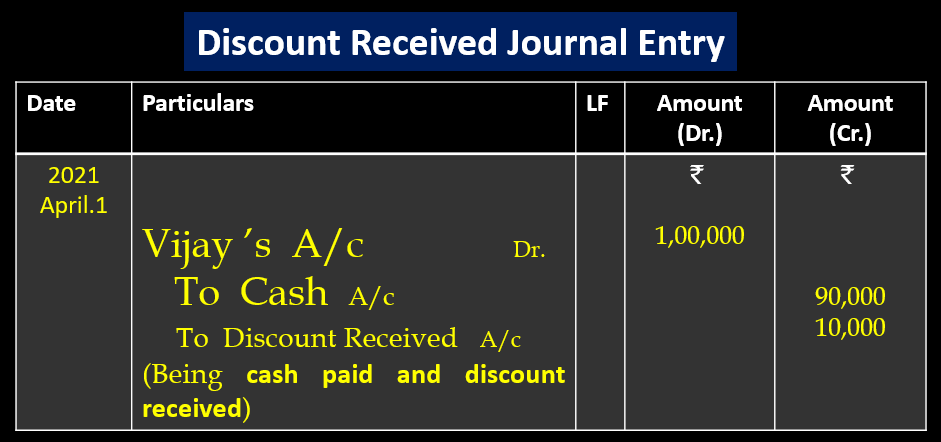

Please prepare journal entries for VAT during purchase and sale Purchase Sale At month end company needs to pay VAT to tax authority During the month we have charge 2 000 from A discount allowed is when the seller grants a payment discount to a buyer A discount received is when the buyer is granted a discount by the seller

Journal Entry For Discount Allowed And Received GeeksforGeeks

https://media.geeksforgeeks.org/wp-content/uploads/20220414185740/TDex-660x315.PNG

Journal Entry For Discount Received Examples TutorsTips

https://i0.wp.com/tutorstips.com/wp-content/uploads/2018/03/Journal-entry-for-discount-Receive-.png?ssl=1

https://www.wallstreetmojo.com › disco…

Guide to what is Discount Allowed and what Discount is Received Here we discuss its journal entries including examples advantages differences

https://accountantskills.com › accounting-entries-for-vat

Points to be remembered that VAT is not income or expenses of the company This is charged on the goods or services on invoice amount If any discount exist on invoice

Discount Received Journal Entry Bhardwaj Accounting Academy

Journal Entry For Discount Allowed And Received GeeksforGeeks

Journal Entry For Discount Allowed And Received GeeksforGeeks

What Does Discounts Received Allowed Mean Online Accounting

Journal Entry For Discount Received Examples TutorsTips

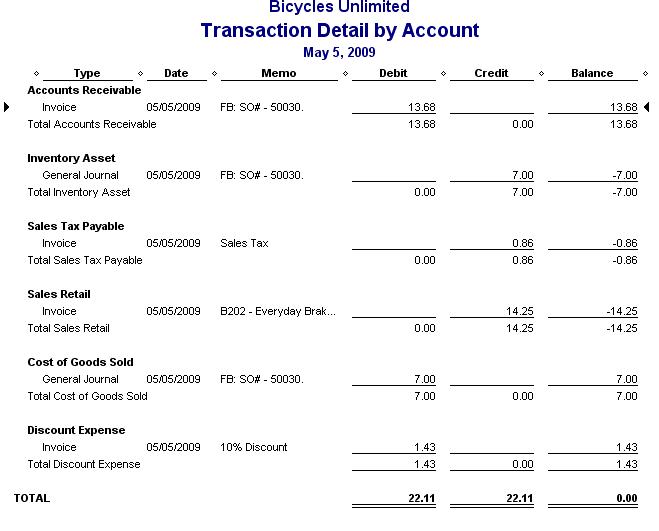

Accounts Receivable Journal Entries In Vat And Discount Perspectives

Accounts Receivable Journal Entries In Vat And Discount Perspectives

Enter Journal Entries With VAT

Journal Entries Of VAT Accounting Education

Advance Payment To Supplier With VAT Tax Accounting Journal Entries

Discount Received Journal Entry With Vat - Accounting for purchase discounts requires two journal entries Purchase Invoice Posted At the date of purchase the business does not know whether they will settle the outstanding amount early and take the purchases