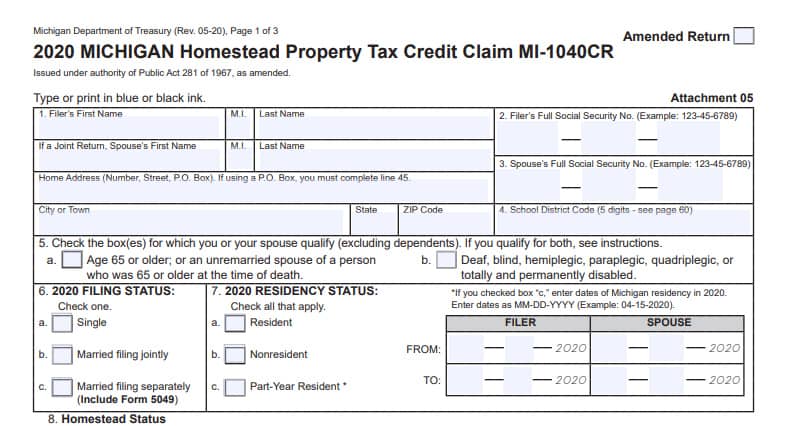

Do I Qualify For Michigan Homestead Property Tax Credit You may qualify for a homestead property tax credit if all of the following apply Your homestead is in Michigan You were a resident of Michigan for at least six months during the year You own or are contracted to pay rent and occupy a Michigan homestead on which property taxes were levied

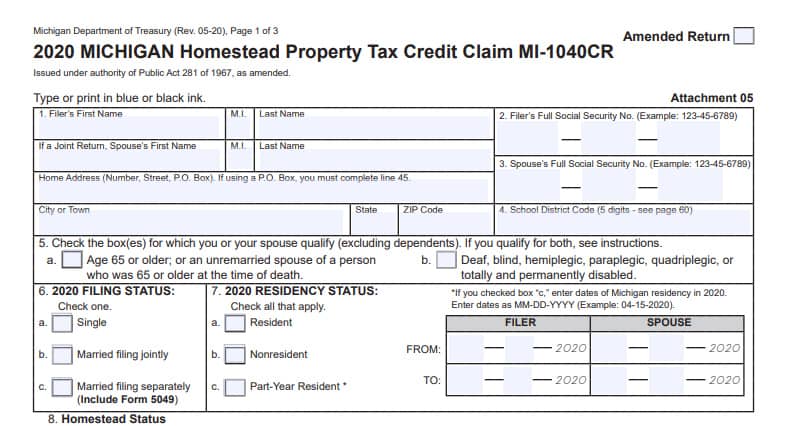

Working families and individuals with household resources of 60 000 or less a year may be eligible for a Homestead Property Tax Credit according to the Michigan Department of Treasury Michigan Homestead Property Tax Credit is a refundable credit available for eligible homeowners and renters in the state of Michigan The amount of credit is based on income household size and property taxes paid

Do I Qualify For Michigan Homestead Property Tax Credit

Do I Qualify For Michigan Homestead Property Tax Credit

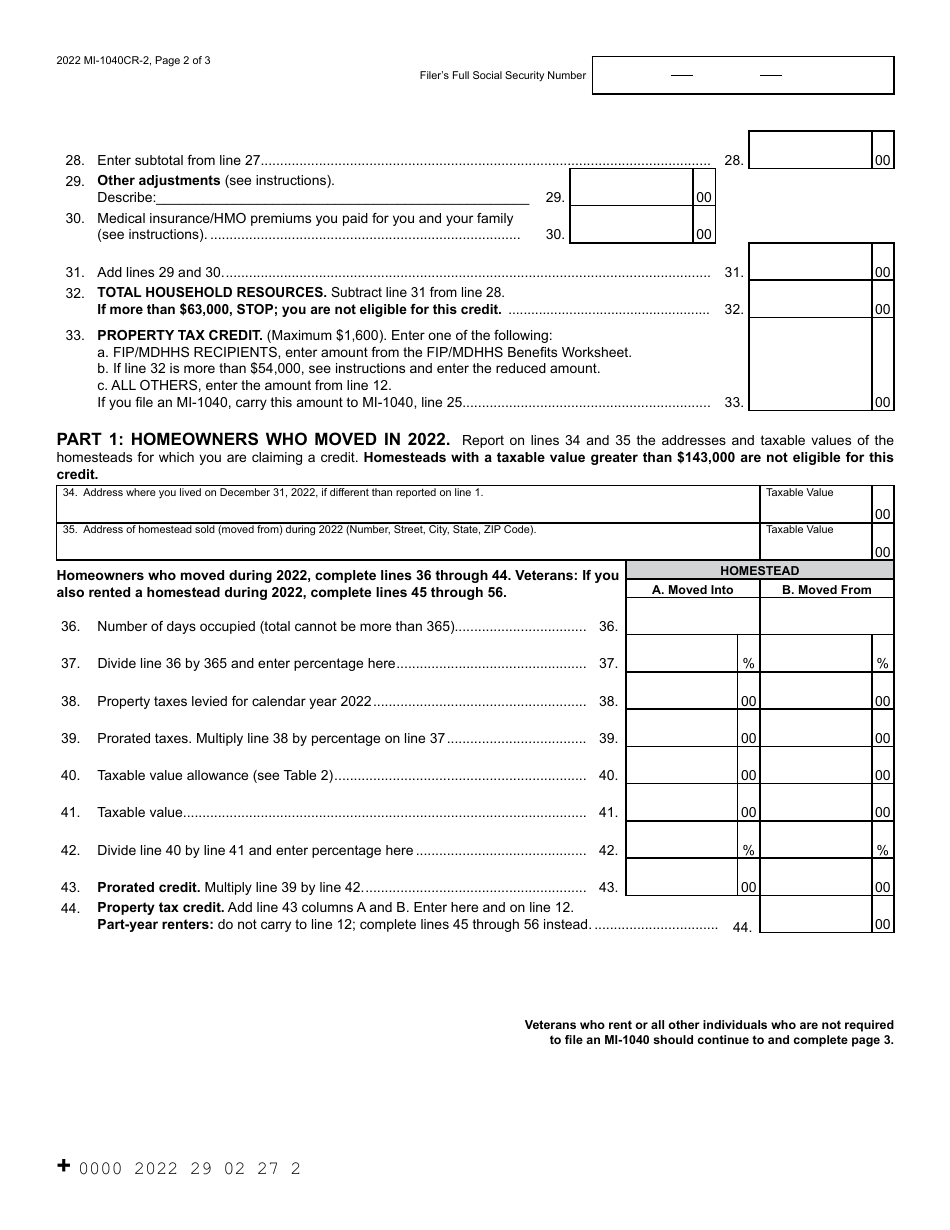

https://data.templateroller.com/pdf_docs_html/2619/26191/2619186/page_2_thumb_950.png

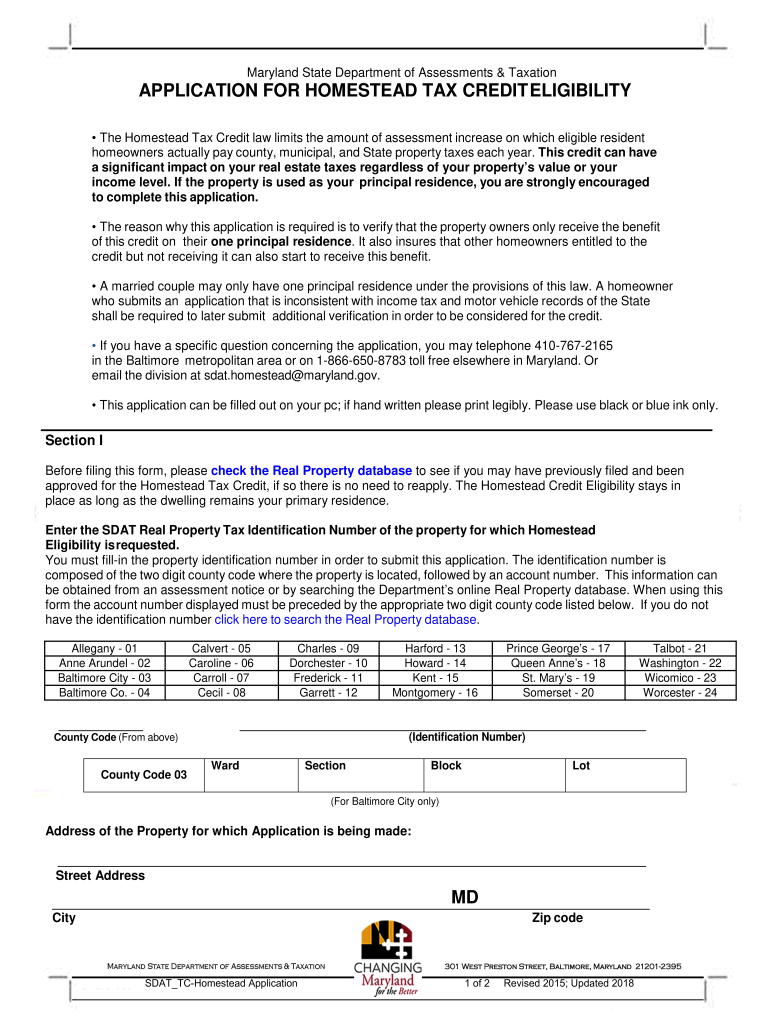

Homestead Tax Credit Maryland Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/463/551/463551018/large.png

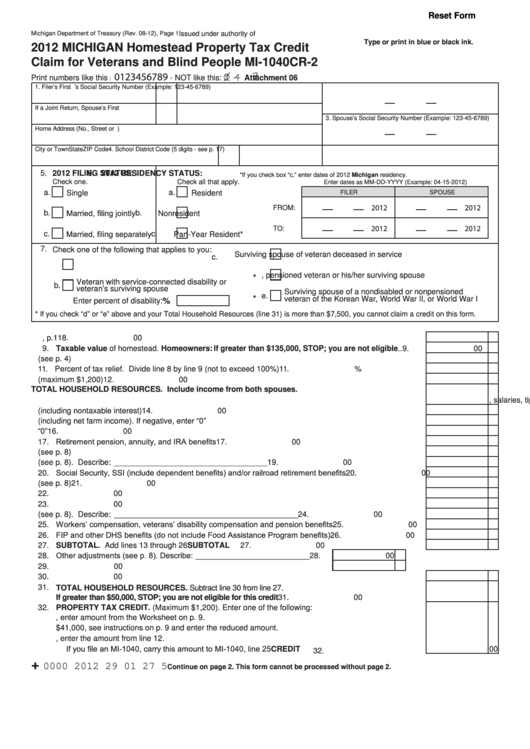

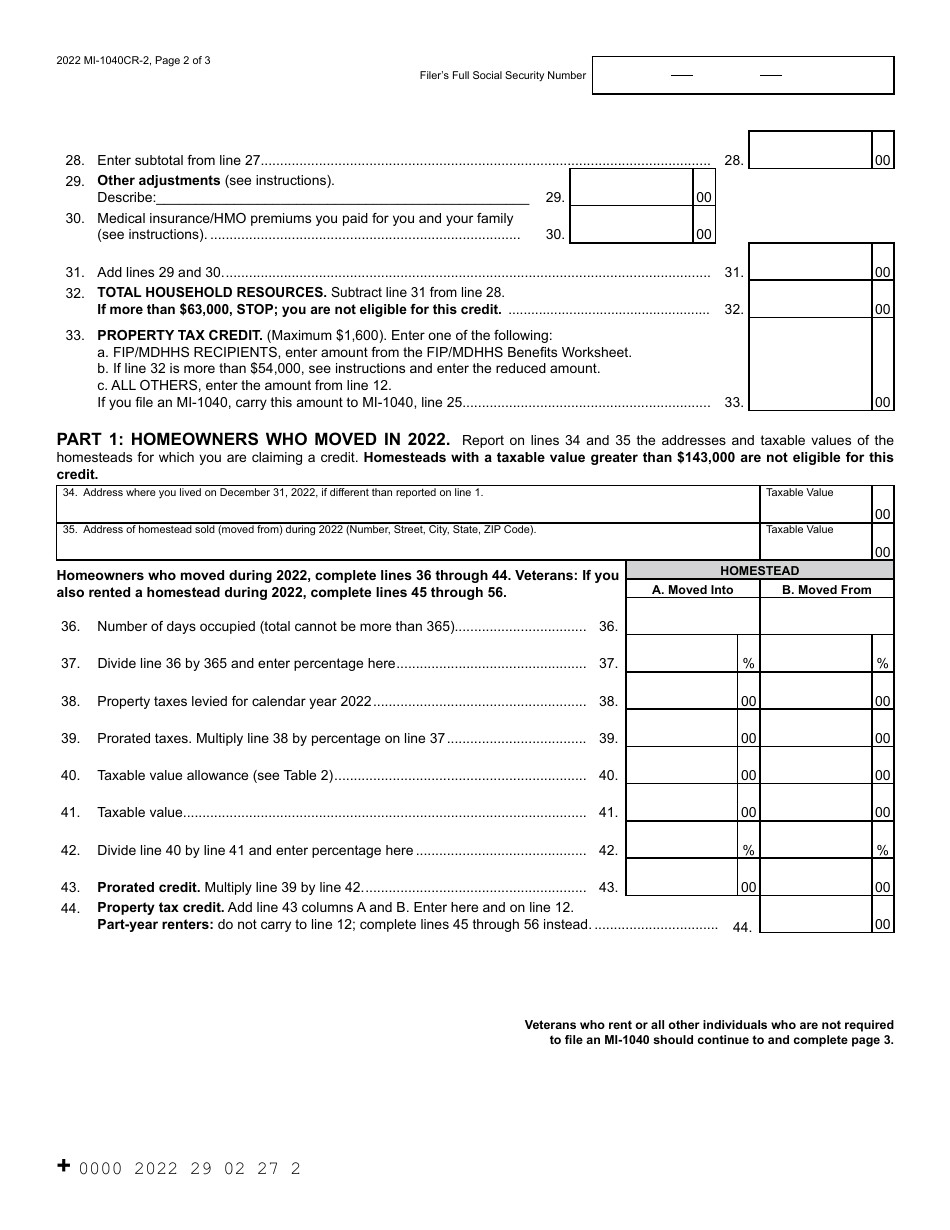

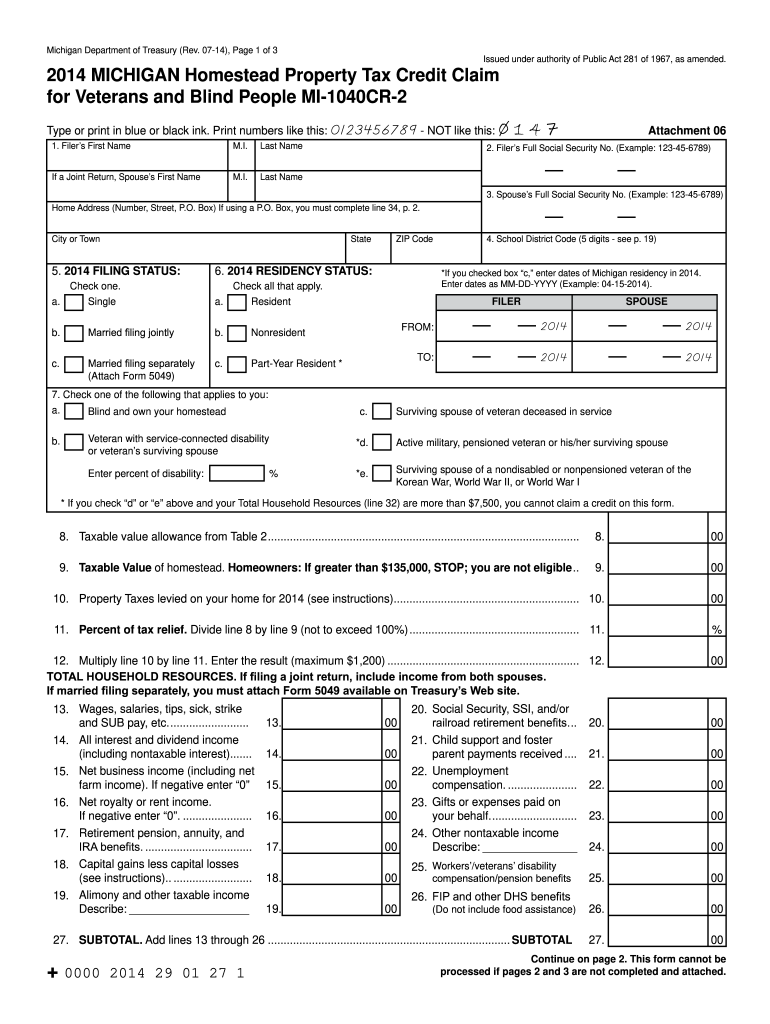

Fillable Form Mi 1040cr 2 Michigan Homestead Property Tax Credit

https://data.formsbank.com/pdf_docs_html/331/3315/331534/page_1_thumb_big.png

Michigan s homestead property tax credit is designed to be an economic break for low to moderate income Michigan residents whose property tax liability is a significant portion of their total expenses It is worth the savings on your Michigan income tax liability to take the time and see if you qualify This booklet contains information for your 2024 Michigan property taxes and 2023 individual income taxes homestead property tax credits farmland and open space tax relief and home heating credit program

Michigan s Homestead Property Tax Credit can help taxpayers if they are qualified homeowners or renters and meet certain requirements Filers who own a home may qualify for a Homestead Property Tax Credit if The homestead the principal place of residence is in Michigan and has a taxable value of no more than 135 000 and The filer lived in Michigan for at least six months in 2018 and

Download Do I Qualify For Michigan Homestead Property Tax Credit

More picture related to Do I Qualify For Michigan Homestead Property Tax Credit

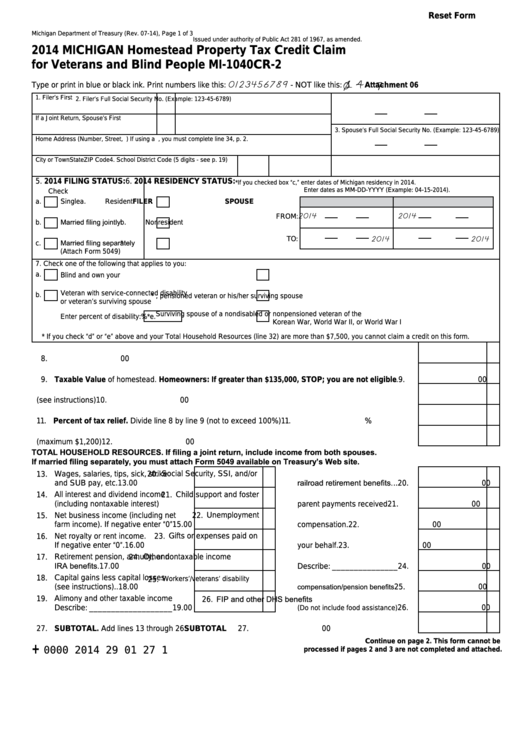

Fillable Form Mi 1040cr 2 Michigan Homestead Property Tax Credit

https://data.formsbank.com/pdf_docs_html/355/3556/355692/page_1_thumb_big.png

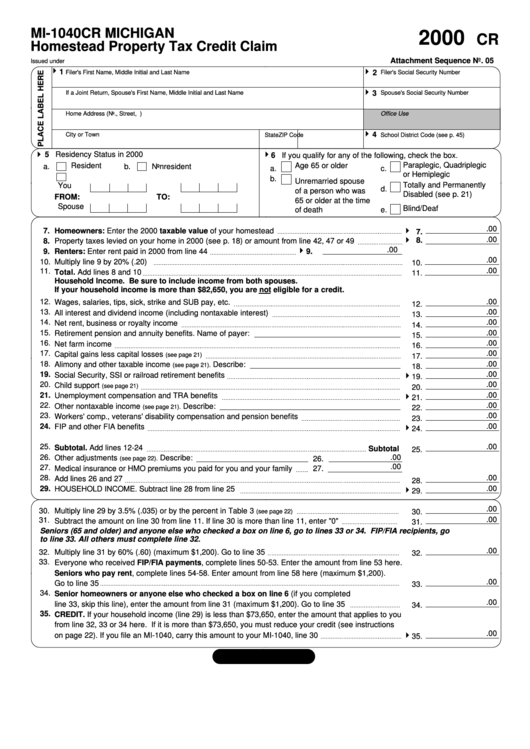

Form Mi 1040cr Michigan Homestead Property Tax Credit Claim 2000

https://data.formsbank.com/pdf_docs_html/273/2736/273690/page_1_thumb_big.png

What Is The Michigan Homestead Property Tax Credit

https://www.rusticaly.com/wp-content/uploads/2022/01/f_wgcUx0kR1ps.png

In Michigan homeowners and renters qualify for the Homestead Property Tax Credit The qualifiers are based on the payment of property taxes which homeowners pay directly and renters pay indirectly through monthly rental payments Michigan allows residents of the state to claim a homestead property tax credit if they meet the eligibility requirements These include a maximum household income and a maximum taxable value of their home Owners and renters are both permitted to file for this credit

[desc-10] [desc-11]

MI Treasury Reminds Tax Filers To Check For Homestead Property Tax

https://dehayf5mhw1h7.cloudfront.net/wp-content/uploads/sites/757/2021/04/08111012/HomesteadPropertyTax.jpg

Michigan Property Tax Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/0/120/120215/large.png

https://www.michigan.gov/taxes/questions/iit/accordion/homestead/...

You may qualify for a homestead property tax credit if all of the following apply Your homestead is in Michigan You were a resident of Michigan for at least six months during the year You own or are contracted to pay rent and occupy a Michigan homestead on which property taxes were levied

https://www.michigan.gov/treasury/about/news/2021/04/08/working...

Working families and individuals with household resources of 60 000 or less a year may be eligible for a Homestead Property Tax Credit according to the Michigan Department of Treasury

Fillable Online 2014 Michigan Homestead Property Tax Credit Claim For

MI Treasury Reminds Tax Filers To Check For Homestead Property Tax

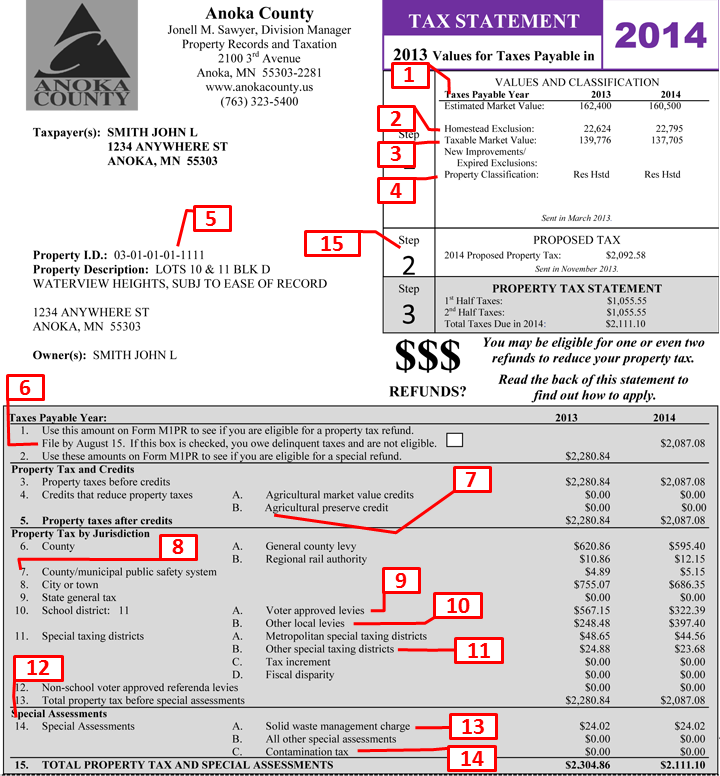

About Your Property Tax Statement Property Records Taxation Anoka

2018 Michigan Form Fill Out Sign Online DocHub

State Of Michigan 2023 Tax Form Printable Forms Free Online

York County Sc Residential Tax Forms Homestead Exemption CountyForms

York County Sc Residential Tax Forms Homestead Exemption CountyForms

Michigan Homestead Tax Credit Have You Applied

How To Calculate A Michigan Homestead Tax Credit Sapling

Earned Income Tax Credit City Of Detroit Free Nude Porn Photos

Do I Qualify For Michigan Homestead Property Tax Credit - This booklet contains information for your 2024 Michigan property taxes and 2023 individual income taxes homestead property tax credits farmland and open space tax relief and home heating credit program