Do Banks Deduct Tax On Savings Interest Yes you need to include interest in your tax return When you file your income tax return at the end of the financial year you need to declare all your sources of income including interest you ve earned in your savings account You ll declare the interest only not your whole balance and pay tax on it at your standard income tax rate

Banks and other financial providers are not always required to deduct tax from any interest you earn What they will do though is report any interest earned to HM Revenue Customs HMRC at the end of each tax year Most people can earn some interest from their savings without paying tax Your allowances for earning interest before you have to pay tax on it include You get these allowances each

Do Banks Deduct Tax On Savings Interest

Do Banks Deduct Tax On Savings Interest

https://www.livemint.com/lm-img/img/2023/07/26/1600x900/ITR_banks_1690348242153_1690348242317.jpg

Income Tax Return Do Banks Deduct TDS From Your Interest Utility

https://images.news9live.com/wp-content/uploads/2023/07/tds-pixabay.jpg

TDS On Bank Interest 2023 Tax Deduct At Source On Fixed Deposit

https://schemaninja.com/wp-content/uploads/2020/04/TDS-on-Bank-Interest.png

Interest on your savings is paid to you gross The tax you owe is therefore not withheld by the banks before passing the interest you earned on to you Your personal savings allowance is the amount you can earn in interest before you have to start paying tax on it This allowance is based on your tax band You can earn tax free interest with any savings account so long as you don t exceed your annual personal savings allowance Otherwise you might like to explore tax free ISAs Just be aware that annual limits apply

Since the introduction of the Personal Savings Allowance with effect from 6 April 2016 95 of taxpayers have no tax to pay on their savings income including interest Because of this the Some savings products pay interest that s tax free regardless of how much you earn or other savings interest you are receiving These include cash ISAs for savings stocks and shares ISAs for investments saving into a pension Any interest or dividend income earned won t impact your tax free allowances such as the PSA or dividend allowance

Download Do Banks Deduct Tax On Savings Interest

More picture related to Do Banks Deduct Tax On Savings Interest

Tax On Savings Interest Elver Consultancy Chartered Accountants Wigan

https://www.elverconsultancy.co.uk/wp-content/uploads/2018/11/2017-03-23-391386.jpg

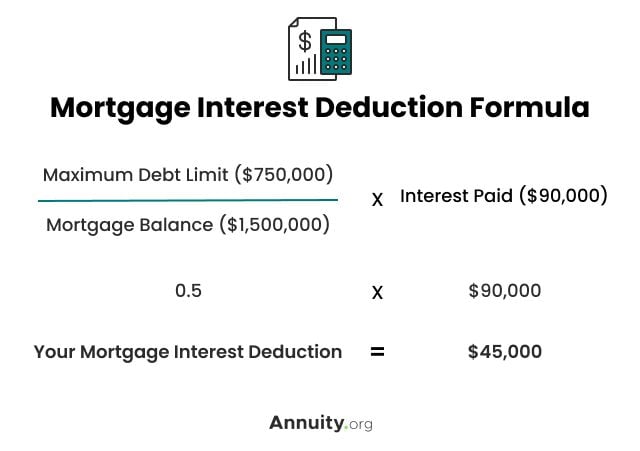

Can You Deduct Mortgage Interest On Investment Property Commercial

https://aurumsharpe.com/wp-content/uploads/2022/09/hh.jpg

Mortgage Interest Tax Relief Calculator DermotHilary

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Guidance and forms for tax on savings and investments Including savings interest savings for children tax on shares and dividends and ISAs Since 6 April 2016 banks and building societies have paid interest gross This means no income tax being taken off Before then we paid interest on non ISA savings and current accounts with an amount taken off for income tax

[desc-10] [desc-11]

Tax Savings 101 Can You Deduct Mortgage Interest On Your Investment

https://canguard.ca/wp-content/uploads/2023/10/mortgage-interest-deduction-from-taxes.width_.jpg

TaxAudit You Can Deduct Mortgage Interest Maybe Sweet Captcha

https://www.sweetcaptcha.com/wp-content/uploads/2019/12/house-mortgage-savings-GI.width-1200-1024x683.jpg

https://www.finder.com.au/tax-returns/how-is...

Yes you need to include interest in your tax return When you file your income tax return at the end of the financial year you need to declare all your sources of income including interest you ve earned in your savings account You ll declare the interest only not your whole balance and pay tax on it at your standard income tax rate

https://www.halifax.co.uk/savings/help-guidance/...

Banks and other financial providers are not always required to deduct tax from any interest you earn What they will do though is report any interest earned to HM Revenue Customs HMRC at the end of each tax year

2023 Section 179 Tax Savings Your Business May Deduct 1 160 000 YouTube

Tax Savings 101 Can You Deduct Mortgage Interest On Your Investment

Tax Deduction Letter PDF Templates Jotform

Banks Will Deduct Tax From Your Cash Withdrawal By Checking Income Tax

You Can Deduct Interest On HELOCs Equity Mortgages Under New Tax Law

How To Pay Tax On Savings Interest Quick Guide

How To Pay Tax On Savings Interest Quick Guide

Is It Legal For Banks To Deduct Credit Card Balance To Your Savings

Deduct Everything Save Money With Hundreds Of Legal Tax Breaks

INCOME TAX ON SAVING BANK INTEREST AND INTEREST ON FIXED DEPOSITS YouTube

Do Banks Deduct Tax On Savings Interest - You can earn tax free interest with any savings account so long as you don t exceed your annual personal savings allowance Otherwise you might like to explore tax free ISAs Just be aware that annual limits apply