Do Hybrid Vehicles Qualify For Tax Credit You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified A6 Beginning Jan 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500 The amount of the credit depends on when the eligible new clean vehicle is placed in

Do Hybrid Vehicles Qualify For Tax Credit

Do Hybrid Vehicles Qualify For Tax Credit

https://static01.nyt.com/images/2022/12/29/multimedia/29EV-LIST-1-7403/29EV-LIST-1-7403-videoSixteenByNine3000.jpg

New Rules Which Electric Vehicles Qualify For The Federal Tax Credit

https://s.hdnux.com/photos/01/27/02/00/22814758/4/rawImage.jpg

What To Know About The 7 500 IRS EV Tax Credit For Electric Cars In

https://media.npr.org/assets/img/2023/01/06/gettyimages-1434797501_wide-81e5e737847555467ff1f49e67402d1a8e8c5801-s1100-c50.jpg

Pricing for the hybrid model starts at 52 750 and it s the only PHEV on the list that s eligible for the full 7500 tax credit All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Find out if your vehicle qualifies for a federal income tax credit of up to 7 500 based on the battery capacity Learn the requirements phaseout dates and As of the start of the year the implementation of new rules by the Department of Energy DOE means only 13 vehicles qualify for federal tax credits for electric vehicles made in

Download Do Hybrid Vehicles Qualify For Tax Credit

More picture related to Do Hybrid Vehicles Qualify For Tax Credit

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

Income Tax Credit Electric Vehicle Update Income Tax Payments Deferred

https://www.taxproadvice.com/wp-content/uploads/tax-credits-drive-electric-northern-colorado-932x1024.png

Lexus Responds To EV Price Wars With Whopping RZ Discount CarBuzz

https://cdn.carbuzz.com/gallery-images/1600/1156000/300/1156312.jpg

A year ago nearly every new electric vehicle and plug in hybrid on the market qualified for a federal tax credit of up to 7 500 provided it was manufactured in As of late 2023 just seven plug in hybrids are eligible for a federal tax credit but there s a workaround

A federal hybrid car tax credit is available to consumers who buy plug in electric vehicles EVs in the United States According to the U S Department of Energy you can receive The electric vehicle tax credit or the EV credit is a nonrefundable tax credit offered to taxpayers who purchase qualifying electric vehicles or plug in hybrid

All About Tax Credit For EV PHEV And Hybrid Cars CarBuzz

https://cdn.carbuzz.com/gallery-images/1600/954000/800/954828.jpg

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction

https://www.irs.gov/newsroom/qualifying-clean...

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Rivian.png)

New Clean Vehicle Tax Credit Plan Means Most EVs No Longer Qualify 2022

All About Tax Credit For EV PHEV And Hybrid Cars CarBuzz

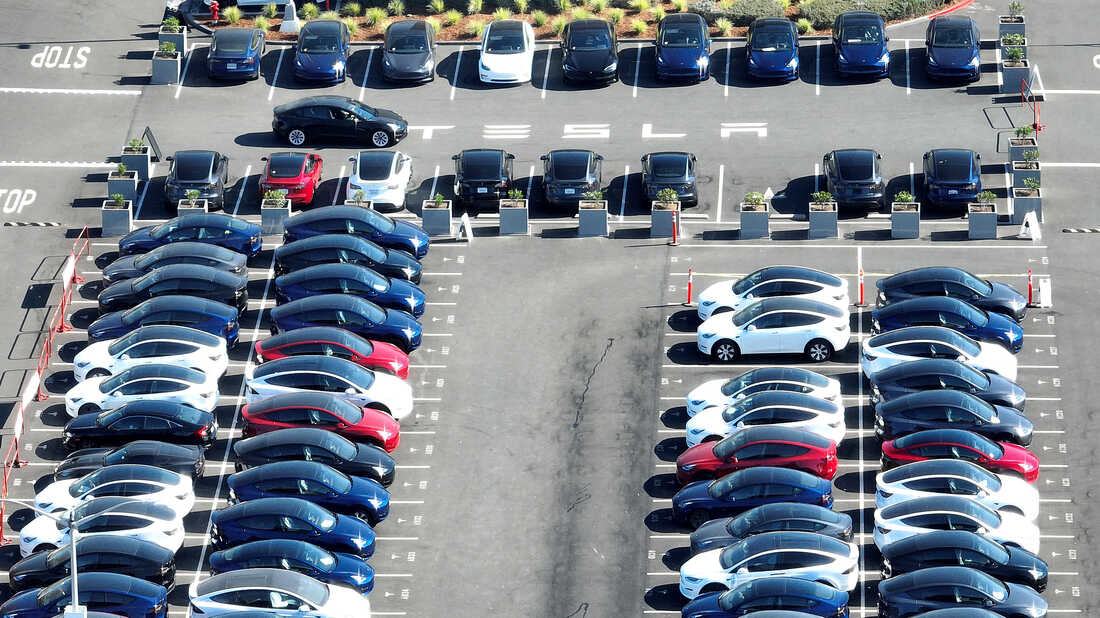

Tesla Model Y And Other Electric Vehicles Will Now Qualify For 7 500

These Electric Cars Qualify For The EV Tax Credits

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Rivian Forums R1T R1S Owners News Discussions RIVN Stock

Rivian Forums R1T R1S Owners News Discussions RIVN Stock

Car Donation Tax Deduction Tax Benefits Of Donating A Car

Toyota Hilux 2022 Dibandingkan

The Uptake Of Plug in Hybrid Electric Vehicles In Europe s Company Car

Do Hybrid Vehicles Qualify For Tax Credit - As promised here is the current list of used EVs that qualify for tax credits in the US per the IRS separated by all electric BEVs and plug in hybrids PHEVs