Do I Qualify For Child Care Tax Credit Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit

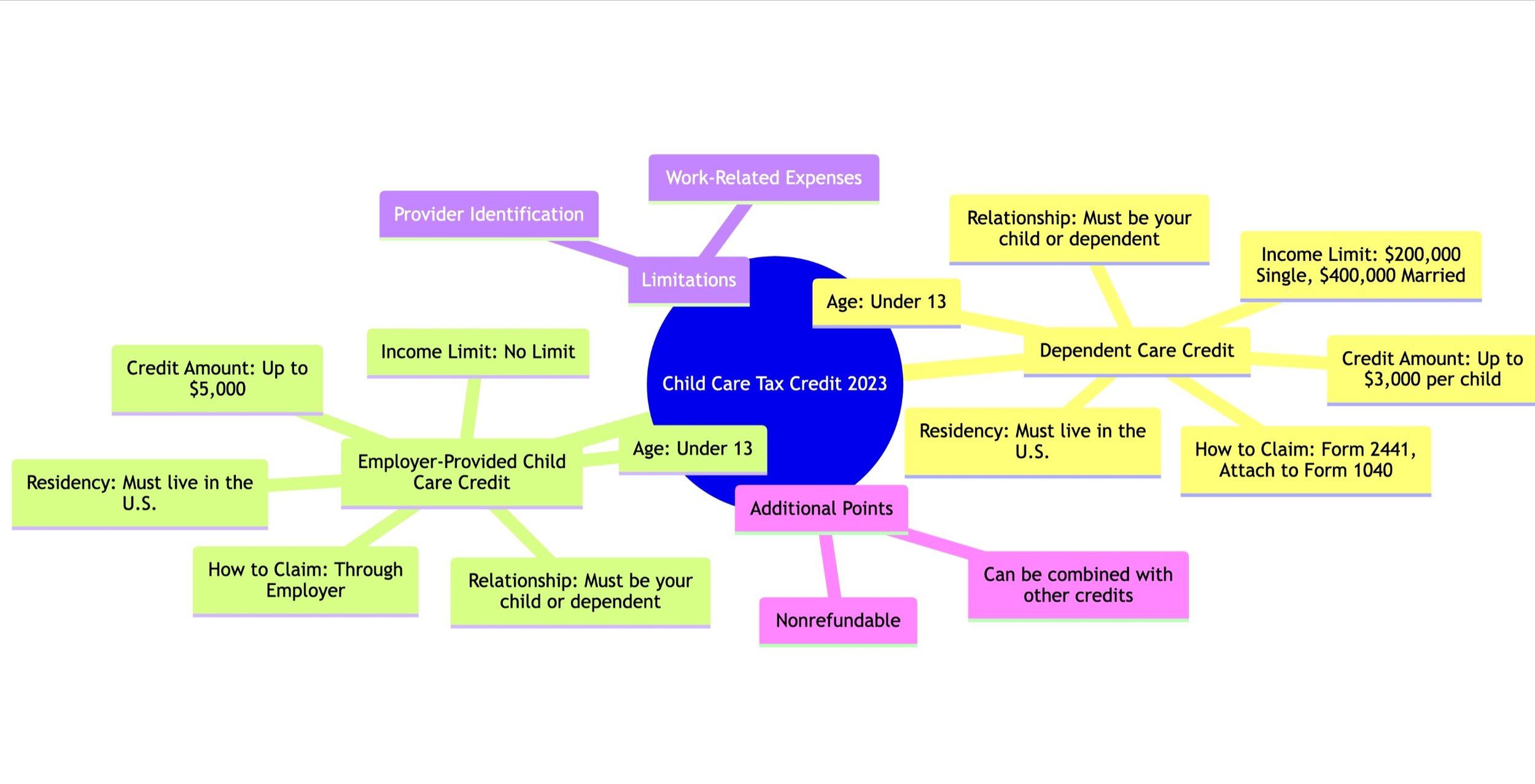

The child tax credit is a nonrefundable tax credit available to taxpayers with dependent children under the age of 17 The credit The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care

Do I Qualify For Child Care Tax Credit

Do I Qualify For Child Care Tax Credit

https://cdn.mos.cms.futurecdn.net/Q6FW9iHViwDjjo7YZxrHj3.jpg

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Child Care Tax Credit 2021 2022 Requirements What It Is Sittercity

https://www.sittercity.com/wp-content/uploads/2020/02/GettyImages-1180592592-1-scaled-e1581105297103.jpg

Thanks to a temporary change codified in the American Rescue Plan parents or guardians can now claim a maximum credit of 4 000 50 of 8 000 in expenses for one child and 8 000 for two or Both of the following must apply your child is in approved childcare the childcare is provided in person not online If you have a child and you re already claiming Working

To qualify for the child and dependent care credit you must have paid someone such as a daycare provider to care for one or more of the following people a If you re a parent or caretaker of young children disabled dependents or a disabled spouse listen up you may qualify for a special tax credit used for claiming child care expenses and dependent care expenses

Download Do I Qualify For Child Care Tax Credit

More picture related to Do I Qualify For Child Care Tax Credit

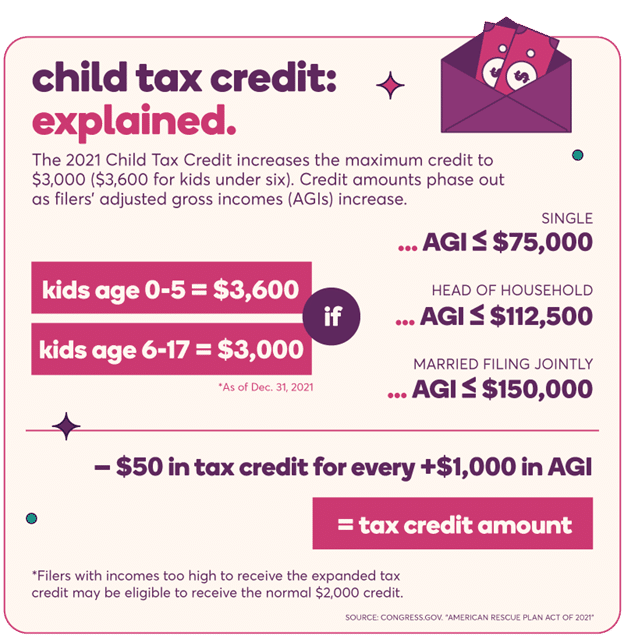

Childcare Tax Statementchild Tax Statementdaycare Tax Etsy

https://i.etsystatic.com/22031907/r/il/c951c4/4432493562/il_fullxfull.4432493562_sh1f.jpg

Minnesota Tax Credits For Workers And Families

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Are They Doing Child Tax Credit Monthly Payments In 2022 Leia Aqui

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/11/GettyImages-1398954446.jpg

Here is everything you need to know to claim the Child and Dependent Care Tax Credit on your tax return How much is the Child and Dependent Care Credit worth If you have one dependent the Child Information you ll need The date of birth for the child or dependent that received care If married your filing status The tool is designed for taxpayers who were U S citizens or

Here are eight dependent tax breaks to consider when preparing your taxes which can help you save money and maximize your refund The Child Tax Credit CTC The Child Care Tax Credit officially known as the Child and Dependent Care Tax Credit CDCTC for short provides taxpayers with children a much needed tax break from

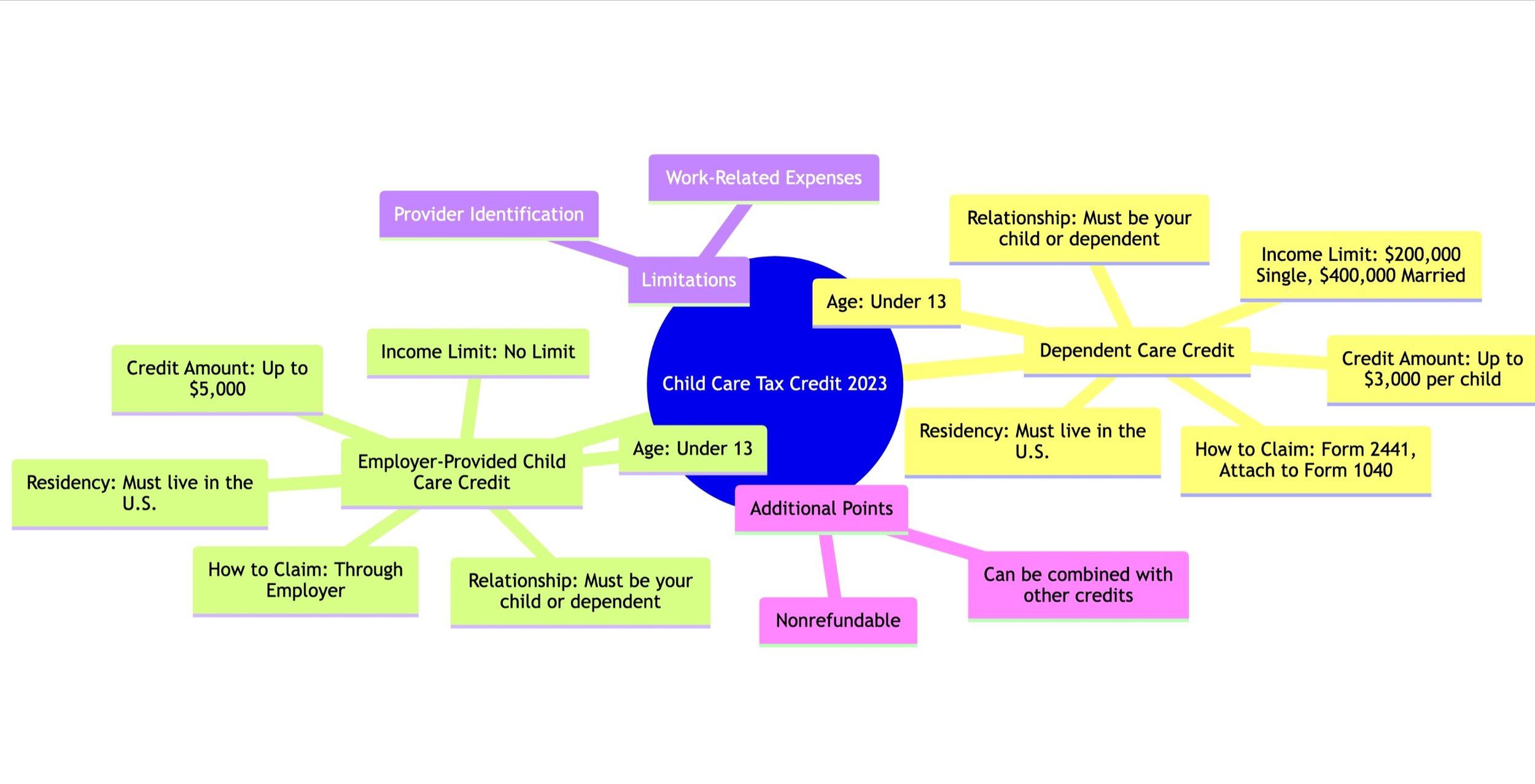

Understanding The 2023 Child Care Tax Credit Types Eligibility And

https://images.squarespace-cdn.com/content/v1/5d940768938dd828fc033675/77a228a5-aaee-47f8-a4be-e62a1c4783b2/Web+capture_25-10-2023_224527_showme.redstarplugin.com.jpeg

How Do You Qualify For Low Income Housing Hanfincal

https://hanfincal.com/wp-content/uploads/2022/05/How-Do-You-Qualify-For-Low-Income-Housing.jpg

https://www.irs.gov/newsroom/understanding-the...

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit

https://www.nerdwallet.com/article/taxes/…

The child tax credit is a nonrefundable tax credit available to taxpayers with dependent children under the age of 17 The credit

2022 Child Tax Credit Dates Latest News Update

Understanding The 2023 Child Care Tax Credit Types Eligibility And

Child Tax Credit Payments Begin Arriving Today For Almost One Million

Daycare Statement Template

FSA Or Tax Credit Which Is Best To Save On Child Care

Indiana Lawmakers Consider Child Care Tax Credit For Employers Fox 59

Indiana Lawmakers Consider Child Care Tax Credit For Employers Fox 59

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

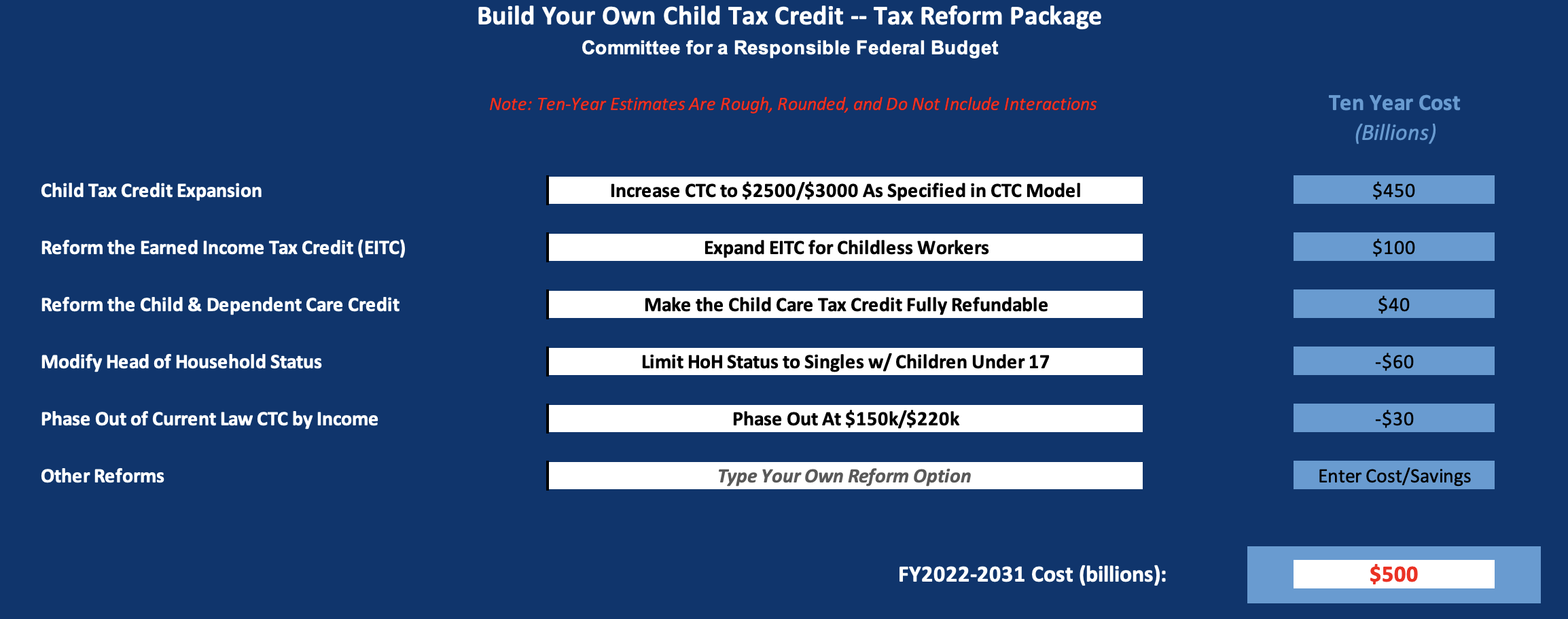

Build Your Own Child Tax Credit 2 0 2022 01 06

Tax Credit Or FSA For Child Care Expenses Which Is Better

Do I Qualify For Child Care Tax Credit - Credit for Child and Dependent Care Expenses For tax year 2021 only the top credit percentage of qualifying expenses increased from 35 to 50 Some taxpayers