Welcome to Our blog, an area where curiosity fulfills details, and where day-to-day topics become appealing discussions. Whether you're seeking understandings on way of life, modern technology, or a little every little thing in between, you've landed in the right location. Join us on this exploration as we dive into the realms of the average and phenomenal, making sense of the globe one blog post at a time. Your journey right into the remarkable and diverse landscape of our Do Apartments Qualify For Michigan Homestead Property Tax Credit starts right here. Check out the fascinating web content that awaits in our Do Apartments Qualify For Michigan Homestead Property Tax Credit, where we decipher the intricacies of various topics.

Do Apartments Qualify For Michigan Homestead Property Tax Credit

Do Apartments Qualify For Michigan Homestead Property Tax Credit

Credit Versus Exemption In Homestead Property Tax Relief ITR Foundation

Credit Versus Exemption In Homestead Property Tax Relief ITR Foundation

York County Sc Residential Tax Forms Homestead Exemption CountyForms

York County Sc Residential Tax Forms Homestead Exemption CountyForms

Gallery Image for Do Apartments Qualify For Michigan Homestead Property Tax Credit

How To Fill Out Texas Homestead Exemption Form 50 114 The Complete

Gov Justice Signs Bill To Clarify Property Tax Credit

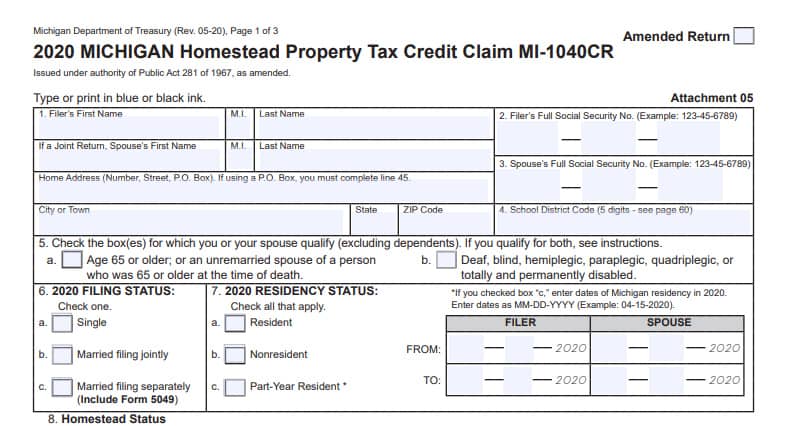

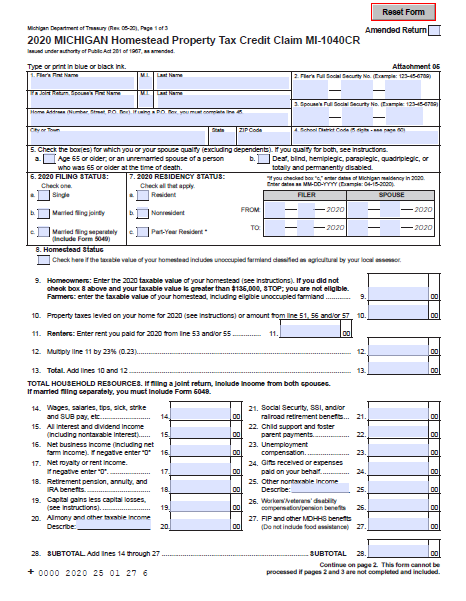

MI Treasury Reminds Tax Filers To Check For Homestead Property Tax

2020 Homestead Property Tax Credit Michigan s Support For Older

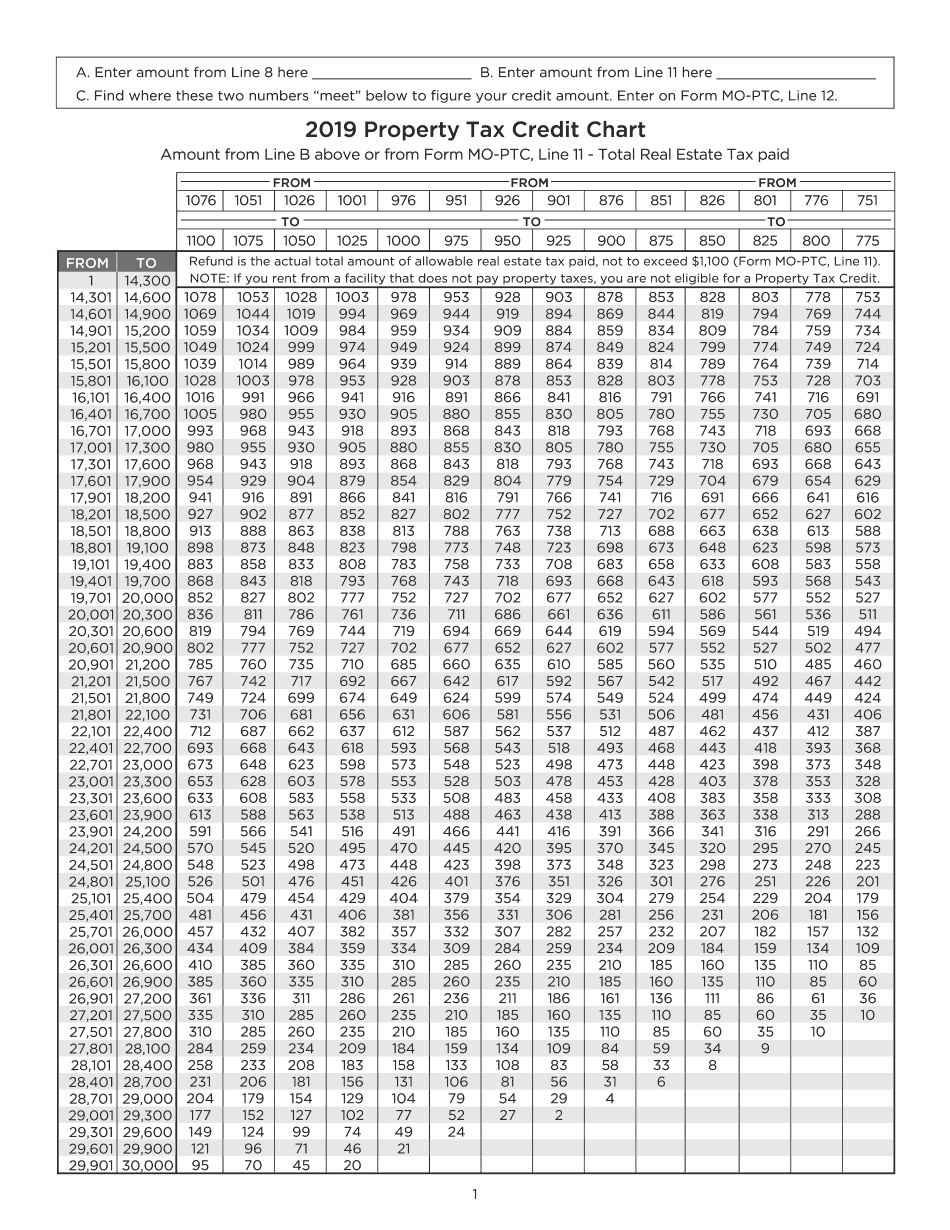

Manage Documents Using Our Editable Form For Property Tax Credit Chart Form

How To Apply For 500 ND Property Tax Credit KX NEWS

How To Apply For 500 ND Property Tax Credit KX NEWS

Michigan Property Tax Fill Out Sign Online DocHub

Thank you for picking to discover our web site. We all the best hope your experience surpasses your expectations, which you find all the information and sources about Do Apartments Qualify For Michigan Homestead Property Tax Credit that you are looking for. Our commitment is to give an easy to use and informative system, so do not hesitate to browse via our web pages with ease.