Do Minors Get Social Security Tax Back Who can get child s benefits To get benefits a child must have either A parent who is retired or has a disability and is entitled to Social Security benefits A parent who died

If you are 62 or older you have turned on your social security benefits and your child meets the criteria above your child would be eligible to receive 50 of your Full Retirement Age FRA Social If a child is receiving benefits from Social Security they are subject to a limit on the amount of earnings they can receive from wages or net earnings from self employment These income limits change on an annual basis

Do Minors Get Social Security Tax Back

Do Minors Get Social Security Tax Back

https://i.ytimg.com/vi/wvZeun032mM/maxresdefault.jpg

Do Minors Get Taxes Taken Out Of Their Paycheck News Week Me

https://newsweekme.com/wp-content/uploads/2022/12/do-minors-get-taxes-taken-out-of-their-paycheck.jpg

Do Minors Need To Pay Income Tax

https://life.futuregenerali.in/media/415jzofb/income-tax-liability-for-minors.jpg

Social Security and Medicare Taxes Teenagers must also pay into Social Security and Medicare the FICA taxes just like any other employee The rate is 15 3 as of 2024 of which 12 4 goes to Social Only Social Security survivors and disability benefits received by minors can be taxable If you don t sign the return or if your child forgets to identify you as a

Can children and students get Social Security benefits When a parent receives Social Security retirement or disability benefits or dies their child may also receive benefits Every year about 4 4 million children receive monthly benefits because one or both of their parents are disabled retired or deceased When a parent becomes disabled or dies Social Security

Download Do Minors Get Social Security Tax Back

More picture related to Do Minors Get Social Security Tax Back

Deferred Social Security Tax Payments Due By Jan 3 2022 CPA

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2021/12/social_secruity_admin_1_.61ca6c0f9a855.png

Do Minors Have To File Separate Income Tax Returns Check Details Here

https://images.news9live.com/h-upload/2022/11/21/583892-itr2.jpg

Can I Get Social Security Disability For Crohn s Disease Yes

https://www.betruetoblue.com/wp-content/uploads/2020/11/canstockphoto9869454-scaled.jpg

A minor who earns tips or makes more than 400 tax year 2023 in self employment income will typically have to pay Social Security or Medicare taxes regardless of their total earnings How do I know if Whether you can get a tax refund as a teenager depends on whether you file a tax return with your parents or separately how much income you have to report

If you determine the child must file a return a portion of the Social Security benefits MAY be taxable based on their other income levels This is calculated on one of the Social Yes under certain circumstances although a child generally won t receive enough additional income to make the child s social security benefits taxable The taxability of

Social Security Tax Provisional Income Calculation YouTube

https://i.ytimg.com/vi/quOchmz47T8/maxresdefault.jpg

Social Security Tax Cut Rolling Blackouts Expected Inflation

https://i.ytimg.com/vi/o0gWVAEy8YU/maxresdefault.jpg

https://www.ssa.gov/pubs/EN-05-10085.pdf

Who can get child s benefits To get benefits a child must have either A parent who is retired or has a disability and is entitled to Social Security benefits A parent who died

https://www.greenbushfinancial.com/all-…

If you are 62 or older you have turned on your social security benefits and your child meets the criteria above your child would be eligible to receive 50 of your Full Retirement Age FRA Social

Calculating The Maximum Social Security Tax You Can Pay

Social Security Tax Provisional Income Calculation YouTube

Do Minors Have To File Income Tax Returns Check What ITR Norms Says

Do Minors Get Taxes Taken Out Of Their Paycheck Everdaily Review

Social Security Who Is Exempt From Paying SS Tax Lifestyle UG

What Is The Social Security Tax Limit For 2022

What Is The Social Security Tax Limit For 2022

When Do Minors Have To Pay Tax On Their Income Mint

Social Security Tax What Employers Need To Know

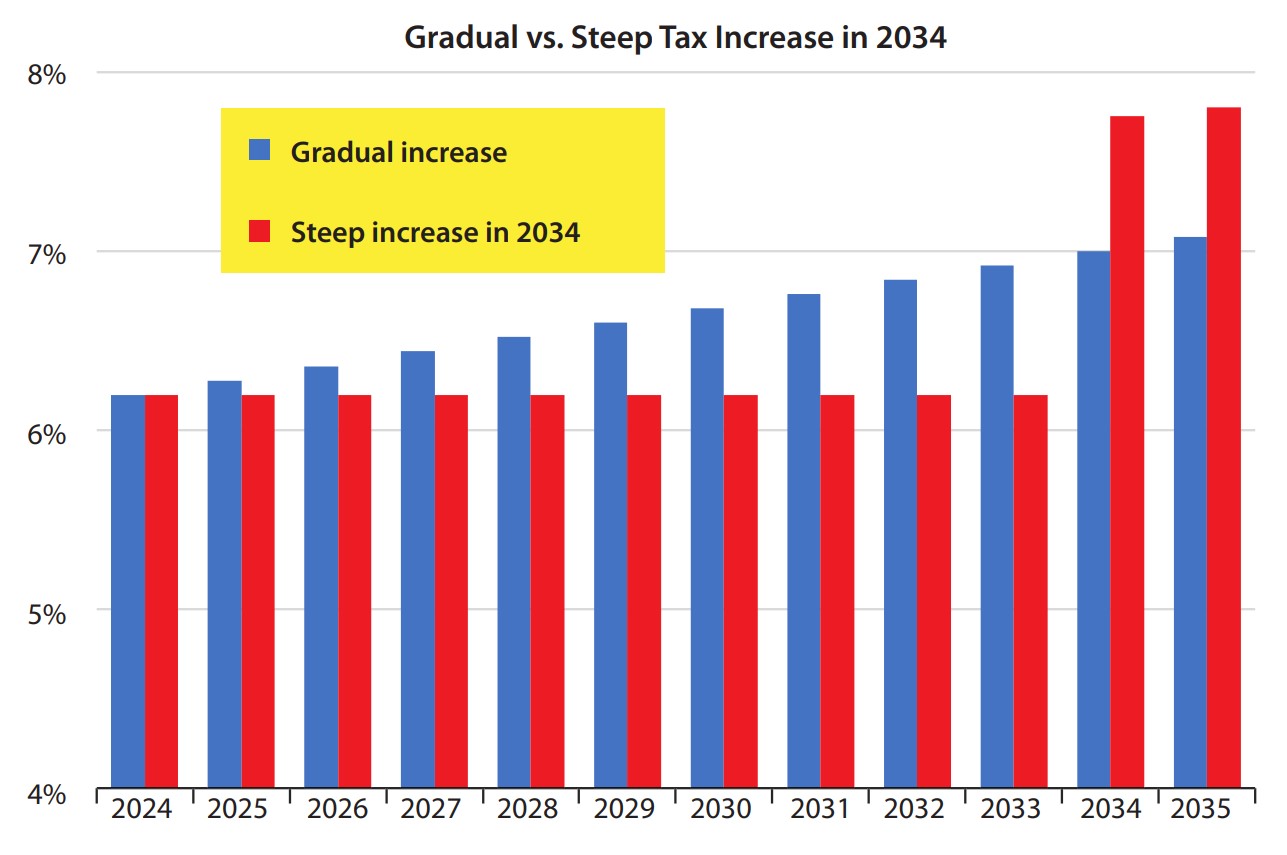

Changing Social Security Sooner Rather Than Later Avoiding A Shortfall

Do Minors Get Social Security Tax Back - First when a retiree takes retirement benefits any child of that retiree who is under age 18 in high school and no older than 19 or disabled can receive children s