Do I Get Tax Relief On Student Loan Payments Tax relief is available for interest on loans where the borrowed money is used for certain specific purposes You can also claim relief for alternative finance payments paid on a

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the Student loans can factor into your taxes as the interest is often tax deductible So you can reduce your tax bill if you include the amount of interest you ve paid during

Do I Get Tax Relief On Student Loan Payments

Do I Get Tax Relief On Student Loan Payments

https://www.moneymatters101.com/wp-content/uploads/2018/04/stloans4.jpg

More Employers Adding Student Loan Payments As A Job Benefit

https://ewscripps.brightspotcdn.com/dims4/default/c0bad39/2147483647/strip/true/crop/1024x576+0+54/resize/1280x720!/quality/90/?url=https:%2F%2Fewscripps.brightspotcdn.com%2Fb9%2Fb5%2Feda2b0294dc6bdf0e2e90b23b507%2Fap22111460700201.jpg

Student Loan Payments In The COVID 19 Crisis Penobscot Financial Advisors

https://penobscotfa.com/wp-content/uploads/2020/04/Student-Loans-2048x1365.jpeg

If you ve paid interest on your student loans you may be able to reduce your federal taxable income by up to 2 500 thanks to the student loan interest deduction or SLID Paying or defaulting on student loans and having student loan debt forgiven can have an impact on your tax return Check out these tips before you file

Five Tax Breaks for Paying Your Student Loan After a three year pause student loan payments have resumed putting a dent in people s wallets But there are some tax breaks that can help Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year

Download Do I Get Tax Relief On Student Loan Payments

More picture related to Do I Get Tax Relief On Student Loan Payments

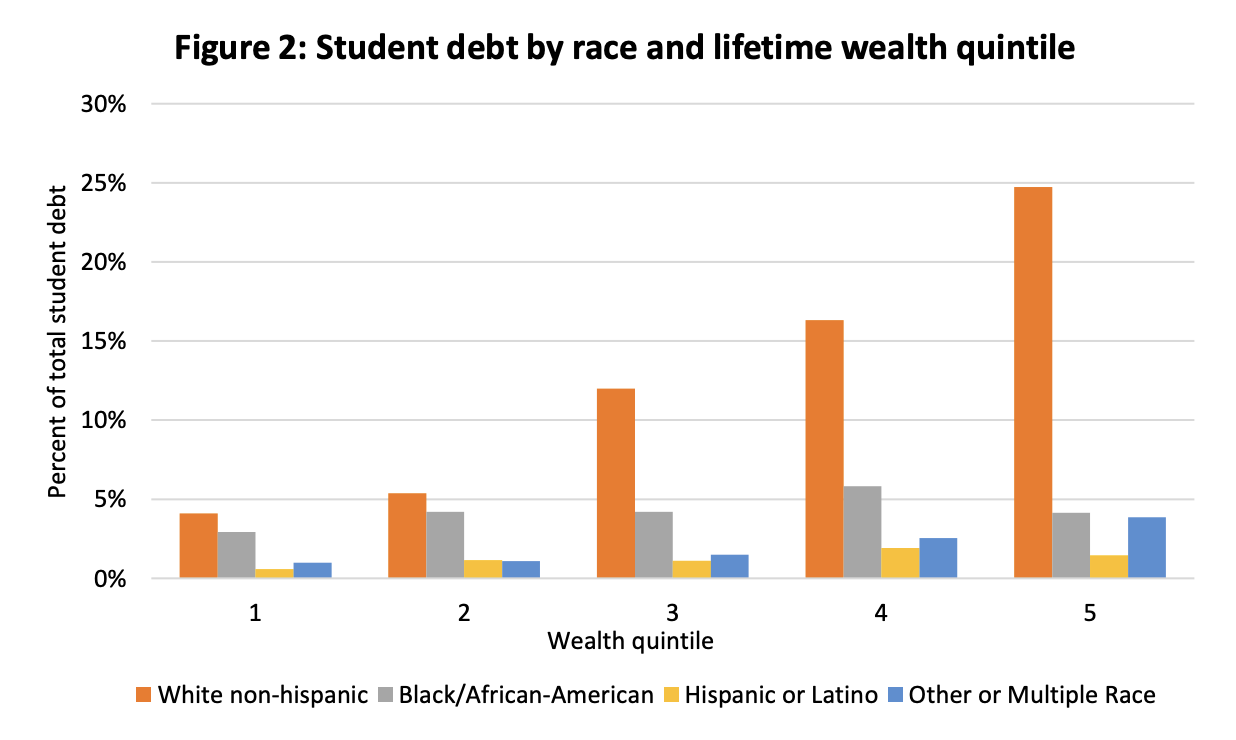

Student Loan Forgiveness Proves Democrats Are Party Of The Rich

https://nypost.com/wp-content/uploads/sites/2/2022/03/money-diploma.jpg?resize=1064

Student Loans Payment Resume Key Dates You Must Consider Now That

https://phantom-marca.unidadeditorial.es/e3ae09fad4671029fff000aa005b5f70/resize/1320/f/jpg/assets/multimedia/imagenes/2023/02/28/16775751269529.png

How To Consolidate Student Loans In 2023 BengaliNewz

https://www.greencountryfcu.com/wp-content/uploads/2020/09/student-loan.jpg

Student loan forgiveness in 2022 will not increase your federal taxable income thanks to the latest American Rescue Plan that makes all student loan forgiveness tax free You may be Based on factors such as your filing status and household income you may qualify for certain tax deductions and credits if you paid interest on a qualified student loan Deductions reduce

However if your modified adjusted gross income MAGI is less than 80 000 160 000 if filing a joint return there is a special deduction allowed for paying interest on a student loan also known as an education loan used for higher education Luckily taxpayers who make student loan payments on a qualified student loan may be able to get some relief if the loan they took out solely paid for higher education In many cases the interest portion of your student loan payments paid during the tax year is tax deductible

Student Loan Rehabilitation What Is It How Does It Work

https://www.studentdebtrelief.us/wp-content/uploads/2014/08/obama-student-loan-forgiveness.png

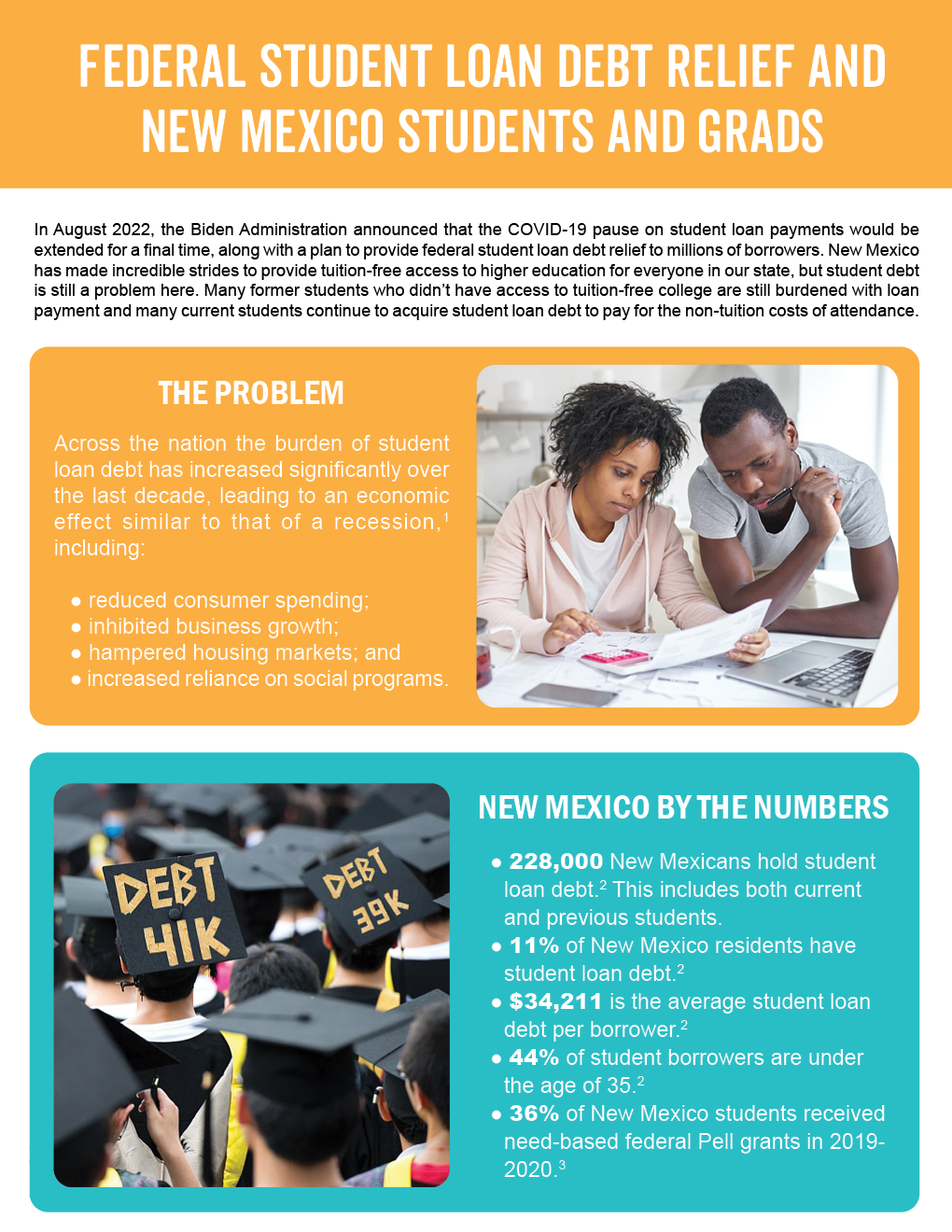

Federal Student Loan Debt Relief And New Mexico Students And Grads

https://www.nmvoices.org/wp-content/uploads/2022/10/Student-debt-fact-sheet_fontpage.png

https://www.gov.uk/government/publications/interest...

Tax relief is available for interest on loans where the borrowed money is used for certain specific purposes You can also claim relief for alternative finance payments paid on a

https://www.forbes.com/advisor/taxes/student-loan...

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

Can I Get Tax Relief On Pension Contributions Financial Advisers

Student Loan Rehabilitation What Is It How Does It Work

Learn How To Generate Tax Debt Relief Leads At Broker Calls

What Will Happen To Your Student Loans Now The New York Times

New Report Shows Student Debt Cancellation Is Regressive Committee

How To Get Tax Relief On Bad Debt CHW Accounting

How To Get Tax Relief On Bad Debt CHW Accounting

5 Myths About Credit That Can Mess With Your Score

Biden Announces Student Loan Forgiveness Are You Eligible

How The REPAYE Plan Works For Student Loans Student Loans Student

Do I Get Tax Relief On Student Loan Payments - Paying or defaulting on student loans and having student loan debt forgiven can have an impact on your tax return Check out these tips before you file