Do Disabled Veterans Get A Tax Break Web 26 Apr 2023 nbsp 0183 32 Tax Breaks for Disabled Veterans Federal Tax Return for Disabled Veterans Disabled veterans must file a federal income tax return to get tax breaks that Property Tax Exemption for Disabled Veterans Since property taxes are paid at the local level these exemptions are not Disability Benefit

Web 12 Feb 2014 nbsp 0183 32 Military Disability Retirement Pay shouldn t be included in taxable income if your disability or injury was caused by combat or if you get military disability instead of VA disability for Web 26 Dez 2023 nbsp 0183 32 Disabled veterans may be eligible to claim a federal tax refund based on an increase in the veteran s percentage of disability from the Department of Veterans Affairs which may include a retroactive determination or the combat disabled veteran applying for and being granted Combat Related Special Compensation after an award

Do Disabled Veterans Get A Tax Break

Do Disabled Veterans Get A Tax Break

https://www.disabledvets.com/wp-content/uploads/2022/06/do-spouses-of-100-percent-disabled-veterans-get-benefits-scaled.jpg

How Many Kids Can I Claim On Child Tax Credit The US Sun

https://www.the-sun.com/wp-content/uploads/sites/6/2022/07/kc-child-tax-credit-plat.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

Disabled Veteran Property Tax Exemption In Every State

https://blog.veteransloans.com/wp-content/uploads/2022/08/Blog-Cover-Disabled-Veteran-Property-Tax-Exemption.jpg

Web 11 Nov 2023 nbsp 0183 32 Disabled Veterans may be eligible for tax breaks at the federal and state levels It s worth noting again that disability benefits you receive from the Department of Veterans Affairs Web 19 Okt 2023 nbsp 0183 32 However if you receive disability payments instead of or in addition to your pension those payments are tax free You don t even need to report them on your tax return Veterans with a particular disability and or are housebound may also qualify for Aid and Attendance A amp A or Housebound benefits

Web Yes the IRS has several tax breaks for veterans available Tax free pensions disability payments grants and dependent care assistance Tax free VA education and training benefits such as the Post 9 11 GI Bill Earned Income Tax Credit EITC that benefits low to moderate income taxpayers including many veterans Web 1 Feb 2023 nbsp 0183 32 Partnership with VA The IRS and US Department of Veterans Affairs entered into a Memorandum of Understanding in 2015 The primary focus of the MOU is to provide free tax preparation services to Veterans and their families Partnering organizations prepare tax returns free of charge for low to moderate income taxpayers

Download Do Disabled Veterans Get A Tax Break

More picture related to Do Disabled Veterans Get A Tax Break

Can Disabled Veterans On SSI Get A VA Mortgage Mortgage Solutions

https://mortgagesolutions.net/wp-content/uploads/disabled-veterans-va-mortgage.jpg

Disabled Veteran Benefits By State NMEDA

http://www.nmeda.com/wp-content/uploads/2016/12/Disabled-Veteran-Benefits-by-State.jpg

Giving Disabled Veterans An Even Break

https://1040.staticserve.net/assets/blog/images/1040-DisabledVeterans.jpg

Web 26 Okt 2023 nbsp 0183 32 The federal government assigns tax breaks to military members based on whether they are on active duty or veterans as they typically bring in different kinds of income resulting from their respective phases in their lives and careers This section explains tax exclusions that apply to veterans Web 16 Feb 2021 nbsp 0183 32 Disabled veterans can qualify for property tax exemptions at the state level These breaks which are usually tied to a specific disability rating can help a veteran save thousands of dollars You can view a list of all property tax exemptions by state and disability percentage here

Web 1 Feb 2023 nbsp 0183 32 Federal and state government offer additional tax breaks to disabled veterans such as property tax benefits The specific benefit you receive depends on where you live In Florida for example a veteran with a minimum 10 percent disability rating can receive a property tax deduction of up to 5 000 That state provides a full property tax Web A veteran who has a disability from service at least 10 could get a tax exemption worth 5 000 on property tax Also a total disability qualifies a veteran for a full property exemption Applying for Tax Breaks Even though the criteria differ for each state one might need to file paperwork to claim them

Top 15 States For 100 Disabled Veteran Benefits CCK Law

https://cck-law.com/wp-content/uploads/2023/05/Top-15-States-for-100-Disabled-Veteran-Benefits-1.jpg

Hecht Group Disabled Veterans In Idaho Are Entitled To A Property Tax

https://img.hechtgroup.com/1664073719689.png

https://www.militarymoney.com/veterans/tax-breaks-for-disabled-vets

Web 26 Apr 2023 nbsp 0183 32 Tax Breaks for Disabled Veterans Federal Tax Return for Disabled Veterans Disabled veterans must file a federal income tax return to get tax breaks that Property Tax Exemption for Disabled Veterans Since property taxes are paid at the local level these exemptions are not Disability Benefit

https://www.military.com/money/personal-finance/taxes-on-military...

Web 12 Feb 2014 nbsp 0183 32 Military Disability Retirement Pay shouldn t be included in taxable income if your disability or injury was caused by combat or if you get military disability instead of VA disability for

Disabled Veterans Property Tax Exemptions By State Tax Exemption

Top 15 States For 100 Disabled Veteran Benefits CCK Law

Do Disabled Veterans Have To Pay Property Taxes In Arizona YouTube

Can Disabled Veterans Get A Discount On Car Insurance Dripiv Plus

Hecht Group Oklahoma Property Tax Exemption For Disabled Veterans

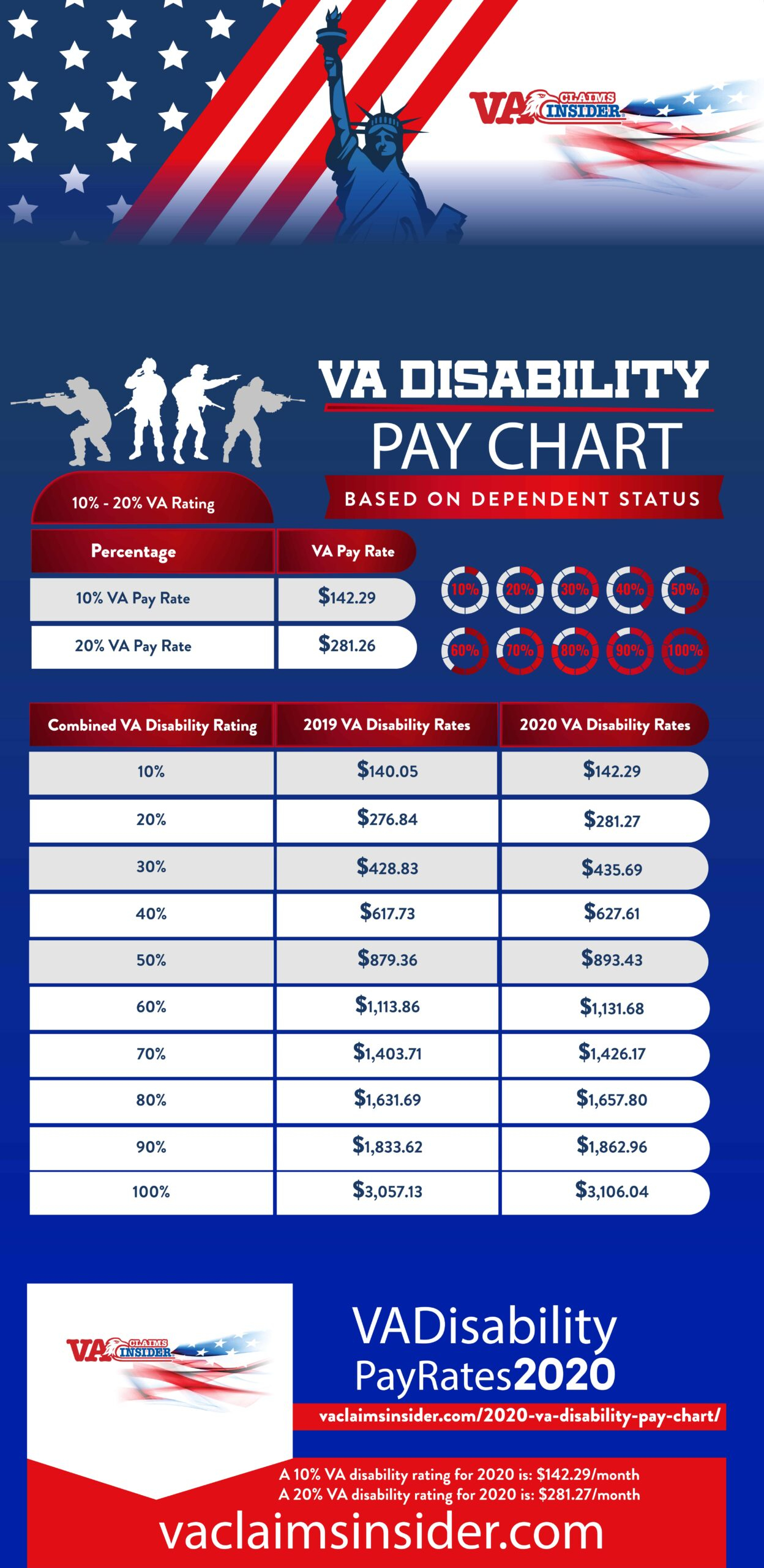

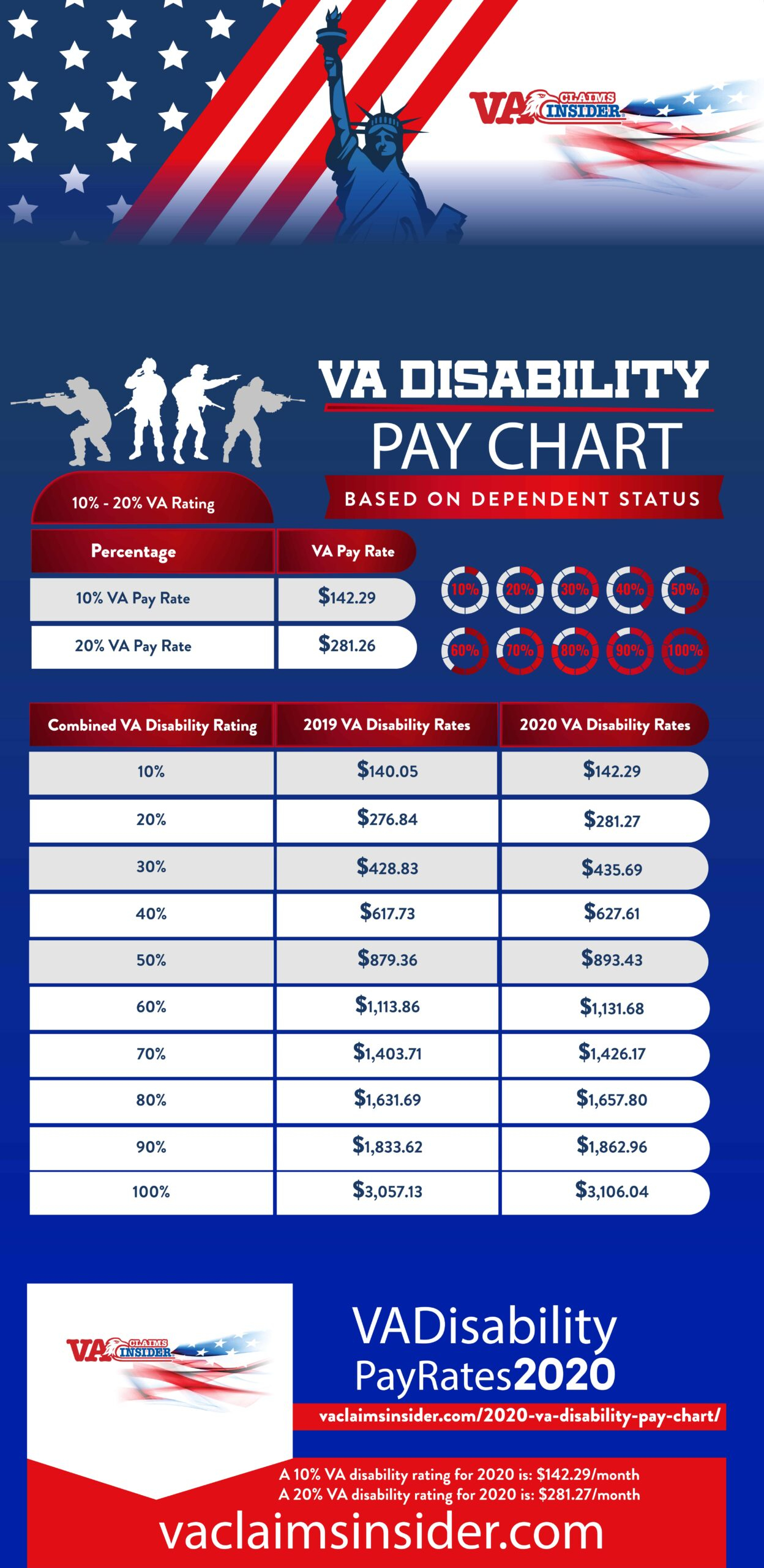

VA Disability Payment Increase VA Disability Rates 2021

VA Disability Payment Increase VA Disability Rates 2021

What Do Disabled Veterans Do If Not Receiving The Treatment They

Property Tax Exemption For Disabled Veterans Esper Aiello Law Group

Additional Benefits For 100 Disabled Veterans CCK Law

Do Disabled Veterans Get A Tax Break - Web 1 Feb 2023 nbsp 0183 32 Partnership with VA The IRS and US Department of Veterans Affairs entered into a Memorandum of Understanding in 2015 The primary focus of the MOU is to provide free tax preparation services to Veterans and their families Partnering organizations prepare tax returns free of charge for low to moderate income taxpayers